The Recession is Over? Really!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

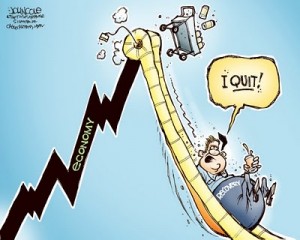

I was dumbfounded by the headline “Recession Ended in June 2009” that came out earlier this week. The National Bureau of Economic Research (NBER), which is a panel of academic economists, called an end to the longest recession since WWII. According to a statement by the NBER, “the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month.” So, the recession is over simply because the NBER said it was over? What? Here we go again. More spin that says we are having a so-called “recovery” when nearly all signs out there say there is no real recovery. (Click here for the complete NBER statement.)

On the same day the headline came out from the NBER, the other headline on the same page said “Homebuilders Confidence stuck at 18-month low.” The Associated Press story said, “The National Association of Home Builders said Monday that its monthly index of builders’ sentiment was unchanged in September at 13. The index has now been at the lowest level since March 2009 for two straight months. Readings below 50 indicate negative sentiment about the market. The last time the index was above 50 was in April 2006.” (Click here for the complete AP story.)

I could not believe my eyes that these two stories wound up on the same page yesterday. Is the NBER crazy? I don’t know, but this group of academics has lost all credibility to me. No one in the mainstream media called BS on this story. They just reported it with a straight face—how amazing!

Someone should inform the Federal Reserve the recession is over so it can start raising rates and tightening the money supply. Oh wait! The Fed met yesterday, and it’s not worried about the economy shooting up but falling off a cliff! A Reuters story said, “The Federal Reserve on Tuesday inched closer to fresh steps to bolster a sluggish U.S. recovery . . .” “Bolster a sluggish recovery” will be done with Quantitative Easing, or money printing, of reportedly another trillion bucks. This is not the hallmark of a robust economy. The story goes on to say, “. . . JPMorgan economist Michael Feroli wrote in a note to clients. “The Fed is now admitting that they are not hitting the inflation mandate, clearly not hitting the employment mandate and — with subpar growth forecasted for the near term — not even moving in the right direction.” The “right direction” means growing, and that’s something the economy just isn’t doing. (Click here for the complete Reuters story.)

You don’t have to be an economist to know the economy doesn’t have enough horsepower to pull the hat off its head. According to a recent survey by the polling firm StrategyOne, two thirds of Americans think the economy will go into the tank on a double-dip recession. According to a PRNewswire story, “Almost two in three Americans (65%) say a double-dip recession — defined as a recession followed by a short-lived recovery, followed by another recession — is now likely to happen. Among those who expect a double-dip recession, nearly half (44%) fear it will be worse than the first one, with 21% worried it will be “much more severe.” Just 24% think the second recession will be less severe. These findings come from a recently conducted survey of 1,043 Americans by the polling firm StrategyOne, a Daniel J. Edelman company.” (Click here for the complete story.)

I don’t know why the mainstream media and mainstream economists are determined to tell the public we are in a recovery when we are clearly not. My guess is things are much more dreadful than anyone would admit, and even in the ranks in the upper echelon of the business world–there is fear.

Steve LIES-man: “Technically you can’t have a double-dip. Now that this recession is over, the next recession would be a new recession.”

Too funny.

http://www.cnbc.com/id/15840232?video=1595544390&play=1

Ace,

You are right.

Too funny!!!

Greg

Greg

You couldn’t be more right about this . Of course government and its friends or wanna be friends are trying to calm an ever more restless society. The manipulation of the stock market makes it seem like the economy is rebounding because folks have been conditioned to think that a DOW above 10K means the situation is OK. People want to believe that everything will be alright.

Most are not paying attention to other indicators such as precious metals. We are now approaching terminal velocity in the crash of our system and our standard of living will begin to decline at an accelerated pace.

You have been in the lead warning people about this but you might as well spit into the wind for all the good it’s going to do for those who don’t want to know.

Our present government, and most likely previous ones, are spinning the facts and publishing reports to promote calm. Unfortunately this cannot continue much longer.

Be prepared.

John,

Yes the PM’s are screaming “brace for impact.” Thank you.

Greg

Greg,

While I know WHY the economist can claim this so called turn around, I have no faith in the data that they are using as a reference. It’s a rigged game and the big boys are trying to get us back in the market to steal what we have left.

What we have is artificial plateau due to Trillions of dollars of Fed intervention before the downward pressures overcome the current measures and speed downward.

George,

Seems things are getting worse faster and faster. Look at the departures from the “O” economic team. Orszag, Romer and now Summers is on his way off the sinking ship. Thank you for the observations.

Greg

wonderful comment dude.

If you have any other questions you can email me too at [email protected]. I am happy to help out.

Greg

Greg,

Very good article. Gold is now above $1290 and silver above $21 per ounce respectively. US Dollar index went below 0.79 against Euro. Peter Orzag, OMB director has left. Christine Romer has left. Larry Summers is bailing out. Chinese stopping buying U.S. Treasuries and opting for Japan and South Korea. Germany is increasing export to China. Fed is ready to print more money and keep interest rates at their lowest. Bush tax cuts about to expire. The emperor has no clothes. Mainstream media knows the facts but cannot admit their big mistakes. Truth is sounded, like Paul Revere,as a clarion call from you, Jim Sinclair, Monty Guild, John Williams at Shadowstas etc. Keep up the good work.

Pat Sonti

Pat,

Thank you.

Greg

Hey Greg,

The MSM are neo-Marxists who are suffering from rationalization and projection.

They think that by being complicit with Obama’s DNC by spreading this propaganda they will help their lost cause. They are aiding and abetting the use of the IRS to slander Alan West and O’Donnel.

I know now that I can never run for elected office. During my divorce, and after, my x-wife did not pay taxes. I am the one who received the tax liens. These tax liens have been removed and my tax situation is up to date. Just as West’s and O’Donnel’s situations are up to date.

If you do anything with your life, the IRS and Franchise Tax Board (Kalifornia) will file liens against you because they think your money is their money. At current tax rates, fees, and other services, I work half of my yearly life for the neo-Marxist income redistributionists.

The academics who populate the NBER need to go back under the institutional rock that they escaped from and read more Engles and Marx.

markm

MarkM,

Thank you for your input on this topic.

Greg

The fiat money systems of those countries whom such stats as “recessions” and the like are applied to are often criticize using metaphors relating them to alcohol drinkers. For example, the fiat system’s ability (delusional) to create money out of thin air is often referred to as a “punchbowl” and the central bankers being “drunk” with money printing powers.

As the price of gold soars, and the Federal Reserve Note drops (notice I didn’t call it a dollar) against other currencies I realized how the alcohol analogy applies to the world economy. It is as if a whole lot of the world’s central bankers have all been hanging around a beer tent for a very, very long time. So long, in fact, that almost all of them are showing some level of inebriation but some are more drunk than others. Some are to the point where they are very near to being “fall down drunk”.

Currency markets are merely betting which drinker will fall down first, not believing its even possible they could fall on a tent stake and cause the whole beer tent to collapse. But once the world gets a good view of how drunk the whole group is they will realize their is none of them fit to be a designated driver to take them all away from the beer tent.

That seems to be where the world is today as it searches for a new “reserve” currency. Why would they believe anyone in the beer tent is a suitable candidate? All the fiat currencies are corrupt just by the fact they are fiat. So any replacement of the FRN with something like a basket of currencies makes me think of a group of drunks walking in an embrace and holding each other up. That is all good that they are still able to stand but no way are they able to lead the world out of this mess.

Robert,

Good stuff man. Thank you for sharing this with all of us.

Greg

Msnbc had an unofficial web poll the other day, it was about 85%-15%, so even msnbc readers gave this report little credence. Their web polls typically trend heavy on the liberal side as I’m sure everyone here knows.

For me this report just illustrated the arrogance of academia in this country. I can’t believe they actually had the nerve to publish this garbage & expect us to believe it. I don’t know if they’re as out of touch as politicians and the media are, or if they’re intentionally skewing facts & trying to shove stuff like this down our throats. Either way, their arrogance is almost unbearable.

MikeD,

I agree. I did not know about the MSNBC poll, thank you for the info for our readers!

Greg

I’m not as sophisticated as the other posters here, but I too was stunned at the headlines. Is it all about looking good in preparation for elections? All kinds of glowing reports have come out this week – one from the USDA about all the fabulous job creation/growth from stimulus money. Another about how technology is making the net gain in ethanol production better (it still is pretty lousy).

I learn so much here and am happy to have found this site.

Deborah,

Thank you for the comment and the support.

Greg

Everything our ‘government’ is doing now is aimed a creating/joining the ‘New World Order’ that they so believe in. I’m worried that ‘O’ will create an ’emergency’ (diversion) somehow so he can claim martial law and override or cancel the November elections. I put absolutely

NOTHING past him and his radical democrat buddies. He is hell bent on destroying life as we know it in our country and subverting us to the European lifestyle. In otherwords, socialism, and worse. I despise the man and whoever is pulling his strings.

Greg,

How do you get a pic to display with your comments, such as Robert L. above?

Thanks!

🙂 Diane

Diane,

I simply do not know but I will check with my IT guys. Thanks.

Greg

Several years ago it was a website called gravatar.com. You signed up & any time you commented on a wordpress blog, your “gravatar” was automatically inserted as long as you used that e-mail address when commenting.

I checked, gravatar still exists.

MikeD,

We can all have our pics up now! Thanks.

Greg

Reading the posts and comments over the past few months, I keep thinking of the band on the deck of the Titanic as the MSM; ‘keep the populace calm at all costs’ – or else the panic that would ensue upon the reporting of real truths would be barbaric and uncontrollable: short of marshal law.

Greg, thank you for the great, informational site; commentors, thank you for you pithy, knowledgeable insights.

I’ll keep reading, accumulating silver; albeit probably too slowly and await the sound of ‘Humpty Dumpty’ taking his great Fall.

May You Live In Interesting Times — Ancient Chinese Warning (some would say curse); ironic isn’t it?

Troy,

Thanks for reading the site and the kind words!

Greg

“No one in the mainstream media called BS on this story. They just reported it with a straight face—how amazing!”

Sorry, Greg, while I know what you mean, I just don’t find this amazing anymore. The American press is all but state-controlled media now. They just report whatever the government says, with very little fact-checking of what are often dubious, unsupported or outright factually false claims.

In this case, the government saying “Recession over” is just another version of “Everything is fine. Move along, nothing to see here.” Existing Home Sales, a major economic indicator, went over a cliff in July to what may actually be the lowest level since the Great Depression. But thank goodness the recession ended last year.

I don’t believe anything the government says anymore, or anything the media reports. Hey, who you gonna believe, that unholy duo or your own lyin’ pocketbook?

Shaggy,

“your own lyin’ pocketbook”–great perspective!!

Greg

Is the recession over? For me, it’s not and I’m beginning to think that for the people I work with, it seems like it’s over because they are lying about their own economic situation. I want to highlight three scenario’s I’m seeing:

1) Most young people I work with are simply living in lala land when it comes to the economy. They don’t own homes yet, have no kids, aren’t making that much, but believe (through osmosis) that the economy will one day pick up (it always has and always will — as one said to me).

Although most don’t particularly enjoy their jobs, they believe that their escape is to apply to grad school, take on huge loads of debt and in two, three or four years, when they’re ready to graduate and enter the real world, the economy will have picked up and they’ll all be able to get that lofty law firm job or wall street they dreamed of. For many, the nightmare will soon hit and that’s why I believe Sallie Mae and co., are headed downwards — too many people still believe that going back to school is the answer and they’re willing to take on huge debt for it, but they don’t understand that the jobs won’t be there and they’ll fall into delinquency very quickly.

2) For the older workers, most will rarely complain about money, but in talking to them I’ve realized that the only way they are still afloat is because they don’t have mortgages. They’ve inherited their parents houses and are living in them mortgage free (this is true for many people over the age of 50+) whose parents are deceased or in nursing homes.

The only time I hear financial concerns from them is when they talk about having to help their kids and their grand-kids with all sorts of expenses, but in truth, if it wasn’t for those mortgage-free houses that their parents left them, many would be in dire straits because they have no savings to speak of.

3) The workers in their 30’s with kids and mortgages and spouses still believe that in 5 years, things will be fine, their 401K’s will be flowing with cash again and they’ll be okay. It’s a strange cockiness they have borne largely from economic ignorance. They spend their time on facebook, not on blogs like this.

** As an aside, I want to tell you about one of my bosses who just purchased a house before selling his old one! He makes $50,000 dollars a year and his wife has been laid off for about one year. Now tell me, how can someone like this afford a mortgage or even qualify for a loan? It doesn’t add up.

nm,

Everyone should read this, it’s great! Thank you.

Greg

Theyre right. The recession did end in June 2009…cause the depression started then!!!

Tomas,

Too funny and too true!

Greg

Greg,we know this data is wrong,but there are many that remain clueless,so I reread this history lesson again today, it’s called “The Rothschld Dynasty”. Your readers should to. http://www.silverbearcafe.com/private/rothschild.html. Next “The Article of the Day” I hope all will read also @ http://www.silverbearcafe.com/private/home.html. Greg,time is short,so I hope this helps all. I am sending this Article to many that dont read your site yet,but they will soon.My best to You!

M Smith,

Thank you for the additional content.

Greg

Hey Greg,

You did a great job on Sussman’s show this morning. I wish all journalists were as good as you.

markm

MarkM,

Mark is talking about Brian Sussamn’s show on KSFO radio in San Francisco. Thanks Mark. Brian gave me my first 2 jobs in TV and we have been good friends ever since. Thank you man!!!

Greg

Mainstream media continues to move closer to irrelevance every day. By simply acting as neural nodes, which are plugged into the Fed’s various announcement mechanisms, most media are simply passing the propaganda on, like a cold. Many thanks, Greg, for cutting through the enormous mounds of BS.

I’m among the 21% who believe things will more likely than not get much worse. Our entire “system” is in a very fragile state right now, and we (most of the world, really) are extremely vulnerable to major events (such as a possible attack on Iran by Israel).

My suggestion to all, is to do some basic/simple/cheap preparation. Water, beans, rice, seeds, etc.. – much more common sense now than paranoid. If we’re all lucky, you won’t need it. Let’s hope.

Jeff F,

Is it just me or as the economy gets worse the lies get Bigger? Thanks for the comment.

Greg

Hey Jeff,

“Water, beans, rice, seeds, etc.. – much more common sense now than paranoid.”

You forgot two heavy metals that may be critical for survival: lead and gold. Make sure you have primers and nitrocellose powder for the lead.

2A rocks!

markm

Greg:

Another good book besides When Money Dies by Adam Fergusson, is The Economics Of Inflation – A Study Of Currency Depreciation In Post War Germany, albeit it is more numbers and economic theory based. I prefer former because one is able to see how everyone was in denial written in their own words. The government was issuing bonds, as well as, monetizing their own debt. The Weimar Republic’s vehicle was “war bonds” instead of treasury bonds. They had the Reichsbank, we have the Fed. You could spend a whole week talking about that book alone.

I also read an article a while back in a London newspaper that stated that upper echelon business people were buying up When Money Dies like crazy. Maybe it’s an indicator.

Best wishes,

Brad

Brad,

More good info!

Greg