Latest Posts

Gold Is Money

The Western financial world is officially in full panic mode. A nearly $1 trillion bailout of Greece confirms that fact. Our very own Federal Reserve is providing billions to the effort, but this is much more than a bailout for Greece. It is a bailout for banks holding Greek debt and the debt of other European nations teetering on default. (more…)

Earth Day: An Assault On Man

Guest Writer for Greg Hunter’s USAWatchdog.com

(Mr. Sussman is a Radio Host in San Francisco, CA and has recently released an new book called “Climategate.”)

In recent weeks while addressing Tea Party rallies here on the left coast, I ask the assembled patriots what appears to be an odd question: “Would all those from the former Soviet Union please raise your hands?” A notable number of hands are always raised — the San Francisco Bay Area is home to a diverse population. I then ask another curious question: “What does April 22 signify to you?” Without exception, someone will shout with great displeasure, “Lenin’s birth date!” (more…)

The Canary is Dead

By Greg Hunter’s

In the early days of coal mining, canaries acted as a warning that odorless poisonous gas was present. If there was a dangerous gas build-up, the canary would be the first to keel over. You can use the “canary in a coal mine” metaphor to describe the situation in today’s financial world. Greece is the canary. (more…)

Inflation and Bailouts Go Hand in Hand

Pick a financial fire and you can be sure the U.S. government will hose it down with gallons of money. AIG, General Motors, Chrysler, insolvent states, FDIC, Fannie, Freddie and all the banks are just a few of the blazes Uncle Sam has sprayed money on. (more…)

Gulf Oil Spill Spells Higher Prices

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A little more than a month ago, President Obama took a big step toward weaning the country off foreign oil. His bold plan, announced at the end of March, included opening up 167 million acres along the Atlantic coastline as well as parts of the eastern Gulf of Mexico and the northern coast of Alaska for drilling. (more…)

Nouriel Roubini Talks Doom Again

By Greg Hunter’s USAWatchdog.com

They call NYU economics professor Nouriel Roubini–“Doctor Doom.” He got the moniker because his ominous predictions, a few years back, came true. I really hate the “Doom” name. I think he should be called “Doctor Right on the Money.” So, when Roubini talks I listen. It seems the spotlight is off the U.S. for the moment because of Greek debt and rumors of default.

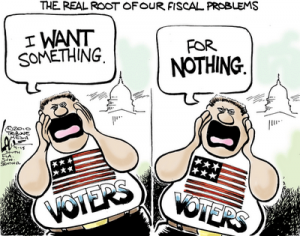

Public Employee Unions Work Against The Public

Unions in this country got started because industry took advantage of workers. But these days, it seems to be the other way around. I am not talking about unions in the private sector. Private sector union workers should be free to get what they can. If private sector unions get too much (health care, pensions and pay), it is the fault of company management. (more…)

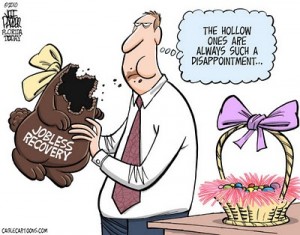

Housing Sales and Inflation Surge

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big news in the economy last week was new home sales jumped 27% in March. It was the best monthly increase percentage wise since John F. Kennedy was in office. What the mainstream media did not tell you was new housing starts jumped up from a very low level– like the lowest level in history! This chart from shadowstats.com illustrates the point: (more…)

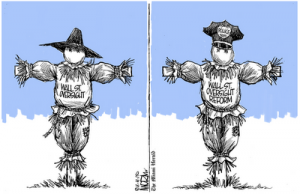

Failure Is the Only Reform We Need

There was lots of talk this week about financial reform for Wall Street. The President gave a speech yesterday on the legislation that is making its way through the Senate. Obama said, “It is essential that we learn from the lessons of this crisis so we don’t doom ourselves to repeat it and, make no mistake, that is exactly what will happen if we allow this moment to pass (more…)

Bernanke Admits Printing $1.3 Trillion Out Of Thin Air

Fed Chairman Ben Bernanke admitted the central bank created $1.3 trillion out of thin air to buy mortgage backed securities. This shocking admission came from the Joint Economic Committee hearing on Capital Hill last week. I was dumbfounded when I saw Bernanke shake his head in the affirmative (more…)

Fraud, It’s Much Bigger Than Goldman Sachs

By Greg Hunter’s USAWatchdog.com

Goldman Sachs was charged with fraud last week by the Securities and Exchange Commission. The investment bank says the charges are “unfounded in law and fact.” Regulators allege “Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party,” SEC Enforcement Director Robert Khuzami said in a statement. In other words

Bernanke Scolds Congress/Keeps Bailouts Details Secret

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Earlier this week, Fed Chief Ben Bernanke told Congress to basically raise taxes and cut the federal budget. The inference was, if Congress doesn’t get its financial house in order, it will be their fault if the economy tanks. (more…)

Will the Bad Economy Cause Crime to Increase?

Over the past 15 years or so, violent crime and property crime (theft) has been on a slow steady decline. According to the Bureau of Justice Statistics, in the past few years, that decline has leveled off. Part of the decline has been attributed to a good economy in most of those years. Part of the decline can also be attributed to good police work and fully staffed departments. (more…)

Follow The Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In the classic 70’s Watergate movie, All the President’s Men, the secret informant, Deep Throat, said, “Follow the money.” It was how reporters Woodward and Bernstein figured out what was really going on in the Nixon White House. If you want to figure out what is really going on in the economy, you do the same thing—follow the money. (more…)

Ignoring the Good News?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I heard Jim Cramer of CNBC say last night people are “ignoring the good news.” I say when it comes to the mainstream media, just the opposite is happening. The folks at the financial news networks are especially good at ignoring the bad news even though they should know better. (more…)