Weekly News Wrap-Up 10.28.11

By Greg Hunter’s USAWatchdog.com

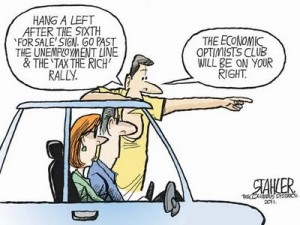

Stocks soared this week as the EU agreed on a deal that will address its sovereign debt crisis. The Dow was up nearly 340 points to 12,200, but is the debt problem really fixed? NO WAY!!! There is just too much debt to deal with. Any solution will need mountains of freshly printed currency. That’s why gold and oil were also up big this week. Meanwhile, the attention returns to the U.S. and the so-called super committee in Congress that is supposed to cut $1.5 trillion in spending. Good luck with that as the stalemate will continue between Republicans that want the spending cuts and the Democrats who want tax increases. Mandatory cuts kick in later this year if no deal is reached. New consumer confidence numbers are out and are pretty ugly right along with new plunging median home prices. All these stories and more from Greg Hunter in this installment of the Weekly News Wrap-Up.

Greg, your lone voice in the wilderness is so valuable, keep it coming. Greg, 2.5 GDP, yea and I own a nice bridge in Brooklyn I can let go for a song. Once again the fat cats on Wall Streets make money on the short run while the people continue to get by on less income, struggle with high inflationary prices on necessities – some old story, no new players, just slip sliding away to third world status for the middle class.

Thank you Art!!!

Greg

greg,

couple things.

you say “plunging median home prices” like it’s a bad thing.

sorry, i just can’t get my head around that one. please explain how housing prices going back up is going to be healthy for the economy? my own take is that anyone who bought into the idea of investing in human shelter on spec and is now losing money on the deal is getting just what they deserve. i cannot muster an ounce of sympathy for them. do we really need to get back to the time when getting joe sixpack into a serviceable home will once again require “creative” financing? have we learned nothing?

this whole higher taxes vs spending cuts thing. weapons of mass distraction. neither road will go anyplace worthwhile as long as money is created out of thin air and borrowed into existence. the fed has to go. and the constitutional directive of government printed money must be reinstated. the only thing that is going to work. so obvious. ad so obviously and studiously ignored by the msm and fed gov.

seems like we are about one more fed friendly president away from the final curtain for the american way.

so far only one announced candidate is addressing this. and hes is being marginalized and ignored for his efforts.

getting to the point where i am beginning to realize that, as a species, we are a pretty sad and silly bunch.

g.johnson,

Rising prices signals demand and there is very little demand. Falling Median home price date refutes the 2.5% “growth” numbers. Actually home prices really need to drop about another 40%, and yes, that will be a good thing for new buyers. I know Ron Paul is being marginalized because the power players want to stay in power even if it sinks the country. Thank you for your participation in the site!!!

Greg

Wow Greg, you hitting on all cylinders on that comment: “I know Ron Paul is being marginalized because the power players want to stay in power even if it sinks the country”. Keep telling it like it is. But you watch when all fails the power players will be the first in the life boats throwing out women and children to get in.

Thank you Art for your support!

Greg

AND WHO OWNS JPM? WHO OWNS BOA? WHO OWNS GOLDMAN SACHS? AND

WHO OWNS THE FEDERAL RESERVE????

THE ROTHSCHILDS DO ! CORRECTION: “WAY TO GO ROTHSCHILDS ” !

It will be interesting to watch the “cuts” unfold as it appears there are miles for the super committee to bridge before a compromise can become reality. Even within each party there are differences to overcome.

I fear that the committee will come to conclusions that the full congress can not agree on or that no decisions will be made at all, so automatic cuts will occur and then the congress in session will write some new law that will overturn the legislation that created the super committee to begin with and eliminate their actions. What congressman or woman wants to run for reelection with those cuts hanging over their heads? I see the USA ending up like Europe where a crisis will require action and action not taking place until the crisis occurs.

RP,

I think this analysis is very sound. Thank you for posting it here!

Greg

I challenge anyone to do a comparison of economic news headlines from five years ago and today. It has been a slow change, but viewed at that interval, the contrast is stark. French Prime Minister Francois Fillon was right when he said, “unknown territory”. These guys have opened Pandora’s box and never considered the last option in closing the door; that is the option of there is no option, which must always remain a valid choice.

What a week of news. The gang of super crooks are in charge of writing bills that the rest of congress have no say in at all. Damn the Constitution & Bill Of Rights and the millions of people who are not repersented in any way. When a person tells a lie, the next one has to cover the first one and keeps growing until they now believe the lie they told instead of the truth that all ways finds its way to the surface in the end.

Nothing has been fixed in Europe or in the USA. This link is a damn scary one and if people don’t think it could never happen here they better re-think their own way to keep food & water & things that they could barter with stored away in a safe place. http://www.thenewamerican.com/economy/commentary-mainmenu-43/9525-how-hyperinflation-could-start-in-america. After reading this & other articles all on the same subject, all have one thing in common, it only takes one event to set it off & then all hell breaks lose!

Greg, enjoy the weekend, I have feeling next week will be very busy as far a news that will be twisted by the MSM lap dogs we have grown to dis-like.

Thank you for your comment and spirit!

Greg

AROBIN SAYS I DONT BELIEVE THERE WILL BE MUCH CHANGE THIS ELECTION. PEOPLE ARE NOT READY FOR REAL CHANGE. IT DOESENT MATTER WHO GETS IN WE ARE GOING TO HAVE FOUR MORE YEARS OF SLIDE. THE SNOW BALL HASENT GOT BIG ENOUGH YET. BY 2016 THAY WILL BE SAYING WE SHOULD HAVE LISTENED TO RON PAUL. THAT WILL BE THE YEAR OF SOME REAL CHANGE IN DIRECTION. AFTER THE YOU KNOW WHAT HAS HIT THE FAN. PEOPLE ARE STILL TRYING TO FIGURE OUT WHICH CELEBRITY THAY WANT FOR PRESIDENT. THE NEWS PEOPLE ARE TRYING TELL WHO WE NEED. IT IS A CIRCUS OUT THERE IT IS NOT VERY SERIOUS OUT THERE TODAY. THERE IS NOT A HALF DOZEN PEOPLE IN THESE U. S. STATES THAT KNOWS HOW TO UNRAVEL THIS THATS ABOUT HAPPEN.

Ending fiat money will unravel it and in a hurry. Maybe there is another 5 out there that agree with me. Fiat money historically has never worked in the long run because its to easy to just declare what it is worth and make more of it thereby destroying its buying power. Back the currency will real touchable gold at a set price and watch the unraveling of this cancer stop dead in its tracks and start get well again.

Greg,

Does the growth in consumer spending match inflation? Until it does, there is no growth.

As for the rise in the stock market due to Europe fixing its problems, I just can’t believe the major investors are that stupid….I believe this is just market manipulation. Watch for a slow selloff.

It’s funny, Argentina crashed and defaulted…but it seems to be doing great now. When left alone, the healing process may hurt, but it works.

Greg,

Another great news weekly wrap-up! You are absolutely correct that the current economy is worse than it looks. The economy is not sustainable when a country spends more than it takes in. The good news from Wall Street is only temporary.

According to CNBC.com “The World’s Biggest Debtor Nations” (http://www.cnbc.com/id/30308959/The_World_s_Biggest_Debtor_Nations), the following twenty countries have the highest external debt to GDP ratios:

1. Ireland 1382%

2. United Kingdom 413.3%

3. Switzerland 401.9%

4. Netherlands 376.3%

5. Belgium 335.9%

6. Denmark 310.4%

7. Sweden 282.2%

8. Finland 271.5%

9. Austria 261.1%

10. Norway 251%

11. Hong Kong 250.4%

12. France 250%

13. Portugal 223.6%

14. Germany 185.1%

15. Greece 182.2%

16. Spain 179.4%

17. Italy 146.6%

18. Australia 138.9%

19. Hungary 120.1%

20. United States 101.1%

Fifteen of the twenty-seven EU members are in the list. Germany, France and other EU countries are not in much better shape than Greece. Just like you said, the EU debt crisis is far from over.

Ambrose

Ambrose,

Good stuff!! Wow, many are past the point of no return!!!

Greg

Greg,

There’s a 404 error on your Monday posting. I’ve received the email thru Feedburner for The 2.5% GNP Growth Spin Job, but when you click on the link, you receive the error message. If you simply go to your site, the article isn’t displaying

🙂 Diane

Diane Carol Mark

Thank you I fixewd it. I do not know what happened. So sorry.

Greg