Fear, Inflation and Debt

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

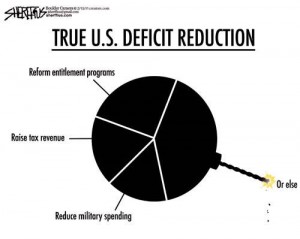

Yesterday, gold hit fresh all-time highs at $1,432.10 an ounce. Silver hit a 31 year high, closing at more than $34.50 per ounce. Oil nearly touched $100 per barrel, which is the highest it has been since September 2008. What’s going on? Part of the price spikes are, no doubt, due to riots and rebellions in the Middle East, but it is also the world’s awakening realization America’s crushing debt will never be repaid in real money. The U.S. needs to slash its budgets, but finding politicians on Capitol Hill with the nerve to make deep cuts is elusive, to say the least. Yesterday, the Associated Press reported, “The Republican-controlled House is on course to pass legislation cutting federal spending by $4 billion and averting a government shutdown for two weeks. And Senate Democrats say they will go along. . . . Republicans want to slash more than $60 billion from agency budgets over the coming months as a down payment on larger reductions later in the year, but are settling for just $4 billion in especially easy cuts as the price for the two-week stopgap bill.” (Click here for the complete AP story.)

Over in the Senate, the Banking, Housing and Urban Affairs Committee asked questions of Fed Chief Ben Bernanke about the state of the economy and raising the debt ceiling. It currently stands at $14.3 trillion. Senator David Vitter said “the biggest” problem the nation faced was “reaching our debt limit . . . sometime between late March and May.” Senator Vitter asked Mr. Bernanke, “Would it be better to increase the debt limit and go along our merry way on the present fiscal path or would it be better to increase the debt limit and at the same time pass meaningful budget reform?” I really do not see how cutting $60 billion is “meaningful reform” when PIMCO’s Bill Gross said two months ago on CNBC, “We have a deficit in the $1 trillion plus arena, which means we must borrow at least a trillion dollars additional a year in order to fund the deficit. And, so, the debt ceiling currently at $14.3 trillion, which is 95% of GDP, has to go up by another trillion or so every 12 months.” (Click here to read more about raising the debt ceiling.)

Bernanke responded to Senator Vitter’s question by saying, “Clearly, the latter. You want to make sure the debt is paid, interest is paid, and meaningful budget reform is highly desirable. I’m just concerned that there could be a significant probability that we would not raise the debt limit, and that would cause real chaos…This is money we’ve already borrowed. These are commitments we’ve already made to contractors, to senior citizens and so on…”

I take “and so on” to mean the continued bailout of the banks through vehicles such as failed mortgage giants Fannie Mae and Freddie Mac. The government just forgave Bank of America for potential future claims of $127 billion worth of sour loans. (You can read the complete story in a post I wrote called “B of A Settlement, Another Taxpayer Rip-off.”)

The government (Fannie, Freddie and FHA) is supplying more than 90% of the mortgages in America. When asked how commercial banks could be enticed to come back into the residential mortgage market with new mortgage-backed securities (MBS provide financing), Bernanke touted recent financial reform (Dodd-Frank) and said, “What we saw in the crisis where firms would take a whole bunch of lousy mortgages and then use financial engineering to make them into triple-A securities, that should not be possible anymore if the credit rating agencies meet certain standards.”

I could not believe my ears! Bernanke cavalierly admitted banks bundled “lousy mortgages” (into MBS) and ripped-off buyers. I wonder how many of those “lousy mortgages” are on the balance sheets of Fannie, Freddie and pension funds! This is probably trillions of dollars in securities and, yet, Mr. Bernanke made that statement with a smirk. It was as if he was saying “problem solved.”

This past weekend, New York magazine published an interview with Bernie Madoff. He’s the mastermind of the biggest Ponzi scheme in history–$65 billion. The magazine reported, “The whole new regulatory reform is a joke,” Madoff said during a telephone interview with New York magazine in which he discussed his disdain for the financial industry and for its regulators. . . . He said in the New York magazine interview the Securities and Exchange Commission “looks terrible in this thing,” and he said the “whole government is a Ponzi scheme.” (Click here to read the complete story.)

Maybe it takes a giant fraudster to spot a giant fraud? And, maybe, the rest of the world is running to gold, silver and oil because they fear the dollar is dying at the hand of the printing press while inflation is thriving.

Greg, I predicted the debt ceiling would be raised a couple of weeks ago on your blog, although, to be honest, it was a no brainer. I heard the Speaker of the House interview and he said “unless meaningful cuts in spending are done it he would not support a raise in the debt ceiling”. I knew right there and then a deal had been struck, a token cut and then they will do it. It will be raised as not one on Capital Hill has any b@@@s, including our female representatives. They simply refuse to do what needs to be done. They are driving the middle class out of existence with their monetary policies all the while talking like John Wayne.

I saw that staged Bernanke questioning as you did. What a bunch of bull crappers the whole bunch of them, including Mr. Bernanke. Snow ball questions, non responsive answers, diatribe introductions, a real dog and ponny show, vaudeville comes to mind. My point is this:

the world is blowing up, our way of life is degrading around us, and these fools are play acting on stage for the benefit of CNBC and their breaking news every two minutes.

Your quote.., “maybe, the rest of the world is running to gold, silver and oil because they fear the dollar is dying at the hand of the printing press while inflation is thriving” is right on except on word you use used was “maybe”. In my mind, a better word would be “clearly”. The rest of the world is not as stupid as our government takes them to be. We are going down as a great power and as one of your readers once wrote …”Roman circus like times” was what I witnessed yesterday at the Senate hearing.

Art,

Where did these folks in Congress go to school? $60 billion in cuts (if it really is that much) and a $1 trillion $1000 billion) rise in the debt ceiling is preposterous. How do they get this math problem to work out to a lower deficit? That still means $940 billion in more debt!!! I’ll bet they raise the the debt ceiling by more than a trillion bucks! Thank you for your prediction and comment.

Greg

What is most disappointing is Members like Paul Ryan, whom I had high hopes for, agree to these meager cuts, knowing where that road leads. Even Rand Paul’s $500 billion in proposed cuts is less than half of what is needed and he is viewed as extreme. These people are nothing more than the band on the Titanic.

Thank you for your site Greg, see you on the other side.

Mungo

Yes Mungo, see you on the other side when the rebuilding begins.

Greg

Where should I start; First, Madoff is just stating facts and the MSM is either willfully ignoring the issue while acting as a public relations arm of the corporate entities which they are a part of.

Then we have Freddie and Frannie which are used by the banksters to shift all risk to the taxpayer. Then the banks sell the loan to a consumer an FHA loan; then the banks collateralize the debt and sell it off into itsy-bitsy pieces while using fractional banking to create new bank money …….. then take that new bank money and use it to back another FHA no risk loan and the cycle of continues …..

all that out of a no risk investment backed by the taxpayer!

Fannies and Freddies are just dumping grounds for risk ….. and theres a lot of dung being dumped!

Mitchell Bup,

Well said! Thank you.

Greg

Hello Greg and fellow readers,

Greg, this is a great post with real insight and self questions we need to answer…Like: What are you going to do for your future? What action or steps can you take now to help yourself and family with your current financial position?…

As you are aware I do Commentary on Coin Docere®™ News Site

but I also do appraisal work and lately I have had the pleasure of working with clients that want/and are storing Gold and Silver not selling their bullion as a safe haven.(even buying scap gold and silver). Now on the avg You still have the folks that want quick cash but the trend is to put away a nest egg…it is funny/sad that it is coming to this point..

As for your question: Maybe it takes a giant fraudster to spot a giant fraud? I think it is a safe bet to say.. It sure is a Possibility this statement is true..

Kudos to you for your work and placing current issues in the lime light..

Thank-You for all your effort,

Dr. Neal J. Houston (cgvs)

Chief Numismatic Consultant

and a note to your readers –

Keep Reading the USA Watchdog..because:

“An ounce of Prevention Today for a Healthier Financial Future Tommorow”©

Thank you Dr. Neal, that’s good advice.

Greg

Dear Greg,

Great article.

Personally, I believe that silver is in a bubble right now. Right now, Joe and Jane Sixpack are climbing on the silver train, inflating the silver bubble even more. Watch out for those who bought silver early, they’ll sell out first, causing the bubble to deflate. Eventually the bubble will POP, causing a massive sell-off. This will be great news for serious investors, so keep your powder dry, folks!

Oil: look what happened with Egypt. Oil started to rise, and the fearmongers came out of the woodwork. When the corrupt leader left, oil dropped down. The same here with Libya. Once “Daffy Gaddfi” is gone, watch for oil prices to come down again.

Gold is something else again. It will continue to bounce around as it flirts with the $1500 mark. It’s true that people don’t trust the dollar, but then, they should not have in the first place. Read your Constitution, fiat is ILLEGAL! (Only hard currency, gold and silver, is legal, paper is just a receipt for gold. If it can’t be changed to gold, it’s worthless!)

Sam,

I don’t think silver is in a bubble at all. Silver’s all-time high was about $50 in 1980, and we are nowhere near that now, especially when you consider inflation. According to John Williams at Shadowstats.com, 1980 silver at $50 would equal more than $450 today. (provided inflation was computed the way is was then.) According to silver market expert Ted Butler, for the first time in human history there is less above ground silver than gold. That doesn’t mean there will not be wild price swings and corrections along the way but silver is not in a bubble in my opinion. But you may be right because as I always say, “Good men can disagree.” I think troubles in the ME are far from over and that will put some real upward pressure on oil. You are spot on about fiat currency. We would not be in the trouble we are in here in the U.S if we had honest money.

Greg

Greg, The US has honest money. It’s called the dollar. What the US does not have as much these days is common sense in Government. The Real and Positive message to get into the political positions and into the Tea Party is Permanent Federal Income tax relief for the tax payers (and Business) plus PERMANENT relief from the debt that is owned to foreigners. The dumbest thing that has been done for so long is that the US taxes its own citizens to make interest payments to foreigners on DEBT that cannot be paid off. To see it another way, If America retired the debt by simply printing the 2 Trillion, the global economy will have 2 trillion in cash to invest in the future and some of it into the US. Why? Because retiring this deadly Debt would signal that the US government has come back to it senses, or at least, to the American people. Printing is is NOT A CRIME if it retires FOREIGN DEBT. It is a very smart move in the New Global Age.

Reader,

The U.S. Dollar is NOT honest money. It comes into existence by the issuance of debt, therefore our money is a form of debt. Debt can be either repaid or defaulted on. The U.S. is in the process of defaulting on our debt because we are paying lenders back in devalued dollars. You do make a good point by saying, ” The dumbest thing that has been done for so long is that the US taxes its own citizens to make interest payments to foreigners on DEBT that cannot be paid off.” However we are seeing the destructive powers of the printing press. Gold, silver, oil, wheat, corn, soybeans, cotton and many other commodities are rising, and this is only the beginning. All of America, (especially the poor) will feel the coming pain of inflation, and a currency crisis (hyperinflation) is now a lock. In my opinion, printing money to pay off the bad debts of those at the top (and we will need 10’s of trillions of dollars , not $2 trillion) is a crime against 99% of Americans. I hope everyone is preparing for what is here now and will get worse. Thank you for all your comments. It is good for people here to see many viewpoints.

Greg

My thoughts here only. The u.s. is going to call all their coinage in to get there silver from it. Then repace it with copper coins. An also the price of silver will hit $50+ an stay there for years in limbo to get the sellers to sell an the gov will give tax credits to help you sell it. But all will lose since the dollar will be revalued soon after.

What silver in coinage? You could still get some silver out of most coins minted up to 1969 (copper out of pennies minted up to 1982). When the major meltdown comes, coins will still be trusted, paper (linen) will not.

Greg, you said:

” And, maybe, the rest of the world is running to gold, silver and oil because they fear the dollar is dying at the hand of the printing press while inflation is thriving.”

I say that just about sums it up! The world financial system of today, is well past the tipping point. There is no returning. It isn’t just the dollar; it is every currency! It is just a matter of time and tears, before the Banksters admit it.

Gold and Silver in a bubble?? I have a Zimbabwe 100 trillion dollar note, I will trade for any amount of gold/silver. Gold/silver will reach a point that no price, for paper dollars, will exist…imho

Thank you LostinMissour.

Gregi

Does that really sum it up, Missouri? I think The Printing Press is the only US tool left to immediately deal with the debt in one move. This is completely legal and possible.

My point is – why wait? Why tax American Business and Taxpayers just to make endless interest payments to foreigners? Is this sensible? patriotic? Does the Tea party get this?

It’s all fake, the gold,oil, housing the rule of law. The fake news, the fake wars, the fake sports. People are so screwed up they think you can be bullied, when they log in on facebook. %@#* it.

The situation is getting worse than what people know. As I said before I’m a Deputy and work two jobs. My off-duty job is working at a grocery store. Inflation is not only here it has been here for atleast a year, I see it in the prices and the packaging of the products. The shoppers comming in the store are acting different, I’m guessing it’s their loss of purchasing power and their jobs. Lots of people using foods stamps now. Crime is increasing and normal people are now committing theft offenses. I was talking to a man stealing bread and a jar of jelly, he lost his job, his un-employment ran out and the welfare department wont help him because he owns his home, has two cars along with other liquid assests, he had no choice but to steal as he has children. Things are getting realy bad folks, PLEASE prepare your families!!!!! I am getting my family out of the city soon.

We made sure the man had food, I also directed him to a church that gives out food to the needy.

Justin,

Thank you for this report. What city do you live in?

Greg

For now I live in Toledo, Ohio. Was just working this evening at the grocery store, the value sugar that was .99 cents last October is now on sale for $2.29. Was also talking with a city officer, she reported the large increase in criminal activity (shootings, robberies, B&E’s) they’re seeing on the streets, seems the information on stats they give the public are not correct, shocking I know!

Thank you Justin!

Greg

Thank you Justin for being a real American and helping that person out. Out here on the Western Front things are going the same way you described, you can see the fear in the people.

Thank you again for your American and humanitarian values. With people like you out there brings me hope that we will survive.

Greg, no bubble in silver or gold, the US Mint has a huge problem getting silver for blanks because they don’t want to pay market prices. By US law the mint must procure the silver to meet public demand, the mint just can’t pick & choose what laws to enforce!

I watched the hearing yesterday & some today, there was nothing new. One thing that stood out was a question why cant we go to a gold standard? The Bernank answer was, there’s not enough gold, “wrong” he was afraid to say what the price of gold in dollars would have to be to go back to the gold standard! So be it!

As I just listen to 3 of Fox biz top market callers, each one talked down both silver/gold & other PMs, but failed to say that silver is not recycled, most being lost in tiny amounts now in dumps world wide. Also almost all silver mined is a by product of other mining, that makes silver more precious than gold.

I would like to give the readers a look at what our silver miners have to deal with in the USA, its sad to say the least. (http://www.silverminers.com/commentary/wallace/index.php?&content_id=1344) I hope others will see fit to pass it to others because we are in a battle for more than most realize, without these folks, the many things we take for granted is being destroyed by the sorry bunch called the EPA,the fed & its owners! Keep the faith Greg, you support is growing!

M Smith,

Thank you for adding valuable information to this post!

Greg

This is just the beginning!!

http://joshuagamen.wordpress.com/2011/03/03/gold-and-silver-surging-as-government-hits-debt-ceiling-and-federal-reserve-prints-more-money/

http://www.youtube.com/watch?v=TAQ6ySTtjzg

if a 1% tax on all Wall Street transaction instantly collected [into the most fractional of a second / trade(s)] would pay off all state(s) debt and federal

debt thus ending fear and throttling speculators… then why are we still talking

about debt? It should be a done deal…

Steve, the US can just print the money and pay off the debt. Done deal. Forget the Tax!

I have a question that I’ve never heard anyone ask before regarding gold and silver. If everybody is buying gold and gold starts to tumble…let’s say it drops dramatically and everybody wants to sell, what kind of price will we be forced to sell it for? Won’t the dealers be jacking up their commissions? It could get out of hand. Maybe this is a dumb question but honestly it’s a “what if” I wonder about.

Martha,

I don’t know but I do know you will be much better off with it than without it. Anybody else want to take a shot at this? Thank you for your question.

Greg

Martha asks an interesting question, although she doesn’t say whether or not she owns gold and doesn’t define what “drops dramatically” really means. Would that be a 10% or 50% drop?

In any “what-if” scenario, one needs a starting point. Once the baseline is established, one needs to consider stimuli and resistance factors. Martha has not provided a starting point, so her question is not answerable.

However, although Martha doesn’t say it explicitly, she realizes she should have bought some gold five or ten years ago. Going forward, I believe the gold price is going to be very up and down. “Damatically” This is a bsttle about “real money.” The battle will get ugly, but ordinary people need not be concerned about the price of gold. All they need to know is that the US dollar is toast, and that makes gold a better place to put your “money.”

To Martha gold may appear to act “dramatically” but she and others must be reminded that gold is not an investment. It is a protection of capital. When your dollar is buying less, shouldn’t some of your savings be in gold?

…ikb

We’ve seen gold take a tumble recently, but events in Libya pushed it up again. The nice thing about gold and silver is that they’ve never gone to zero.

Gold and silver COINS have never gone below face value (the trade value stamped on the coin). For example, if you own twenty buffalo gold coins (face value $50 each), and five rolls of silver dimes (face value $5 per roll), and if the value of precious metals dropped, you’d still have $1,025!

Should the price of precious metals drop, all you do is take a crewcut on the PREMIUM (the price above the face value of the coin; which is the spot value of the precious metal of the coin, the coin’s collectible value, and the dealer’s markup).

Thanbk you Sam,

Greg

Are you are asking if their is a floor price should a panic set in? I read 1000 dollars seems like a reasonable “floor” price TODAY.

In any case, no one can FORCE you to sell your gold or silver… Except the government! 🙂

Actually the printing Press may be America’s best friend right now. If QE1 / QE2 had been used to pay off the Foreign DEBT, the Federal budget would have been in much better shape today.

Printing to retire the debt is still possible (and legal) even at this point in time…

Reader,

The printing press right now equals another fix to the heroin addict and puts off the kicking the habit. Printing money does not lead to prosperity. Not a single country has ever been able to do it in perpetuity. There is always an end an America is no different. Thank you for your comment and participation in the site.

Greg

The printing press to fix the economy is a ponzi scheme, and sooner or later it fails. The Fed knows that they can’t get around gravity, they have no special powers and all rules and laws apply to them sooner or later. Therefore, its only a matter of time till its over. Perpetual easing is just a stall until gravity takes it down.

Thank you Art and Harry!

Greg

Greg, here a piece of data you & the readers MUST SEE ASAP, IT WILL BLOW THE LID OFF OF JUST HOW MUCH SILVER IS MANIPULATED DURING A CERTAIN TIME FRAME DAY AFTER DAY(SORRY ABOUT THE CAPS,WAS NOT LOOKING AT SCREEN)The silver log, (http://www.youtube.com/watch?v=sR28o5f9aKE&feature=player_embedded#at=87.It) seems if you were to get in after PM EST & out before 5 or AM EST you would not be one of the millions who JPM & the other market manipulators took to the cleaners, it’s funny how bits of data comes to light after these banksters make head lines in the worlds news papers for fraud.

You also will find it at Ed Steers Gold & Silver daily in the articles section. Plus the jobs report today is more disinformation.

Also the stories about food thief is on the rise here also(Henderson,TN)most used to have well paying jobs,but they have gone to Mexico or China. Also beware of the energy saving light bubs, my neighbor had one catch on fire last night,it was made by GE in China, the ballast went up in flames! More stupid gov intrusion or just plain out right control, because gov know whats best,right!

M Smith,

Thank you.

Greg

A comment above said the following:

“Unfortunately, the fall of the greenback will only become obvious in primary indexes once it loses its world reserve status”…

And when will this happen or why hasn’t it happened yet? Could it be that nobody knows what to replace it with?

China and a few others are lining up to become the reserve currency, why, as America experienced it, its a 60 year ride at the top! Clearly, China and a few others would like to ride that ride. But in reality, for any currency to have real value it needs to be tied to gold. Rembember gold since the dawn of time was the currency of choice. When our greedy wall street white shoe boys in the depression left the gold standard it was only a matter of time. The Fed knows this and its has only about 5 years left, if that, befoare for the schrade ends and the dollar is retired as the reserve currency.

Yor first paragraph above makes me think of the expression “You ain’t seen nothin yet.”

Listen even if the Federal Reserve quit cold turkey printing money and government stopped spending more than they take in (ha ha like that would happen) the dollar is going to keep falling.. falling.. falling. The Bernanke chapter has just begun even if Congress canned his ass tomorrow, ( he will get the boot soon enough)The enourmity of money printing quarantees hyperinflation. Hyperinflation guarantees huge gold hikes in price.

People think just because the dollar is valued at about .75 against other currencies that the situation is not too bad. That is not the way to measure its worth. This is why.

We print money to bail out something lets say and its 750 billion dollars. So what do the Chinese do? Or the Russians or Germany? Yes they have to inflate their money supply too. If they do not then their currency rises in value against the American dollar. That would be the worst thing for other nations. You see America had the reserve currency status which means everything like oil ect has to be traded in U.S. dollars. So if these other countries do not debase their currency like the U.S. did their dollars would hurt their manufactoring jobs and also their exports would drop. This is a no no.

So all currencies are in a mad race to the bottom.

Crazy man “bubbles Bernanke” prints more and other countries print more. The race is called “the dollar death dance race” because as it gets going faster and faster it becomes impossible to stop the race of each country printing more and more. This is the recipe for hyperinflation.

We are witnessing a race to the bottom for the worlds paper currencies.

The first time in history all nations have left the gold standard and now all countries have pushed the money printing button to often. This will be a world wide government default caused by every country of the world inflating the amount of their currencies. The race is on and the finsih line is death to these countries paper dollars when they all go. to ZERO.

You do not have to own gold or silver. Hyperinflation is not prices just going up a little bit. Real hyperinflation is simalar to a herd of animals all stampeding. Hyperinflation is when the masses in a very short order all do the same thing.. they panic and want to get rid of their dollars. Anything but paper money becomes inflated in price as the herd rushes out of paper money.

Now ask yourself when considering owning gold or silver. Do these metals have any debt against them? No. Can these metals be printed up at will by pressing a keyboard button?. No. Then ask yourself if you trust your government.

The only way gold would drop drastically for any length of time (if it drops it drops for a short period as many many many of us see a drop in golds value as a sweeeeeeeet time to buy more thus pushing its price back up) so like I say the only way gold could drop and stay low is if confidence in a money system is fully restored.

This essentially means government does not have debt nor does it spend more than it takes in. Ie we would literally have to stop all defense spending and drop paying all social security and stop paying for medicare for elderly.

Ha ha gold going to drop dramatically. Don’t walk to the coin store.. run like hell.

Roderick,

Well said my man!

Greg

Gold might test 5000 dollars per ounce at some point in the future.

Just balance that ‘good news’ with the fact that extremely high gold prices in this day and age signal danger – danger to the viability of Government…