More Bad News for the Dollar

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

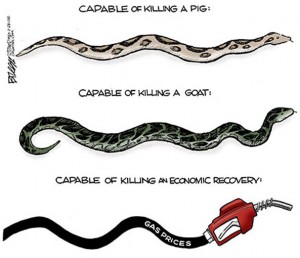

Buying gasoline these days has turned into a horror show. I filled up my car and handed the attendant a $50 bill to turn the pump on. I had a little more than a quarter of a tank. So, I thought that would do the trick and peg the needle past full with change to spare. I was wrong. I stood in shock as the pump rolled right past $40 and up to $50. The car (which is a Buick Lacrosse) was still not quite full. I thought, $50 is not enough to fill up a standard size car with already more than a quarter of a tank? You could say fuel has gotten expensive, but in reality, the dollar is losing its buying power. Money printing and monster deficits in America are the big problems for the buck. The more dollars we produce, the less each one is worth. The rest of the world has been noticing and moving away from the dollar.

Oil and almost everything else is traded mostly in U.S. dollars globally, but that is changing. There has been a definite move by some of the biggest economies in the world in the last few years to not trade in dollars. China is the second biggest economy in the world and is leading the charge to do business in its own currency–the renminbi. The Financial Times reported last week, “China has signed a $31bn currency swap agreement with Australia, a step towards boosting the renminbi’s profile in developed markets. Beijing has established nearly 20 bilateral swap lines over the past four years, but Australia ranks as the biggest economy yet to sign such a deal, which analysts said could give a shot in the arm to Beijing’s goal of internationalising its currency.” (Click here for the complete FT.com story.) This is bad news for the dollar in the long term.

China is also doing business in Saudi Arabia. It is building a new gigantic oil refinery that is slated to be operational in 2014. China is already a key Saudi oil importer, and the upcoming refinery will make the two countries even more intertwined. Is there any reason to believe China will not want to bypass the greenback? A story last week on TheEconomicCollapseblog.com said, “Essentially, China is running circles around the United States when it comes to locking up strategic oil supplies worldwide. And all of these developments could have tremendous implications for the future of the petrodollar system. . . . So what happens if the petrodollar system collapses? Well, for one thing the value of the U.S. dollar would plummet big time. U.S. consumers would suddenly find that all of those “cheap imported goods” would rise in price dramatically as would the price of gasoline. If you think the price of gas is high now, you just wait until the petrodollar system collapses.” (Click here for the complete story from TheEconomicCollapseblog.com. It is really good!)

The dollar is slowly but surely losing its buying power and reserve currency status. That will mean higher prices over time, especially at the pump. If there is a collapse of the petro dollar system, it would mean higher prices over night.

BRICS Bank Could Change the Money Game

Analysis by Kester Kenn Klomegah

MOSCOW, Mar 19 (IPS) – India’s proposal to set up a bank of the BRICS nations (Brazil, Russia, India, China and South Africa) will top the agenda at the summit of the group in New Delhi Mar. 28.

India believes a joint bank would be in line with the growing economic power of the five-nation group. The bank could firm up the position of BRICS as a powerful player in global decision-making.

http://ipsnews.net/print.asp?idnews=107115

AcePilot,

Thank you for adding important content to this site. Mr. Sinclair is spot on and way ahead of the pack–as usual!!!

Greg

Comments made in the year 1955:

I’ll tell you one thing, if things keep going the way they are, it’s going to be impossible to buy a week’s groceries for $10.00.

http://www.jsmineset.com/2012/03/25/in-the-news-today-1141/print/

The Supremacy Of The US Dollar Is Behind Us

Posted by Jim Sinclair on March 25, 2012 @ 11:23 pm in General Editorial

Brazil, Russia, India China and South Africa are meeting next week because of the use of SWIFT as a weapon of war. Expect the formation of a competitive SWIFT system in three blocks. The dollar will test .7200 USDX and fail on the third tap….

….2012 is the year that the US dollar will suffer from a significant drop in utilization as the international settlement currency. The utilization of the SWIFT system as a means of making war is the singular greatest mistake dollar managers have ever made….

http://www.jsmineset.com/2012/03/25/the-supremacy-of-the-us-dollar-is-behind-us/print/

BRICS’ move to unseat US dollar as trade currency

2012-03-25 10:00

Thandeka Gqubule and Andile Ntingi

South Africa will this week take some initial steps to unseat the US dollar as the preferred worldwide currency for trade and investment in emerging economies.

Thus, the nation is expected to become party to endorsing the Chinese currency, the renminbi, as the currency of trade in emerging markets.

This means getting a renminbi-denominated bank account, in addition to a dollar account, could be an advantage for African businesses that seek to do business in the emerging markets.

The move is set to challenge the supremacy of the US dollar. This, experts say, is the latest salvo in the greatest worldwide currency war since the 1930s….

http://www.citypress.co.za/Business/News/Brics-move-to-unseat-US-dollar-as-trade-currency-20120324

I would love to have fuel this cheap. I am in the UK and it costs me around £80 to fill my tank. That’s $127!!!!!!!!!!!!!

And since our food is transported by trucks etc., an oil shock will basically wipe us out. Get some seeds!

Oil is today over $106 a barrel. Legget’s book The Empty Tank was written c. 10 years ago. In that he said (I paraphrase) “Oil is ALREADY at $39 a barrel.” I don’t remember the exact figure but it was low compared to today and he thought the price was shocking. He goes on to predict peak oil around 2006 and forecasts basically everything that has happened in the past ten years.

Sarmad,

I guess I sounded like a cry baby. I think we too will see $100 fill-ups as well. Thank you for adding your UK perspective.

Greg

Very sorry about your fuel prices.

However why do Americans think they should have cheap petrol?

Iam in Sydney where our dollar has performed like a trained seal and yet we pay some of the highest prices for fuel per literin the world.

I drive a SMART, ugliest car on the planet and it costs me $85.00 for a fill up, I watch while SUVs go past $150.00.

Maybe if the four trillion that was spent on two unwinable wars was spent on an alternative fuel source and research into finding it we might be living in less volatile ecconomic times.

Btw, Australia is in Afghan and Iraq as well, we seem to follow you guys into every conflict , and to this end our fuel prices might indicate we are leading you over the abyss.

America is a large country [Per land area] with a low density of population. America has always enjoyed low Petro prices due to being in bed with SA. Americans have always had oil cheap. Imagine being a heroin addict and all of a sudden your dealer raised the price x4. I guess that is a good signal to go to rehab?

With all due respect, the fuel prices in America are way TOO LOW. Why? Those low fuel prices lead people to buy too big cars with too big engines (typically big V8 engines) that consume A LOT. Compare fuel prices with Europe: Typically USD 2,25/ltr (USD 8,50/gallon). What would happen in the US with such fuel prices? Although I agree that the prices in Europe are too high, they do create a strong incentive for people to choose cars that consume less, far less.

A typical mid-size European car will consume 6 ltr per 100 km on average (many consume less), which is same as 2,55 gallons per 100 mile. Compare that with a typical American car and you see what I mean..

Morgan Anderson,

Relative to silver gasoline is cheap. I think it was around .25 cents a gallon in 1964. That 1964 quarter is worth nearly $6 according to Coinflation.com http://www.coinflation.com/coins/1932-1964-Silver-Washington-Quarter-Value.html So my good man, you are absolutely correct. However, the economy is so weak that even $4 a gallon as a national average is enough to dramatically slow the economy. $6 a gallon will be an economy killer. By the way, I have 4 cylinder vehicles and a small v6 that gets 32 miles to the gallon on the highway. Thanks for the comment.

Greg

Gas priced shooting up at the same time the President expands his martial law powers to me is no coincidence. It could just be the government being prepared for the worst but you have to consider it could be a forgone conclusion that our currency will collapse and our economy with it. This would not fall in the conspiracy theory category either. It is just good ole fashioned preparedness. The people in power should not be judged by their speeches but their actions. They know more than us and are acting on that information. Be concerned.

Steve

I’m finding a lot of complacency among the people I know and speak to on a regular basis about the U.S.’ financial woes. The level of cognitive dissonance they have is simply astounding. They are unable to fathom the economic dangers facing this nation and they have bought into the image of the U.S. economy peddled by the MSM, the Fed, and the POTUS. Added to this is the cultural polarization caused by media editorializing that Americans have been subjected to for a generation. The end result I’m finding is that practically no one I know takes the threats seriously, generally because no one knows what to believe, and none of them are preparing in any way whatsoever. This leads me to believe that when the crisis truly hits, triggered by an major war, natural disaster, or default, its effects will be far more devastating and widespread than it could have been. We are approaching the single most predictable national crisis in history and only a tiny percentage of us are ready for it.

ABR,

Thank you for your input and analysis. You are spot on.

Greg

You could have filled up that Buick with a couple Morgan dollars easily.

Hoppe,

If it was the right “Morgan” I could have bought the car with it. Thank you for adding your perspective.

Greg

Greg, drilling is up in the U.S. while demand is at a two or three year low and the price of a barrel is holding at about $106+- and has been there for couple of months yet gas pump prices continue to creep north; must be the value of the dollar as your premise suggests. Funny how all the politicians blame it on not enough drilling. Maybe they don’t understand the relationship, after all, just because your mouth moves at light speed and got you into Congress doesn’t mean you have any real knowledge of facts or theories or that you are capable of thinking about anything but backroom deals, contributions, insider trading and re-elections.

Regards reserve currency its easy to see that the dollar is losing ground and will at some point be not sought after by world economic players. Hell, maybe CNBC can find a buy signal on that one, as they find a buy signal behind every such downgrading tragedy. Your article is a followup from others like “dollar quietly and continually under attack” yet not enough people understand what the FED is doing at this point. China is setting the stage for world reserve currency and at the rate of the U.S. debt increasing & FED printing it can’t be all that far in the future.

Thank you Greg for pointing out the 2nd most important concern to our country.

As i see it we have a all out assault on the constitution.

2nd is the dollars decline as the world currency.The dollar will collapse because were not following the constitution with sound money principals.It could happen fast..not slow if a great spike in oil mixed with a land slide drift from the dollar as the world trade.

Thanks again.

Jay,

You are correct. The assault on the Constitution is paramount! Thank you for the comment.

Greg

As a small businessman I find that fuel costs have been eating up my profits for years now. Imagine running a truck and pulling a trailer to work on foreclosed homes. Once my mian cost was labor and now it has become fuel. The foreclosure crisis has not hit bottom yet because the long drawn out process of aperson losing everything as they work twice as hard and more hours to make less and pay more.

The failing economy is like a giant austery measure on everyone. The economy is slowly imploding because of government austerity measures and an economy that serves Wall Street not Main Street!

Economys of scale have reduced profit margins across the board leading to reduced wages and concentrating business for the mega-corporations which compete in a predatory manner against local businesses.

The too big to fail business model where a few giant companies with access to Congress control the marketplace is the result of deregulation and it has bled America to death.

I used to pay 25.9. then it went to 59.9, more than double! Hoorrorrs! Then 79.9 and when over a buck (silver certificate) it was a 400% increase. Now check it out. Silver. nuff said.

Mr. Hunter,

USAWatchdog may not be the “best” Alternative Media site on the web, but you have become for me like a “portal” to other Alternative Media sites which I greatly appreciate and for which you should receive credit.

I don’t know if or how much longer this good and important situation will last (i.e. having access to an Alternative Media) but keep up the good work and don’t quit if you can avoid it at all possible.

Thanks very much.

James M.

Thank you James M. for your comment and support!

Gre4g

the barbarians busted through the gate years ago.

we are getting royally reamed and there is not political solutiion, no diplomatic solution and no “civilized” solution because we are not being reamed by gentlemen. we are being reamed by thinly disguised subhuman sociopaths because we went to sleep at the wheel and ignored the eternal vigilance part of the freedom deal.

only serious pissed off can help us now.

the fed has to go, period. everything else is window dressing.

Thanks Greg for discussing this topic. I have to admit, at some level I get very tired of people whining about gas prices. If your truely middle class then it shouldn’t hurt that bad, assuming its short term. Yet, your right, the underlying reason is a currency that is getting weaker. And a weak currency will eventually hurt most everyone.

When I try to explain this to others I get responses that vary from “thats MSM BS” to “stop the right wing BS”. The funny thing is that its neither. The MSM almost never discusses a weak dollar. The right wing simply believes DRILL, DRILL, DRILL, solves everything.

Simple supply and demand curves dont factor in the price of currency.

Anyway, I’m preaching to the choir. 🙂 Keep up the good work.

Shawn In San Jose,

This is really good pointed analysis and you are correct. This is not a Left/Right issue. In the end, we will have a currency crisis and it becoming more apparent by the day. Thank you.

Greg

The government is making more from the sale of gas than is the oil companies, the government is making harder for energy companies to meet the market demands with over regulation, the size of government is making life more difficult for you by making everything cost more and then growing in size.

Looks like government is the problem and not the solution….still.

Hey Greg, thanks for another well done piece of writing.

I feel compelled to point out that the DEA a few days ago here in the land of Zion [ Salt Lake City ] said that Marijuana cultivation is the number one public danger.

Off topic? Hardly. 2 acres of certain types of Marijuana/Cannabis/Hemp can produce enough fuel for one car or truck for one year!

Heres the math: 1 acre = 400 gal. methanol. 2 acres = 800 gal. = 16,000 miles @ 20 miles per gallon.

Average miles driven per year = 15,000 miles.

Do we ever hear this fact in the marijuana debates?

Does prohibition of this plant effect gas prices?

According to the Dept. of Ag. 12% of current farmland growing Hemp would fuel our entire energy needs, vehicles, power plants and aircraft.

Please check out Jack Herer’s book, ” The Emperor Wears No Clothes” if you want to get all the numbers.

We hippies and tree huggers have been screaming at the top of our lungs for years on this.

How bout a little article from you on this subject, we need all the help we can get to get the word out to the badly brain washed masses.

Keep up the good work.

The Cabal is falling.

Dr. Dope

There is one way to bring gas prices down, all these blends required by the EPA is just plain stupid, refineries can not operate on a loss to make all the different blends! China is building refineries & the U.S. is closing them! Ron Paul is right, the ledership from DC is all about retaining power, not what’s right for the nation.

This is not the time to be swapping silver for gas, but that don’t stop people from doing it, Craigs List had a listing today offering gas for pre 1964 U.S. silver coins, and a lot more stuff also for your silver coins! Heck gas went up 20 cents over the week end, but if you drive just 16 miles away it’s 29 cents cheaper, why is this?

I have a four cylinder Kia and a 4 cylinder honda. I have never had a v-8 although I did have a v-6 a decade ago. I still can’t afford the price of gas.

peace

Hey Greg, India has got a deal with Iran for 1,000,000 barrels of oil per day. Guess what India is going to pay for the oil with (around requested sanctions mind you). You might have guess it, GOLD. Google “India – Iran Oil Deal”. That deal has been made and guess what again? Yep, that is right, no mention of it in Main Street Pravda. This is a very big deal and ties into your decline of oil being paid for in dollars. Where are our politicians at, why are they not yelling at India? Find out how many of our gang of 535 have taken money from India or Indian companies lately, that would be telling.

Actually, your site definitely .is. one of the best. Also it’s level-headed and informative.

Thank you rrrr.

Greg

A little advice for you Greg, Always keep the top half of the tank full. We learned that from living in a small town back in the days when the gas station closed at 10 PM and the closest station was 30 miles away.

I feel sad for those living on a fixed income or living from paycheck to paycheck. The money that now goes in the gas tank means less for food, shelter & other basic living expenses. I went to the grocery store today, the package sizes keep getting smaller and smaller, but the price is the same or higher. The decline of the dollars purchasing power is going bring a lot of pain for people.

Jan,

Good advise Jan!

Greg

This does not bid well for obesity in Amerika.

Greg: Dr. Dope has a great point. An expose on why gov’t has prohibitions on hemp would be a great article. I often wonder, since more than 85% of the people have used/tried marijuana/hashish, why is PROHIBITION still in effect? I estimate we could save almost $500 billion a year by abolishing prohibitions on hemp, marijuana, and hashish which, in turn, would permit: generating ethanol; and reducing police budgets, court time, court backlogs, police backlogs, inmate populations. If the majority want it legalized, why is gov’t still insisting on the prohibition? Note to politicians: if you don’t have enough tax dollars to pay for everything tear down prohibitions on relatively harmless things so you can direct precious tax revenue on things that really matter: safety, infrastructure, addressing unemployment, and especially violent crime related to hard drugs.

Thanks Ken, let’s see if we can get Greg to take on this taboo subject.

Here’s a little more on this very important issue.

The seeds of Cannabis/Hemp?Marijuana contain oil {300 gal. per acre}

that can be used as diesel fuel, unaltered. This is in addition to the 400 gal.s of methanol or ethanol per acre.

When we can grow it, price per gallon .75 cents.

Don’t we want to make our farmers rich instead of some other country?

How about paper making, no nasty chemicals needed.

No more cutting down our old growth forests.

Biodegradable plastics are made with Hemp seed oil.

Press board products like 2×4’s and building materials of all kinds including carpets, drapes, and even concrete that is lighter and stronger that current methods.

The list really goes on to 50,000 different products.

The sad truth is we have never needed petroleum oil.

How bout it Greg, your writing and research skills are far above mine, what say ye man?

Dr. Dope

BuzzKill,

Good subject but I probably will not do it. Too many other things that take precedence.

Greg

James M. & all the other readers of USA Watchdog. I sure Greg will do his best to keep bring us the real news, but there is more attacks coming via the UN, here is the link. http://thedailybell.com/3728/Anthoney-Wile-The-Empire-Strikes-Back. It is bad enough we have special interset wanting to control the internet, now we have the UN to watch out for, here is one sentence from the article. “UN agency new power to manage the internet” Russia, China, N.Korea, Iran & other nondemocratic nations are advocating for International Regulation of the Internet through a treaty-based org in the UN.

This is another attack on the freedom of speech coming out of the UN, you just can’t take any thing for granted these days. This is another reason to pressure every member of congress to with draw from the UN & kick the UN off U.S. Soil!

M Smith,

Thank you for the news story and comment.

Greg

Greg

I sure wish i had my old 70,s datsan b210 hatchback. It got 40 mpg.

I paid 400.00 for it,and loved it.

Can one see the begining of The New World Order taking place?

I read the news about the dollar, then I see the current news of a possible government shutdown…its kinda scary! This just continues to back the theory of having some portion of your portfolio in precious metals like silver and gold for sure.