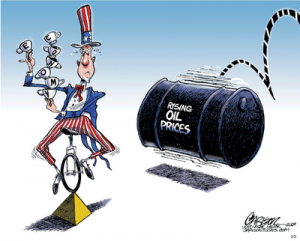

Spiking Oil, Plunging Economy

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This weekend, violence continued to erupt in the Middle East. In Libya, the Gaddafi government launched counter attacks against the rebels. Many fear there is a full blown civil war brewing in that oil rich country.

Yemeni loyalists also staged counterattacks against anti-government protesters in hopes of dispersing them. They used sticks and stones, but still, 25 people were reported injured. All is not quiet in Egypt this weekend as the peaceful revolution there turned violent. Reuters is reporting, “Men in plain clothes armed with swords and petrol bombs attacked protesters in Cairo on Sunday night during a demonstration demanding reform of security services with a reputation for brutality, witnesses said.” (Click here for the complete Reuters story.)

Even Saudi Arabia, the world’s 2nd biggest oil producer (Russia is now #1), is seeing protests gain momentum. Officials are so worried, the security forces rounded up and detained nearly two dozen protesters in an effort to quell even the hint of revolution, but it may be too late. Reuters reported yesterday, “More than 17,000 people backed a call on Facebook to hold two demonstrations in Saudi Arabia this month, the first one on Friday. A loose alliance of liberals, moderate Islamists and Shi’ites has petitioned King Abdullah to allow elections in the kingdom.” Keep in mind, public dissent is frowned upon in that part of the world. (Click here to read the complete Reuters story.)

“Allow elections in the kingdom?” A few months ago that would have been unheard of, but now it is openly talked about. Anyone who thought the trouble in the Middle East was going to be over quickly and quietly—forget it. The problems are just getting started as well as the price increases at the gasoline pumps. In the last 2 weeks alone, gas prices in the U.S. have jumped an average of 33 cents a gallon! CNBC reported yesterday, “The Lundberg Survey of fuel prices released Sunday says it’s the second biggest price increase over a two-week span on record. Analyst Trilby Lundberg found in the survey completed Friday that the average national price of a gallon of regular is $3.51. The average price for mid-grade is $3.64, and premium was at $3.75. Diesel is up 29 cents, to $3.88 a gallon.” (Click here for the complete CNBC report.)

Please note, not only spiking gasoline prices, but diesel fuel as well. Nearly $4 a gallon trucking fuel will undoubtedly cause shipping costs to rise, and, of course, high fuel prices for consumers will rob them of buying power. This will be the proverbial “double whammy” for cash strapped shoppers trying to stay ahead of inflation. The Obama administration is so spooked that it is already thinking about tapping the nation’s Strategic Petroleum Reserve (SPR) to try to push prices back down. CBS News reported yesterday, White House chief of staff, William Daily, said, “The issue of the reserves is one we’re considering,” said William Daley. . . .”I think there is no one who doubts the uncertainty in the Middle East right now has caused this tremendous increase in the last couple of weeks.” (Click here to read the complete CBS News story.)

The Obama Administration might want to hold off on tapping reserve oil until there is a much clearer picture of the Middle East. The U.S. may desperately need the SPR if war breaks out and further reduces or cuts off supplies. As far as the oil price spike, according to an unscientific USAWatchdog.com poll of nearly 1,000 readers, more than 60% think gas prices will be $5.00 or more a gallon by this time next year. I think a nation-wide average of $4 a gallon is a lock by summer. No matter what, it looks like prices will go much higher before they go lower. That will plunge the economy deeper into recession and may, finally, confirm a full blown depression before it’s all over.

Hey Greg, peak oil could very well be the Achilles’ Heel for the so-called ‘Recovery’. Whatever little reserves people may have will be evaporated, in those poored developing countries first felt.

Just returned from the PDAC (Gold/Silver etc) mining show in Toronto. It was a zoo down there!!

Thank you Glenn. What were you hearing for price targets for gold and silver?

Greg

Received more hype with Silver than Gold to tell you the truth. Listened to some good speakers, mostly the big newsletter guys. Most agree, Silver $50-$60 end of year or early 2012 and Gold breaking out again heading to $1500. Personally, I would jump all over this oil move now. Once these protests exacerbate in Saudi Arabia, oil’s price will surge. $150-$200 oil is certainly in play.

Thank you Glenn for the solid reporting!!

Greg

According to the us Dept. of Energy, “the top five sources of US crude oil imports for December were Canada (2,064 thousand barrels per day), Mexico (1,223 thousand barrels per day), Saudi Arabia (1,076 thousand barrels per day), Nigeria (1,024 thousand barrels per day), and Venezuela (825 thousand barrels per day). The rest of the top ten sources, in order, were Iraq (336 thousand barrels per day), Angola (307 thousand barrels per day), Brazil (271 thousand barrels per day), Algeria (262 thousand barrels per day), and Colombia (220 thousand barrels per day).”

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/company_level_imports/current/import.html

Tunisia, Libya, and Egypt don’t even make the top 10 list of oil suppliers to the USA. And Arabia hasn’t even erupted yet. Nigeria hasn’t either. Venezuela has always been troublesome.

Methinks oil and gas prices are rising in the US for reasons other than Mid-East unrest. It’s possible prices will fall once the futures manipulators have had their fun.

We once had the most honest markets in the world. I’ve doubted their honesty and fairness for the last ten years or so. I doubt there is honesty in oil trading, and I doubt all markets for honesty and fairness.

…ikb

IKB,

You make valid points here, but one thing to consider is oil is fungible. Meaning, it can go to the highest bidder and make up for supply losses elsewhere, but who know what goes on in the dark world of our markets. Thank you for your perspective.

Greg

On second thought, although Arabia hasn’t erupted yet, maybe that’s part of the futures risk play.

Libya cannot and will not invite the US or NATO to intervene. Acting to either stop rebels or “crater runways” and “take out air defenses” creates a third war front.

We don’t want to be seen supporting Kaddafy’s genocide. And yet we don’t know who we’re supporting if we support rebels. It’s no wonder Obama can’t develop a strong position.

However, futures traders know that the Saudis probably CAN invite the US and NATO to help in their defense, should it come to that. If the US and NATO end up strafing and bombing Saudis, you know it’s all about royal friends and the largest source of oil. And oil and gas prices will recede once US military might is called.

So, in Libya it would be war. In Arabia it would be rescue. That’s a no-brainer for this administration… unless something bigger arises in the meantime.

…ikb

Thank you IKB for the comment. The ME is a mess that’s for sure.

Greg

“…but who know what goes on in the dark world of our markets.”

You mean all those years of college to get a degree in finance, nearly starving to death, a legacy of debt, and the diploma is worthless? What about accounting? Is that too a dark world? A place where rules do not apply and laws are mere window dressing to entice investors cash? Where we are trained for double entry bookkeeping but not triple entry or quadruple entry.

If so then I say our way of life is already over. Protecting wealth in such a world is not only going to be really hard I say it will be utterly futile.

Ruinean,

This is a monster of a mess, but people are trying to protect wealth with physical gold and silver. Thank you for your comment.

You also need to consider that Mexico’s production is dropping off rapidly. Greg good point about oil being a commodity and as such goes to highest bidder as opposed to who need it. And that is before you factor in politics. If Hugo Chaves could stop selling the USA oil tomorrow he would. CHINA is making significant investments there to handle this corrosive extra high sulfur oil they have there.

And I hate to bring up this point but who the frack gets to decide what honest is? Micheal Moore? Obama? I do advocate a level playing field. I am against the high speed program trading that the Wall Street guys use to steal from my 401K plan with relish. At the same time I don’t want you deciding what is fair. I want honest regulation without political or social activism (think anti oil drilling, Global warming, and social justice BS). I want people put in jail when they rob us (Jamie Dimon, corrupt Congress…just see how many people got hard time over the S&L ripoff verse 2008 banking collapse. About 1,000 then to zero now. And no, Bernie doesn’t count

Whichever way it you see it happening, your readers should know High Oil prices are certainly not the cause of a major US (and European) Depression.

In fact, it was Debt in Government and Debt in Real Estate from teh past 7 years that “baked in” a serious depression into the US Economy.

The question is “does the depression end western civilization as we know it?” or “does the depression act as a catalyst to ease the world into a new global Age plus a Renaissance to boot?”

The answer mostly depends on how the US deals with it 10.7 Trillion Debt held by Foreigners and how the US Government treats its citizens as far as Taxes as concerned. There is a solution and it is important to get this Solution and Message out there.

Reader,

Yes, you are correct, but this oil shock is akin to throwing gasoline on a raging fire. This will surly accelerate the decline of the sinking economy. Thank you for weighing in.

Greg

Maybe. The world, as we knew it, did end last time we had a depression or did you miss it. FDR confiscated the public’s gold then deflated the value of the US Dollar by 75%. The rise of social justice and big government deficits, taxation without end…only WWII and the destruction of the rest of the world got us out of it. Golden age? Hardly ; unless you are talking about your payment options. One last point, what civilization has ever rebounded from bankruptcy? Rome? Wiermar Republic (spelling?) The land and the vacant headed warm bodies that survive remain but golden age?

And before I go…what is your solution?

High oil prices do have a negative economic impact . The cause of high oil prices has more to do with the valuation of the US dollar or in our case devaluation.

Greg,

How can this be? Haven’t you been listening to Obama, the Republicans and the democrats? We are saved! The recession is over. We have NO inflation. Gas or food prices cannot be going up.

George,

Thank you for the comedic relief.

Greg

Love the cartoon Greg, The only way I know to describe our current fiscal condition is comparing it a family who bought more house than they could afford but they have an unlimited credit card to keep staving off foreclosure. I believe that is the position that we are in. The only question is when will this house of cards fall and how fast. My fear is that it will be a catastrophic collapse which happens in a few days shocking the public who has listened to the MSM and government PR/BS.

I was reading one of your articles on http://www.beforeitsnews.com when I saw an article about the top 100 things that will disappear quickly in an economic crisis. I would advise everyone to think what they would need to live with and without electricity if the defecation hits the rotary oscillator.

Thank you Mitchell. Good info and advice.

Greg

The CEO of Exon/Mobil predicted $4.00 a gallon in December before all of the Middle East crisis………….now $5.00 is a no brainer even if Obama taps the reserve, with a more realistic price of $5.50. I live in Western New York and our low price in the area is $3.59 with an average at $3.69 for unleaded regular.

The Obama administration is at a loss of foreign policy and it changes like the wind trying to tie on with a winner. It would support a Hitler if he could deliver cheap oil to the world markets. The one thing coming out of all of this is that it will have no quick resolution and that will keep oil prices high for a long time. The stock market is all ready inflated with the goverment printing press working overtime but even that won’t turn it down at $4.00 a gallon and climbing!

Good stuff Jeff, Art and Mike.

Greg

This economy is allready on life support. It cannot absorb much above $4.00 per gallon. After $4.00 the buying, driving, and social trends start to change. The inflationary spiro of commodities lags behind the fuel costs a few months so the full impact of the price increase won’t be seen until sometime after labor day. This is shaping up to be a pretty ugly economy and maybe the “real” working class may have to start protesting. What a novel ideal, the people without guaranteed good jobs, pensions and health care actually taking it to the streets and making their voice heard.

Tap the national oil reserves?? Short term solution at best.

As of this moment this is not even about the supply side of oil.

The supply WILL become an issue – and sooner than anyone thinks.

We don’t have enough reserves to counter this – period!!!

One could hope that this administration would open up drilling our own untapped oil reserves (yeah – we should drill – so what!)but I do not think they will. Plus it would take years for those to come online.

$4 a gallon gas by summer??? Please – it is there already on the west coast. I predict $5 by summer – maybe sooner.

77 day supply. Big whoop. Save it for a rainy day. A real crisis

Dear Greg,

Great post! I thought that you’d instead post on the unemployment fallacy that came out on Friday (Drudge reported 9.1% on Thursday, this was changed by the LSM to 8.9% on Friday).

Well, it’s what others and myself have said earlier. The price of shipping will go up, causing other items to go up. Gee, does the usurper still think there is no INFLATION?

Those 194,000 “jobs” that were “created,” most of them are temporary, or at best, part time. These “new hires” will soon get a heck of a whammy. They’ll have to shell out more for gas, and more for basic necessities. They’ll be lucky if they have enough “disposable income” for such luxuries as rent/mortgage and utilities, never mind for such items as medical care for themselves and their families, auto repair, and perhaps a tin for their pets.

In order to avoid “disturbances” here the liar-in-chief will have to tap the oil reserves. Gee, kind of like what we’re doing now, only its called SAVINGS! Hey, shouldn’t we be looking for new sources of oil, like we wanted to four years ago (only to be ignored by the Democrat-controlled Congress then?). After all, we’ve GOT the HOUSE!

Only, a lot of people wussed out and left the Senate to the Democrats. And we have a quasi-tree-hugger as POTUS.

How do you people like your “Hope & Change?” Or, in reality, “Hoax & Chains?”

Sam,

I was going to do something on unemployment, but all the violence in the ME overshadowed that story. The big headline on unemployment is that it has been stuck at more than 22% for months. I am talking about the “true” unemployment, if it was computed the way it was done by BLS before 1994. By the way, there have been plenty of sins committed on the Republican side of the isle. For example, the Republicans talk about cutting the budget $60 billion, but ignore the $127 billion giveaway to B of A in forgiveness of toxic debt shoved into Freddie Mac. We can really start cutting the budget is we stop supporting the crooked banks. Both parties are to blame for the shape the country is in now. You do make a good point about drilling for more domestic oil here in the U.S. Thank you for your comment and support.

Greg

Dear Greg,

Yes I know, both have sinned. The Democrats get the brunt of it only because they are currently in power. If the Republicans were in, it would be they.

I also know of the true state of unemployment, having been there for a while. Those whose unemployment has run out are not counted. Those whose pay from a temporary/part time “job” exceeds their unemployment are counted as “employed,” a fallacy I used to resent.

Reagan used to count the military as “employed,” driving down the unemployment numbers. Even during Clinton’s second term, that 5% unemployment was 6% too low, it was really 11%.

No matter the numbers, if you are unemployed, it’s one too many.

Sam,

Thank you for your participation in this site. You are always welcome here.

Greg

Revelation 6:6.

“And I heard a voice in the midst of the four living creatures say, a measure of wheat for a penny and 3 measures of barley for a penny, and see that ye hurt not the oil and wine.”

That’s about a days wages for a days food. No extras and it doesn’t pay the rent.

Jay,

We have that now, it’s called “diverse weights and measures,” part of the folly of paper.

And, you’re right. Having been unemployed and having to try to survive on temp work/unemployment, it’s hard as all get out trying to save. Being a businessperson now, it’s hard as all get out trying to make a sale in a phony “recovery.”

Greg:

I’ll wait for your post on unemployment. A friend just got hired by Dell after being unemployment for only a few months. Again, in Massachusetts. I think if you’re in IT or Bio-tech (at least in Massachusetts, the jobs appear to be there).

I have a question for anyone who cares to answer though:

If you had the chance to take a higher paying private sector job, would you leave a public sector job in this economy and take the higher pay?

nm,

I can field that one.

My ex is a whoopee-doo in the Federal government. Even with all the good jobs in the private sector, and her whining about her “low” pay in government, she refused to leave. Too many benefits that she would be giving up, as well as the “security” of a public sector “job.”

So no, IMHO, I don’t think that one would leave.

Greg , I doubt we will be plunged into a depression , my area in the northeast is actually improving and in my field I am seeing more SUV purchases regardless of gas prices .

Rich,

The top was bailed out and continues to be bailed out by the government. The Fed is creating at least $75 billion a month, and that money is finding its way into the stock market and commodities. You live in the NE which is in proximity to the financial sector (IE: Wall Street and hedge funds). They were and continue to be the big winners in the bailout bowl. Stop the QE, and the NE will fall on its face. That said, I don’t think QE 2 will end, it will be followed by QE3. That’s when Pandora’s box will be pried open and the dollar will tank as interest rate rise. The NE is only doing well because of money creation, and that should make you a little nervous because it cannot go on forever. You better hedge your bet on the depression scenario. Thank you for your comment and perspective. By the way, you don’t really believe the U.S. created 192,000 jobs last month do you? We lost jobs my friend, and I’ll be writing about that in an upcoming post.

Greg

Hi Greg

I enjoy your articles. Wanted to make you awatre that RUSSIA is now the world’s largest exporter of OIL…..

We need to amend the Constitution to REQUIRE a balanced budget and return to SOUND money, ie money backed by precious metals…also another amendment to the CONSTITUTION after we RETURN to sound money that REQUIRES a public referendum for any major changes to our monetary system so that another Jeckyl Island (1913 implementation of the FED/IRS) cannot happen……

Greg, Thank You so much for doing “The Peoples” work!!!!!!

Thank you Ken for the info and kind words.

Greg

Please keep in mind that the budget may be balanced by raising revenue, i.e. taxes, rather than cutting spending. It might be worth considering a limiting spending to a portion of GDP as a starting point.

Everything in America, moves by motor freight. If you think food prices are high now, wait till the $5.00 gas, and $6.00 diesel, comes our way.

Let the fun begin! Thanks Greg…keep it going.

Love this website Greg. It’s a common sense revelation of the politician’s lies…

No one seems to talk about plastics. They’re a product of oil, and each auto produced requires about a barrel of oil. Look around and count all items around you that are either made of, or use plastics. How many plastics are used in a hospitaql???

To clarify one more thing…a barrel is not 55 gallons. It’s 40 gallons. Keep up the good work Greg.

Oldcoot,

Thank you for adding your voice to this post.

Greg

Hi Greg,

I really enjoy your site; I live in the Seattle burbs.

I would say average price today for regular is about $3.75

To well over $4.00 for premium.

Diesel is going from about $4.15 to $4.60 Now today.

I think it can go well over $5.00 in no time.

And my Townhouse has lost about $300,000 in value 3 years.

Don’t you just Love the New Economy…

“Yes We Can” NOT!

Brassbear,

Thank for for the reporting from the West Coast!

Greg

To be correct: a barrel of oil equals 42.00 gallons.

Good to know Oilman, thank you.

Greg

Thanks for the correction oilman. At my age, some details become fuzzy.

Tucson regular gas price today: $3.18 per gallon; cheapest place I could find.

Just came back from working in L.A.: $4+ in some areas of the greater L.A. metroplex.

I’ve been listening to Pastor Lindsey Williams (who evidently lives in Phoenix now via way of somewhere in Kansas). Wondering what folks think of “The Chaplain”? He kind of drives me a bit nuts with the way he talks and often wonder if his information is for real and/or accurate.

Does anyone have any thoughts on him (if you’ve heard him) and what do you make of his predictions? Supposedly, one of the “elite” who has since died told him of things to come.

Samantha,

Lindsey Williams is real, and he has made several well documented predictions that have come true in the past few years. If you look at what is happening in the ME, you don’t have to have a wild imagination to believe that some or all of what he is saying now could happen. I would not bet against him. Thank you for your question, anybody else want to add something to this?

Greg

When gas hit $4.00 a gallon in 2008, people parked their cars and took the bus or light rail. The tourist towns starved for business. The economy here has gotten worse, not better so I see a repeat. No seats on the bus.

Greg:

Over the course of the last almost one hundred years, since the inception of the Federal Reserve Bank, our financial systems and its bankers and our political system and it politicians have become increasingly and indeed incestuously intermingled. This relationship has created what can only be defined as a vortex of corruption. Into this vortex have been drawn a wide variety of other American institutions including unions, insurance companies, mega corporations like GE and variety of so-called non-profit organizations that claim to be independent and unaffiliated but in reality function as shock troops, employed to work around the social edges of the vortex, stirring up the periphery with outrageous behavior just enough to keep the public and the media distracted from the more insidious looting of the nation’s, if not the worlds wealth through pernicious practices of institutionalized inflation, progressive taxation, and the creation of a vast body of citizens dependent on the same institutions of government. Dependendents who in turn further enslave themselves by paying for the chains they are shackled with, by voting for the same politicians who forged them.

So while on the one hand, while the actions on the periphery stir the opposition to useless emotional rage, targeting the surface corruption of the likes of ACORN and Planned Parenthood or Jesse Jackson and Al Sharpton blatently playing the race car, all the while on the other hand the inner circles, those behind the curtains of power, the FED, the TBTF banks and their wholly owned and fully subsidized politicians, have looted 90% of the value of the dollar, taken us off the gold standard and demonetized real money, silver.

This has created an imbalance in the distribution of the nations wealth that has not been seen since the late 20’s in the lead of to the collapse of “Black Monday” and plunged the nation and the whole world into the “Great Depression.” But rather than honestly informing the public of this great imbalance and its inherent dangers the game continues unabated through the POMO process wherein the banks, acting as Primary Dealers, borrow money from the FED, (there are essentilly borrowing from themselves, as they are the owners of the FED), at near zero interest rates, and buy Bonds issued by the Treasury Department. As “Primary Dealers” they receive a “fee” from the Treasury for making theses purchases. Then after holding these T-Bills for as little as three weeks, they turn around and sell these same T-Bills to the FED for a 3-4% premium over what they paid the Treasury for them. They then take these profits and deposit them back into the FED and receive another 3-4% rate on the deposit of these now “excess reserves.” This little bit of paper shuffling yields them a deposit of $6 Billion each month on which they earn interest at a 4.5% rate or an additional $270 Million each year for each monthly deposit or $3.240 Billion each year. All this is course paid for by the largess of the American taxpayer. In addition to this, the taxpayer also get the privilege of becoming the subsidising debtor of the whole mess and paying the interest and principle due on the T-Bills originally issued by the Treasury Dept.

I fail to see how anyone could come up with a more fraudulent yet “legal” scheme to fleece the working taxpayers and pay out but a small pittance to an ever expanding dependent class to buy their votes to elect the politicians who keep the whole thing in place by accepting the bribes know as campaign contributions from the very malefactors that built the corruption in the first place. And who says America isn’t a great place!?!

Davis,

Thank you for your excellent analysis and comment. You are spot on man!

Greg

Hey Greg,

My coffee has gone from $7 to $11.00. Other food products made with imported items have increased in price. The stock market is rising in “so-called” value. Oil is increasing in price based on the world market place.

QE2 is working! Monetization of the debt is working. The value of american’s assets are being devalued to pay for rich union workers (gubmint workers) and fat-cat union bosses.

The price increases we are seeing is called INFLATION.

“Change we can believe in!”

233 billion defecit in one month, and paid for with printed money. Of course, the price of oil is increasing.

markm

You are right again MarkM. Thanks for the real world inflation report.

Greg

Plenty of negative aspects to higher oil prices, no doubt. But also a possible silver lining: High crude prices push up the cost of importing goods and any long distance shipping, especially from overseas. Hence higher crude prices may actually create jobs in manufacturing domestically. Truth be told, a floor on crude prices needs to be created to give businesses the confidance to move jobs back to the states, knowing full well that prices will not retreat back to a point where the endeavor becomes unprofitable. Of course, higher prices are painfull to all but they would also push up demand for more energy efficient vehicles and spur fuel conservation. Not all bad things…

Mike Goo point man! Thank you.

Greg

The great thing about America is nobody makes you hold on to your dollars or buy a house. You are free to make up your mind on what a house is worth. My 60 years living in this system told me that inflation is something you better plan on. Everyone is looking to blame somebody are the system,but I think the people have grown soft.

We await the, “Day of Rage” in the Saudi Kingdom. Have to see if they turn the guns on their own people. Where will the USA stand on that matter? Can the news media cover that event? We will be all riding bicycles before its over.

It happens on the 11th of March = Ides of March?

Slingshot,

We do live in interesting times. Thanks for checking in.

Greg