Real Estate Market Gets Worse Before Getting Better

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I have been sour on real estate since I sold my home in Florida in 2006. Back then, I predicted home prices were headed for a crash. Many people thought I was crazy for saying it. Today, my former Florida home is probably worth a little more than half of the selling price.

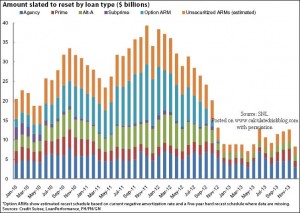

In one of my first articles on USAWatchdog.com in August of 2009, I said this about the real estate market forecast, “This does not mean there are not bargains out there in the market, but let’s not confuse a plateau on a downward trend as a bottom. Please keep the picture above on your “favorites” and every time you hear “the real estate crisis has bottomed” take a long look at it. When I gaze at the Credit Suisse chart, I do not see a bottom until at least 2012.” (Click here to read the complete original post) The picture I am talking about comes from Credit Suisse Bank. It is actually a chart that has been updated since that post. Please check it out on the left side of the screen below:

I updated my “2012” real estate bottom in March of 2010 to be “2013 at the very least” because Credit Suisse updated their chart. The most recent chart shows the resets don’t really slow way down until around October 2012. Back when I made my first real estate bottom prediction, there were plenty of people who thought I was too negative on the real estate market. Today, I look downright optimistic. A Philly.com story out this week said, “If you were hoping to sell your house for top dollar in the next few months, you’d better wait. Until 2014, or maybe later. That’s when 54 percent of Americans responding to a semiannual survey by two real estate search engines believe the housing market will recover from its now four-year-old malaise. Six months ago, when Trulia and RealtyTrac had Harris Interactive poll more than 2,000 adults 18 and older online, 42 percent estimated 2014 as the turning point.” (Click here for the complete Philly.com story.)

I updated my “2012” real estate bottom in March of 2010 to be “2013 at the very least” because Credit Suisse updated their chart. The most recent chart shows the resets don’t really slow way down until around October 2012. Back when I made my first real estate bottom prediction, there were plenty of people who thought I was too negative on the real estate market. Today, I look downright optimistic. A Philly.com story out this week said, “If you were hoping to sell your house for top dollar in the next few months, you’d better wait. Until 2014, or maybe later. That’s when 54 percent of Americans responding to a semiannual survey by two real estate search engines believe the housing market will recover from its now four-year-old malaise. Six months ago, when Trulia and RealtyTrac had Harris Interactive poll more than 2,000 adults 18 and older online, 42 percent estimated 2014 as the turning point.” (Click here for the complete Philly.com story.)

Foreclosures are the biggest drag on housing prices. MSNBC reported last week, “Since the housing market peaked in 2006, some 6.5 million homes have been lost to foreclosure. There are likely another 4.3 million more homeowners who are “seriously delinquent,” meaning they are more than three months behind in their payments, according to data released by the Mortgage Bankers Association this week. Many of those homeowners will soon enter the foreclosure pipeline.” (Click here for the MSNBC story.) Banks are sitting on nearly a million foreclosed properties and are expecting to take back another million homes this year.

Even though the Credit Suisse chart above shows the resets will crest at the end of this year, housing prices could keep going down for some time to come. The Wall Street Journal reported a week and a half ago, “. . . Zillow.com reported that real-estate prices fell nationwide in March for the 57th month in a row, echoing other home-price indexes that have kept dropping and defying hopes of a recovery in housing values. Economists are forecasting a decline of 1.4% for 2011. And, while unlikely, “a 30-year decline in home prices [adjusted for inflation] is certainly a possibility,” says Yale University economist Robert Shiller. It wouldn’t be the first time prices dropped over three decades’ time; they fell by 14% cumulatively, after inflation, between 1912 and 1945, according to Prof. Shiller’s data.” (Click here for the complete WSJ report.)

In past interviews with me, Professor Shiller said real estate declines are on average “10 years” in length. What happened in the last decade was the biggest real estate boom and bust in history. It was a global phenomenon according to Professor Shiller. I don’t know how much further prices could decline, but we are nowhere near the bottom. Home values are still falling right now, and that is despite low mortgage rates of around 5%. The Federal Reserve has been keeping rates suppressed artificially by purchasing government and private debt. (Please read “the Fed’s Biggest Fear.”) When that stops, interest rates will go back up to a more normal level. What will happen to home prices then? My real estate market forecast is they will surely drop more.

This presents a real conundrum for home buyers with cash. We would like to build a place. Materials cost is going through the roof, thanks to the weak dollar and commodities inflation. However if we were willing to buy a place already built, we can find some bargains ( relatively speaking).

Movable houses are becoming very desirable as we have recently learned, when a realtor showed us some acreage that had an older farmhouse on it. She said she had a long list of clients ready with cash to buy the house and move it, if we did not like it.

BTW, arable land prices, at least where we live,have only paused in their price appreciation in the last three years. No bargains there.

I have met two families that have moved from the city and are now producing boutique cash crops of berries and melons.

Thank you Hoppe for the reporting and comment.

Greg

Hoppe,

1) Get rid of that cash today!

2) Buy Physical Gold and Silver

3) The time to buy a house will not be before the dollar collapses

4) Once the dollar collapses, you will be able to buy a house for pennies on the dollar with your physical

5) If you hold your dollars waiting for the right time to buy a house then when the time is right to buy a house your dollars that you saved won’t even get you a doll house.

Greg, with inflation eating away at the average american, wages not keep up with inflation, unemployment and or underemployment, dollar in trouble, just how could a recovery in the largest single asset of the average person not go down? A month ago McDonald’s announced they were hiring 50,000 new employees, does anyone one think that jobs of that type coould make real estate buyers? Greg, if the dollar is failing, the recovery stalling, pm’s and commodities on the rise, and employment stagnat, three wars on the books and more on the horizon, trillions in debt, it siffles the imagination that we will see a bottom in a year or in any near term. I don’t buy a bottom, just a continued very very slow slog downwards to where the invester class will buy it up and produce a country full of renters or be homeless.

Good points Art. Thank you for weighing in today.

Greg

Good Day Art, we are going to see a “bottom” sooner than you think. Kind of like if you were to jump off the Empire State Building you would hit the “bottom”.

My husband and I saw this crash coming long before the first wave hit the real estate market. We sold everything at the markets prime. We held onto those funds and have recently started buying real cheap properties. Like a 2/2 condo that Fannie Mae had listed for $32,000. We negotiated with them and purchased it for $18,000. We have done this 3 times already.

The ironic part is, Fannie Mae doesn’t care about the total money they lost because the government will make up the difference. Oh, did I say government? I meant the tax payers.

PS. Love your daily emails and listening to you on Coast to Coast AM.

Thank you Craig. Sounds like you are approaching this the right way.

Greg

In what part of the country do you reside? Curious.

I wonder, if our currency were not manipulated by the Federal Reserve (i.e., real money), would falling housing proces be the norm? I see them as similar to computers, as you innovate and find better, more efficient methods of design and construction, prices should fall.

The market distortions by the Fed have made them into an “investment” that isn’t.

I, for on, would like homeprices to fall long-term so I can pay cash for one, and invest money in other, real, asset classes.

Good point Dave, but there’s always that location, location, location thing going on too. Thanks for the comment.

Greg

Think Japan 1994. In my opinion we’re about there. Zombie banks, mountains massively overvalued MBS, a huge shadow inventory, etc… I’d say RE won’t really make a recovery. At some point it will just stop getting progressively worse. Maybe many years from now, when this is all forgotten people will some day drink the cool aid again and believe that RE can only go up, up, up!

the chart is hard to see.

James,

Yes, I now realize that, and I will try to fix it.

Greg

Art Barnes – you expressed very well everything I was thinking when reading Greg’s article. I might add that over 9 million jobs have been lost since the downdraft, plus nearly 1/2 million business’s have gone overseas over the years. Just how is any recovery possible with lower and lower wages along with fewer and fewer jobs? A realestate agent in Boise, Idaho(experiencing it’s slump) did say most home sales are going to investors. I’m curious as to the nationality of some of these investors….Greg – spot on!…..and all this is sad to see as I as most everyone else do know people that are stuck in this pickle jar, most of whom are honest, hard working and well intentioned middle class americans….americans that are being led down the rabbit hole of ‘green shoots’ and the ‘recovery’ nonsense sponsored by our not so illustrious MSM, a front for our less than esteemed politicans and bureaucrats who are pulling the roof down upon the not so suspecting working class citizen.

This housing market hangs around our necks like a albatross. Money, money everywhere, but none for me to spend. I’m just wondering what the US Dollar is going to be worth in 2013? Will wages keep pace with inflation? There is something else that bothers me. If these people who have walked away from their respondsibility of owning a home, what is to say they would not do it again? Large down payment?

Are the banks willing to give them a loan to “kick the can down the road” just to make a balance sheet adjustment?

Want a real eye opener? Pull up one of those distressed property sites for you area and see the furure. I have family homes that became rentals and now the rentals are vacant. Where are these people living? Sad.

They need to stop manipulating the market and let it fall. This is only delaying the pain. I realize cities and states are hurting for tax revenue and pressuring banks and real estate industry insiders to continue the manipulation, but it is only going to delay the deleveraging that has to happen. It has always been a fallacy that real estate will continue to rise. If that were true, future generations would pay $2 million for a 900 square feet starter home. It’s not going to happen. The insiders must allow the natural cycles to complete. The real estate market has a very long way down to go. In most markets another 70% down is required. Stop the manipulation and let it fall to the real bottom. Then you will see the fence sitters get into the market and the recovery begin. It could take another 7 years to hit bottom at this pace. We will be in a full deflationary depression by then.

Amen to that KC!

Greg

Thanks for keeping us updated with real estate because that is the only thing that will take us out of this depression. Real estate here in the Western New York continues decline in an area that never saw a boom , so I guess we are a better gauge on the overall market trends. We NEVER had a major runup in prices but we are seeing the downtrend. We have seen a decline in value of about 10% since 2008 and another 5% in 2011.

The US Census figures are in and they show a stat that is not counted in the over 4 million homes in inventory now on the market………..they include another 1 million of houses that are either second homes people want to sell or foreclosed and not yet sold. A normal year cycle has about 2 million in workable inventory.

The stats coming out of the National Association of Realtors should not be taken at face value as they hide the real story. This organization continues to overstate sales & inventory over 30% to its favor. If I were to consider a purchase in a boom/bust area like Arizona or Florida I would only consider buying at 2000 assessed value……..more than that would not be wise looking at another 20% drop over the next few years.

Jeff,

Thank you for the report from Western NY! By the way W NY it is a beautiful place!!

Greg

Little late to the conversation but curious to get some reality check on my (simplified) thinking here.

Two directions things can possibly go:

1) Economy will continue to worsen with more lay offs and continued falling real estate prices for the foreseeable future. In this scenario inflation will continue (accelerate) and interest rates will HAVE TO GO UP. Downward pressure on rental prices as a result of reduced pool of renters which will only be moderated by increase inflation.

2) We will experience a (global) turn around, halting the inflationary march and increased (middle class) financial stability. Home prices will stagnate before rising.

Assuming the first scenario is more likely (as I believe) I see this as EXACTLY the time to be buying real estate for long term holding. Two important criteria I use are no more than 3 times the local median income to sales price and 70% cost to (potential) income ratio. There are plenty of properties meeting these criteria. I am still expecting home prices to fall considerably but with low interest rates and ratios mentioned above am not loosing sleep over this at night.

Waiting for the dollar to completely erode is waiting for a high interest, high inflation environment which I fail to see how that will lead to “buying properties for pennies on the dollar” as somebody else has suggested in this thread.

Interested in hearing any constructive criticism where my logic fails.

Greg: Great articles on this topic. How could one use this information to make practical decisions regarding investments. Specifically, real estate mutual funds and REIT. Would he start investing heavily in the real estate sector? Should he dollar-cost-avg, through the dip, into the RE fund over the next year? Not asking for investment advice but just a generic discussion of how someone could use this information. Any thoughts?

Chris,

I am sure you can make money in the foreclosure market but you must do your home work. I think home prices are going much lower because interest rates will not be suppressed by the Government forever. When the suppression game ends look out.

Greg

Enjoyed your article, Greg. You are very wise.

So, if I want to invest in rentals, is this a good time to buy? Or should I wait until 2012? Or a few more years? I’ve been staying put for the last few years. I’d like to pay cash, so the low morgage rate is not an issue for me.

What do you wise ones think? Now? Or a few years later?

Lynn,

I am not a real estate expert but I would wait and make sure you have exposure while you wait in Gold and silver coins. Here’s my thinking. There are at least a few more million foreclosures coming between now ands 2014. Also the Fed is suppressing rates to around 4% for a 30 year note. When interest rates rise home prices will take another hit. I am not talking about a giant jump either. Let’s say 30 year mortgage rates go to 6.5 or 7%, what will happen to prices. If you said prices will go down you are correct!!!!! I just don’t see a compelling reason to buy rental property unless you get some outrageous deal on the courthouse steps. If you are a professional, there are some deals to be made but pros make it look easy and real estate is not easy right now for the armature. I hope my non expert opinion helps you figure it all out.

Greg

Thank you, Greg. I’m not a pro; I know very little about real estate. I have a little extra cash sitting in a CD that’s going to mature soon, but right now interest rate is pathetic, at 1.6%. So I thought maybe I should invest in some inexpensive houses for rentals.

I think you are right about the millions of foreclosures until 2014.

Interestingly, I just read the news that Prez Obama is launching a refiancing deal to help with people who might be facing foreclosures. I wonder what’s your thoughts on that. Would it make a real difference with the housing market?

His opponents’d rather the market hit bottom without interference.

Also, I’m not familiar with gold or silver. Is it better than real estate? Please share your wisdom.

Lynn,

If you have no gold or silver coins please consider investing in them for protection. Forget yield and think capital preservation. I wrote a “How Too buy Gold and Silver” post on the home page. It is under my picture on the right side. I do not sell gold or silver, so this is what I would tell a friend or family member. Please take action ASAP!!

Greg