Latest Posts

A Nasty Email Says I Don’t “Get It”

I got this rather nasty email from a reader who identified himself with only an email address. So, I am going to identify this person with the first part of the address, which is Jdavidm24. Here is what he had to say about my most recent post called, “Two Stories that Should Scare the Heck Out of You.” (more…)

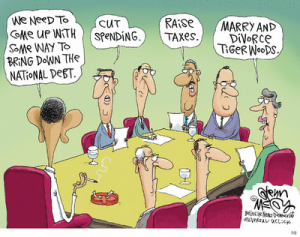

Two Stories that Should Scare the Heck Out of You

I was sitting here trying to find a way to wrap up the week and then, like a bolt of lightning, an idea hit me. Gold expert Jim Sinclair sent me this story: “Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY’10.” The story said, “The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009.” (more…)

“Myths” Paul Krugman Does Not Want To Talk About

I have been telling you for months there is going to be a double dip in the economy. Nobel Prize Winning economist Paul Krugman also thinks the economy is so bad we need to keep on stimulating the economy. In a New York Times Op-Ed piece last week, Krugman said, “. . . somehow it has become conventional wisdom that now is the time to slash spending, despite the fact that the world’s major economies remain deeply depressed.” (more…)

Greg Hunter On The Edge With Max Keiser

By Greg Hunter’sUSAWatchdog.com

By Greg Hunter’sUSAWatchdog.com

I was interviewed by Max Keiser in Europe last week. For the 4th of July holiday on Monday the 5th, I am posting part three of a three part interview. (more…)

Another Sign on the Road to a Devalued Dollar

The President gave a speech on immigration reform yesterday. One of the most outrageous things the President said, “The southern border is more secure today than at any time in the past 20 years.” Please, Mr. President, Phoenix is the kidnapping capitol of America, second only in the world to Mexico City. Meanwhile, as the President tried to score political points, questions about the viability of the U.S. dollar as the world reserve currency are increasing on the world stage. (more…)

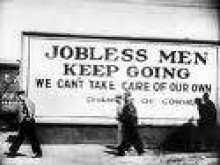

Stealth Austerity Already Hitting the U.S.

Last week, at the G20 meeting in Toronto, there was much discussion about money printing for bailouts and cutbacks for austerity. These were the two main options talked about to deal with the economic malaise facing the globe. The U.S. is firmly in the money printing camp. Europe, on the other hand, is officially taking the cutback and austerity path. (more…)

Financial Reform Bill Will Not Stop the Next Meltdown

The much awaited financial reform bill was finished up in an overnight marathon House and Senate committee session last week. Now it appears there is a holdup in the Senate because of the $19 billion bank tax contained in the legislation. Several Senators on both sides of the isle want to remove the tax leaving a bill that must be paid for by taxpayers or not implemented at all. This bill came about as a result of the near collapse of the financial system brought about by reckless bankers with little oversight and regulation. It is supposed to reign in the banks and not allow any bank to be “too big to fail.” (more…)

Double Dips Coming Everywhere

Respected banking analyst Meredith Whitney dropped a bomb on CNBC at the beginning of the week by saying, “Unequivocally, I see a double-dip in housing. There’s no doubt about it . . . prices are going down again.” Whitney warned as foreclosures and short sales go north, bank profits head south. She said, “You look at the non-performing loans on bank balance sheets and they have doubled in one year alone (more…)

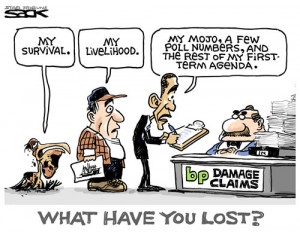

Pedro’s Nightmare BP Scenario

The possibility of a BP bankruptcy because of the ongoing Gulf oil spill is very real. Since the oil spill disaster on April 20, the company’s share price has been cut in half. BP has lost $90 billion in value for shareholders. The company dividend has been diverted to help pay for stopping the out-of-control well, cleanup and damages. At the beginning of this month, the President said, “Untold damage is being done to the environment — damage that could last for decades.” This broken well is spewing out an Exxon Valdez every 4 or 5 days, and experts say it will be at least 2 months before it is stopped. (more…)

The U.S. Dollar Falls by Fall

Last week, three stories acted as signposts for the direction of the U.S. Dollar value. The first is about a letter President Obama sent to members of the G20 (Group of 20 major industrial countries) in advance of next weekend’s meeting in Canada. The President’s letter asked members to “reaffirm our unity of purpose to provide the policy support necessary to keep economic growth strong.” (more…)

Limited Fed Audits Will be Part of Financial Reform

It’s not exactly the kind of audit Congressmen Ron Paul and Alan Grayson wanted in their original legislation, but it looks like their wish to peel away some of the Federal Reserve’s secret deals in lending and the securities market will be exposed for the first time in history. The House and Senate are working to reconcile two similar bills and make them into one to put on the President’s desk. (more…)

Obama Gulf Speech Takes a Wrong Turn

Last night, President Obama addressed the nation from the Oval Office in the White House on the Gulf oil disaster. He got off to a great start by saying, “Already, this oil spill is the worst environmental disaster America has ever faced. (more…)

Recovery Hype and Fed Audit

It seems everyday I watch mainstream media there is a discussion about the ongoing so- called “recovery.” Yesterday was no exception. I was watching an anchor on MSNBC ask a guest why the “recovery” is so uneven and why it was hard to maintain upward momentum? I yelled out to my TV, “Because there is no recovery!” (more…)

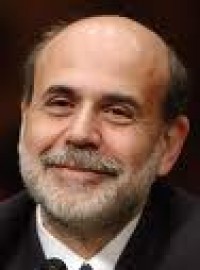

Do the Opposite of Ben Bernanke

Fed Chairman Ben Bernanke gave testimony to the U.S. House Budget Committee a couple of days ago. His preposterous statements seemed to go unquestioned by the Committee. So, I am going to tackle the highlights, ask a few questions and make several statements of my own that I think should have been made by our Congressmen. (more…)

Gold’s Flashing Warning Sign

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gold hit another all-time high yesterday! According to gold website Kitco.com, “. . . investors continue to seek out the precious yellow metal as a safe-haven asset amid heightened financial, economic and geopolitical uncertainty. One market watcher in a wire service report summed up nicely gold’s recent price action, saying “it’s a warm blanket on a cold day.” August Comex gold closed up $4.80 an ounce at $1,245.60 after hitting a new high of $1,254.50 in early trading.” (more…)