Beginning of Panic Rate Cut Cycle – Ed Dowd

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Former Wall Street money manager and financial analyst Ed Dowd of PhinanceTechnologies.com had a storied Wall Street career. He got out of Enron and Lucent long before they crashed and burned. A few of the many other more recent correct calls Dowd has made include: interest rates topping and heading lower (they did), housing tanking and going lower (happening now), massive fraud propping up the Biden economy with illegal immigration (20 million brought in by Biden Admin) and the BLS just restated job creation numbers for 12 months ending in March. The restatement revealed an eye popping 911,000 jobs were fake. Dowd said just after the 2024 election that “Trump inherited a turd of an economy.” Now, Dowd says, “Trump has to deal with a turd of a disaster.” On the phony jobs number alone, Dowd says, “You could say this is statistical fraud or bureaucratic incompetence. Let’s say it’s both. It such an egregious 7 standard deviation. 3.4 standard deviation is the chance of lightning hitting you at least once in your lifetime. It’s not likely. 7 deviation is suggestive of fraud–full stop.”

All the frauds propping up the Biden economy isn’t causing inflation now–just the opposite. Dowd says, “The housing market is rolling over because people can’t afford them. What was keeping a floor in the housing market were rents by the illegal aliens. That’s all going the wrong way. Trump is deporting people, and we closed down the border. Our housing report that we put out a month ago . . . all the indicators are rolling over, and we are going to have a housing recession. We are going to see inflation go lower because housing is 36% of the economy. We expect to see a sub 2% print on inflation.”

What about the Fed cutting interest rates next week? Dowd says, “They cut rates in the Great Financial Crisis starting in 2007. Our stock market did not bottom until 2009. This is the beginning of what I think is the ‘panic rate cut cycle.’ We are going to see the Fed cutting rates all the way down into this asset deflation that we see coming in this panic rate cut cycle. Cutting into slowing growth does not cause assets to reinflate. They are behind the curve, and they are going to be cutting all the way down as we deflate.”

Dowd still likes gold and says his clients are acquiring gold and land, not crypto. He also says there are big problems coming in the not-so-distant future from China and Europe. Dowd says his forecast of the world going into a “very deep recession” will come true soon.

There is much more in the 54-minute interview.

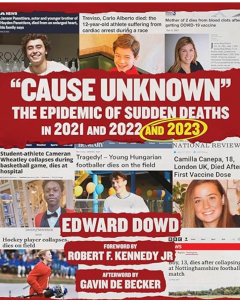

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with money manager and investment expert Ed Dowd, author of the updated book called “Cause Unknown: The Epidemic of Sudden Deaths in 2021, 2022 and 2023” for 9.13.25. Dowd contends the “sudden deaths” and disabilities are still happening at epidemic levels. Now, there are 6 million Americans permanently disabled from the CV19 injections!!

After the Interview:

There is lots of free information on Dowd’s website called PhinanceTechnologies.com. You can also order his reports there.

There is lots of free information on Dowd’s website called PhinanceTechnologies.com. You can also order his reports there.

Ed Dowd has a new website for you to book him for consulting and speaking engagements. It’s called EdDowd.com.

Keep in mind, Dowd’s new report on China will be coming out in the next few weeks.

You can order Dowd’s updated book called “Cause Unknown” by clicking here.

This is a fantastic book that everyone should have.

Great Guest

Very Smart and point blank details

Interest rates are going to go down big time and the housing market here in Florida is already crashing

Two home people are selling and taking huge loses

Thanks for the street reporting, Rod!! Keep it up.

Greg

Always my friend

Stay Well

great

I can give many anecdotal examples of the economic downturn – which, by the way, actually started in earnest in May of 2024 (just as Marty Armstrong said the economy would turn down years before it actually happened)) . Tip of my hat to Marty.

All across the country Americans are suffering from rising costs (e.g., insurance, taxes, food, shelter, transportation medical care) and this is just the beginning of a stagflationary downturn lasting into 2028 – the entire presidential term of Donald J Trump.

Severe economic downturns are what fuel both war and civil war. You can actually now feel the beginning of what’s coming: think Charlie Kirk. Can you feel it in the air? I can.

What’s ahead?

Step one: economic calamity including a true cost of living crisis.

Step two: fomenting discontent, riots, burning cities, more assassinations, more public murders like what happened to that poor little Ukrainian woman.

Step three: more both civil war and war. Lots of people will die horrible deaths

Step four: the collapse in confidence in government and a Humty Dumpty for Western Civilization.

Of course a nuclear war (including deploying secret weapons) will short-cut all of the above and end in a true nightmare and hell on earth.

At this point I no longer believe in all my silver and gold and real estate and material goods and personal skill sets. I believe in Jehovah God as the only solution and His Kingdom come.

AG……AU……..+……..XRP

heavy on AG and XRP

They shall cast their silver into the streets, and their gold shall be [discarded] like an unclean thing or rubbish; their silver and their gold shall not be able to deliver them in the day of the wrath of the Lord; they shall not satisfy their animal cravings nor fill their stomachs with them, for [wealth] has been the stumbling block of their iniquity.

Ezekiel 7:19

great

Everything has a life cycle or 2, actually. First is the market n how well we can enter & exit it, for profit or loss. Second is our own balance sheet, to keep liquid & invest extras for retirement (or large ticket items’ buys).

Your metaphor, while biblically correct, will vary relative to the market and/or our personal budget, & the wise man (or woman) will know the difference

XRP its use to track every living thing on the planet even grass.so called CHRISTENS who support the mark disgusting.

david the…

Biblical Scholar ….OR….did you Hear Directly from your god?…..Amazing

“What’s ahead?”

“Of course a nuclear war (including deploying secret weapons) will short-cut all of the above and end in a true nightmare and hell on earth.”……….

WRONG,WRONG, WRONG!………there will be NO Nuclear War…..

“At this point I no longer believe in all my silver and gold and real estate”…………

..Really Awake……………………..Can I have Your House?….PLEASE…..and will you leave some AG ans AU in the Pantry?……..

‘Preciate it!

They shall cast their silver into the streets, and their gold shall be [discarded] like an unclean thing or rubbish; their silver and their gold shall not be able to deliver them in the day of the wrath of the Lord; they shall not satisfy their animal cravings nor fill their stomachs with them, for [wealth] has been the stumbling block of their iniquity.

Ezekiel 7:19

self…

there is a DIFFERENCE between ILL GOTTEN GAINS…..and HONEST LABOR…

Educate Yourself…..

Good comment Stanley! I agree.

Greg

Did they really think 911K ‘correction’ would not be noticed or investigated?

BTW Greg, been good about posting on Rumble and NOT want to come back here just to post because you have muted me there so this is my LAST POST anywhere.

James,

Your choice. You are not muted here.

Greg

ITS ONE BIG FRAUD AND YOU ARE IN IT.

I can just feel their pain, meaning I sense most people are slowly being squeezed-out, from more recent homeowners to renters. Cost of housing is sky high in most urban markets (ALL Western Cities are expensive right now).

Take where I live, for example: a two bedroom/one bath rental is an eyepopping $3100/month yet is more affordable than buying an existing 80-year-old+ house in my suburban neighborhood. You need at least $150,000 a year in annual household income to be “in the game”.

Few qualitied buyers and nobody really wants to buy or even sell at these prices anyway. So, the housing market remains essentially frozen. Ed Dowd is correct; It’s

all one big fraud. I suspect some U.S. Banks may fail, again due to potential fraud.

If one does not feel confident about the future then they won’t want to borrow money at ANY Interest Rate either. So, rate cuts are unlikely to spur more consumer spending or debt.

Now, NOBODY trusts anyone so gold has even more appeal, as Kathren Fitts says: “If you hold it, you own it.” Ditto if you own your own house, free and clear. Sure hope people can make it until 2028 when markets bottom-out according to Martin Armstrong. If equities blow-up, we might actually face a Depression, as consumers would freeze-up and company earning would collapse from today’s lofty levels.

Whatever became of Aaron Brickman?

Mike,

Brickman was never on USAW.

Greg

where is WALDO?

He is right next to Jimmy Hoffa

between Stan, n Hoffa

Raw milk is something to do a show on.

wish Raw Milk was Available to all of us “FREE UNITED STATES CITIZENS”……….

I agree with Ed Dowd when he says that AI is a joke (if you think that there is a reasonable ROI potential as an investment).

AI is nothing more than an English language interface on the same digital computing platform that has been evolving since the 1940’s. There is no major advancement in terms of parallel computing or quantum computing where the serious investment potential exists.

AI saves the user considerable time due to ease of use and is cute and novel – I use it to advantage. But there is no way to justify the meager ROI potential from the $trillion that is being thrown at it.

ENDLESS BULL

Old metrics such as: ROI, P/E, and Sales/Income are irrelevant in a momentum driven market or a stock market mania, as we currently appear to have with large tech. stocks (A.I.). Many market experts expect a pullback of say -10% at any time. So what?

Not prescient, as this is always true and accounts for most of the short-term capital risk to equity investing. There has yet to be a 20-year period in which equity investing did not pay-off. So, you are either an investor or you are a speculator/day trader. One or the other.

Between Gold and real estate, you’re better off with Gold. You don’t pay property tax on Gold every year like you do with a house. And with Gold you can sell a little bit at a time. With a house it’s all or nothing (you can’t just sell your kitchen or your bathroom).

Beyond physical Gold (and Silver), a good way to beat the taxman is Gold and Silver stocks or mutual funds in a Roth IRA. I recently loaded up on HL (Hecla Mining) at $8.50. It’s now over $11. Hecla is one of the top Silver miners in the U.S. and about to be added to the S&P 600 on September 22.

As for a really crazy bet, when I was out in Vegas in June I loaded up on Vanderbilt to win the NCAAF national championship. Not looking so crazy now.

One thought:

Is it legally possible to cleave-off the land itself from the house? In-effect, split the property in two and sell the house while retaining ownership of the lot. Most County appraisers and U.S. BANK mortgages only bill property taxes on the combined deed of house + property together. Old, overpriced homes would be worth much less than the property in desirable locations. Such a legal innovation might upset the real estate ‘apple cart’

None at all…

Cheri,

Between Gold and Government Bonds, you are better off with Physical Gold in your hands. You don’t pay tax on Gold every year like you do with your Treasury Bond Interest ($10,000 worth of Gold can be sold Tax Free each year). I disagree with using a Roth IRA for your Gold, Silver or Treasury Bonds (as protection from the taxman) as you will eventually have to take your money out in “Depreciated IOU Paper Money” (even if it is not Outright Defaulted Upon or Declared Null and Void)!!!

Katy,

Yeah, you want to have physical Gold & Silver but when you cash in with certain coins and bars, the government hits you with a 28% tax.

The Roth IRA lets you totally escape any tax. I’m no fan of Peter Thiel, but from 1999 to 2021, he grew his Roth from $2,000 to more than $5 Billion. Once he hits 59.5, his withdrawals are tax-free.

A house is nice. A few monster boxes are nice. But maxing out your Roth IRA each year is a no-brainer.

Cheri

Cheri,

What I’m talking about is a day is coming when Peter Thiel will take out his one-hundred trillion dollars (tax free) and receives fiat like “this”: https://c8.alamy.com/comp/CC5AWF/one-hundred-trillion-dollar-bank-note-one-hundred-trillion-dollar-CC5AWF.jpg !! Trump is now making US $500 dollar bills to replace the US $100 dollar bill (because the only way to get the Nation out of debt is to inflate the currency)!! So effectively your Roth “goes valueless” while your Gold goes up and up in terms of the “ever worthless” fiat paper in your Roth “that you don’t have to pay tax on”!! As Jim Sinclair warned: “YOU SHOULD BE TRYING TO GET OUT OF THE SYSTEM”!!! Did you hear Ed Dowd say his associate is predicting $30,000 dollar Gold (this is not Gold going up in value it is the US Dollar going down in value. If Peter Thiel put all his money into physical Gold he would still have 72% of his wealth left after paying taxes (while the tax free fiat paper in his Roth goes to zero)!!!

Katy,

Not sure where your info is coming from but don’t have trillionaires yet LOL.

When that happens money will be worthless

Greg

I was heading to bed and saw you had Ed Dowd back. Heading back to den to watch you and Ed on TV

Good morning Greg,

Here in Frans on holiday. your interviews get sensored here i see. have to listen when i get back home.

Tony,

The French government has been banning my videos for years. Can you still read what I write up about the interview on USAW?

Greg

Greg, the text you write is visable.

Tony,

The video of the interview is there too. If you don’t see it, then your browser is blocking you. Try a different browser. Also clear your Cashe. That may help too. So sorry you are having trouble.

Greg

Seems like “someone out there” is trying to “BAN EARTH” (by throwing big rocks at Earth) but so far they have been missing (Aphophis almost hit the Tony,

Moon recently which would have been catastrophic for us on Earth). Although NASA scientists are effectively ruling out the possibility that the asteroid Aphophis will come around and impact Earth in 2036 (it may still possibly hit the Moon). However, the “Rocks Keep Coming” like the 3I/Atlas “Dark Star” that just missed Earth. From a Jewish perspective the Jews have always talked about “Entities Up There in the Heavens” https://www.youtube.com/watch?v=wC0WNToKucc that had the propensity to “Always be at War” with somebody (like the EU now trying to start WWIII)!!! One interesting note made at the end of the above video is that although we women came from Man (Adam), Jesus came from a Women!!

Another interesting perspective mentioned (which gives me and should give all Christians pause) is the “Kabbalistic” belief that Serrof (snakes) – are actually the Reptilians (or Watchers) and “Are The Good Guys”?? And that they sing praise to the Lord of Hosts saying Kadosh (קָדוֹשׁ) , Kadosh, Kadosh (which means “Holy, Holy, Holy”)!! Holy cow, are “Kabbalistic Jews” interpreting Isaiah 6 – as giving praise to the “Big Snake” (Lucifer)?? Their Amidah Prayer seems to acknowledge such a relationship (for as they pray they stand up tall like a Cobra on its tail)!! Is this why Satanism is so prevalent in our Society???

Near where we live, there was a family that i believe self deported. They lived in an old single wide with some acreage for the longest time and just finished building a new 2200 ft house. If you’re not sure about stereotyping- the fighting chickens they had tied to dog house type shelters were a dead give away. Not sure how i view all that- maybe they had fried chicken the day after. I’m sure they took a large amount of dollars south of the border and they earned it. An investment llc bought thier place (flip) and is fixing it up even more. I’m curious if they will get a profit out of it. I will look at the county records after some time.

If anyone doesn’t know, most counties by now should have an online version of searching for county records- public records. You can look under the auditors site/ tab and search for recorded documents. There’s a number of document types that each have a purpose and each property should have a numerical number that makes record keeping and searches easier. I guess I’m a bit nerdy like that, but i figure its one more example of how our public education doesn’t teach kids how the world around us works.

“I’m sure they took a large amount of dollars south of the border and they earned it”………………..RIDICULOUS……..

They earned it ILLEGALLY….Should “DRUG DEALERS” be allowed to keep the money that they “Earned”?

ILLEGAL CRIMINAL MEXICAN INVADERS or any other INVADING SPECIES should not be rewarded with their ILL-GOTTEN GAINS…

Thanks Mr Hunter and Mr Dowd.

Shining a very bright light of truth on our economies particularly here in the UK and Europe that are desperately seeking war and death to cover up the complete failure of our economies courtesy of our elites where corruption and incompetence reigns.

Meanwhile Mr Sasha Yanshin a number guru has again uncovered corruption within our statistical numbers for the UK by agencies that supposed to be truthful and unbiased ?

https://www.youtube.com/watch?v=n3t-lKogLJA

All put together by supposedly genius Phds.

Meanwhile the Fed’s Phds seem unwilling to count their numbers for some inconvenient reason.

The Dow and S&P are in the stratosphere while the Dollar is strong as money is fleeing to the USA from the warmongering Europe.

Flee British Bonds and the British is a quiet and learned refrain here in London.

Corporate insiders insiders seem to be sending us plebs a subtle message. That message may be “run!”.

Maria,

Interesting how the Collapse of Europe will strengthen the US Dollar (as EU money flees to the US)!! Could it be the Diabolical Neocons in Washington AC/DC “purposely started” the Ukrainian War (and blew up the Nord Stream Pipeline, supplied weapons to Zelensky, flooded the EU with refugees from the Middle East and is now imposing Tariffs under Trump) to actually help bring about the “Destruction Of The EU” (to kick the can down the road and save the US Dollar for a little bit longer)???

Amazing Grace, how sweet the sound

https://youtu.be/89g9yMGFGlM?si=H3n8-6xdMmwhxfwv

What kind of idiot would invest in land? We are over peak value and going lower. Nobody has money to buy it. Taxes go up up up never down. So py out the wazoo for some land and think you will make a profit? You have to be the stupidest investor on earth. Gold is private with no yearly tax and if you don’t pat it will be taken from you. Grow a brain!

“Dumm,”

Land can produce crops and support livestock. The Harvard Endowment has been buying farm land and so is Bill Gates amung many others at the top. They have gold too.

Greg

So why buy land unless you are going to live there and farm? Rich people buying it NOT the average investor. Of course they have gold too, they are rich. For the average Joe with say a 100k income land is an extremely bad investment.

“Dumm,”

In am telling you what the rich are doing. This is a percentage of portfolio. Think tangible asset diversification against paper assets. Dowd is talking about big money here. One example is Bill Gates. He has 242,000 acres of farmland: https://finance.yahoo.com/news/bill-gates-finally-explains-why-194910939.html Harvard Endowment also has lots of farmland, and they are not alone: https://www.realtor.com/advice/finance/ivy-league-property-holdings-tax-breaks/?msockid=240ce56405b265fa095df32e04cc6417

Greg

Reply to Dummass:

Timing, location and price are everything when it comes to buying land. I would have sold all of my real estate back in 2022, but I chose to hold on to most of it because what’s coming up just over the horizon isn’t just a normal economic downturn. Yes. Indeed. Do own physical, tangible material goods e.g., gold, silver, platnum, land, art, antiques, collectibles (e.g., collectible guns with gold engraved art etched on them) and other valuables which can be held in your hand such as fine jewelry.

Land with surface water and/or water rights bought at the right price in a low taxed location is a good investment, too. However, buying land on Maui right now (where Ed Dowd lives) isn’t a good investmentvest in my opinion. I lived on Maui for a decade back when real estate was a deal of a lifetime. I know the island backwards, fowards and upside-down. And it’s a prime example of where you don’t want to be going into 2032….

There are a lot of really smart guys out there who chose to live in really un- strategic locations……. Location. Location. Location. Remember that old phrase when choosing a place to make your last stand going into 2032.

And if you do own farmland and that’s where you’re going to make your last stand, then you might want to actually have the know-how to farm it the old-school way without a power-grid. And be sure that your farmland is in a location where the locals will respect you – including your race. Anybody who is a white man on Maui is going to get torn to little pieces when the SHTF, the power goes out and the food doesn’t get shipped in. The locals will unleash decades of hatred that’s been building and only intensifing on anybody who is perceived as an outsider. Count on it.

This is where Nick Fuentes gets it right and others totally fail to factor in a racial component into their calculus , viz., if you’re a White man, then you better think carefully about where you choose to live, work, invest and vacation. And if you don’t understand how important the racial factor is going foward, then you risk losing everything- including your life.

Only Jehovah God and His Kingdom Come will solve the burning racial and religious hatred that mankind is about to experience going into 2032. Therefore, choose wisely your strategic location.

Really Awake,

Re : the Anti-White Racial Component

Whites’ Slow-Motion Genocide, by Paul Craig Roberts :

https://www.lewrockwell.com/2025/09/paul-craig-roberts/the-american-dilemma/

-Rick

P.S.

Wimpy Republicans, by Paul Craig Roberts :

https://www.lewrockwell.com/2025/09/paul-craig-roberts/the-twilight-of-the-white-ethnicities/

What kind of idiot investment is renting?

Real estate is better in good times because you can actually rent it out and make money on it, in addition to things like sweat equity and refinancing. Most rental real estate is owned by mom & pop investors and it’s the backbone of the upper middle class. Gold and silver have to sit around for years with no velocity or profit.

Real estate should be a screaming buy should we survive till 2030 methinks, then we’ll be okay.

tks for post ed greg

Weirdo Wilson back in 1913 created the demonic Fed, IRS and what we now know as the UN to stop wars… what happened in 1914? It’s time to end his satanic legacy.

Wilson created the League of Nations, not the UN

As long as they are printing money, gold is going to go up.

MLK,

Gold goes up in deflation too. Armstrong has said this many times.

Greg

MLK,

Dowd said one of his associates is predicting $30,000 per ounce Gold – so on any pullback stock up!!!

One question for the Sir Dowd, how many of those blue shirts do you own? Do you buy them at Sam’s Club?

Katherine,

You are concentrating on his shirts? He has a washing machine, I am sure. If you are concentrating on his shirt, you are not going to make it. Seek Jesus/Jehovah and divine knowledge.

Greg

Katherine – Likely Dowd has enough blue shirts to cover the entire roof of his house (so his house won’t be burned down by Blackrock when they create their next “15 Minute City”)!!

He said it. We had woke DEI hires in the government fraudulently rigging the financial system.

The mantra “GO WOKE GO BROKE” is real and evident.

Ed’s over-cautious nature about calling a spade a spade puts him behind the curve, you have to factor in fraud and abuse in your calculations. How do you do that? Simple. Just think like a crook and factor that in as plan B.

This guy is way too cautious for my taste.

We have the all natural pain cream in stock now along with the Silver Gel that you use. All natural pain relief can be found at http://www.tm3united.com/bethany or call a live person at 417-257-7799 and no pressing of buttons for English.

Kevin,

I use the Silver-Gel and I can say it works well for me!! Keep doing the “Talk to Human” customer service. This customer service is now cutting edge in the coming AI apocalypse.

Greg

great day

100% on target.

I can see buying gold and silver, but land? The housing and real estate market isn’t in free fall just yet, but heading there real soon. Shouldn’t land be bought at the bottom, or just before?

65,

Think tangible assets as opposed to paper assets.

Greg

I agree Greg. Land is called “real estate “ for Reason

When Dowd (or anyone else) says the real estate market is facing some headwinds and will decline in value, they’re talking about housing, not farmland, which will probably retain its value or appreciate. The difference is that housing is a depreciating asset–a consumer good that does not produce wealth. Farmland is a wealth-producing asset; it does not depreciate like housing. It can depreciate, of course, if it’s allowed to run to brush or the soil is allowed to erode, but that doesn’t happen if the land is in use and not neglected. Many people who own farmland rent it out for a share of the crop. You don’t have to be on the spot farming it yourself.

Housing “can produce wealth” just like farmland!! Instead of growing food you simply rent out a room in your home!!

Deflation…..That’s funny. Maybe in the stock market and real estate, but not in what consumers buy everyday.

Pee on my shoe and tell me it’s raining.

Jason,

Dowd is right on the deflation in high dollar assets. This was free top-notch information, and you are pretty ungrateful and nasty.

Greg

The more the economy start to go sideways, the more weird shootings and civil unrest will happen. Also, the more we will be pushed for a World War.

Watch, there is a faction that loves to plant Tares and accuse others of doing it and play sainthood. They are embeded in the Political, Media, Banking and Medical Industries Be careful for who you are rooting for.

Greg,

Right when I started watching this interview…lights out. No electricity! So glad I bought my large battery from your sponsors. So glad I went back and bought two more to stack. Even talked my brother to buy one. So happy I can watch your interview !

Thanks Southern Girl for sharing this with us all!! The batteries buy you time, and you can charge them with a generator and then shut the generator off. There is also solar, but I know you know this!!

Greg

Electricity is wonderful. We are a spoiled people. It would be hard for most of us to go many weeks without it.

You were wise to prepare

Those who can’t afford batteries, solar panels and electrical generators can still have light at night for months and months on end by simply having enough candles stored away and if you run out of candles some oil that you can put a wick into will do (if you can take the smokey fumes)!!

GW

Yes, candles for light and even your refrigerator can potentially be run using a candle as a heat source (absorption refrigerators use heat to cool) – that heat could be provided by natural gas, propane “or a candle” (such a “candle absorption refrigerator can probably be re-configuring from a propane refrigerator by serious preppers who want total and complete independence from the electric grid (and the oil/gas industry)!!!

Luv this guy, Greg. So young too! Thanks for having him on again.

I agree Bob. Dowd is very smart and is not afraid to go out on a limb. He’s been right a lot in his career. The White House should include Ed Dowd as an advisor.

Greg

This world is blessed that you Greg, and people such as Ed Dowd are on our Saviour’s side!

Thanks Sister Susan,

I worked for a career to make it to the networks (ABC News/GMA and CNN). I thought that was THE prize. I was wrong–very wrong. Jesus was and always will be the prize in this world. Thank Jehovah for sending Him. We don’t deserve Jesus, but I’ll take freely the Grace, he gives us.

Brother Greg

I own my own home except i have to pay an ungodly amount of property taxes each year to my masters and the freaking school system and if i dont they will take all i have, so I am am looking forward to housing prices collapsing and hoping property taxes are reset also. On the economy, having never hung out with big dollar investors I can only report on my experiences this year with my food truck. My income is down by 50% compared to previous years. This has been devastating.

Charlie,

I’d say your experience is real street level experience, and we should all take note. I am sorry your income is way down, but we thank you for posting this important perspective.

Greg

All those School Taxes should not increase faster then the CPI (but they do) which will eventually drive most people out of their American Dream Home property investment. At least with physical Gold and Silver as an investment the freaking School System can’t assess it and forcibly take a percentage of your wealth each and every year (to teach all the illegals children at Story Time Hour 2 + 2 = 5 and about how they should become Gay Queer Transgenders and cut off their sexual organs!! Then these Queer Transgender kids (we pay big bucks to educate) go around with AK47’s shooting and killing all the kids they hate in school for not becoming Queers just like them)!!!

I would ask what the heck was wrong with these people but we know that demons walk among us.

This teacher is one

https://www.thegatewaypundit.com/2025/09/teacher-suspended-after-forcing-10-year-olds-repeatedly/

The Eurozone devils really want war against Russia, as long as USA bankrolls the entire Shiite sandwich

https://www.thegatewaypundit.com/2025/09/european-warmongers-angry-that-trump-did-not-buy/

The Left is The Party of Murder?

Elon Musk’s Speech At UK Protest Which Saw Violent Clash: Speaks On Charlie Kirk, Migrants, Starmer

Hindustan Times Sep 14, 2025

At London’s huge “Unite the Kingdom” anti-immigration rally organized by Tommy Robinson, Elon Musk addressed over 100,000 protesters via video, calling for regime change in the UK and warning that “violence is coming” if mass migration continues. Musk blamed Britain’s political left for “slow destruction” of the nation, denounced the “woke mind virus,” and said those in the “reasonable middle” must act before violence reaches them. He invoked the murder of conservative activist Charlie Kirk in the US, accusing the left of celebrating “murder,” and slammed the government for failing to protect citizens—calling for the “dissolution of Parliament” and fresh elections. Musk’s remarks led the far-right rally’s free speech and anti-immigration calls, drawing sharp criticism from British politicians and sparking counter-protests by anti-racism groups. Violent clashes left 26 police officers injured and dozens arrested in one of the capital’s largest demonstrations in years.

https://www.youtube.com/watch?v=tKbdoa9wgOc

SPECIAL REPORT: Charlie Kirk and America’s Turning Point (Outsiders) Sky News Australia 8,886 views 4 hours ago

Sky News Australia hosts Rita Panahi, Rowan Dean and James Morrow present a special edition of Outsiders, dedicated to the memory of Charlie Kirk and with analysis of the world’s reaction.

The Outsiders discuss Charlie Kirk being mourned around the world following the shocking political assassination, growing fears of political violence, the latest updates on the FBI investigation, the horrific reaction from left-wing influencers and media, and look ahead to what’s next for the conservative movement.

In this special edition, guests include Alex Stein, Corey DeAngelis and John Hinderaker.

https://www.youtube.com/watch?v=ggOsq5K2loQ

@TOH-NAF 3 hours ago

Ironically, if Charlie Kirk had lived, he would have forgiven the assassin and tried to find out, through peaceful questions, why he was so triggered that he had to resort to violence.

.

Case,

It’s true what you wrote. If Kirk had survived, he would have forgive the shooter all the while asking for his full punishment and execution. Those are not opposing positions. He would have also questioned the shooter.

Charlie Kirk forgive his assassin? The assassin had an extremely high IQ and Should Have Known Better (you don’t forgive such people). Jesus said: “Forgive them Father for they Know Not What They Do”!! This assassin “KNEW EXACTLY WHAT HE WAS DOING”!!! (DEATH PENALTY AND STRAIGHT TO HELL WITH THIS EVIL DEMON)!!

Greg, those that ascribe to believing in Jesus are now being hunted in broad day light =-

RAINBOW BRIGADES STRIKE AMERICA

https://www.youtube.com/watch?v=xmgBc5mFeUw

and the info going out about Kirk’s murderer is already changing as the META data exposes even more…but that’s another story not to be followed…so just go along with the BS narrative’s adn meme’s on FOX on the other ‘establishment owned’ mockingbird crews.

AS to Dummass comment…yes…the prices are being rigged just as the STK and PM markets. But, one has to live somewhere…so why rent if one can own (kind of- trust deed not allodial title or ‘grant deed’ or the ‘old land patent process few use or even can these days) . ..but if one wants/needs land to produce your livelyhood’ and can keep up the taxes and the insurance required unless you can own such outright…the REAL property market is beccoming as highly manipulated and returned as in the days of feudalism…= YOU may just end up owning nothing and ending up where YOU land might not be that happy !

UNLESS people can stop them, am afraid Klaus Schwab might be right ! =

Blackstone Bought HALF of AMERICA… Now WHAT?

https://www.youtube.com/watch?v=KNZp8qmv5RI

If you do buy a home don’t buy it in a beautiful expensive location as you risk the possibility that Blackrock will burn down the entire community to build a 15 minute city!! Strive to buy your home where “the population is decreasing” which will cost you much less in Property and School Taxes!! Actually Democratic States like New York, Illinois, and California are experiencing significant population declines and specific counties like in Mississippi have also seen notable decreases!!

GW,

The best place to buy a home is Luxembourg which has the lowest home property taxes, Switzerland comes in as the second-lowest, followed by the Czech Republic. Who would have thought that the People who fought a War for Independence in 1776 (to rid themselves of a Small Tariff on Tea) would one day have the “highest school property taxes in the world” imposed upon them (so that teachers can tell their children 1) that 2+2 = 5 and 2) that their children “can’t be told by their own parents” (under penalty of imprisonment) that they “should not cut off their breasts or genitals”!!

Greg,

Is all these people that are hating on Charlie Kirk, reveling in his murder… Do you think any of this is vax related?

These evil people just can’t seem to understand that their evil positions and opinions are not a social norm… it’s just F’ing evil

https://www.thegatewaypundit.com/2025/09/department-war-suspends-army-colonel-scott-stephens-saying/

My opinion. Yes, judgement has been impaired. My observation here in the Philippines is that even though Sino-Vac was used the result is the same; but not as severe. A doctor here told me that cancers have also gone way up.

I am sure the gay shooter’s boyfriend was involved

She knew about it and likely helped. By making this statement, the Governor has disqualified himself from future elected office

https://www.thegatewaypundit.com/2025/09/watch-gov-cox-claims-trans-boyfriend-wasnt-involved/

G500,

The Queers are not only “Coming” sexually for our children they are now taking up rifles and “Killing” our children in schools, and “Killing” the parents of those children (like Charlie Kirk) right on the Streets of America!! https://www.youtube.com/watch?v=xm08CkYoL2U

Yes they are

That’s correct. Jasmine doesn’t want to give up her party’s slaves, the illegal aliens.

https://www.thegatewaypundit.com/2025/09/thicko-rep-jasmine-crockett-compares-ice-raids-slave/

Greg,

These people will kill us just for disagreeing.

This happened in Bryson City NC

These people think we deserve death and there is no reasoning with the unreasonable and the unreasoning

https://www.thegatewaypundit.com/2025/09/deranged-leftist-tries-kill-elderly-north-carolina-man/

Who would be stupid enough to own or purchase sub prime US Bonds?

Plenty of traitors at the FBI. It’s time to clean house.

They hid the shooters pictures from Kash and it’s easy to believe the FBI weasels did this as well

https://www.thegatewaypundit.com/2025/09/fbi-reportedly-attempted-hide-identity-charlie-kirk-assassination/

Surprise Surprise Surprise

The Gay boy shooter with the boyfriend in a dress was motivated by Trans ideology

https://www.thegatewaypundit.com/2025/09/no-surprise-kirk-shooter-was-liberal-motivated-trans/

I think US Treasury just said we’re at $2 trillion just for yearly interest payments. By the time Trump leaves office in 2029, that should surpass $5 trillion.

Mr. Dowd says gold to $30k in 2030. I wonder will I live that long.

Pislam absolutely is the enemy. White Erasure is terrible if you want to avoid global contagion economic collapse. White Erasure is the number 1 most compelling evil of our time. Europe is vastly more important to our collective well being than any shithole nation in the middle beast. Crusade vibes needed.

Pislam is absolutely the enemy. White Erasure (the didplacement of the westernkind biospirit) is probably the number one most compelling evil of our time, especially if you want to avoid global contagion economic collapse. Europe is vastly more important to US interests than any shithole middle beastern nation.

This video offers viewers a rare chance to hear Russia’s perspective on global security, Western policies, and the path toward peace in Europe — unfiltered and in full context.

https://www.youtube.com/watch?v=XEAM3m3CxZk

“Can Only See Ruins”: Russia Compares West’s Decline to Rome | APT

Auto-dubbed APT 1,628 views Sep 12,2025

At the St Petersburg International United Cultures Forum, Russian Foreign Ministry spokesperson Maria Zakharova drew a stark comparison between modern Western states and the Roman Empire, warning that distorted values could lead to societal collapse. Zakharova emphasized that when core values are replaced with “anti-values,” civilizations risk disappearing, citing Rome’s fall as a cautionary example. Russian Deputy Minister Konstantin Mogilevsky highlighted that, unlike the West, Russia preserves traditional European and Russian values and remains open to dialogue. The forum, running September 11-13 in St Petersburg, brings together representatives from over 2,000 diverse cultures. https://www.youtube.com/watch?v=GZlmBBd_e_4

Lindsey THREATENS Moscow As NATO’s Weakness Has Been Exposed!

Sebastian Sas 90,674 views Sep 12, 2025

US Senators Lindsey Graham and Richard Blumenthal are promoting a bill that would designate Russia as a state sponsor of ter**rism. Senator Graham has also threatened Moscow with 500% tariffs on anybody that purchases Russian oil. Politico is reporting that Russia’s drone incursion into Poland has proven that NATO is not properly equipped to effectively deal with threat of drones. The argument they make is that NATO doesn’t have any cost effective means of intercepting drones, so NATO is forced to spend billions of dollars just to down Russian drones worth a few thousand dollars. Donald Trump has stated that he’s unhappy about what he sees in Ukraine, but he thinks that Russia’s drone incursion into Poland might have been a mistake. Russia and Belarus have started the West 2025 military exercises today, in Belarus.

https://www.youtube.com/watch?v=OEtz-vS183o

‘We love you Charlie’: TV host’s emotional tribute to Charlie Kirk following his tragic murder Sky News Australia 154,331 views Sep 11, 2025 Power Hour

Today on Power Hour, Charlie Kirk assassinated – the Trump ally shot dead at a Utah university, left-wing media’s “disgusting” reaction, and emotional tributes to the slain husband and father. https://www.youtube.com/watch?v=Ki-v4PIGw7o

They Killed Charlie Kirk to Silence America, Instead They Lit the Fire That Will Consume Them Promethean Updates Sep 13, 2025 1 product

shop.prometheanaction.com/products/a-police-dossier-it-is-the-british-who-murder-our-presidents-digital-edition-epub-and-pdf?variant=afb6a5a8-0073-4045-8a2a-b6cb64c3f016 Free

Barbara Boyd discusses the fallout from Charlie Kirk’s assassination, including President Trump’s vow to seek justice and the radical divisions plaguing America. Boyd explores the arrest of Tyler Robinson, the involvement of Antifa, and the implication of foreign intelligence operations. She reflects on the cultural and ideological battles influencing current events and shares Erika Kirk’s powerful message about continuing her husband’s legacy. Boyd also highlights President Trump’s comment on prosecuting George Soros and the broader deep state network. Subscribe to Promethean Action for more updates. https://www.youtube.com/watch?v=_vRzRMuCL5A

Douglas Macgregor: I WARNED You, And Now It’s Too Late

fresh info insight 9/13/2025

https://www.youtube.com/watch?v=ITPCi3JcAS0

Greg, my last two benign comments have not been posted here. Just an FYI. Thank you for your great work!! I’m about an hour and a half northeast of you. We’re dry here, how about you? Tabitha

Demon possessed… actions speak louder than words.

Yokel-Hochul sows discord, weakens rule of law and Law enforcement, makes sure that education fails and now has come out in support of a demon who would finish destroying a once great city, New York.

Do not forget that our opponents are evil. You can’t reason or compromise with evil. Words never sway demons until you invoke the name of our Holy Lord, Jesus and command them to return to the Abyss.

Be prepared to protect your family. If you think you can reason or kindness, they will utterly destroy you and anything you care about.

Ephesians 6:12 King James Version

12 For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Remember: You can’t reason spell DEMon with DEMs

https://www.thegatewaypundit.com/2025/09/ny-governor-who-endorsed-mamdani-oversaw-billions-failed/

https://www.thegatewaypundit.com/2025/09/new-york-gov-kathy-hochul-endorses-communist-zohran/

Greg,

2 comments: First, I know you have been a staunch supporter of Trump and defended him many times on your program. (I myself voted 3x, so am not a hater.) It was very refreshing to hear you express that you are disappointed in both he and RFK regarding the whole COVID issue. Thank you for your honesty and unbiased reporting on this.

Secondly: Regarding the VA, I was career military and as part of my job had to work with the VA all the way back to the 1980’s. From that time to now, they have not changed and I doubt ever will. In all Federal buildings the photo of the top national leaders are to be posted, starting with the POTUS. Under Trump’s first term, it took the VA medical facilities in NC almost a year to put his picture up. Many kept Obama’s photo up instead or displayed a blank frame with a piece of cardboard in it. I know because these are VA medical facilities I personally visited. That showed me that no matter who is Commander in Chief, they will do what they want to and when they want to. I have had to file a congressional complaint with my congressman and get the media involved when they authorized my medical treatment with an outside provider but took more than a year to pay the civilian provider and I was referred to Debt Collection. My first visit to them after I recovered from COVID, I had a VTC with my provider. He berated me for not getting the Jab and tried to humiliate me. I stood my ground with him and filed a complaint asking to be reassigned to another doctor. I followed this up with multiple calls but NEVER got a response. Two years later I get a new doc only because the other one left the system. Our local Veteran’s Services Office (These are county funded offices nationwide not affiliated with the VA but are advocates for Vets) advised me that provider is horrible to say the least. Doctors, PAs, NPs in the VA system who are good and care about patients are few and far between and must stay under the radar. The VA tends to punish those providers and reward the ones who act as gatekeepers to deny us medical care. And on a final note, I did not know until the Biden administration that VA disability funds are not permanent. At that time, they were looking at taking away the disability checks from those who are rated for lifetime benefits and making them income based. If that had gone forth, we would be financially destroyed. They were able to entertain that proposal because Congress has to vote every so many years as to whether to fund VA disability benefits. Vets have to fight harder once we get out than we ever had to while in uniform.

Thanks for all you do! Praying for ya.

Thanks Marti!

Greg

The Rosetta Stone Decoded by AI — What Was Revealed is Terrifying

The Secret 370,952 views Aug 28, 2025

The Rosetta Stone Decoded by AI — What Was Revealed is Terrifying!

For over two hundred years, the Rosetta Stone has been seen as the key that unlocked ancient Egypt. Scholars thought every detail had already been uncovered. But when cutting-edge AI scanned its surface deeper than the human eye could ever reach, something terrifying came to light. What was revealed is not a correction of history, but a revelation carrying a darker weight. The stone’s surface suddenly told a story that left experts questioning everything they believed. Join us as we delve into the mystery of this ancient Stela. https://www.youtube.com/watch?v=V9WlWHBKrYA

Greg,

Reading all these remarks about land and the taxes. Some states such as mine, Arkansas has a law that if you are disabled or reach 65 you can freeze your real estate taxes. My home is paid off as well as my car. My taxes use to be around 1,500.

then a couple of years ago they reassessed our county and everyone’s shot up. Mine stayed the same. Then last year reassessed again and it is now down to a little over $1,300. They can never make me pay more. California, Florida, Texas, Ohio, and South Dakota are a few that you can freeze your real estate taxes at age 65. Check out your state and see if you can qualify. Saves a whole lot of money over time.

Please see ‘The Jim Humble Story’. Chlorine Dioxide has been shown to remove all residue of the shot.

I started taking chlorine dioxide water purification tablets 3 weeks a ago. One tablet per one litre of spring water. Taken 6 hours before bed time. Cleans out your bladder and bowels first thing in the morning. Feeling great no fatigue and lots more energy. Started going to the gym again and doing 9 kilometers on the tread mill everyday. No side effects and feeling 10 years younger. Doing well for a 60 year old man. Give it a try and hopefully it will give you a new life ………

France Protests LIVE: Anti-Government Protesters Clash With Police In Paris;

200 Arrested |TN LIVE TIMES NOW Started streaming on SATURDAY Sep 11, 2025

France Protests LIVE: Violence erupts across France as protesters clash with police in a dramatic nationwide movement under the slogan “Block Everything.” Over 200 people have been arrested, with reports of fires, blocked roads, and tear gas in central Paris and other major cities. https://www.youtube.com/watch?v=jydzJeohVig

INTERVIEW: The t*rror exchange George Galloway 64,770 views 17 hours ago

Trump is fearful of Netanyahu, insiders claim. Jackson Hinkle on the power dynamic between the leaders. And is America on the way to civil war, with tit-for-tat violence between left and right? https://www.youtube.com/watch?v=24cuypqkYco

This Clip of Charlie Kirk Talking About Bibi Netanyahu and Israel Proves Candace Owens Right! Lu Mazing 87,041 views Sep 14, 2025

In this video, Charlie Kirk speaks candidly about Israel, Bibi Netanyahu, and the Israeli government, revealing moments where he questions certain decisions and actions. He talks about intelligence, possible stand-down orders, and internal conflicts that raise serious questions about accountability. Even though he is pro-Israel, Charlie demonstrates critical thinking and independence, highlighting the complexities of supporting a nation while observing troubling realities. This video also connects to Candace Owens’ point about the pressure Charlie was under, showing how public figures can face intense scrutiny and consequences when speaking truthfully. Listen carefully to understand why Candace Owens’ perspective resonates with what Charlie was experiencing. Charlie Kirk, Israel, Bibi Netanyahu, Patrick Bet, Gaza, Candace Owens, pro-Israel, political pressure, critical thinking, public figures, accountability.

https://www.youtube.com/watch?v=LY01SAL1sf4

Bill O’Riely today on Glen Beck’s show, talking about Evil and Putin in his new book. Startled the audience, close to screaming! Asking, Putin why? Why are you killing woman, Children and a million of your own soldiers why, why why?

Well here’s some of the answers out the horses mouth Bill. Listen……to Maria mate.

What came to mind when you were asking why? Why did JFK Stand up to Khrushchev? In Cuba? Why did he risk the total antihalation of humanity in nuclear war? Why don’t you put your big boy pants on Bill and ask Putin! You got the chomps. But maybe not the Cannolis? My advice, get to an Italian pastry shop pronto, this could spiral out. Nuclear war is the ultimate lose Bill. Put your money, life everything, where your mouth is. Death is the ultimate lose! We all have skin in this game, mate! Your not going to sit this one out. You asked the question, ask it to the evil dictator. I’m sur Put’s will answer.

Me thinks Charlie Kirk was a bigger man than you Bill. It takes more than big broad shoulders and a big mouth to be a man Bill. Prove me wrong please.

By the way Bill, Charlie was a Scot, old son! As an Irishman, I guess your close enough.

Charlie would start his show with this little ditty and end it with everyday. . . .

https://www.youtube.com/watch?v=5eDNvfhCmz0

Long live Charlie Kirk! Charlie you’ll be back! God Almighty guarantees it!

See you soon Charlie, we love you brother! Later mate. . . . . .

https://www.youtube.com/shorts/AUikRF5KaxY

🎵 “Scotland the Brave” – A call to courage, a march toward the Kingdom

Gone, But Not Forgotten. . . Can you see him? The silhouette of a lone piper on a hill at sunrise, with a banner reading “The meek shall inherit the earth” (Matt. 5:5).

“The meek shall inherit the earth, and they will find exquisite delight in the abundance of peace.” – Psalm 37:11

“Do not be amazed at this, for the hour is coming in which all those in the memorial tombs will hear his voice and come out…” – John 5:28, 29

Charlie will be back — Almighty God guarantees it. Until then, we march on in faith.

✒ – “The Piper’s Call”

Charlie Kirk – Gone, But Not Forgotten

The pipes still play in the morning mist, Though the piper’s hands we sorely miss. His voice was strong, his banner high, Pointing hearts toward the Kingdom nigh.

He spoke of hope when the world grew dim, Of the Earth made new, and the King within. Though silence falls where his footsteps trod, His faith still speaks, his trust in God.

For the dead shall rise again when the trumpet sounds, And joy will sweep through Heaven’s grounds. Till that day breaks and the shadows flee,

We’ll keep the march — for eternity.

Dry your tear’s, friends brothers and sisters,

Charlie understood. Some moments just need to be felt, not rushed past. Let the tears fall if they must—they’re proof of our love, respect and hope of many.

When you’re ready, we can turn that ache into something lasting: a tribute that not only remembers Charlie, but also points others toward the same Kingdom promise that comforts us now.

Until then, picture it—pipes on the wind, the march continuing, and the sure voice of our Lord saying, “You will see him again.”

We’ll be right here, at USAWatchdog.com, as Charlie was. . . . When you’re ready Lord, to pick Ole’ Charlie back up. Were waiting Jehovah God, Yahweh of the Hebrews, with baited breath.

Thy Kingdom come, thy will be done! On Earth as in Heaven and so be it! Amen….

Charlie Kirk: Russia Slams Ukraine After Trump Ally’s Murder – Watch Why| US| Utah| FBI| Putin| CIA Hindustan Times 22,992 views Sep 14, 2025

Russian Foreign Ministry Spokeswoman Maria Zakharova used her weekly press briefing to denounce what she called a “Nazi-like, monstrous reaction” by Ukrainian social media to the assassination of U.S. conservative activist Charlie Kirk. Zakharova alleged an outpouring of joy among Ukrainian bloggers and suggested their response proved the “bloodthirsty” nature of the Kyiv regime — also linking the event to Kirk’s outspoken critique of Western support for Ukraine, his calls for peace, and his controversial statements about Crimea. She argued this reaction underscores claims that Ukraine must be “denazified.” The Russian MFA used Kirk’s murder to attack the West, charging that violence against dissenters is tolerated, and warning that the West “has no moral right to lecture others.” American and international reactions, by contrast, focused on rising political violence and broad calls for civility, with President Trump ordering U.S. flags at half-staff in Kirk’s memory.

https://www.youtube.com/watch?v=KxFRnbw6ktM

Terrified Oligarchy Strikes Back Against Trump and Charlie Kirk

Promethean Updates Sep 15, 2025

Barbara Boyd elaborates on the expanding investigation into the assassination of Charlie Kirk. She explores the alleged ties to trans killer cults, furry ideology, and the involvement of higher-ups like George Soros and British intelligence. Boyd discusses President Trump’s upcoming meeting with King Charles amidst British political turmoil and rising global support for the fight against the ‘evil imperial system.’ She emphasizes the need for a deeper look into psychological warfare systems and the broader cultural awakening among young people, highlighting their shift away from the Democratic Party and increased engagement in political and religious activities. Boyd also previews President Trump’s changes to corporate reporting requirements and their potential impact on Western civilization.

https://www.youtube.com/watch?v=WQGrMRMVk4c

Reply to Hiram Galloway Bay

Bill O’Reilly REACTS to Charlie Kirk’s Assassination & Collapse of Mainstream Media

BlazeTV Sep 16, 2025

Bill O’Reilly joins Glenn Beck with a powerful prediction about Charlie Kirk’s legacy. Evil tried to destroy his movement, Bill says, but as his new book, “Confronting Evil,” lays out, evil will just end up destroying itself once more…

https://www.youtube.com/watch?v=FKLT_dDCRpU

Correction Hi?

” Nuclear war is the ultimate [ loss not lose?] Bill. Put your money, life everything, where your mouth is. Death is the ultimate [ loss!” Corrected?]

And Hi, isn’t separation from God, or eternal death worse, the actual ultimate loss?

I LOVE YOU! Erika Kirk shares heartbreaking video beside Charlie’s open casket 💔 🕊️

https://www.youtube.com/shorts/c5AA2Tvwcxs

“Me thinks Charlie Kirk was a bigger man than you Bill”………………… Almost Right………….Charlie Kirk is WAAYY MUCH….BIGGER….BETTER…..BRAWNIER…and A Hell of Alot More INTELLIGENT …..Than bill o;reily the narcissist

My gracious

Tldr

Greg, am still holding out on the WHY of the Charlie Kirk situation…and the WHO for what reason, since we all know or should know how ‘narratives’ are fabricated and adjusted in the media, AND ‘agencies’ can be quite manipulated to cover up aspects they do not wish ‘exposed’. To this point…more recent ”’circling back”’ and delving into is the DNI ””alternative report”’ which is rarely reviewed about the JFK murder…and has a more pointed view than anything the ””WARREN Commission” basically run by the very people JFK was trying to defang. AND in the DNI report the names and ‘reasons’ are more pointed, as is the ‘RUSSIAN info’ provided and ””ignored”’? Much in it that has been strongly suspected by lead away from….as everyone pounds the table to release the FBI or CIA files…. but…nar a word about the DNI report?

John Oloughlin is now running down that rabbit hole in his UNDO the COUP series. John Oloughlin’s father was a naval officer and served on McArthur’s flagship, worked directly under J Edgar Hoover, ‘the Russia desk , and moved to DOD and with SASCA, and died a mysterious ‘fast cancer’ type death not long after JFK.

So, for those that find looking at current events with a much more broad view of the events and how the narratives are shaped…and from different angles…the people behind the nations and ‘their’ puppets and reaosns for them…like ‘the mafia’ or intel agencies, or STAKEHOLDERS of banking, or the shifting tide of weapons, drugs, sex, child trafficking, as well as using the shifting of ‘low income workers via migration across borders to effect wages OR attacks on other nations economy via collapsing safety nets etc… making war, trafficking, labor exploitation, and the age old ‘use of the Hegellian dialect all just the means of deceptions for fun and profit…’the ends are PROFITS and ‘their’ means has always been whatever it takes which includes those ‘means’ including being MEAN to the point of ‘neutralizing’ people or obstacles.

#UndoTheCoup, part 11: “Justification” September 15, 2025

https://www.youtube.com/watch?v=a6hMjrLndoU

https://spartacus-educational.com/JFKcrowleyR.htm

Sometimes…ALTERNATIVE points of view…albiet some seeming quite bizarre end up closer to truth than the ‘fiction’ presented in MSM. and of course that is why many are at USAwatchdog…and other podcasts these days…as people have learned how deeply the ‘mockingbird media’ may have become as well as the tops of other pinnacles controlled by compromised or bribed ‘influencers’ including churches or maybe like with views like Charlie Kirk, some deem need some ‘neutralizing’ for what reason? Always it is CUE BONO…financially or politically or just a distraction to get the masses mind off and in another direction.

With that…yup…one can ONLY speculate when ‘agencies’ refuse to consider = SYNC SHOTS? and yes there are times when X military and intel people that have spent decades involved in such ‘incidents’ have specific knowledge of tech, have been in the field or around such events in hundreds of nations across the globe have insight more than the general public. So, take it as a grain of salt…or….just in the view it as a Tom Cruise, MISSION NOT SO IMPOSSIBLE?=

Charlie Kirk – Sync Shot?

https://www.youtube.com/watch?v=IzQySYJS3Jo

@1:09:00 =

https://www.youtube.com/watch?v=949x2DR3MdY

more view although IMO what he is saying likely wrong…but the red dot looks like a laser designator that IF the guy that has ‘something pointing at the neck from the right side is then pointed on the right spot…the guy could have been told it is where its supposed to be by either the guy looking at Charlie from the fence and the signal is then made with the hand signals which activates both guy on roof and the guy that never looks and drifts off? Which is what I think George Webb is referring to as the sync shots. Have to add I no clue as to what is true other than having been in the military and hunted deer, elk and bear for 5 decades with such rifles…knows which way energy pushes a target on impact… Charlie Kirk went to his left or even UP and left,.,not back…rather like the ‘problem’ of same in the JFK murder, which is why ‘the controvery’ of JFK’s hair was on the back of the limo. Would expect if the scenario in the vid above…there should be a small enterance around the right side of neck that exited the left… AND with all the 30-06, 300 win mag, 7mm or 7.65 NATO …IF it was any of those…it either grazed the neck and cut the artery,,,which should have hit the back of the tent area and damages other stuff… wherever it supposedly ricochetted off to. To be clear..most would never use a 30-06 on deer because of the extensive damage and waste using such a high caliber on 150 to 200 lb animal, which if that caliber hit Mr. Kirk in the front I’d have expected to have seen him be knocked back out of his chair as 30-06 at 200 yards would have hit with a force of about 1900 to 2200 ft lbs of energy.

That they packed up the scene, and removed everything so fast? Nobody seemingly concerned to find the fragments, spent jacket of the bullet that might have sufficient rifling to match with a rifle to be found later, which at ‘that point in time’ would not have known ‘they’d find it, or which might have been a clue to match in their data bases for prior use in crimes or sales etc? Personally, IF that angle is from the roof, they are lucky someone was not on the other side of the back of the tent area. Doubt that…go shoot a cantaloupe or watermelon with a 160 to 200 grain 30-06? And by the way. another part of the question is HOW prevalent or rare are Mausers in ‘that’ caliber? Inconclusion…would be nice to see that fan placed under his chair, and the bottom of the chair and see if a ‘projectile’ went up thru and out the neck, which might there also be a hole in the chair and in the top of the tent? and IF that was the path…might explain the huge puff of air of something that went up hit the backside of a chest plate IF he was wearing one..and then angles out thru the left side of his neck? There too, hope they went back and rounded up all the rest of objects of the rest of crime scene that went wherever as fast as that camera they took off with that was directly behind him.\ Sorry, just hope’n to get to the truth and not have to wait another 60 years for a ‘release of the files’ that never happens!

Possibly HOW =

Ballistics don’t LIE | A video I didn’t want to make.

https://www.youtube.com/watch?v=ltakvGyzfZs

Possibly an EARSHOT of George Webbs speculation of a SYNC SHOT? in prior link?

AND this new Webb vid = Earshot – The Charlie Kirk Murder

https://www.youtube.com/watch?v=214OOfJd5wo

THEN THERE IS strong speculation =

@26:00 = https://www.youtube.com/watch?v=JA0XvLvXNd4

THEN THIS @ 9:00 shows a cell phone gun EXAMPLE =

https://www.youtube.com/watch?v=rY57lAA8FPM

WHICH IF one of the two barrels had a LAZER POINTER inserted like one of these=

https://m.media-amazon.com/images/I/41oxZltQgwL.jpg

fitted or in the right caliber the ‘suspected’ shooter would/could put a red dot on his neck rather than ‘aim’ it like a regular gun with a sight at short range?

WHICH TAKES US BACK TO ANOTHER WHO AND THEN TO WHY?

They Are Lying About Charlie Kirk. | Candace Owens

https://www.youtube.com/watch?v=czVBmqZP6Ss

Candace Owens report confirmed by Max Blumenthal =

[BREAKING NEWS EXCLUSIVE] – Max Blumenthal Reports: : Charlie Kirk and the Israel Lobby!

https://www.youtube.com/watch?v=GceyZzZzYlc

Breaking! NEW Video

https://www.youtube.com/watch?v=EpLu_SWKkiA

foreign prespective =

https://www.youtube.com/watch?v=rY57lAA8FPM

https://www.youtube.com/results?search_query=silberjunge+thorsten+schulte

Greg, one has to wonder if Kash Patel even has a clue what he should be looking at to make most people be…believers and NOT think they are hiding something? This is a military round…and no, it is NOT 200 yards but also is a tat SMALLER 30 caliber in this vid…a 30 caliber = 308./ 7.62 NATO bullet

Explosive History of Ammo (S1, E11) | Lock N’ Load With R. Lee Ermey

https://www.youtube.com/watch?v=jgS8tzApX9U

A compared gel (meat penetration) 308/7.62 to a 30:06

.308 vs .30-06 – Best for Big Game? BALLISTIC GEL TEST

https://www.youtube.com/watch?v=FKpua2zeyPI

Sorry, KASH…thinking with as thin as a neck is…there should have been a pass thru and more damage IMO.

Still sold on the Webb sync shot from the side with a smaller caliber …just say’n, but then this is still just speculation and ‘opinion’ which everyone has. My guess is, like ONE of the JFK rounds from the back could have by a pass thru could have hit Connelly. and another from the front put what Jackie was chasing on the back of the LIMO deck, which means I am not buying either story-so far.

Greg….

This video shows the true shooter. Its the guy in the back with the white shirt, standing side of the girl. Watch his handgun shot motions. Watch it over and over… you’ll see it, from 00:28 to 00:42 (not the guy in the white hat, but the guy in the back next to the girl on the left.

https://www.facebook.com/1626751703/posts/10235919456719920/?mibextid=rS40aB7S9Ucbxw6v

Bill,

Not sure this tells anything.

Greg

Only some that gets their gets their gun information from movies and internet would think the ideal “cellphone gun” could be used like this. It’s made for point blank shooting where you can reach out and touch someone

Bill

Is that your post saying he was using the cellphone gun?

Bill, if Tyler is a Patsy, they’ll eventually get him like they got Oswald. Tyler better give it up before it’s it’s to late. Epstein should have spilled the beans before whomever got to him. The sooner you talk Tyler the better. Better late than never mate, doesn’t work with these guy’s, won’t work.

The Podesta Plan Got Us Here – Special Report

by Bowne Report | Infowars.com September 16th

The division and chaos America has witnessed in recent years is all part of a globalist plot

https://www.infowars.com/posts/the-podesta-plan-got-us-here-special-report

Tuesday LIVE: Democrats/Leftists Celebrating Charlie Kirk’s Death Trigger Biggest Mass Awakening We Have Ever Seen! Trump Announces Plan To Prosecute Soros NGOs Directing/Funding Leftist Terror Groups! Plus, Alex Jones Investigates Possible 2nd Shooter! By The Alex Jones Show September 16th, 2025

Alex Jones is LIVE right now taking your calls, hosting special guests and covering the news, the globalists DO NOT want you to know! https://www.infowars.com/posts/watch-live-fbi-confirms-dna-on-charlie-kirk-assassination-rifle-matches-tyler-robinson-as-feds-investigate-potential-co-conspirators Jones is on ah Roll!

Ed mentioned the class problem. I wish they would complete the thought; Government is a class, red and blue is to divide and conquer.

It’s an old Roman trick..🤔

It could have been Red, White and Blue but the Demons have decided to kill off all the Whites!!

MR,

The trick that Alex th Great used, was to send his spies, as defeated enemies of a past conquest, into the new foe – n the spies spun narratives of Alex’s armies being merciless, to have that spread among the people, as negative gossip. Just as covid became spun as worse than it truly was, Alex th Great would have been proud of the Plandemic marketing team …

These people want to increase the war already being waged

https://www.thegatewaypundit.com/2025/09/watch-left-wing-streamer-steve-bonnell-aka-destiny/

If my CD’s earn half as much interest next year, so does Uncle Sam earn only half of

my tax money.

🤣 , right?

My IRMA will go back down too.

👍

Martin has said Civil War. Ed says our Economy sinks a lot lose their jobs, home prices tank, wars up, so Jesus is coming sooner than most think now. I predict many more shootings of Republicans, Right Podcasters and more dividing of people now. This is all predicted in the Word.

To those who made the United the Kingdom rally happen. I SEE YOU.

Katie Hopkins OFFICIAL 3 hours ago https://www.youtube.com/watch?v=gjTBntxAqyg

INTERVIEW: It’s an extremely ominous moment

George Galloway Sep 15, 2025

The martyrdom of Kirk has given the far-right the green light to accelerate the snuffing out of what’s left of democracy

https://www.youtube.com/watch?v=OtS2LlP2ShU

Here is Satan’s church exposing itself. There are many Demons in the pulpit, there are many Demons in leadership positions. How else do abominations get into the pulpit where they can push deviant behavior as “normal?”

https://www.thegatewaypundit.com/2025/09/jasmine-crocketts-pastor-mocks-charlie-kirks-assassination-christian/

I am not the only one that sees these demons

https://www.thegatewaypundit.com/2025/09/proof-evil-charlie-kirks-assassination-shows-america-is/

It’s this acting our is this sincere?

https://www.breitbart.com/entertainment/2025/09/15/jamie-lee-curtis-cries-over-charlie-kirk-assassination-a-father-and-a-husband-and-a-man-of-faith/

Manchin says he wanted GOP to win Senate to stop Democrats’ quest for ‘raw political power’

Former Democrat-turned-Independent senator accuses Schumer of pursuing votes to prove loyalty to ‘radical left’ in new memoir By Alex Miller Fox News September 15, 2025

https://www.foxnews.com/politics/manchin-says-he-wanted-gop-win-senate-stop-democrats-quest-raw-political-power?spark_wn=1

He’s right, support common sense not enemies foreign or especially domestic!

Once again, Bondi has proven herself to be an idiot. This morning on the Katie Miller talk show (not a watcher, Dave Rubin showed a clip) said that “there is free speech, and there is hate speech, and we will send law enforcement against anyone using hate speech”.

Quick, attach an electrical generator hook-up to the graves of Jefferson and Madison as they are spinning in their graves.

These people can kill you and the judges may set the killer free. They really do hates us and cheer those that kill us.

https://www.thegatewaypundit.com/2025/09/breaking-new-york-judge-drops-terrorism-charges-against/

And I thought my state was full of kooks… nope, UT has us beat hands down

https://www.thegatewaypundit.com/2025/09/marxist-lgbtq-paramilitary-group-utah-under-investigation-fbi/

Was this guy part of the conspiracy and his job was distraction?

https://www.thegatewaypundit.com/2025/09/george-zinn-first-suspect-detained-charlie-kirk-shooting/

https://www.thegatewaypundit.com/2025/09/fox-news-host-asks-fbi-director-kash-patel/

Zelensky Overthrown – NATO Is On The Verge Of Collapse| Douglas Macgregor

AzizGaming hours ago https://www.youtube.com/watch?v=EW2Lb9lPBOs

Mel Gibson LOSES IT WITH Stephen King Over ATTACKING Charlie Kirk After His Death! MIKE ZEROH 446,444 views Sep 14, 2025

With the Charlie Kirk death already creating so many emotions right now in the united states and around the world…..one major development going on now goes beyond the charlie kirk shooting which was caused by Tyler Robinson….but now involves the3 aftermath of Stephen King….and how stephen king mocked charlie kirk in the worst way possible with now those like Mel Gibson calling him out for saying such terrible lies about charlie kirk…..This also comes days after the Erika Kirk speech went viral on social media…one thing is for certain is that the charlie kirk murder is changing everything right now. https://www.youtube.com/watch?v=VK1HA_r5pSM

Trump: Zelensky Must Act To End War Or Face Serious Consequences | Times Now World Times Now World Premiered 78 minutes ago

Trump slams Zelensky over the Ukraine conflict, highlighting “tremendous hatred” between him and Putin. He warns Zelensky that he must make a deal as hostages remain at risk and criticizes Europe for continuing to buy Russian oil. Key developments in Ukraine, Putin’s strategic moves, and the geopolitical fallout explained. https://www.youtube.com/watch?v=YxiEoVjjdKA

Kate Middleton Stuns World With Her Key Role In Donald Trump Historic UK State Visit US Tonight 152 views 22 hours ago

https://www.youtube.com/watch?v=Wwm9Z7qDM48

Tyler Robinson DENIES Shooting Charlie Kirk

Sabby Sabs 262,863 views Premiered 23 hours ago

Guest: Ken McCarthy is the author of JFK and RFK’s Secret Battle Against Zionist Extremism: The Documentary Evidence.

https://www.youtube.com/watch?v=JbOsU-3jiXY

Comments interesting too. . . . . .

Dear USAWatchdog Readers,

Re : Real “Money”

If you have gold and/or silver metal in your possession,

you possess real money. PAPER – of any kind – is a

promissory note or contractual instrument representing

something of value—not of value in itself. Or Street-Litter.

The Federal (sic) Reserve (sic) is neither Federal nor a

Reserve of anything of value.

The so-called “Fed” is a criminal/grifting private “bank,”

which purposely triggered the Great Depression, in order

to seize valuable farm lands and other properties in

cities.

See the 3rd report in here, about the TRUE history of the

Fed. :

https://stateofthenation.co/?p=91290

-Rick

And I thought my state was full of kooks… nope, UT has us beat hands down

https://www.thegatewaypundit.com/2025/09/marxist-lgbtq-paramilitary-group-utah-under-investigation-fbi/

Was this guy part of the conspiracy and his job was distraction?

https://www.thegatewaypundit.com/2025/09/george-zinn-first-suspect-detained-charlie-kirk-shooting/

It’s not possible to hate the legacy media mouthpieces enough

https://www.breitbart.com/politics/2025/09/16/abc-news-reporter-says-kirk-assassin-messages-confessing-to-murder-were-touching/

Hey Greg,

Video has surfaced of the shooting of Charlie Kirk. Here is the video of the shooting:

https://rense.com/general98/31fcdec5-8f27-4688-a665-446ec6e3f5b5.mp4

More information is at Rense.com, including another video that loops through the moment the shot is taken by the brown short guy. He raises his hand at the 5 second mark and takes the shot.

Blessings

How many of us do the Dems want to sacrifice for their pet illegals? Easy answer… All of us.

Illegal Pedophile upset by young girl who declines his sick advances murders 16 yo old

https://www.thegatewaypundit.com/2025/09/horror-illegal-alien-drunk-driver-mows-down-kills/

Ephesians 4:29. King James Version

29 Let no corrupt communication proceed out of your mouth, but that which is good to the use of edifying, that it may minister grace unto the hearers.

Ephesians 4:29 is a command to not let unwholesome or corrupt talk come out of your mouth but instead to speak only what is good for building others up, fitting the situation, and ultimately to give grace to those who listen.

The verse emphasizes the power and importance of speech, urging believers to use their words to encourage, edify, and minister grace, rather than to tear down or cause harm.

Pray with me!

Jehovah, my Heavenly Father, please guide my tongue today. Help me to speak only what is helpful for building others up, fitting the occasion, and giving grace to those who hear.

Jehovah, In your son’s Jesus’ Holy name, I praise you. Amen

Hazie-Mazie,

She wants fat liberal women like herself that can’t do a single pull up in positions of law enforcement where strength matters. This is lunacy. We have all seen women in LE injuring the public and their partners.

https://www.breitbart.com/politics/2025/09/16/watch-mazie-hirono-admits-men-and-women-have-physiological-differences-in-complaint-about-fbi-fitness-test/

Pam Bondi is not one of us nor is she on our side.

Hate speech is a Marxist construct to deplatform and suppress opposing opinions.

Hate speech doesn’t exist

https://www.thegatewaypundit.com/2025/09/ag-pam-bondi-clarifies-her-stance-first-amendment/

NOW THAT UKRAINE is LOST

______NATO & the EU. NEED a NEW PROXY

Oh SH*T, Serbia is about to become the next Ukraine | Redacted w Clayton Morris

74,406 views Sep 16, 2025 #natalimorris #redacted #news

According to Russian Intelligence Service… the EU trying to overthrow the Serbian government in a Ukrainian style Maidan Coup.

We’ve been warning about this for months. Hearing from Journalist in Serbia who’ve been telling us something big is coming… begging Redacted to cover this story. And we are trying to shine as much light on this as possible. All eyes on the Balkans… it is a powder keg waiting on go off.

https://www.youtube.com/watch?v=kEQ0Yh3yFpM

Serb’s watch out! For Tory Nuland and her cookies, they’re fatal and she’s a fem fatale! Remember, she wants to F**K the EU.! She’ll use you guy’s next like she used the Ukraine! Mark Clayton’s words! Your next Serbski’s!

And EU. taxpayers, your the ones paying for the 4 $Billion to F**K yourselves/ bigly!

https://www.youtube.com/watch?v=RiK6DijNLGE

“NATO just declared War on Russia!” Putin finally declares the truth | Redacted w Clayton Morris

Redacted 261,932 views Sep 16, 2025