Latest Posts

Betting on a “Currency Death Spiral”

By Greg Hunter’s USAWatchdog.com

I have been warning about a currency crisis for weeks. It appears I am not the only one worried about a big drop in value of the dollar. David Einhorn of Greenlight Capital is also betting on a”currency death spiral.” Einhorn is no small player. He runs a 5 billion dollar fund and has a habit of making big calls. In July, Einhorn sold 4.2 million shares of a gold ETF to buy physical bullion. Buying physical gold couldn’t be more bearish and negative. It is also play against the dollar. Now, he is warning of more trouble coming for some of the big players in the financial industry. Einhorn says some big banks like Citi should be broken up so they can not cause systemic risk. To top it off, his fund is still buying gold! This is a story you should read and pay attention to so you can understand what is really going on.

By Alistair Barr, MarketWatch

NEW YORK (MarketWatch) — Greenlight Capital is betting on the possibility of a major currency collapse and a surge in interest rates, the hedge-fund firm’s manager David Einhorn said Monday, citing ballooning government deficits in some of the world’s most developed countries.

Einhorn, who warned about Lehman Brothers’ frailty before it collapsed last year, also said financial institutions that are deemed as “too big to fail,” such as Citigroup Inc., should be broken up.

Reuters

ReutersDavid Einhorn of Greenlight Capital.

Greenlight has been buying physical gold this year because Einhorn is concerned that efforts to save the financial system and fuel economic recovery are undermining the value of such currencies as the U.S. dollar.

On Monday, he said Greenlight has added new trades to this investment theme, buying long-dated options on much higher interest rates in Japan and other developed regions — effectively giving the firm the chance to make big profits from a jump in rates. The options, bought from major banks, are tied to interest rates four to five years out, Einhorn noted.

“Japan may already be past the point of no return,” he said during a presentation at the Value Investing Congress in New York.

‘Lehman shouldn’t have existed in any size to threaten the financial system.’

Japan’s debt is equal to 190% of the country’s gross domestic product and its government deficit will be 10% of GDP this year, according to Einhorn.

Japan has been able to borrow money at roughly 2% a year to finance these deficits, partly because the country has many savers willing to buy low-yielding government bonds. However, some of these savers may begin spending instead as they enter retirement, Einhorn argued.

“When the market refuses to refinance at cheap rates, problems emerge,” he said, adding that this could trigger a “currency death spiral.” (more from MarketWatch)

A Illustration of the Recovery

By Greg Hunter’s USAWatchdog.com

This week I wrote a post about the announcemment of the recession being over. Of course my post (Is the Ression over? Don’t bet on it!) clearly gave reasons why it is NOT over by a country mile. This story from Reuters on Friday is confirmation we have a long way to go.

By Leah Schnurr

NEW YORK (Reuters) – U.S. stocks fell on Friday after disappointing results from General Electric Co (GE.N) and Bank of America Corp (BAC.N) demonstrated the road to economic recovery will be bumpy.

GE, which sells products from aircraft engines to refrigerators, reported a 20 percent drop in revenue, while Bank of America posted a $1 billion loss as both struggled with still meager business and consumer spending.

“As you came into the third quarter there was hypersensitivity to the quality of topline growth,” said Michael Feser, president of Zecco Trading in New York.

“Investors are linking that to the economy, trying to determine if these are quality earnings that are being reported and does it spell a solid economic recovery?”

Friday’s results contrasted sharply with those of JPMorgan Chase & Co (JPM.N) and Intel Corp (INTC.O) earlier this week, which breezed past Wall Street forecasts and helped the Dow to close above 10,000 for two straight days. (more from Reuters)

The latest from shadowstats.com

By Greg Hunter’s USAWatchdog.com

From John Williams at Shadowstats

– September Annual Inflation -1.3% (CPI-U), 6.1% (SGS)

– CPI-U Inflation Spike Due by Year-End

– No Recovery: September Real Retail Sales Continued

Bottom-Bouncing at Low-Level Plateau

– 10 Years of Retail Sales Growth Gone

shadowstats.com is a paid site that is worth the money for access to real numbers! shadowstats.com I do not get paid for plugging this site.

Is The Recession Over? Don’t Bet On It!

By Greg Hunter’s USAWatchdog.com

The headline on Reuters this week read, “U.S. recession over, unemployment seen at 10 percent.” This great news is according to a new survey by the National Association for Business Economics. Forty-four professional forecasters took part in the assay. After four straight quarters of declines, 80 percent of them believe the economy was growing again . I would like to know who the recession is over for because it is not over for main street America. I would also like to know how the 44 professional forecasters were chosen. Did the NABE stack the deck? Are these “professional forecasters” some of the same people who completely missed the financial crisis two years ago and told us everything was just great?

For one thing, the real unemployment rate stands at 21.4 percent not 10 percent. That is according to John Williams of shadowstats.com who computes the UE rate the way it was done by the Bureau of Labor Statistics pre-1994. That’s more than one in five working people who are unemployed or underemployed! Bankruptcies shot past a million in the first nine months of 2009 according to the American Bankruptcy Institute. What end of recession?

Just last month Bloomberg reported, “Sept. 23 (Bloomberg) — The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market, Amherst Securities Group LP analysts said. The “huge shadow inventory,” reflecting mortgages already being foreclosed upon or now delinquent and likely to be…”

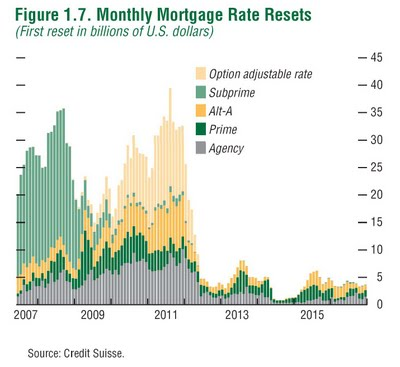

What is the NABE looking at to make such a rosy forecast? It is not this chart from Credit Suisse that shows the mortgage resets for millions of adjustable rate mortgages. This chart shows a tsunami of debt that will wash ashore in waves here in America until mid 2012. There is no doubt mortgage payments resetting higher will cause many more foreclosures than the one million we have had so far this year.

This is my favorite “a picture is worth a thousand words” picture. I have used this before in a prior post because it says so much about where the real estate market is going. Look! The resets don’t stop until 2012. How can the recession be over?

The FDIC is bracing for another round of bank failures according to Chairman Sheila Bair. Banks are coming under increasing financial pressure due to an imploding commercial real estate market. In early September Bair said, “Commercial real estate will be more of a driver of bank failures.” What! You mean more than the imploding residential real estate market? (Click here for more from the original post) This is what the end of a recession looks like?

Speaking of commercial real estate…“The other shoe to drop,” according to Daniel Tishman, Chairman and CEO of the Tishman Construction Corporation, is commercial real estate. Tishman says 3.7 trillion dollars in commercial property will need financing in the next several years. Financing will be difficult because commercial property values are in a steep, ongoing decline. (Click here for a great chart about declining Commercial Real Estate) Where is the end of the recession? I do not see it and neither does a close friend in North Carolina who makes his living as a business broker. He tells me business in his area is definitely “slowing down” not getting better.

Finally, according to John Williams at shadowstats.com, there is still absolutely “no substance to the economic recovery.” Williams works for very big companies and hedge funds as a consultant. He also has a subscription based newsletter. I am not getting paid to plug him. I just admire his very accurate work. He has been spot on with his numbers and predictions. He sees unemployment topping out at 34 percent, computed the way BLS did it pre-1994.

In his most recent alert, he sees the U.S. is “headed for still weaker growth.” When I asked Williams about the new survey that says the recession is over, he said, “A recession does not end until the ecomony begins to recover. At best it has flattened out in some areas, but those are about to turn lower again, as the clunkers and first-time home buyers programs expire. Employment still is plunging, and that is a coincident, not a lagging, indicator.” My bet is Williams will be right again and we have a long way to go.

So as far as I can tell, the recession may be over for some greedy, reckless Wall Street types. Also, the stock market has seen a more that 50 percent rise since March. That is positive news, but that is probably a bear market rally. The recession is not over for the overwhelming majority of Americans. My advice: Take some money off the table if you have enjoyed a big run up in your portfolio. Pay down debt and stay conservative in your investments and purchases. This is not what the end of a recesion looks like. I think all indications show it is appearing more like a deepening depression!

Currency Crisis Coming

By Greg Hunter’s USAWatchdog.com

Everybody is wondering where all of the bailouts and spending are going to take us? Just a few of the big companies the government has bailed out to keep them from going bankrupt are: General Motors, Chrysler, AIG, Citigroup, Bank of America, Wells Fargo, (all the big banks got some kind of bailout) Fannie Mae and Freddie Mac. According to Pro Publica, 721 companies have received some sort of financial help from the taxpayer. If the economy does not improve, many of these companies will require more money to stay afloat.

There were several stimulus programs. The biggest is the 787 billion dollar spending bill passed by Congress earlier this year. Also, there was “Cash for Clunkers.” It was designed to give people with old gas guzzling vehicles up to $4,500 towards a new fuel efficient model. Remember the $8,000 credit for first time home buyers? It looks like the government is going to extend the program. Let’s not forget the trillions of dollars that the Federal Reserve has given away in secret to the big banks. Congress wants to audit the Fed to find out where the money went and why even foreign banks got a half trillion dollars! Meanwhile, Congress is talking about giving every newborn $500 to fund a retirement account. I kid you not! (Click here for the story.)

One respected news source recently claimed we have spent or committed 19 trillion dollars during the financial crisis. Another government source said the final tab for the financial crisis could come in at 23.7 trillion dollars. Who knows how much this will cost? One thing is for sure, the final tab will be big, as in many trillions of dollars. No country in all of history has ever bailed out itself with this much printed money. We are clearly in uncharted territory. We have spent more on the financial crisis than all of these financial expenditures below, combined!

• Marshall Plan: Cost: $12.7 billion, Inflation Adjusted Cost: $115.3 billion

• Louisiana Purchase: Cost: $15 million, Inflation Adjusted Cost: $217 billion

• Race to the Moon: Cost: $36.4 billion, Inflation Adjusted Cost: $237 billion

• S&L Crisis: Cost: $153 billion, Inflation Adjusted Cost: $256 billion

• Korean War: Cost: $54 billion, Inflation Adjusted Cost: $454 billion

• The New Deal: Cost: $32 billion (Est), Inflation Adjusted Cost: $500 billion (Est)

• Invasion of Iraq: Cost: $551b, Inflation Adjusted Cost: $597 billion

• Vietnam War: Cost: $111 billion, Inflation Adjusted Cost: $698 billion

• NASA: Cost: $416.7 billion, Inflation Adjusted Cost: $851.2 billion

TOTAL: $3.92 trillion (Click here for the complete story)

There’s an old saying, “When you find yourself in a hole, stop digging.” But in America, we keep shoveling and piling on the debt. A perfect example of an agency that keeps on digging is the Federal Housing Administration. The FHA is involved in its own version of the bailout game by continuing to make loans to people with very shaky credit. The down payment for its new loans is just 3.5 percent. A recent New York Times article showed the FHA sinking further into trouble in an effort to keep housing prices from falling. The Times said, in part, “The number of F.H.A. mortgage holders in default is 410,916, up 76 percent from a year ago, when 232,864 were in default, according to agency data. Despite the agency’s attempt to outrun its fate by insuring ever-larger amounts of new loans…the current rate is over a billion dollars a day. 7.77 percent of the portfolio is in default, up from 5.6 percent a year ago.

Barney Frank, the Massachusetts Democrat who is chairman of the House Financial Services Committee, said in an interview that the defaults were, in essence, worth it. “I don’t think it’s a bad thing that the bad loans occurred,” he said. “It was an effort to keep prices from falling too fast. That’s a policy.”

The FHA, which insures 675 billion in mortgages, will likely need a bailout of it’s own in as little as 24 months according to some experts. I say the FHA will need help much sooner because the housing market will get worse before it gets better. I talked about why real estate prices will continue to fall in an August post called, “Real Estate at a Bottom…NOT!”

And let’s not forget the two wars we are fighting in Afghanistan and Iraq. Did your taxes go up to pay for that? Of course they didn’t! The only people sacrificing for the war efforts are the men and women of the armed forces and their families! We are paying for all the bailouts and expenditures by simply printing the money!

The world is noticing what we are doing in our financial house. Foreign governments are getting nervous about the creation of all these dollars. There have been calls by many in the international community for a “Super Sovereign Currency.” This would not replace the dollar but compete with it.

Gold is also in competition with the Buck. That’s why the yellow metal hit all time highs last week. Gold is not replacing the dollar but it is competing with it. In a recent interview, gold expert Jim Sinclair said, “Gold is a competitor to currency.” Unlike dollars, it is “hard to expand gold” supplies quickly. Investors are turning to gold as an alternative to the dollar.

The same is true for oil. Despite some pretty healthy supplies, the price is trading around $70 a barrel. Everyone in the oil field knows there is a good quantity of oil, and that is why some have repeatedly predicted a steep decline. A roll back in the oil price has failed to materialize. The high price of oil, relative to supply, is reflecting the fact there is a huge supply of dollars. More dollars are printed out of thin air everyday.

So what does this mean to you? In the end, there is going to be a currency crisis. I am not talking about a problem for the grandkids but a crisis in the here and now. I quoted several experts on this issue in a post last month called, “Something Wicked This Way Comes.”

The bailouts and the spending are going to continue because that, in the short run, that will get politicians re-elected. In the long run, the massive money printing will ruin the buying power of every dollar you have. Expect some deflation as we have right now in the real estate market but also expect big inflation. Yes, deflation and inflation at the same time! A weaker dollar is coming and there will be no way to avoid the inflation it will bring with it.

Gold Flashing Danger Ahead

By Greg Hunter’s USAWatchdog.com

For those of you who think the economy is doing well, gold is saying something altogether different. Today AU hit a brand new high, the record gold price is a major warning sign of, at the very least, big inflation coming.

…”NEW YORK (MarketWatch) — Gold finished at a new record closing level on Tuesday, after earlier hitting a record intra-day high of $1,045 an ounce, as the dollar slumped on a report suggesting the end of dollar-based oil trading”…(For more on the story click here)

Afghanistan Turning Point

By Greg Hunter’s USAWatchdog.com

Could a meeting between the President and a Four Star General in Copenhagen signal a turning point in the war against the Taliban? It has been reported that the NATO Commander in Afghanistan, General Stanley McChrystal, has angered the White House with a series of candid comments about the war that has been going on for 8 years.

When asked if General McChrystal supported proposals to switch to a strategy which used more drone missile strikes and special forces against the enemy, he said it would lead to “Chaos-istan.” McChrystal also said, “Waiting does not prolong a favorable outcome. This effort will not remain winnable indefinitely, and nor will public support.” General McChrystal delivered a report on Afghanistan requested by the President on August 31. The General has asked for 40 thousand more troops. Mr. Obama has held two meetings on the issue since the report was filed. The White House said recently it will take weeks to reach a decision on more troops.

McChrystal also told Newsweek he was firmly against half measures in Afghanistan saying, “You can’t hope to contain the fire by letting just half the building burn.” Also, in a report sent to the Pentagon, McChrystal delivered a confidential assessment of the situation in Afghanistan. The General described the situation there as “deteriorating,” and the likely outcome will be a “failure” unless America sends more troops. This bombshell report was “leaked” to the press recently.

Bruce Ackerman, an expert on constitutional law at Yale University, said in the Washington Post: “As commanding general, McChrystal has no business making such public pronouncements.” Ackerman added that it was highly unusual for a senior military officer to “pressure the president in public to adopt his strategy.”

So why would a Four Star General do such a thing? It is not because McChrystal is politically insensitive. One does not get to be a Four Star General without some sense of political know- how. I assume General McChrystal knows full well what he is doing and is not simply being insubordinate.

It was probably no surprise to McChrystal that President Obama scheduled a 25-minute face-to-face meeting on board Air Force One on the tarmac in Copenhagen last week. President Obama was there to pitch Chicago’s unsuccessful Olympic bid while General McChrystal was giving a speech across the “Channel” in London. Who knows what was said on Air Force One, but I feel the situation in Afghanistan is so severe that McChrystal was taking a risk to get the President’s attention. By all accounts, McChrystal feels the situation is critical and is nearing an ominous turning point. Let’s hope the right moves are made and things take a turn for the best!

We Lost More Than The Olympics in 2016

By Greg Hunter’s USAWatchdog.com

The President made a major misstep by going to Copenhagen to pitch the Windy City as host of the 2016 Olympics. Barack Obama and wife Michelle made impassionate speeches to urge the IOC to pick Chicago, Illinois, over all other cities in the world as the spot for the games in 7 years. The U.S. was blown out in the first round of voting. It was like Mike Tyson knocking out his opponent in the first 10 seconds of a fight. A not even close, dismal defeat considering President Obama, and even Oprah, pitched the event to come to America.

What was he thinking? We are on the brink of a depression. Millions of homes will foreclose in the coming years according to the Treasury Secretary. Unemployment inched higher this week. It is at a 26 year record with 9.8 percent unable to find work. According to shadowstats.com , the real unemployment rate is 21.4 percent if you calculate it the way the Bureau of Labor Statistics did it prior to 1994. Obamacare is facing a major uphill battle from Republicans and Blue Dog Democrats in his own party. Generals in Afghanistan say there is a real possibility of “defeat” if they do not get 40 thousand additional troops to fight the Taliban. Israel is signaling a first strike against Iranian nuclear facilities which could conceivably set off World War 3, and President Obama thought it was necessary for him to personally pitch Chicago for the Olympics 7 years from now!

You are kidding me, right? Obama couldn’t send Vice President Biden or Secretary of State Clinton over to pitch Chicago for the Olympics? You see, if they got shot down, it really would not be the same as the Leader of the Free World getting shot down. The President thought going over to Europe with his buddy Oprah, a talk show host, with more than 15 million Americans out of work was a good idea? How much did that cost…2 or 3 million bucks? Did the President think this was a way to bolster American prestige? Well, it backfired! In my opinion, the trip cut our standing on the world stage when we so desperately need to look strong. Instead, we look weak and unfocused. The President appears oblivious to the massive problems facing the country.

I am sure the President thought getting the Olympics would be a way to create jobs. I guess taking years to build facilities we will use for a month while the Olympics is in town 7 years from now would create jobs. Wouldn’t it be better for the President to create jobs that will be with us long after the Olympics is over, such as permanent jobs in the energy field or maybe even find a way to bring manufacturing back to the U.S.?

I happen to like President Obama, but that doesn’t mean I should not criticize him when he is way off on Fantasy Island somewhere. You will not hear critiscm about this trip from the mainstream media because most of them voted for Obama. Still, the President needs to wake up and see this trip for what it really was… a complete failure on many levels. The United States did not just lose the 2016 Olympics. We lost some of our dignity and standing on the world stage.

“Audit the Fed” H.R. 1207 Congressional Hearing

By Greg Hunter’s USAWatchdog.com

A Congressional Hearing was held Friday on H.R. 1207 also known as “Audit the Fed.” As far as I can tell, there was very little in the mainstream media on this Ron Paul sponsored bill. 290 Congressmen of both parties are behind the bill. The importance of an audit is profound as the Fed controls the value of money for anyone holding or using dollars. The Federal Reserve has spent or committed trillions of dollars in the financial meltdown with virtually no accountability. For example, the Fed took it on itself to bail out AIG. The total cost of the government backstop, so far, is more than 180 billion dollars. The Fed also gave 500 billion dollars to foreign banks during the crisis! If the bill is signed into law, it will enable the Government Accounting Office (GAO) to find out exactly who got money, how much, and why?

Scott Alvarez, General Counsel for the Board of Governors of the Federal Reserve, testified on behalf of the Fed as to why Congress should vote the bill down. Alvarez said, in part, “Moreover, publication of the results of GAO audits related to monetary policy actions and deliberations would complicate and interfere with the FOMC’s communications to the markets and the public about current economic conditions and the appropriate stance of monetary policy. Households, businesses, and financial market participants would understandably be uncertain about the implications of the GAO’s findings for future decisions of the FOMC, thereby increasing market volatility and weakening the ability of monetary policy actions to achieve their desired effects.”

In layman’s terms, getting the Fed to open its books and do things out in the open would make it hard for the Fed to do its job. Representative Brad Sherman said what the Fed is really saying is “trust us” with creating and distributing money “in enormous and unlimited amounts with secrecy.” The Fed contends secrecy is needed to maintain its independence.

Thomas E. Woods, Jr., was called to testify as to why H.R. 1207 should be passed. Woods has a PhD in history and has written many best selling books including his most recent about the current financial meltdown. He said, “The Fed’s arguments against the bill are unlikely to persuade, and will undoubtedly strike the average American as little more than special pleading. Perhaps the most frequent of the claims is that a genuine audit would jeopardize the alleged independence of the Fed. Congress could come to influence or even dictate monetary policy. This is a red herring.”

Woods also said, “If there is any truth to the idea of Fed independence, it lay in precisely this: the Fed may reward favored friends and constituencies with trillions of dollars in various kinds of assistance, while keeping the public completely in the dark. If that is the independence we’re talking about, no self-respecting American would hesitate for a moment to challenge it.”

Below is one of the better exchanges between Congress and the Fed’s lawyer.

The mainstream media’s lack of coverage of this historic bill is disturbing and disappointing. The Federal Reserve has never been audited in its 96 year history. I worked for ABC and CNN as an investigative correspondent for 9 years. If I were still working for either organization, I would be screaming to management to cover this because it is so important to almost everyone. The “Audit the Fed” story has what I call mass audience appeal and, not just for the U.S., but for the world. I have written various posts on this web site about the lack of transparency and downright secrecy of this government subcontractor. I guess telling the truth and shining a light into the dark corners of government is the upside to being outside the control of the mainstream media. I will continue to follow stories involving the secret money and policies of the Federal Reserve.

Obama Calls Out Iran On Nuclear Secrets

By Greg Hunter’s USAWatchdog.com The test-firing of a new medium-range surface to surface missile, named Sejil-2, in Semnan in north-eastern Iran on 20 May 2009. Take a look at today’s headline from Reuters, “Obama Accuses Iran of Building Secret Nuclear Plant.” This just one day after the Israeli Prime Minister said the U.N.’s most urgent challenge “is to prevent the tyrants of Tehran from acquiring nuclear weapons.” This is just part of the scolding Benjamin Netanyahu delivered to the General Assembly. The President of the United States was flanked by the Prime Minister of the UK and the President of France when he accused Iran of building a secret nuclear fuel plant and demanded Tehran immediately halt what he called a “direct challenge” to the international community. This was done under the backdrop of the G-20 meeting in Pittsburgh, PA. The announcement has the backing of at least France and the UK. It is an ominous development that could signal implementation of very strong sanctions or possible military action in the future. This is appearing like it is shaping up to be one or the other unless Iran capitulates on it’s nuclear ambitions which seems the least likely at this point. A “direct challenge” is usually met with some sort of “direct response” and signals that time may be running out on the sanctions option. In my mind, the”direct challenge” language signifies an approaching showdown in an ever escalating impasse. Please read my post directly after this called The 2 Biggest Geopolitical Wild Cards in the World for much more on this very important world issue. (View the complete Reuters story or check the link under “Hunter’s Top Stories” on the right side of the USAWatchdog site.)

By Greg Hunter’s USAWatchdog.com The test-firing of a new medium-range surface to surface missile, named Sejil-2, in Semnan in north-eastern Iran on 20 May 2009. Take a look at today’s headline from Reuters, “Obama Accuses Iran of Building Secret Nuclear Plant.” This just one day after the Israeli Prime Minister said the U.N.’s most urgent challenge “is to prevent the tyrants of Tehran from acquiring nuclear weapons.” This is just part of the scolding Benjamin Netanyahu delivered to the General Assembly. The President of the United States was flanked by the Prime Minister of the UK and the President of France when he accused Iran of building a secret nuclear fuel plant and demanded Tehran immediately halt what he called a “direct challenge” to the international community. This was done under the backdrop of the G-20 meeting in Pittsburgh, PA. The announcement has the backing of at least France and the UK. It is an ominous development that could signal implementation of very strong sanctions or possible military action in the future. This is appearing like it is shaping up to be one or the other unless Iran capitulates on it’s nuclear ambitions which seems the least likely at this point. A “direct challenge” is usually met with some sort of “direct response” and signals that time may be running out on the sanctions option. In my mind, the”direct challenge” language signifies an approaching showdown in an ever escalating impasse. Please read my post directly after this called The 2 Biggest Geopolitical Wild Cards in the World for much more on this very important world issue. (View the complete Reuters story or check the link under “Hunter’s Top Stories” on the right side of the USAWatchdog site.)

The 2 Biggest Geopolitical Wild Cards in the World

By Greg Hunter’s USAWatchdog.com

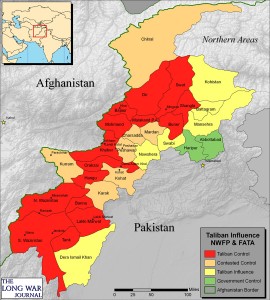

If you look around the world for the countries with the most geopolitical risk, what comes to mind? Plenty of people would say places such as North Korea, Iraq and Afghanistan. There is no question these nations are trouble spots for the U.S. and the world, but they pale in comparison to the one eyed jack and the joker of wild card countries. The two hot spots that could destroy the fragile world economy, if they destabilize, are the Taliban/Pakistan conflict and the Iran/Israel powder keg over alleged nuclear weapons.

Let’s start with the Taliban/Pakistan conflict. I love the cliche’ “a picture is worth a thousand words,” and the one below, from The Long War Journal, screams trouble! Take a minute and look how much of the northern part of the country is firmly under control of the pro west government. The government is only in control of the areas in green. Those are around the Pakistani capitol of Islamabad.

That simply is not a lot of real estate between the Taliban and the central government. The big fear for the world is Pakistan’s nuclear arsenal. The government says their nuclear security compares with “the best in the world.” When it comes to a missile attack by terrorists, India is probably the biggest target because it is the biggest foe. New Deli is within easy striking distance if the Taliban gains control of Pakistan’s nuclear weapons. Pakistani missiles would have a harder time causing damage to the rest of the Middle East because, in most, cases they have a top range of about a1000 miles. Experts say the biggest problem with Pakistan’s nuclear arsenal comes from something like a suitcase bomb. If the Taliban could get control of one, it would be relatively easy to transport to a precise location and detonate it. What would happen if the Taliban suddenly took control of Islamabad and the nuclear arsenal was up for grabs? Would U.S. Special Forces go in to secure the nuclear weapons? Would there be an air strike from the U.S. or a preemptive strike by India? The idea of even a partial Taliban takeover in Pakistan would be dire, to say the least.

Then, there is the second and probably biggest wild card of them all, the Israeli opposition to Iran’s nuclear ambitions. The U.S. wants the Iranians to freeze its nuclear projects. Iran says it will not yield to pressure and is continuing with its nuclear ambitions. Iran claims its reactors are for peaceful uses. Israel claims a nuclear Iran is “catastrophic” for their tiny nation. When the Prime Minister of Israel, Benjamin Netanyahu, was asked this week if he was convinced that Iran wanted a nuclear weapon, he said unabashedly, ”Yes I am.”

The United States has been asking the world for tough sanctions against Iran such as a blockage of its gasoline imports. Iran imports about 40 percent of its gasoline and a cut off of fuel would bring the country to a near standstill. China is one of Iran’s big suppliers of fuel and is firmly against tough sanctions. Russia also trades with Iran and has assisted with its nuclear program. It is also against tough sanctions.

That leaves Israel in a tight spot and has signaled a strike could come before the end of the year. Former Israeli Deputy Defense Minister Ephraim Sneh told Reuters recently, “We cannot live under the shadow of an Iran with nuclear weapon.” Mr. Sneh went on to say, “By the end of the year, if there is no agreement on crippling sanctions aimed at this regime, we will have no choice.” That sounds a lot like a deadline to me. Remember, the Israelis have a habit of surprise attacks on nuclear assets. The Israeli Air Force was successful in bombing Iraq in 1981 and did it again in Syria in 2007.

Meanwhile, it has been reported that Iran is trying to purchase the sophisticated S-300 missile defense system from Russia. Experts say if Iran had that air defense system in place, it would make it very difficult for the Israelis to pull off a successful air strike on Iranian nuclear sites.

So, it appears that Israel will not wait much longer for sanctions and will strike before Iran beefs up its air defense systems. It is looking more and more like it is a matter of when, not if, Israel will strike Iran. If an air strike happens, it would be catastrophic to the world economy.

For one thing, the Straits of Hormuz would be almost immediately shut down by war. It is only 30 miles wide at its narrowest point. Oil supplies to the world would be greatly restricted. The global economy would go into a tailspin in short order. Oil prices would spike! Who knows, maybe a barrel of crude could double in a week! There would be open season on all U.S. interests in the Persian Gulf. Iran would attack everything from oil tankers to the U.S. Navy. China would certainly weigh in, as would Russia. The conflict would not end quickly and there will be blood.

Things could get worked out and a peaceful solution reached. Then again, keep in mind that there is a very real possibility of an attack against Iran. You should put your hard earned assets in a defensive position in case the worst happens. Likewise, you should also consider the Taliban/Pakistan conflict with a conservative stance. With the fragile world economy still on life support, it would not take much for a financial meltdown to occur if either one of these “wild cards” flip out of control.

Desperation at the FDIC

By Greg Hunter’s USAWatchdog.com

The latest plan at the FDIC to replenish its drained insurance fund is to borrow from the people they are supposed to bailout, the banks! What!? This smacks of desperation at the FDIC. You have been hearing since the financial meltdown began that the banks are in trouble and most are severely undercapitalized. The plan regulators are considering is to have the nation’s healthy banks lend billions of dollars to rescue the FDIC insurance fund that protects bank depositors.

I have some questions about this plan to borrow money from the banks to lend to the FDIC. Aren’t those the same banks that are supposed to lend money to consumers to help get the economy out of recession? Aren’t those the same banks that are not lending because it’s too risky and they need capital? Wouldn’t the FDIC borrowing reduce the pool of money to lend? Are some of these “healthy” banks lending the government back its TARP money and then collecting interest off bailout funds that were not needed?

I do not know the answers to those questions, but here’s one I do know the answer to. Guess who is firmly behind this idiotic idea? If you guessed the bankers and their lobbyists, bing, bing, bing, you are correct! The reason they like this “plan” is because they don’t want another emergency assessment. That cuts into their profits. Bankers also can collect interest that they are guaranteed by the taxpayer to get back. You got to love that about the banks these days. They never seem to miss an opportunity to cash a check at the expense of you and me.

The FDIC has a standing 500 billion dollar line of credit at the Treasury. Why doesn’t Chairman Sheila Bair just tap that money? It has been rumored that relations with her counterpart at the Treasury, Tim Geithner, are strained because they have butted heads when dealing with the financial crisis. But that excuse sounds childish to me, almost like a grade school feud. After all, the 500 billion buck line of credit does not belong to Geithner. It is taxpayer money appropriated by Congress. I think the “FDIC’s borrow money from the banks plan” is a way to make it look like the government isn’t going deeper into debt, once again, to bail out bankers who made bad loans. The “plan” gives the elusion that the banks are solving their own problems this time. That, of course, is a load of crap! Taxpayers ultimately will be on the hook again one way or another.

The FDIC now has less than 10 billion dollars to insure about 4.5 trillion dollars in deposits. Think about that, less than 10 billion to insure 4,500 billion dollars in deposits. Put the thin insurance fund up against the backdrop of massive problems with residential and commercial real estate and there is plenty for the FDIC to be very concerned about. There are still “millions of homes,” according to the Treasury, which will end up in foreclosure. “The other shoe to drop,” according to Daniel Tishman, Chairman and CEO of the Tishman Construction Corporation, is commercial real estate. Tishman says 3.7 trillion dollars in commercial property will need financing in the next several years. With just those two problems to consider, expect the FDIC insurance fund to continue to be desperate for cash to pay depositors at banks that continue to go bust.

For the entire interview with Mr. Tishman on CNBC, you can check out the video below.

The Banks Are (Still) In Trouble

By Greg Hunter’s USAWatchdog.com

The 94th bank of the year was taken over by regulators on Friday. Irwin Financial Corporation in Kentucky and Indiana cost the FDIC, or you the taxpayer, 850 million dollars. That is a lot of money for just one Midwest bank, considering the insurance fund had just 10.4 billion dollars. Maybe that’s why FDIC Chairman Sheila Bair said, on the same day as the bank failure, she was considering borrowing from a 500 billion dollar line of credit at the Treasury. Bair said at a global finance summit in Washington, “We are carefully considering all our options, including borrowing from Treasury.”

That is a huge flip flop from just 2 weeks ago when Chairman Bair said, “…We can tap up to 500 billion in a line of credit if we needed to, I can’t imagine that would ever be necessary…” Bair’s denial of ever needing to borrow from the 1/2 trillion dollar line of credit was not a single offhanded comment but an exhaustive rejection of any serious thought of using it. Bair went on to say, “If we have to go to the Treasury borrowing, I never say never, but I think that would be a pretty profound decision…we don’t need it right now and I am not sure we will, ever…” You can watch the entire video on my September 2 post called, “Second Wave of Bank Failures? You Bet!” The FDIC, back in late August, estimated there were 416 “problem” banks on a “watch list.” Does that mean that there are 322 additional failures likely before the end of 2009?

There is no telling what is coming, but the thought of tapping a half a trillion dollar line of credit to take over insolvent banks is not good news for taxpayers, the economy, or bank depositors. Some outside experts say the FDIC needs about 70 billion to get through this “tsunami” of bank failures. I say, if that’s the case, then why does the FDIC need a 500 billion dollar line of credit? Wouldn’t just a 100 billion dollar line of credit cover the banking meltdown? The only sure thing I can report is the FDIC insurance fund has been significantly drained by a sharp increase in bank failures. Taking steps to do what you can to protect your assets would be prudent. You should be sure your accounts are at or below the 250 thousand dollar FDIC insurance limit. It might also be a good idea to check your bank’s rating. I like to use The Street.com or Bankrate.com. These two are free for the public to use. I do not get paid to promote these companies.

The Fed’s Secret Money and the Media Cover-Up

By Greg Hunter’s USAWatchdog.com

HR 1207 is a bill, first sponsored by Congressman Ron Paul in the U.S. House of Representatives, that will audit the Federal Reserve. The Federal Reseve has never been audited in it’s 96 year history. Contrary to popular belief, the Fed is not an arm of the U.S. Government but a subcontractor for monetary policy. It is the Fed that also produces the money in your pocket, thus the term Federal Reserve Note. The Bill, as of September 16, has 289 co-sponsors in Congress. If the Bill is signed into law, the Fed will be forced to open its books and show how clandestine policy decisions are made. Some of the questions Congress wants answered are: Why did the Fed give foreign banks 500 billion dollars during the financial meltdown last year? What are the names of the all the banks, both foreign and domestic that got bailed out, and how much money did each bank get? Why was AIG bailed out and not Lehman Brothers? The Fed has spent or committed trillions of dollars; where did the money go? These are just a few of the secrets the Fed is keeping from American taxpayers. H.R. 1207 will receive a hearing in the House Committee on Financial Services towards the end of September. Representative Alan Grayson of Florida’s 8th Congressional District has been a staunch advocate of the Bill. Listen as Rep. Grayson announces the hearing on H.R. 1207, also known as The Federal Reserve Transparency Act of 2009.

I also have some questions for the mainstream media. Why is a story with trillions of dollars in secret bailout money not being covered? As a former investigative correspondent for both ABC and CNN, I know what makes a good legitimate story that will hold up to scrutiny. This is a very big legitimate story with profound implications for every American!

Just last month, the Fed lost a Freedom of Information Act lawsuit in Federal Court: “Aug. 25 (Bloomberg) — The Federal Reserve must for the first time identify the companies in its emergency lending programs after losing a Freedom of InformationAct lawsuit….The judge said the central bank “improperly withheld agency records” by “conducting an inadequate search” after Bloomberg News reporters filed a request under the information act. She gave the Fed five days to turn over documents it told the reporters it located, including 231 pages of reports, and said it must look for more at the Federal Reserve Bank of New York, which runs most of the loan programs…Banks are worried that the disclosure of borrowers’ identities by the Fed, the lender of last resort, would cause customers to empty their bank accounts in a run on the bank, said Scott Talbott, vice president of governmental affairs at the Washington-based Financial Services Roundtable, a lobbying group.” (click here for the full story)

The Fed has indicated it plans to appeal the case and has until the end of September to do so. Meanwhile, the biggest story in the financial history of the country is being ignored by the press. Maybe this is part of the reason the news media’s credibility rating sank to a new all time low in a recent Pew Research Center poll.

Carter Plays The Race Card

By Greg Hunter’s USAWatchdog.com

Barack Obama, the first black President, has been in office just nine months. People like left wing comedian Janeane Garofalo have wasted no time in accusing anyone in opposition of the administration as being a racist. It is one thing for a regular citizen to make that claim, but it is quite another for a former president. Jimmy Carter doubled down on the race card when he said on NBC Nightly news,”I think an overwhelming portion of the intensely demonstrated animosity toward President Barack Obama is based on the fact that he is a black man…”

Visit msnbc.com for Breaking News, World News, and News about the Economy

Michael Steele, the first African American RNC Chairman says, “President Carter is flat out wrong. This isn’t about race. It is about policy…Characterizing Americans’ disapproval of President Obama’s policies as being based on race is an outrage and a troubling sign about the lengths Democrats will go to disparage all who disagree with them. ”

There is no doubt that the Democrats are frustrated. They have to compromise on health care reform even though they have an overwhelming majority in Congress. Some Democrats felt they had to give up the “public option” because of a very intense opposition to government run health care. Carter and others cannot grasp there is a genuine opposition to what some say is a costly and bad idea. There is not a shred of evidence to back up the former President’s assertion of racism. I also find it odd that NBC let that comment go on the air unchecked. I thought the interviewer, Brian Williams, should have pressed Carter on what is an absurd and unprovable comment.

What West said was stupid and insensitive but not racial. What Representative Joe Wilson said when he yelled out “You Lie” during a Joint Session of Congress was stupid and insensitive but not racial. Remember, to the Presidents credit, he accepted Wilson’s apology and moved on. Bravo Mr. President for being, well, Presidential. I’ll bet you Barack Obama wishes Carter kept his remarks to himself! To risk blow back and distraction on a phony race issue is foolish, especially considering the financial crisis and geopolitical problems the country is facing. I look at Barack Obama as the President of the United States, period.