You Should Rent Instead of Own a Home

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? In the body of the USA Today story it says, “Part of the decline was seasonal. Foreclosure activity slows around Thanksgiving. But some of it stemmed from delays that lenders and mortgage servicers imposed after reports surfaced in September that their employees or contractors signed, and in some cases backdated, documents claiming knowledge of facts about mortgages that they did not know.”

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? In the body of the USA Today story it says, “Part of the decline was seasonal. Foreclosure activity slows around Thanksgiving. But some of it stemmed from delays that lenders and mortgage servicers imposed after reports surfaced in September that their employees or contractors signed, and in some cases backdated, documents claiming knowledge of facts about mortgages that they did not know.”

Former Congressman Alan Grayson said, just two months ago, it was much more than backdated documents and sloppy paperwork. He said it was “foreclosure fraud” on a large scale. (Click here to watch Grayson’s entire video for yourself.) Why doesn’t the newspaper dig deeper and report the truth? Maybe USA Today would not want to make its many banking advertisers angry. (That’s just my opinion and a guess on my part.) The story goes on to report, “Mortgage servicers and lenders, meanwhile, are pressing ahead to resume stalled foreclosures. November’s lull will be followed by a bulge of cases later, says Lawrence Yun, chief economist with the National Association of Realtors. The pace of foreclosures will return to more normal levels in the second quarter of 2011, says Rick Sharga, RealtyTrac senior vice president.” (Click here to read the entire USA Today story.)

Why didn’t the headline read “After November Lull, Foreclosures set to Explode”? Don’t expect the mainstream media to give it to you straight. This is one of the many reasons Patrick Killelea started his real estate website called Patrick.net. He is a hotshot San Francisco based computer programmer and analyst by trade, but became a self-proclaimed “real estate bubble blogger” in 2004. He could not get the math to work out to justify buying a home in the Bay Area. (That must be the “analyst” in him.) He booted up his site, started to warn people there was a big bubble blowing in real estate and predicted prices could fall by 50%. Up until the bubble burst, many people thought he was nuts. Of course, we all know now he’s “crazy like a fox!” History has proven him spot on. His site (Patrick.net) gets more than 20,000 visitors a day. Recently, he put out another warning–telling people to rent and hold off buying. If you thought now is the time to buy real estate, you better wait and read this excellent article below first. –Greg Hunter—

——————

It’s a Terrible Time to Buy an Expensive House— 10 Reasons Why?

By Patrick Killelea Guest Writer for Greg Hunter’s USAWatchdog.com

- Because house prices will keep falling in the areas where prices are still dangerously high compared to incomes and rents. Banks say a safe mortgage is a maximum of 3 times the buyer’s annual income with 20% down payment. Landlords say a safe price is a maximum of 15 times the house’s annual rent. Yet in affluent areas on the coasts, both those safety rules are still being violated and there is still a huge housing bubble. Buyers are still borrowing 6 times their income and putting only 3% down, and sellers are still asking 30 times annual rent, even after recent price declines. Renting is a cash business that proves what people can really pay based on their salary, not how much they can borrow. Salaries and rents prove that those high prices will keep falling for a long time. Anyone who bought a “bargain” in those areas last year is already sitting on a very painful loss. On the other hand, housing prices in cheaper areas have now fallen well below the cost of renting. In some housing markets, gross rents exceed 10% of the price of a house. It does makes sense to buy in those places now. Housing prices could still fall more if unemployment rises or interest rates go up, but on a month-to-month basis, the buyer of a very cheap house wins. So the housing market is split.

- Because it’s often still much cheaper to rent than to own the same size and quality house, in the same school district. On affluent areas, annual rents are 2.5% of purchase price while mortgage rates are 5%, so it costs twice as much to borrow the money as it does to borrow the house. Renters win and owners lose! Worse, total owner costs including taxes, maintenance, and insurance come to about 9% of purchase price, which is more than three times the cost of renting and wipes out any income tax benefit. Buying a house is still a very bad deal in those neighborhoods, but it does now make sense to buy in some neighborhoods where prices have already fallen into line with salaries and rents, or even below. Check whether you should rent or buy in your own area with “What’s It Really Worth?”The only true sign of a bottom is a price low enough so that you could rent out the house and make a profit. Then you’ll know it’s safe to buy for yourself because then rent could cover the mortgage and all expenses if necessary, eliminating most of your risk. The basic buying safety rule is to divide annual rent by the purchase price for the house:annual rent / purchase price = 3% means do not buyannual rent / purchase price = 6% means borderlineannual rent / purchase price = 9% means ok to buySo for example, it’s borderline to pay $200,000 for a house that would cost you $1,000 per month to rent. That’s $12,000 per year in rent. If you buy it with a 6% mortgage, that’s $12,000 per year in interest instead, so it works out about the same. Owners can pay interest with pre-tax money, but that benefit gets wiped out by the eternal debts of repairs and property tax, equalizing things. It is foolish to pay $400,000 for that same house, because renting it would cost only half as much per year, and renters are completely safe from falling housing prices.To see the rent vs buy numbers for a specific house and change the assumptions used, try this calculator.

- Because it’s a terrible time to buy when interest rates are low, like now. House prices rose as interest rates fell, and house prices will fall if interest rates rise without a strong increase in jobs, because a fixed monthly payment covers a smaller mortgage at a higher interest rate. Since interest rates have nowhere to go but up, prices have nowhere to go but down. The way to win the game is to have cash on hand to buy outright at a low price when others cannot borrow very much because of high interest rates. Then you get a low price, and you get capital appreciation caused by future interest rate declines. To buy an expensive house at a time of low interest rates and high prices like now is a mistake. It is far better to pay a low price with a high interest rate than a high price with a low interest rate, even if the mortgage payment is the same either way. o A low price lets you pay it all off instead of being a debt-slave for the rest of your life. o As interest rates fall, real estate prices gerenerally rise. o Your property taxes will be lower with a low purchase price. o Paying a high price now may trap you “under water”, meaning you’ll have a mortgage debt larger than the value of the house. Then you will not be able to refinance because then you’ll have no equity, and will not be able to sell without a loss. Even if you get a long-term fixed rate mortgage, when rates inevitably go up the value of your property will go down. Paying a low price minimizes your damage.4. Because buyers already borrowed too much money and cannot pay it back. They spent it on houses that are now worth less than the loans. This means most banks are actually bankrupt. But since the banks have friends in Washington, they get special treatment that you do not. The Federal Reserve prints up bales of new money to buy worthless mortgages from the most irresponsible banks, slowing down the buyer-friendly deflation in housing prices and socializing bank losses.Big bank cash flow will never run out as long as the Federal Reserve exists. The Fed exists to protect big banks from the free market, at your expense. Banks get to keep any profits they make, but bank losses just get passed on to you as extra cost added on to the price of a house, when the Fed prints up money and buys their bad mortgages. If the Fed did not prevent the free market from working, you would be able to buy a house much more cheaply.As if that were not enough corruption, Congress authorized vast amounts of TARP bailout cash taken from taxpayers, to be loaned directly to the worst-run banks, those that already gambled on mortgages and lost. The Fed and Congress are letting the banks “extend and pretend” that their mortgage loans will get paid back.It is necessary that YOU be forced deeply into debt, and therefore forced into slavery, for the banks to make a profit. If you pay a low price for a house and manage to avoid debt, the banks lose control over you. Unacceptable to them. It’s all a filthy battle for control over your labor. This is why you will never hear the president or anyone else in power say that we need lower house prices. They always talk about “affordability” but what they always mean is debt-slavery.

5. Because buyers used too much leverage. Leverage means using debt to amplify gain. Most people forget that debt amplifies losses as well. If a buyer puts 10% down and the house goes down 10%, he has lost 100% of his money on paper. If he has to sell due to job loss or a mortgage rate adjustment, he lost 100% in the real world.

The simple fact is that the renter – if willing and able to save his money – can buy a house outright in half the time that a conventional buyer can pay off a mortgage. Interest generally accounts for more than half of the cost of a house. The saver/renter not only pays no interest, he also gets interest on his savings, even if just a little. Leveraged housing appreciation, usually presented as the “secret” to wealth, cannot be counted on, and can just as easily work against the buyer. In fact, that leverage is the danger that got current buyers into trouble.

The higher-end housing market is now set up for a huge fall in prices, since there is no more fake paper equity from the sale of a previously overvalued property and because the market for securitized jumbo loans is dead. Without that fake equity, most people don’t have the money needed for a down payment on an expensive house. It takes a very long time indeed to save up for a 20% downpayment when you’re still making mortgage payments on an underwater house.

It’s worse than that. House prices do not even have to fall to cause big losses. The cost of selling a house is kept unfairly high because of the Realtor® lobby’s corruption of US legislators. On a $300,000 house, 6% is $18,000 lost even if housing prices just stay flat. So a 4% decline in housing prices bankrupts all those with 10% equity or less.

6. Because the housing bubble was not driven by supply and demand. There is huge supply because of overbuilding, and there is less demand now that the baby boomers are retiring and selling. Prices in the bubble, even now, are entirely a function of how much the banks are willing and able to lend. Most people will borrow as much as they possibly can, amounts that are completely disconnected from their salaries or from the rental value of the property. Banks have been willing to accommodate crazy borrowers because banker control of the US government means that banks do not yet have to acknowledge their losses, or can push losses onto taxpayers through government housing agencies like the FHA.

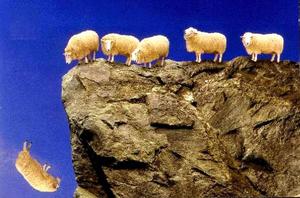

7. Because there is a massive and growing backlog of latent foreclosures. Millions of owners have simply stopped paying their mortgages, and the banks are doing nothing about it, letting the owner live in the house for free. If a bank forecloses and takes possession of a house, that means the bank is responsible for property taxes and maintenance. Banks don’t like those costs. If a bank then sells the foreclosure at current prices, the bank has to admit a loss on the loan. Banks like that cost even less. So there is a tsunami of foreclosures on the way that the banks are ignoring, for now. To prevent a justified foreclosure is also to prevent a deserving family from buying that house at a low price. Right now, those foreclosures will wash over the landscape, decimating prices, and benefiting millions of families which will be able to buy a house without a suicidal level of debt, and maybe without any debt at all!

8. Because first-time buyers have all been ruthlessly exploited and the supply of new victims is very low. From The Herald: “We were all corrupted by the housing boom, to some extent. People talked endlessly about how their houses were earning more than they did, never asking where all this free money was coming from. Well the truth is that it was being stolen from the next generation. Houses price increases don’t produce wealth, they merely transfer it from the young to the old – from the coming generation of families who have to burden themselves with colossal debts if they want to own, to the baby boomers who are about to retire and live on the cash they make when they downsize.”

House price inflation has been very unfair to new families, especially those with children. It is foolish for them to buy at current high prices, yet government leaders never talk about how lower house prices are good for American families, instead preferring to sacrifice the young and poor to benefit the old and rich, and to make sure bankers have plenty of debt to earn interest on. Your debt is their wealth. Every “affordability” program drives prices higher by pushing buyers deeper into debt. Increased debt is not affordability, it’s just pushing the reckoning into the future. To really help Americans, Fannie Mae and Freddie Mac and the FHA should be completely eliminated. Even more important is eliminating the mortgage-interest deduction, which costs the government $400 billion per year in tax revenue. The mortgage interest deduction directly harms all buyers by keeping prices higher than they would otherwise be, costing buyers more in extra purchase cost than they save on taxes. The $8,000 buyer tax credit cost each buyer in Massachusetts an extra $39,000 in purchase price. Buyers should be rioting in the streets, demanding an end to all mortgage subsidies. Canada and Australia have no mortgage-interest deduction for owner-occupied housing. It can be done.

The government pretends to be interested in affordable housing, but now that housing is becoming truly affordable via falling prices, they want to stop it? Their actions speak louder than their words.

9. Because boomers are retiring. There are 70 million Americans born between 1945-1960. One-third has zero retirement savings. The oldest are 64. The only money they have is equity in a house, so they must sell. This will add yet another flood of houses to the market, driving prices down even more.

10. Because there is a huge glut of empty new houses. Builders are being forced to drop prices even faster than owners, because builders must sell to keep their business going. They need the money now. Builders have huge excess inventory that they cannot sell at current prices, and more houses are completed each day, making the housing slump worse.

—————————————-

Patrick Killelea started his site (Patrick.net) in 2004. Killelea did it because he wanted home buyers to understand the market and not get ripped off. Killelea is a computer programmer and analyst by trade. He has worked for Sun, Charles Schwab, Wells Fargo, Motorola and Amazon. He has appeared on the ABC-TV show “Nightline” and has been quoted in the Wall Street Journal for his real estate insights and correct calls on housing. Patrick says he’s “A liberal who wants socialism. I say that just to piss off all the people who love labels too much, but there is some truth to it. Liberalism is a wonderful thing! Everyone should be a liberal. You know what “liber” means in Latin? FREE.” BTW, Killelea is an Irish surname, originally Mac Giolla Leigh or Mac Giolla Leith in Irish. Killelea says, “Many people ask me if it’s Hawaiian.” (Check out his site Patrick.net by clicking here.)

I love it when reporters question headlines. Virtually nobody does it, glad to see you doing it, MR. Hunter. Huffington Post used deceitful, misleading and leading headlines in 2008 as part of a bigger plot to ensure Barack Obama defeated Hillary Clinton in the 2008 democratic presidential nomination race.

Alessandro and Teflon,

Thank you both for the kind words and support.

Greg

Greg

Recently a story was published about wall street honchos deciding to rent their home rather than buy. In New York City reports have emerged of these multi-millionaires paying $20,000 per month for a large apartment in the city as their main residence. This adds credence to your article.

In years past most people were renters mainly because down payments of 20% were required for most loans. Veterans Administration loans were one of only a few exceptions. If a person were to apply for a 90% they were required to pay an additional charge for mortgage insurance (PMI) to protect the lender in the case of default.

The progressive agenda of systemic collapse was facilitated by the government drive to put a family in every home. Thus the bubble began to inflate. This drove American prosperity for the next 30 years; it is now over. The previous 30 year prosperity was driven by the USA’s being the only country not burned to the ground during World War II.

The housing situation is just another symptom of the economic depression we are enduring. Our government is completely corrupt and looking for ways to seem to be of the people while protecting themselves from the people. That is way the Democrat congressional staffers now out of work require psychiatric counseling. They just can not adjust to being plain old citizens.

The sale of a single house has a ripple effect through the economy from furniture, carpets, drapes, lamps, appliances, etc. Multiply this by a million and the results are impressive.

Renters usually cannot afford or justify the extra expenditure. They may also be sensible, frugal individuals or families that want to preserve their financial independence. It is possible to leave a rental property almost at will; there is no capital holding one back.

It is obvious that given current circumstance renting is almost always better than owning.

Good info John Bernard, as usual!!

Greg

Greg, good information for all. I most enjoyed the part where Patrick discussed the fact that the Government really does not want lower and or “affordable” home prices; a real eye opener, I would have never thought that. Thanks for posting this valuable information.

Art,

That is a very good point. The Gov. wants to protect those trillions in Mortgage-backed Securities!! Thank you man!

Greg

Hi Greg,

there are a few factors that your guest writes doesn’t factor in. Ownership, high to hyper inflation and the availability (or lack there of) of credit. The mortgages rates HAVE BOTTOMED and are heading up. Your dollars will be worthless in the future. You aquire wealthwhen you own property as opposed to renting. Even if I lose half the value of my home on paper today with a 6% mortgage, if I can make the payments and we go to a realistic inflation rate of 10% to 15%[my guess in two years it will be much higher]even ten years in the future, you are paying with greatly deminished dollars.

then there is the financial strength of your land lord. My stepson came home to his rental home, six months into a 12 month lease,to foreclosure papers. He paid his rent on time but the landlord doesn’t appear to have paid the mortgage. Renting is no safe haven or sure thing.

George,

Thank you for making some very good counter-points.

Greg

I do likesome of his analysis,but I do not know how in the future troubles anyone will be able to save to pay cash for a house with uber high inflation. Every day the renter holds his USDollars[or any other currency] he will lose buying power. The banks are never going to pay interest on what the money you save is really worth. Maybe Gold and silver if you can get it?

Greg,

Thanks for this great post. I have been telling my sister and brother in-law not to buy and this article should set it all in concrete for them and answer any doubts.

Ben

Ben,

There will be a time to buy later and there will be some really great deals. Thank you for sharing your view here.

Greg

Coupling the bankruptcy of nations treasury (that will impact the ability to payout the anticipated social security and medicare benefits to people who’ve paid into those programs for decades) with the fact that the banks own most of the property in America, it seems that their last quest is to get every bit of equity into their hands with these reverse loans, that many boomers are going to need to help fund their retirements, thus putting the property back into the hands of the banks.. Which makes one ponder is the goal to remove every last ounce of wealth from us commoners?

Thank you Robert. that’s a good question.

Greg

Greg

I’m so glad that you address the foreclosure situation frequently. I have just discovered patrick.net & financial survival podcast, both about housing. I’m in OC calif and there are thousands of homes that should’ve been foreclosed on years ago, but do not show up as being delinquent. Prices are still much too high. My guess is that the gov’t doesn’t want these numbers to be known in order to prop up the economic news, and also because CEOs of banks want their stocks to look good so they will continue to get huge bonuses. This is another form of manipulation isn’t it? It should be in Mainstream news, yet all we hear about is how we are in a “recovery”.

Alyce,

What is going on in mainstream media is not journalism. They will be punished for not telling the truth. People are loosing confidence in there message and the MSM will steadily lose of readers and viewers. Thank you for your comments.

Greg

I read a newspaper article a couple of months ago with the same theme, the peeps don’t should buy their homes, just rent. The article mentioned something about Ginny Mae being used to end the foreclosure mess. Homeowners would sign away their equity to the government and the government would become their landlord. In time these properties will be sold to the banks & hedge funds as safe, secure rental properties investments. They will be sliced and diced like the mortgage backed securities. No one will know who owns what again, but the beat goes on and the banks make a bundle of money.

MSM is being used to promote renting over property ownership. If Congress takes away the mortgage interest deduction it is one more step to discourage home ownership.

Yes, I believe they have found one more means of sucking the wealth out of the people.

Jan,

Keep in mind Patrick is saying don’t buy right now until prices come down some more. He is not advocating to never buy a home. The other points you are making make sense and illustrate the pure evil that some Wall Street bankers have become. Thank you.

Greg

This article and patrick.net does a very good job in proving how “owning” is not always the best route to go. I am a firm believer that you do not own your home until it’s paid off. The bank simply owns you. You work everyday to pay for that home and God forbid something goes wrong in year 27 of your mortgage and you can’t pay then “poof” your 27 years of equity is gone through foreclosure. Our mentality is so warped and fixated on payment that we don’t consider that we are grossly overpaying for something when the cost to borrow money to buy it is cheap. I will highlight one exception though.

With all of the foreclosures out there you can get a really good deal and actually move into the house with equity. For example: I recently did a loan for a couple who bought a foreclosure at $192k that had a tax value of $343k. We allowed them to wrap $30k in renovations into that first mortgage bringing their total acquisition cost to $222k. The down payment was 3.5% of the $222k and they chose a 15 year fixed loan. On a 15 year fixed you are paying more principal than interest on day 1 and accumulating equity very quickly. This doesn’t even factor in the fact that their house appraised for $310,000. They have a $90k buffer so if they had to sell their house they could.

This example IMHO is the ONLY way people should be buying homes right now.

Stephen

Industry Insider

Good point Stephen. Thank you for sharing the insider perspective!!!

Greg

Why is no one mentioning the following that I find important:

1-) A home gives you write-offs that renting does not do! Why in the world would I rather give my money to uncle sam instead of putting it into where I live? I understand the above, but I am still receiving a tax advantage that renting does not give me!

2-) Renting puts you at the whim of your landlord. You can be an excellent tenant and still be asked to leave if the landlord decides to sell, move a family member in, etc.

3-) You are limited when you rent. If you wanted to redo the kitchen, install a pool, etc. – you can’t and at the same time, why would you – you don’t have any right too like you would if it was yours.

Any thoughts on these points Greg and others? I mean real debating points.

Mike,

The implication of the article is not saying never buy a house, just not now. Thank you for bringing up these points.

Greg

Thank you for your reply, but it still doesn’t help people like myself that NEED write-offs or else we have to pay much higher taxes. I understand all points in the article, but this one point (on top of my other ones) is something that is never addressed in earnest.

Basically what I am getting out of what everyone is saying – is that I and others like me, need to just pay higher taxes, rent a place that we can’t fully alter/furnish to our likings and in all honesty – just deal with it until some undefined time on the future that may or may not occur…meaning in our life time if the gov’t keeps up their handy work which they have been able to keep up for as long as they have. Correct? Is this what you are saying???

Mike,

You do realize you are paying dearly for those write-offs? Please answer me why homeowners are entitled to a write-off anyway? Why should homeowners get a tax break for going into debt? What happens if that tax break goes away. Why don’t all Americans get a tax break for their living expenses? Nobody is telling you to sell your home, just that right now renting is a better deal with less downside exposure. I really do not think you are grasping just how bad the economy is and how bad it will get. Please keep in mind, The government is artificially forcing down interest rates right now. The government is supplying 95% of ALL MORTAGAGES. Interest rates should be 9% or 10% right now, and would be if the government were not holding down rates. If you have a home, and you like it, then keep it. There is nothing wrong with that just be aware the real estate market will probably not come back for a very long time.

Greg

Greg check this out http://www.youtube.com/watch?v=FDmZePV2Rtw

Tomas,

This is funny and a bit sad because it is true. I hope readers follow the link and have a laugh.

Greg

You should buy now !

Why?

So that you can lock low rent price for 30 yrs.

When you are renting you are at the mercy of the plp who owns a house.

If he says next years rent goes up 30% because of the inflation that this blog keeps talking about then what are you going to walk away.

What if everyone is raising rent because of the inflation, what then?

Now you can buy at a low low price with super low rates for 30 yrs.

I think you would be a fool to say lets rent and expect the rent to remain steady for another 10 or 20 or even 30 yrs.

Grom,

When interest rates go up (and are no longer supported by the government) you will also lock in one hell of a loss and negative equity. When rates go up prices come down.

Greg

yup!

According to David Stockman tax reform will be the only way we will ever tackle the deficit. The tax rates will never go up in our lifetime as these Bush tax cuts are now cast in stone. Can you see any person running for office ever asking for these to expire in two years and get elected in all but 20% of the country?

Any tax reform will have to include the mortgage deduction for any mortgage over say $100,000 though that will most likely start off at $250,000. The banking/real estate lobby will scream but what else is there to address the deficit?

As for real estate the charts show more mortgages in reset this year that will cause even more foreclosures…………why buy now? This act could take another 2 years to play out as prices drop! I think real estate will not level for at least another year or two.

Jeff,

If you look on the chart of mortgage resets on the Nov. 8th post “The Feds Biggest Fear” you will see your math is right on track. The resets do not stop until November 2012! You will not get a bottom until AT LEAST 2013. Thank you for your on target comment.

Greg

No one can own real estate in this country; No one can have title to any real estate in this country; which is why real estate can be stolen so easily by simply recording a piece of paper with county recorders; I have proven this in my lawsuits, in Orange County, Ca. a/k/a “World Capital of Fraud”

Real estate ownership is a scam, and it always has been. We are all temporary. Who owned that USA real estate 100 years ago? 200 years ago? 500 years ago? 1000 years ago.

Sure, by some decree from some king or queen?

Puh-lease!

ct,

I don’t know about this, but I am going to post it.

Greg