Latest Posts

Can The Financial System Really Be Fixed? Some Say No.

By Greg Hunter’s USAWatchdog.com

Every time I see a speech on the economy, such as President Obama’s on Monday, I rarely see someone cut to the heart of the problem. There is too much debt! That is the simple answer to what is wrong with the economy. The President really did not address that issue. He basically just scolded Wall Street for needing a bailout. We have spent or committed 13 trillion dollars and we are nowhere near out of the woods.

Here are a few examples of the debt problems American is facing that I have talked about in a previous post. Let’s review: We just paid people $4,500 a pop to trade in their “clunker” and buy a new car because it was the only way to pull the auto industry out of a tailspin. America is in the hole and going deeper by the day. The second week in September, the government sold 70 billion of our national debt. That is 70 billion dollars in Treasuries in a single week to finance our needs! 2009 will produce a record deficit of 1.58 to 1.84 trillion dollars of red ink. That’s nearly 4 times what the Bush administration ran up in 2008. The Treasury Secretary also thinks we will not be coming out of this economic mess anytime soon, and he admitted as much in early September at a Congressional Hearing on TARP spending. Foreclosures are up, and it’s forecast by the Treasury Department that “millions more are coming.” Speaking of real estate, those lucky enough to stay in their homes are going to continue to be hit with falling prices. Commercial real estate is in free fall. Banks are failing at a rate we haven’t seen since the Savings and Loan crisis. The government is printing money to buy its own bonds to artificially suppress interest rates. Finally, unemployment is at 21% and rising (using shadowstats.com computations). There is no way the worst is behind us, quite the opposite. That said, the President has to try to put lipstick on this pig of an economy.

When President Obama entered office, he installed Tim Geithner as Treasury Secretary. This was the guy who sat at the top of the New York Fed and watched silently as all the big banks took on enormous amounts of debt. In many cases, leverage at the banks was 40 to 1. In a word, insane. Geithner’s punishment for letting that happen on his watch? A promotion to Treasury Secretary! Ben Bernanke was just reappointed by the President for his job as Chief of the Federal Reserve. The Fed and Bernanke basically caused the debt meltdown problem with their interest policies and guidance. The Fed Chief has been hailed as the man who saved the system from financial collapse. That is like a drunk driver causing an accident with a bus full of children. After the crash, the drunk stumbles over and pulls the kids out of a burning bus and is then hailed as a hero!

How did these banks load up on way too much debt? It was done with a security called an Over the Counter derivative or OTC derivative. Over the Counter means from a seller to a buyer and not done on an exchange. Wall Street bundled up debt like car loans, credit cards, and mortgages into securities and made big commissions selling these bundles of debt around the planet. Currently, there is no public market for OTC derivatives, contrast that with the Chicago Board of Trade. That is a public market. Take for example what happens when a bushel of corn is sold on the CBOT. There are standards for how much a bushel weighs. You cannot pour dirt, ball bearings or water into the bushel to make weight. There are rules and regulations that guarantee a “clean” delivery with universal value. Remember OTC derivatives have no public market. That means there are no standards, no guarantees, no regulation and most importantly, no price discovery. A pricing mechanism is the hallmark of a bid/ask public market.

The price for an OTC derivative is whatever the seller says it is. There was little equity in most of these “securities” because, after all, there were no regulations. Why put money into a security when the seller could put money in his pocket instead? When the economy went sour, many people stopped paying their car loans, credit cards and mortgage payments. What do you suppose happened to the value of OTC derivatives when people stopped paying their bills? According to the Bank of International Settlements, or BIS, there are 592 trillion dollars of OTC derivatives. What do you suppose would happen if there was a public market now? We would find out what this stuff is really worth and it would not be pretty! According to famed investor Jim Sinclair at JSMineset.com , there is no way most of the 592 trillion dollar ball of debt can be priced. Sinclair thinks the BIS is underestimating the size of the OTC market. Sinclair contends it is really more than a quadrillion dollars. (A quadrillion is a thousand trillion!)

Sinclair recently wrote,”Unless financial contracts have standards there is no way to clear them.

Unless financial instruments have accurate means of daily valuation, there is no way to clear them.

OTC derivatives outstanding from 1991 to 2008 have no standards.

OTC derivatives outstanding from 1991 to 2008 have no sound means of true valuation in any time frame…”

Sinclair goes on to say,“ With this being the incontrovertible set of facts: The Bank for International Settlements is for the first time proposing the world’s central banks take over the financial risk of the entire mountain of more than one quadrillion one hundred and forty four trillion dollars (valuation before the change to “value to maturity” method valuation of nominal value of OTC derivatives) of OTC derivatives created from 1991 to 2008. The reason is simple. This unchanged in size mountain of weapons of mass financial destruction as still sitting there ready to explode in the second chapter of the greatest double dip depression of 2007 – 2009.”

So, now the BIS is proposing that central banks backstop the entire global OTC derivative market. It was recently reported by Bloomberg News,” Regulators are pushing for much of the $592 trillion market in over-the-counter derivatives trades to be moved to clearinghouses which act as the buyer to every seller and seller to every buyer, reducing the risk to the financial system from defaults.”

Still, the debt is not really going away under this plan or any other we have seen so far. The mistakes of greedy bankers are being transferred to the public by massive money printing on a scale never seen before in history. Who knows how this will turn out. My predictions: it will not end well for the U.S. dollar and most people will suffer from enormous inflation.

Poll: News Media’s Credibility Plunges To New Low

By Greg Hunter’s USAWatchdog.com

I want to highlight this AP article below because it is why I started USAWatchdog.com. I do not think people are getting the whole story, especially when it comes to the economy. Things are much worse than what is being reported, and it is going to get a whole lot worse before it gets better. I know that is not what you are hearing in the mainstream media. Maybe the press, as a whole, is just not brave enough to put out the real story. Some journalists are doing good reporting, but often their stories are down played or are accused of spreading unfounded doom and gloom for telling the truth. Maybe corporate America, which owns most of the mainstream media, is subtly distorting the news to make things look better than they really are. The mainstream media completely missed the financial meltdown and covered it like some unforseen event. There were plenty of signs we were headed for trouble and no one wanted to report on them except a few people. Here is what I said on CNN in March 2008.

I wrote an article called “The Soft Truth” when this site first launched three weeks ago. In it, I described how the media doesn’t really lie to you, it just does not tell you the whole story. I know the editorial and legal side of the news media because I worked for ABC and CNN for 9 years as an investigative reporter. I didn’t get a story on the air without approval from the company lawyers and management. The networks and cable are doing a lot less of that kind of work these days. Mainstream media is putting it’s resources on superficial stories instead of covering news that really affects your life. So, when I hear people tell me they do not trust the mainstream media or they are not getting the full story, it makes me wonder if this a national trend? Now comes a story that validates what I am hearing and why USAWatchdog is in existence…

By MICHAEL LIEDTKE (AP)

SAN FRANCISCO — The news media’s credibility is sagging along with its revenue. Nearly two-thirds of Americans think the news stories they read, hear and watch are frequently inaccurate, according to a poll released Sunday by the Pew Research Center for the People & the Press. That marks the highest level of skepticism recorded since 1985, when this study of public perceptions of the media was first done.

The poll didn’t distinguish between Internet bloggers and reporters employed by newspapers and broadcasters, leaving the definition of “news media” up to each individual who was questioned. The survey polled 1,506 adults on the phone in late July.

The survey found that 63 percent of the respondents thought the information they get from the media was often off base. In Pew Research’s previous survey, in 2007, 53 percent of the people expressed that doubt about accuracy….More from the AP article.

Get Out Of Debt, Stay Out of Debt!

By Greg Hunter’s USAWatchdog.com

This cartoon would be even funnier if were not partially true. These days the average American owes $8,000 dollars on his credit cards. I was asked by a friend of mine, “How should I hedge my investments in this environment?” What he really should ask is, ” How do I prepare for an economic storm?” I am not a money manager, so I cannot tell you how to make tons of money. I can tell you how to rig for trouble.

First of all, the best hedge you can have is low or no debt. Once you have a car payment, credit card payment or mortgage payment, you cannot cut back on it. In tough times, you either continue to pay or default. So, cut your debt first and foremost. If you have a car payment, pay it off. When you own your car and your state DMV sends you the title, it will amaze you how well that paid for car will run. Car leasing is one of the worst things you can do financially unless you work in sales and you can write it off. Do not lease. Find a good used car and pay it off as fast as you can. It will be cheaper and more cost effective.

Credit cards are death on plastic. You should only use a credit card if you can pay it off every month. If you are carrying a balance, interest is eating your financial house like termites 24/7. If you want some motivation to help you accelerate paying off your credit card debt, then take a good long look at what you pay in interest every month. Let’s say the interest portion of your payment is $300 dollars a month. Start thinking in terms of 300 bucks a month in gas, groceries, shoes, tires, whatever, but start thinking in terms of what you could be buying instead of paying interest to the credit card company. This will be painful to ponder but you need to do it for motivation to pay off those credit cards.

Save some money! Keep at least 6 months of emergency money! Then and only then are you ready to hedge your investments. You should bank at more than one institution and check its financial health at a place like The Street.com or Bankrate.com. I do not get paid to promote these companies; these are just the ones I use. You should also have two well capitalized brokerages. I like Scottrade and Edward Jones. Again, I do not get paid to promote these companies. These two places have some of the highest capital ratios in the business. That is important because the insurance that you get on your brokerage account is not really worth that much. It is not easy to collect and you are not guaranteed to get all of your money back. Also, look at the Bernie Madoff and Alan Stanford fraud cases. People who were wiped out had all their money in ONE PLACE and that is stupid!!

You should also own some physical gold such as U.S. minted coins. Most experts recommend between 5 – 15%. You should keep it in a safety deposit box at a bank you check out and trust. I guarantee you every rich person has a physical gold position. And finally, let me repeat myself…GET OUT OF DEBT and STAY OUT OF DEBT. If that means staycations and wearing shoes longer than you would like – suck it up and do it!

Prediction: Obama Wins Health Care, Loses Economy

By Greg Hunter’s USAWatchdog.com

President Obama’s speech on health care to Congress was high on emotion but short on details. When he was finished, I wasn’t sure the “Public Option” was in or out. I do not know how you can insure an additional 46 million people for free. Obama said he won’t sign a bill that adds,”one dime to the deficit, now or in the future.” On the other hand, the Congressional Budget Office thinks health care will add 239 billion dollars to the deficit in the next 10 years. Michael Tanner of the Cato Institute says,”If the new health care entitlement were subject to the same 75-year actuarial standards as Social Security…” the bill will add an additional 9.2 trillion bucks to the deficit over the next decade. That said, I think the President will get a health care bill through Congress. It will not be the bill the far left or far right wants, but there will ultimately be a bill to sign. Obama needs a victory, and I predict he will get one and it will cost real money!

I’m worried about the real problem in America, unemployment! Yesterday on MSNBC’s “Morning Joe,” someone said “…unemployment was Obama’s next big problem.” What!! It was a problem when the President entered office, and with 15 million people out of work, unemployment is a problem right now!!! That comment was made while Time Magazine was rolling out it’s next cover. It’s called “Out of Work in America.” If Obama doesn’t get this fixed by 2012, he will be standing at the end of that long line on the cover.

I cannot for the life of me figure out why the health care issue was pushed ahead of unemployment, which is a symptom of a bad economy. Don’t get me wrong, health care is a big issue but compared to the ongoing financial meltdown, it’s like fighting over band-aids on the deck of the Titanic! The financial situation in the country is not just bad, it’s in cardiac arrest! I know the Fed just came out and said the worst recession in 70 years was over, but that is simply preposterous!

We just paid people $4,500 a pop to trade in their “clunker” and buy a new car because it was the only way to pull the auto industry out of a tailspin. America is in the hole and going deeper by the day. Just this week, the government sold 70 billion of our national debt. That is 70 billion dollars in Treasuries in a single week to help fuel the biggest budget deficit in U.S. history!!! 2009 will produce a record deficit of 1.58 to 1.84 trillion dollars of red ink. That’s nearly 4 times what the Bush administration ran up in 2008. The Treasury Secretary also thinks we will not be coming out of this economic mess anytime soon and he admitted as much in early September at a Congressional Hearing on TARP spending. Foreclosures are up, and it’s forecast by the Treasury Department that “millions more are coming.” Speaking of real estate, those lucky enough to stay in their homes are going to continue to be hit with falling prices. Commercial real estate is in free fall. Banks are failing at a rate of a half dozen a week. The government is printing money to buy it’s own bonds to artificially suppress interest rates, and unemployment is at 21% and rising (using shadowstats.com computations). There is no way the worst is behind us, quite the opposite.

Obama may win the health care battle, but he will lose the war on the economy or, at best, just keep it on life support.

Something Wicked This Way Comes

By Greg Hunter’s USAWatchdog.com

I am not a gold bug, but I can spot a warning sign when I see one. Gold is near an all time high and this is no fluke! High prices are the result of big demand from monster players who are afraid of a dollar crash. My fears all center around Fed Chief Ben Bernanke’s announcement in mid-August of plans to end Quantitative Easing. QE is a program where the Fed used more than 300 billion in “printed money” to buy Treasuries to artificially hold interest rates down. The Fed wants this program phased out by the end of October. Oh really! Bernanke is going to stop buying debt and allow interest rates to spike! Not a chance. Interest rates could go up dramatically, and any homeowner with an adjustable rate mortgage would be hit with higher payments…much higher. I, and many other people, think The Fed will be forced to keep “printing money” and that creates an even bigger problem for the dollar. Martin Hutchinson at the Prudent Bear revealed his prediction in a recent article called “October Surprise,” …” Given the current predilections of the world’s central bankers, it is likely that when the T-bond bubble bursts, they will rush to the printing presses, the Fed buying Treasuries in a frantic attempt to stabilize the bond market. In all but the shortest term, that is unlikely to work; it will cause a spiraling increase in gold, oil and other commodities…” Hutchinson goes on to say,”If October 2009 fails to produce a full-scale T-bond rout, it will not be long delayed thereafter…”

He’s not the only one feeling something bad is coming. New York University Professor Nouriel Roubini, who predicted the financial crisis, said recently,“If markets were to believe, and I’m not saying it’s likely, that inflation is going to be the route that the U.S. is going to take to resolve this problem, then you could have a crash of the value of the dollar.”

Nassim Taleb, author of the runaway best seller “The Black Swan,” said in mid-August on CNBC ,”The risk is still there and we are probably worse off than we were before.” You definitely cannot call Taleb a market cheerleader and he is clearly not comfortable with this so-called “recovery.” You can check it out in the video below.

I think when Taleb says, “worse off” , he means the economy is worse now than when Secretary of the Treasury Hank Paulson told members of Congress last year that there was risk of “systemic failure.” Right after that Congress voted for TARP money to bail out the banks.

Even easy Al Greenspan is a little worried about the dollar. “Unless we roll in this whole degree of expansion, we will be in trouble,” the former Chairman of the Federal Reserve told a conference in Mumbai via videoconferencing. “I am not talking 3-5 per cent inflation, I am talking double-digit inflation in the US.”

Finally, there is John Williams at shadowstats.com. Just last week, he correctly predicted there would be a “negative surprise” with the unemployment number. He was right on target, it was worse than expected. Now he says,”With both the economic and systemic solvency crises, I believe the worst

still is ahead of us.”

How far ahead of us is my question? Famed gold investor Jim Sinclair thinks the dollar will take a big hit,”in the middle of the fourth quarter.” Sinclair also thinks the Fed will once again be forced to “print money” to buy Treasuries when the QE program ends. When that happens, the dollar will fall hard and all hell will break loose.

Just like the famous book “Something Wicked This Way Comes,” there will be horror. Who knows how it will all turn out, but there will be no happy ending and gold will sell at a much higher price.

The Other Real Estate Problem

By Greg Hunter’s USAWatchdog.com

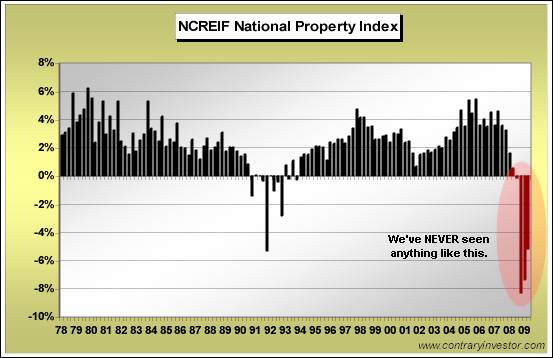

I love the phrase “A picture is worth a thousand words” because you tell a lot of people a complicated story in a short amount of time with just one look. The “Other Real Estate Problem” I am talking about in the headline is commercial real estate such as malls, hotels, office space and industrial sites. You have not heard too much about this problem, and most people believe it does not affect them, but it does! As commercial real estate goes so goes the economy and that could very well mean continued job losses. The picture below is from the The National Council of Real Estate Investment Fiduciaries:

This graph is included in an excellent article written by Brian Pretti of Financial Sense Observations. Please note in the lower left hand corner of the chart,”We have NEVER seen anything like this.” That means this is big folks! This chart shows what is happening to the value and the income generated for about 6,000 properties with nearly 300 billion in value. For the rest of the story about commercial real estate, please read Pretti’s well done in depth article by clicking this link.

The Real Unemployment Rate

By Greg Hunter’s USAWatchdog.com

The Friday headline in the Wall Street Journal reads “Job Losses Moderate But Unemployment Hits 9.7%.” This is just a short post to give you the “Real” number according to John Williams at shadowstats.com. He recreates government statistics the way they were done before the Bureau of Labor Statistics changed methods to make things look better than they really are. According to shadowstats.com, the unemployment rate using the BLS method in 1994 would be 21.1%, an increase of .5%. By the way, Williams predicted there would be a negative surprise two days ago. (see USAWatchdog post “Alert! No Substance to Economic Recovery) He was right on target!

The Smell of Money Harvesting is in the Air!!!

By Greg Hunter’s USAWatchdog.com

There are so many reasons why this stock market should be hitting a wall. Just a few are: high unemployment, plummeting tax revenues, major real estate declines, defaults in both residential and commercial properties, hundreds of banks are expected to fail this year and next, cities and states going broke and wars fought on 2 fronts. There is no end or resolution in sight for any of these problems.

Yet, the stock market has “climbed a wall of worry” to produce one of the biggest bear market rallies in history. The DOW is up about 50% in just 5 months. The market by most standards is not cheap. So is everybody crazy? Well, apparently corporate insiders are not. They were dumping their stocks at a rate of 30 to 1 during the month of August according to TrimTabs Investment Research. That means for every insider buying shares of stock, there were 30 insiders selling shares of stock! According to TrimTabs, that is a record. Take a deep breath…that is the smell of the money harvesting Wall Street machine revving it’s engine! Nowhere is the buy low and sell high mentality more apparent than in this chart of the S & P 500 below :

The S&P 500 is at about the same level as it was in 1997. And consider this, people have been stuffing around 5 to 10 percent a year into their pre-tax retirement accounts (which amounts to hundreds of billions of dollars.) So shouldn’t the market be much higher? Where did all that cash go? The money was ” harvested” by insiders, hedge funds and big banks! These folks sold high, took your contributions and left you holding the losses. All the while, “the experts” told you to be a “long term investor” and be “diversified.” What happened in the last 12 years? Isn’t that enough time to make some money? Isn’t a group of 500 top stocks diversified? Well look at the picture above and any 3rd grader can see THAT DIDN’T WORK!!! You could have beaten S&P 500 returns by a mile by just putting your money in an FDIC insured bank account during the last 12 years!! On top of that, you would not have paid a management fee (1 percent on average) which would have saved you another 12 percent! What a rip-off!!!

Also, consider the fact there are a whole lot of companies that are no longer in the S&P 500 because they have either gone bankrupt or the share price has evaporated. That means the “investing” picture for the little guy is actually a whole lot worse than the S&P shows. Let’s name just a few companies in the past 11 years that delivered a big loss to anyone holding them: Lehman, Bear Stearns, Fannie, Freddie, AIG, GM, Chrysler, Enron, WorldCom, Adelphia, Wachovia and WaMu. That is only a few I can name off the top of my head. I think you get the point.

Fast forward to today and reconsider the 50% increase in the market in just 5 short months. Still, most people are down at least 30 percent from the high. If you are a trader or insider, you love this market! If you are a “buy an hold” investor, get ready to sit on another big loss in the old 401k or sell some stock and you too can harvest some money just like the big guys!

Alert! No Substance to “Economic Recovery”

By Greg Hunter’s USAWatchdog.com John Williams of shadowstats.com put out an alert today (9/2/09). It read, in part,”Something Brewing in Systemic Solvency Crisis?” Part of what Williams does is give forecasts to clients, some of which are big companies and hedge funds. He bases his predictions on government statistics but not the way they are done now. Williams rebuilds government stats the way they were computed before they were distorted. In other words, the way government statistics are done now makes things look better than they really are. For example, the official unemployment rate stands at 9.4% , but if you compute UE as it was done by the Bureau of Labor Statistics (BLS) prior to 1994 it would be 20.6%. By the way, Williams predicts unemployment will reach 34% in 2 years! Williams says money growth is slowing which is probably why he thinks there is “no substance to economic recovery.” Slowing money growth equals big problems for the financial system and it will force the Fed to act again. So what will the Fed do? It appears create more money. Williams says the monetary base…”surged” at the end of August . Also, Williams thinks the reappointment of Ben Bernanke is another yellow flag. Even though there were rumors of replacing him, it just does not make sense considering the problems on the horizon. My take: There are plenty of shoes that will be dropping and it’s probably best to give the appearance of continuity and stability in the face of a new wave of financial turmoil. Finally, Williams thinks there is going to be a negative surprise with Friday’s (9/4/09) unemployment number. In other words, there is going to be a bigger unemployment number than expected. For the complete report and other accurate recreated government statistics, subscriptions are available at John Williams’ site: http://www.shadowstats.com/ I did not get paid to write this article or to push shadowstats.com. I just think Williams knows what he’s talking about and backs it up with facts. What shadowstats.com does is something you will not see much of in mainstream media. John Williams has appeard on network and cable TV and has been quoted in many national publications.

Second Wave of Bank Failures? You Bet!

By Greg Hunter’s USAWatchdog.com

FDIC Chairman Sheila Bair dropped a small bomb on CNBC last night. She said, “Commercial real estate will be more of a driver of bank failures.” What! You mean more than the imploding residential real estate market? Oh… at that point I felt a little sick at my stomach. There already is a huge unrelenting problem in housing. (see my post from last week “Real Estate at a bottom?…Not!”) Now there is going to be an even bigger drag on the banks! It will be a colossal second wave of commercial property defaults that will kill bank balance sheets. I have to admit, Larry Kudlow did a good job of pressing Bair for a true picture of the banks’ financial health both big and small. When she started mentioning “full faith and credit,” she looked nervous to me. Just give it a look right up until they start talking about the “Super Regulator.” (This is kind of long so you can also just skip it and read on after the video.)

The Federal Deposit Insurance Corporation has about 4.5 trillion in insured deposits with only 10.4 billion in net worth. Said another way, that is 10.4 billion to insure 4,500 billion dollars. No wonder Bair looked nervous. The FDIC does have a direct line of credit to the Treasury of 500 billion. There is no doubt she will be tapping that money to pay depositors in this next wave of commercial real estate collapse. There are about 3.5 trillion in commercial real estate loans held by banks. Commercial property owners are defaulting at rates not seen since the 90’s. Banks are getting stuck with malls,office buildings and industrial sites. Add the ongoing residential real estate meltdown to the equation and you have big losses and inevitable bank failures. The question is how many and which ones? “The bottom line: Defaults are exploding,” said Richard Parkus, an analyst with Deutsche Bank. “It’s terrible. It’s going to be worse than in the early ’90s.”

Then, there is this wrinkle. Earlier this year, Congress and the big banks got the Financial Accounting Standards Board or FSAB to change the rules. Instead of “mark to market” accounting where a bank is required to value an asset at the price you can sell it today, banks can price assets at what they might get in the future. I and a few other people call it “mark to fantasy.” I also think it’s government sanctioned accounting fraud. There is no way for the government, an investor or a depositor to really know the financial health of the banks. That is sad and a little scary. Remember it was about a year ago that Treasury Secretary Hank Paulson told members of Congress that if he did not get the TARP money, there would be a “systemic” failure. There is simply no way of knowing how bad this could get or if the government can keep things under control. So what can you do? I check my bank every 6 months. Here is a free link to The Street.com Banks and Thrift Screener. This is a fast simple way to see if your bank is headed for trouble.

Tale of Two Stories

By Greg Hunter’s USAWatchdog.com

This is a tale of 2 stories the press started covering last week. One, let’s call it the “Kidnapped Girl” story. It’s about a young woman who escaped after being kidnapped and held against her will for 18 years. The other, let’s call it “The Fed Secrets” story. It’s about the Federal Reserve losing a court decision that will force it to say who it gave trillions of dollars to during the financial meltdown.

No doubt, the young girl who was kidnapped 18 years ago will get plenty of coverage. Every news organization will be fighting for the first exclusive interview with the victim and the children. They will spare no expense. Already there have been live shots, aerial footage and front page stories. Before it is through, you will know every detail imaginable of this sad story, from the food she ate to the birth of the 2 children she allegedly was forced to have with her abductor. The “Kidnapped Girl” story will be followed right up to the end of the criminal trial. Mark my words, this story will be covered for months. Heck, the kidnapped girl may even get her own reality TV show.

On the other hand, there is “The Fed Secrets” story. The Fed lost a Federal case last week that could force its secret actions into the light of day. Also, considering the Federal Reserve is responsible for the value of every dollar you spend or save, this should be a very big deal with worldwide implications! Still, “The Fed Secrets” story is barely a blip on the mainstream media radar.

The Fed will file an appeal. Meanwhile, the Federal Reserve asked Manhattan Chief U.S. District Judge Loretta Preska to delay enforcement.

“The immediate release of these documents will destroy the board’s claims of exemption and right of appellate review,” the motion said. “The institutions whose names and information would be disclosed will also suffer irreparable harm.” It went on to say The Fed’s “ability to effectively manage the current, and any future, financial crisis” would be impaired, according to the motion.

Does The Fed think lying and concealing will help the public? It certainly will help the insolvent banks. I think it is very likely the Fed also bailed out foreign banks, and these “loans” are not loans at all but taxpayer giveaways. If the Fed was forced to reveal facts such as those, then the very existence of the Central Bank could be in question. In short, most Americans would be angry and outraged!

It is up to the media to cover stories so the public is informed and it does this by the allocation of resources. On one side of the scale, you see an “anvil” of journalistic weight. Much has and will go for the coverage of the “Kidnapped Girl” story. On the other side of the scale, you see a “feather” weight of commitment for “The Fed Secrets” story. So little being spent to cover a something that could affect the lives of every American goes to show you how out of touch the mainstream media can be. Masters of the media may be scared to tell the truth or are downright dishonest and know full well what they are doing.

Both the “Kidnapped Girl” and “The Fed Secrets” stories deserve to be covered. There is nothing wrong with lopsided coverage as long as the highest priority is put on the story with the biggest impact on the lives of the people. Instead, the biggest story is getting the “feather” treatment and the smaller story is just more of the infotainment that keeps the public in the dark.

Goldman Problems and John Crudele’s Warning

By Greg Hunter’s USAWatchdog.com

John Crudele is one of the good guys when it come to telling the truth and protecting your investments. The article below is nothing short of brilliant, concise and adds real clarity with what stinks about the economy. When I say stinks, I mean fishy. If you have money invested in the stock market, you should read this until the very end because Crudele offers a warning everyone should give serious thought to. I have been reading Crudele’s column in the New York Post for years, and he has a habit of speaking his mind and backing it up with fact! See his must read article below:

——————————————————————————————–

HOW GOLDMAN SACHS’ PROBLEMS ARE HURTING YOU

By John Crudele/ NY Post 8/27/09

AMERICANS should boycott the stock market. No, I’m not kidding. And this isn’t going to be one of those funny columns. In fact, I’m deadly serious that investors shouldn’t risk any more of their money until there are promises of a thorough investigation of Goldman Sachs.

Over the past few years I’ve looked into the much-too-cozy relationship between Goldman and Washington. I’ve suspected that this Wall Street firm has been acting, in essence, as an arm of the government. And I am also pretty sure that if Goldman and Washington have something secret going on, the investment firm isn’t doing it for altruistic reasons. There’s money to be made.

In 2007 I reported in this column that Treasury Secretary Hank Paulson let the cat out of the bag when he confessed on a cable TV show that it was “my job to talk regularly to market participants . . .” Paulson had been the chairman of Goldman right before taking the job as head of Treasury. So, if he felt it was his “job” to talk with people on Wall Street then who else would he speak with if not his old friends at Goldman? The head of the US Treasury would, of course, know lots of secrets. In the olden days, this would be called “inside information.”

And despite Paulson’s contention it would be entirely inappropriate for him to discuss sensitive matters with people who could profit from the information. It is, in fact, illegal. And the penalty could be jail time. More on the story…

Is Ted Kennedy’s Passing a Bad Omen for Obamacare?

By Greg Hunter’s USAWatchdog.com

The country has lost one of the most influential members of the U.S. Senate in the last 50 years. Ted Kennedy was called the “Lion of the Senate” for good reason. Even though he was a staunch Republican opponent, he was also known as the “go to” member of the Senate to get bipartisan support for legislation. Few of Kennedy’s big bills did not have at least one big name Republican sign on to it. This morning, I heard Hard Ball host Chris Matthews say on television he did not see anyone in the Senate with his “stature” and that the President “didn’t really have a quarterback on the field that could carry out the play.” Still, Ted Kennedy will probably serve the Democrats in death on the health care legislation. The health care reform bill will now likely bare Kennedy’s name, at least that’s what Democratic leaders in the Congress are saying today. In a statement, the Speaker of the House, Nancy Pelosi said, “Ted Kennedy’s dream of quality health care for all Americans can be made real this year because of his leadership and his inspiration.” Pelosi is planning to push the legislation that the late Senator called “the cause of my life.”

But not all Democrats are as optimistic as Pelosi. Just last week, according to the Lakeland Times in Wisconsin, Senator Russ Feingold told a large crowd in his state, “Nobody is going to bring a bill before Christmas, and maybe not even then, if this ever happens.” He reportedly went on to say, “We’re headed in the direction of doing absolutely nothing and I think that’s unfortunate.”

On top of that, there was more bad news on the economic front according the White House budget Chief Peter Orszag. He says because the recession was deeper and longer than expected, unemployment will surge to more than 10 percent and the budget deficit will be 1.5 trillion dollars next year. That is more than 3 times bigger than the Bush administration deficit in 2008. A far as the real unemployment rate, John Williams at Shadowstats.com says it is already 20.6 % figured the way the government did it before 1994. Williams says within the next 2 years unemployment will soar to 34%. Yes, he told me 34%!

Couple the ballooning deficit and skyrocketing unemployment along with declining tax revenues and the Obama health care plan will have a hard time finding funding. This bill will likely collapse under its own financial weight not to mention most of the public is against it. Sorry, Ted.

The Biggest Story Not Covered in the News

By Greg Hunter’s USAWatchdog.com

Yesterday, the Federal Reserve lost a big decision regarding it’s transparency. Bloomberg, a financial news organization, filed a Freedom Of Information Act last year to get records to find out where the Fed spent trillions bailing out big banks in the financial crisis. When the Fed refused the request, Bloomberg sued and now won. Every American should want to know what the Fed is doing and who it is helping by printing trillions of dollars out of thin air. After all, the Federal Reserve is ultimately responsible for the value of every dollar you save and spend. Look for the Fed to fight giving up it’s secret information to the death! I predict it will appeal the case. This story is not being covered today in the mainstream media. Not covering this type of important story is part of the reason why the public is in the dark about what is going on with their money. More about this case and why the mainstream media is not fully informing the public in “The Soft Truth” posted below. Meanwhile, here’s more on the Fed losing it’s case to keep you in the dark.

The Soft Truth

By Greg Hunter’s USAWatchdog.com

In July comedian Jon Stewart, anchor of the Daily Show on Comedy Central, was voted the “Most Trusted” Newscaster. He had almost as many votes as Charlie Gibson and Brian Williams combined. Katie Couric, according to the Time Magazine poll, came in dead last. Boy, if that is a not a wake up call to mainstream media I do not know what is.

I don’t think it’s as much of a put down of the anchors as it is what they put on the air for news content. The Daily Show is comedy but it also can be hard hitting, reveal conflicting statements by politicians and hold people accountable for their actions. Look at the now famous exchange between Stewart and Jim Cramer from CNBC’s Mad Money. The public has lost a fortune in the stock market and the “experts” telling us to buy, buy, buy are never held accountable. What the Daily Show does with comedic license has taken a back seat in the mainstream media bandwagon.

You see, what the media heads have done over the years is cut expenses. For example, look at the “Fleecing of America” segment that used to appear regularly on NBC Nightly News. It’s now, according to the company web site, “a continuing occasional series.” NBC is simply not doing much of this kind of reporting. “Fleecing of America” was very good government watchdog reporting that took time and money and no one in the government was your friend after one of these revealing segments. Now, Brian Williams got what he called “unprecedented access” to the President in June and, as far as I can tell, Williams never asked a single tough question. The interview was so light that President Obama made Williams the butt of a joke at the Annual Correspondent’s Dinner.

Obama said, “I have to admit though, it wasn’t easy coming up with fresh material for this dinner. A few nights ago, I was up tossing and turning trying to figure out exactly what to say. Finally, when I couldn’t get back to sleep, I rolled over and asked Brian Williams what he thought.” If Williams would have done his job, there would not have been any jokes. In June, 60 Minutes did an updated profile of Fed Chief Ben Bernanke. Good time to do this story because we are suffering through what former Fed Chief Paul Volker says is “the mother of all crises.” The Fed has denied Freedom of Information requests by two different news networks to get the Fed to reveal which banks got trillions of dollars to avoid systemic collapse. When U.S. Senator Bernie Sanders asked Ben Bernanke in a March Congressional hearing, “Will you tell the American people to whom you lent $2.2 trillion of their dollars?” Bernanke simply said, “No.”

Who got 2.2 trillion dollars is a secret and, according to Bloomberg, that is not the only one. It has also been reported and discussed in Congressional hearings that there is an additional 9 trillion dollars in off-balance sheet transactions that the Fed can not or will not account for. When asked about the trillions the Fed wants to keep secret, the Federal Reserve Inspector General fumbled for answers. Why 60 minutes did not press the Fed Chief about the secrecy of vast sums of money is troubling to me. Should the American taxpayer expect the Fed to “fix” the system behind closed doors without public scrutiny? We did get to see Bernanke’s childhood home in the CBS story and that is what’s really important!

Doing superficial event type news programming is something I call “The Soft Truth”. It is more or less superficial news and is cheap, fast to produce, and you will not make enemies. The news in mainstream media has mostly become just the stuff between the commercials. Then, there is what I call “The Hard Truth”. This story is not cheap, it ties up the company lawyers and management and, if done right, you will piss some people off. And even if there are cutbacks because of advertising shortfalls, you can still ask hard questions. It seems to me the reporters have gone soft or stupid or have been told not to rock the boat.

Take, for example, the July press conference at the White where the last question was about Harvard Professor Henry Gates getting arrested in his own home. I was shocked to see the President even answer it. I don’t blame the President; he just answered a question he probably should have passed on. I blame the Press for bringing up something so trivial to a nation with huge geopolitical and financial problems. We are fighting two wars. We’ve spent or committed nearly 13 trillion dollars in an ongoing financial crisis. The Special Inspector General claims it will take 23.7 trillion to fix the problem caused by reckless bankers. (By the way, a trillion bucks is a stack of 1,000 dollar bills 67.9 miles high.) There are serious risks to the nukes in Pakistan and Israel is dying to drop a Daisy Cutter on Iran’s head!!! So we get this stupid Henry Gates question that the mainstream media covers for days! WHAT!!!! The Gates incident is hardly a “Rodney King moment” in America. Most people have probably already forgotten this non- story. I do have few questions that the White House Press Corps should have asked:

Mr. President, July was the highest month for American causalities since the Afghanistan war started. Can you tell us why the United States should shoulder this cost in lives and money?

You fired the head of General Motors. Why have you not fired a single banking CEO; after all, aren’t they the ones that caused the financial crisis?

Do you approve of the bankers paying themselves big bonuses after a taxpayer bailout while so many Americans are losing their jobs?

Do you approve of the Federal Reserve keeping secret the trillions of taxpayer dollars given to the banks to avoid financial collapse?

What is America prepared to do if the Taliban is successful in gaining control of the nuclear weapons in Pakistan?

If Israel attacks Iran’s nuclear sites, what is America prepared to do?

Of course we did not hear any of those questions at the press conference and probably never will. When my Dad was disgusted with someone he would say, “He doesn’t know sh*t from shinola.” My favorite poster ever hung in the Programming Office of a Beaumont TV station I worked at in my early days. It was a blow up of a Shinola Shoe Polish bottle. The caption at the bottom of the poster simply said in bold letters, “There’s a Difference.” I think people can see the difference between the “Hard and Soft Truth.” One is good and is the real thing and the other is, well, crap and people can tell the difference. Maybe that’s why Jon Stewart is the most trusted newscaster in America.