Latest Posts

When Is One Vote More Than Just One Vote?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

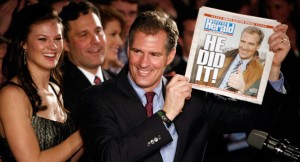

Scott Brown is the new Senator from Massachusetts. When a virtually unknown Republican can take a seat formerly held by Ted Kennedy in the bluest of blue states, the word “upset” doesn’t come close to what happened last night. This is nothing short of a sea change, and any Democrat up for re-election should be scared of losing his job this fall. The Brown win was not really a “yes” vote for Republicans but a great big “No” vote on health care. (more…)

Is the Recession Over? Not a Chance!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

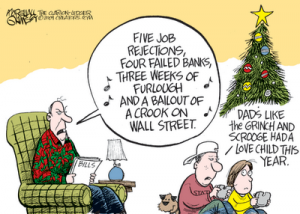

In February of last year, Fed Chief Ben Bernanke testified in a Senate hearing that he thought the recession would likely be “over in 2010.” In September of 2009, The Fed Chief declared “…From a technical perspective, the recession is very likely over at this point.” In December, the Obama Administration’s top economic advisor, Larry Summers, said, “everyone agrees that the recession is over.” Broadcast and print mainstream media are constantly proclaiming we are in a recovery, but who is the recovery for? Not the 27 million unemployed or underemployed people in this country, that’s for sure. (more…)

Fannie, Freddie and Gold

By Greg Hunter’s USAWatchdog.com

On Christmas Eve of 2009, the Treasury decided to lift the caps on how much bailout money failed mortgage giants Fannie Mae and Freddie Mac would receive to stay in business. The caps represented a maximum taxpayer exposure of $400 billion for both companies. Now, taxpayers will be on the hook for an “unlimited” amount for, at least, the next three years. How much is “unlimited?” Well, for starters, Fannie and Freddie guarantee about $4.67 trillion in mortgage backed securities. Add that to the combined debt of nearly $1.59 trillion for both companies, and you get more than $6.2 trillion of taxpayer liability. (The Fed has bought at least $1.25 trillion of Fannie and Freddie MBS) (more…)

The Federal Reserve Will Fight to the Death

By Greg Hunter’s USAWatchdog.com

The Fed is currently fighting tooth and nail in a federal appeals court to keep its bailout of big banks secret. In August of last year, the Fed lost a lawsuit in federal court that would force the 97 year old Central Bank to say who it bailed out during the financial crisis in 2008. The Fed gave a half trillion dollar bailout to foreign banks alone during the financial meltdown.

Unemployment 5 Times Worse than BLS Reports

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Friday, the Bureau of Labor Statistics released its latest unemployment numbers. The BLS said, “Nonfarm payroll employment edged down (-85,000) in December, and the unemployment rate was unchanged at 10.0 percent.” Shadow Government Statistics founder, John Williams, looked at the same data the government did and said, “…payrolls likely declined by about 500,000.” (more…)

Double-Dip Recession Warning

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There has been some positive financial news to start 2010. Some auto makers reported good sales in December to end the year. Retail sales also perked up in December, and even home sales in some areas showed a small rebound. Does this good news mean the recession is over? I say, not a chance. In a large part, we saw a bounce in economic activity because of all the bailouts and spending. Even Nobel Prize winning economist Paul Krugman is worried about a double-dip recession. (more…)

More on the Banks

By Greg Hunter’s USAWatchdog.com

Monday, I did a post called “Bank Ratings Keep Slipping Away.” My colleague across the pond, Max Keiser, sent me an email with his thoughts on the post. Max is a former Wall Street broker turned financial journalist. He does a couple of different financial TV and radio shows in Europe. (more…)

Bank Ratings Keep Slipping Away

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was checking the financial health of my local bank and discovered that it had slipped to a (C-) rating. Not more that three years ago, this bank carried a solid (A) rating. The ratings I am talking about come from TheStreet.com. The top rating is (A) or “Excellent” next (B) or “Good” followed by (C) for “Fair” then (D) meaning “Weak” and finally (E) for “Very Weak.” Checking your bank is a free service provided by TheStreet.com and other sites. I have been checking banks for friends and family for years. This free service will allow you to quickly track the trend of your bank. (more…)

Party At Your Own Financial Risk

By Greg Hunter’s USAWatchdog.com

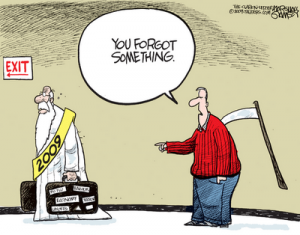

Everybody on Wall Street is breaking out the balloons and party hats and celebrating the end of the recession. Even Larry Summers, the top economist in the Obama Administration, says “Everybody says the recession is over.” Really? “Everybody” says it’s over? I’ll bet you the more than 15 million out of work Americans won’t say the recession is over. Sure, we did have an upturn in the economy, but it took trillions of dollars we do not have to do that. We paid people to buy cars and houses. The Congress passed and injected the biggest economic stimulus into the economy in history. (more…)

Uncle Sam Plays Santa Claus

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The government has made some pretty big financial announcements during the Christmas holiday season. So-called Pay Czar, Kenneth Feinberg, decided to boost the pay of an unnamed AIG executive by $4.3 million. Was Feinberg just playing Santa or taking strategic action to get the least attention possible while the media was busy with Christmas and snow storms? (more…)

Is Health Care Really America’s Top Priority?

By Greg Hunter’s USAWatchdog.com

In September, I wrote a post called “Prediction: Obama Wins Health Care, Loses Economy.” It appears the Senate has the votes for passage of its version of health care legislation; so the prediction is halfway complete. I am not going to argue whether or not health care reform is a good idea. Do we need to take care of sick people? The answer is a resounding yes! My problem is putting health care before the biggest crisis facing America, and that is unemployment. (more…)

False Positive Signals For The Economy

By Greg Hunter’s USAWatchdog.com

According to economist John Williams at Shadow Government Statistics (SGS), we are getting “… false positive signals…” for monthly numbers such as retail sales and unemployment. So, a recovery looks like it is taking place when a deeper analysis into the government numbers shows it is not. Williams says in his latest report, “Generally, the economy continues to sink or bottom-bounce; no recovery is in place.” A perfect example of a false positive is the seasonally-adjusted retail sales data from last year compared to now. In November 2008, we were in the middle of a financial meltdown. When you simply compare this November to last November, it looks like there are improving sales. But if you compare November 2009 to normal years when we were not in a meltdown, such as 2006 and 2007, then retail sales have fallen slightly. (more…)

Gold or Dollar, Up or Down

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Alex,a friend of mine, sent me an email with just one sentence. It said, “Did you read this?” It was an article published this week by NYU Economics Professor Nouriel Roubini titled, “Roubini: Here’s Five Reasons The “Barbarous Relic” Gold Is Going To Tank.” Alex and I like and respect Roubini because he was one of the few economists to call the coming financial crisis well before the meltdown. Alex knew I would be taken aback, like he was, at the bearish call on gold. (more…)

“Pay Czar” Idea is a Crock!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Kenneth Feinberg was appointed by the Obama Administration as a so-called “Pay Czar” after public outrage over big compensation packages at firms that were bailed out by the government. Feinberg has been on the job as pay cop for a little over 6 months. He is attempting to cut the salaries of top executives by limiting the cash portion of pay to just $500,000. The rest of the compensation can be in stock but must be held for 3 years before cashing it in according to Feinberg’s new rules. Also, fringe benefits such as using the private jet are capped at $25,000. What happens after that? Will executives be forced to spend some of their half million dollar salaries to fly first class? (more…)

George Will Is Wrong On The Fed

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This week nationally syndicated columnist George Will wrote a piece called “Playing Politics with the Fed.” Mr. Will is squarely against Congressional legislation called the Federal Reserve Transparency Act of 2009. This bill will force the Federal Reserve to open its books for an audit. The bill, also known as “Audit the Fed,” has 317 co-sponsors in the House of Representatives alone, a more than two-thirds majority. There are 137 Democrats and 180 Republicans backing an audit, so it is very serious bi-partisan legislation. (more…)