Could a Dollar Crash Be Coming Soon?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

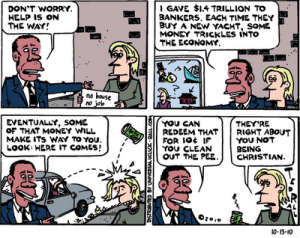

It’s official. The economy is in trouble. The Fed seems to be hitting the panic button and is sending numerous clear signals that it will print more money to push up the economy. The Fed has already printed $1.7 trillion to buy mortgage-backed securities in the past year or so. New money printing (Quantitative Easing) will be done to buy U.S. Treasuries, or America’s own debt. This, in turn, will supposedly reduce interest rates even further into record low territory and, thus, spur economic activity. The clearest signal of more money printing came last Friday from the Fed Chief himself, “There would appear — all else being equal — to be a case for further action,” according to the Associated Press. (Click here for the complete AP story.)

Other Fed officials are, also, in favor of pouring gas on the smoldering economic fire that is the U.S. economy. According to a Reuters story over the weekend, at least two Fed Presidents are giving a green light to print more greenbacks. Boston Fed President Eric Rosengren and Chicago Fed President Charles Evans spoke at the same event in Massachusetts, and both gave their reasons why aggressive measures by the central bank were needed now. Fed President Rosengren was especially dire in his plea for QE, “Insuring against the risk of deflation may be much cheaper than waiting until it has occurred and then trying to address it. A gradual response may not be as effective as a more active response to arrest deflationary pressures before they become embedded in thinking that can affect household and business spending,” Rosengren said. (Click here for the complete Reuters story.)

“A more active response”? Are you getting the feeling the Fed is freaked out by the stumbling economy? So, why is the Fed in panic mode? Could it be stubbornly high unemployment, a stock market hit with week after week of investor withdrawals, declining retail sales, declining residential and commercial real estate prices, and the foreclosure fraud story that has blown up causing trillions of dollars in mortgage backed securities to be exposed for the worthless rip-off they really are? My vote is for all of the above.

So, if the Fed is going to open the money printing flood gates, I guess we can just buy stocks and let inflation make us all rich—right? Wrong, according to economist John Williams at shadowstats.com. In his latest report, out last Friday, Williams warned, “Buying U.S. stocks because the Fed says it will proactively debase the U.S. dollar is like sitting on the beach in order to get a great view of an incoming tsunami. Any pleasure so derived should be short-lived, when the terror of underlying reality quickly takes hold.” So, I know what you are thinking right about now—when? I wish I knew, but when the market tanks, don’t expect warning sirens to sound and church bells to ring. Williams goes on to predict, “Given the current systemic distortions and extreme irrationality in the equity markets, a severe and violent sell-off in stocks would not be a shock, and it could come with minimal, if any, warning.”

And, if the economy is in a downward spiral as the Fed claims, then what do you think is happening to tax receipts? Plunge is the word that comes to mind for me. And if the Fed is going to print lots of new money out of the thin air, what do you think that will do for the buying power of the U.S. dollar? There is that word again—plunge! Williams puts the dollar picture into better focus when he says, “There is particular risk of recent dollar selling — which has been closing in on historic lows — turning into an outright dollar-dumping panic, which not only would roil the domestic U.S. markets, but also would set the stage for a rapid acceleration of domestic consumer inflation. Irrespective of any near-term market volatility, gold and silver, as well as the stronger currencies, remain the best long-term liquid hedges against loss in purchasing power of the U.S. dollar.”

The last question to answer is how much new money will the Fed create? Former Bush economic advisor Marc Sumerlin gave a clue less than two weeks ago on CNBC. He said, “U.S. households have $70 trillion in assets,” Sumerlin explained during a live interview. “And the Fed essentially needs to buy enough Treasurys and mortgages that you can get a bid on all those other assets. And when you have leakage in the international system it takes a pretty big amount to be successful. To me, it starts to get interesting at six to seven trillion dollars.” (Click here for the complete CNBC story.)

“Six to seven trillion dollars!” Yikes! Talk about letting a big fat cat out of the bag—meow. Do you understand how bad the Fed thinks the economy has gotten? I have said this many times on this site, “the one sure thing you can count on is big inflation.” The Fed has flat out said (many times now) it wants more inflation. It is determined to give us all just that—and maybe a whole lot more.

Our situation is beginning to unravel,slowly but surely, attitudes among the young are changing from confidence to despair. Of course football is still all important but that only has a few weeks left. As I sat down to a meal yesterday it occurred to me that such an act might be an indication of complacency.

How long will food be readily available and not cost prohibitive? What happens when supplies become scarce? Where will the ultra wealthy be safe? How will cities function when those in power are revealed and admit to their incompetence? Who is going to pick up the garbage and dispose of it?

These are only a few things that come to mind as the esoteric discussion of applied economics and outright fraud are discussed here and other places. I suggest that people examine their options with relation to how they answer these and other questions. Individual action is apparently paralyzed in the USA as we cannot believe disaster can strike in any form beyond an earthquake, flood, etc.

In the near future natural disasters will be remembered with fondness.

Well said John

Greg

If we do go into high inflation, I wonder if the banks will pay high interest rates on savings/money market accts or just charge higher interests rates to consumers and somehow find a way to avoid paying higher interest rates to depositors?

It seems the banks and much of big business has no moral compass and only do what is best for them at the expense of the consumer…

How are we going reign in these goliaths when they pay off through their lobbyisits, the very politicians that regulate their industry?

How are things going to get better when even the police in this case are crooked and on the take? Is some other country going to have to come in a clean up our act like what happened to Germany after WW2? How else does this kind of activity get cleaned up? Certainly doesnt appear the Fed and the banks are going to initiate it themselves?

Do you sometimes get the feeling that our country is being dismantled and sold off like an old battleship that seen its better days? Is our nation being sacrificed by the corporations to the new and fresh economies in Asia?

Do corporations have any allegiance to nation states. If they don’t and their only reason for existence is to make a profit, then that also means the politicians that regulate them and allow this to be done have no allegiance either, doesn’t it. They can talk patriotism all they want. Its their actions that matter and it seems that even the US Chamber of Commerce is throwing its full weight into the movement of jobs to overseas location. The trans-nationals have no allegianc to the USA… and yet nearly 50% of the people will vote for the party of big business (R’s) somehow thinking they represent the best interests of the people? By mandate, they are the party of big business.. How can people of average means believe that R’s are going to help them?

If tax cuts and less regulation and oversight was the answer, why are we in such a mess after 8 years of lower taxes and a dismantling of the oversight agencies? And now we have new crop of politicians that are continuing the government is bad and even less regulations is their campaign directives.. And don’t forget that the nations debt, that some say has grown huge after Obama took the reigns, is only because the Bush administration ran the war budget off the books and Obama is now including it….Im not saying that Obama is an angel nor am I implying that dems are the answer, just saying that we’ve been severely mislead by big dollars that have huge control over the media.. We as citizens and voters need to hold our officials accountable…

I know the Dems have been taken in by corporate dollars too, but right now the large donations from big business are going into the Republican party… and even the Tea Party is funded through front groups that are nothing but shills for the corporations and the Republican party…

We need more choices… its time to start throwing our votes at not only 3rd party candidates, but 4th, 5th and 6th and so on… and until some viable alternative candidates show up, were going to have to endure this decay in our choice of electable candidates…

Robert,

We are a country without true statesmanship! There are a few exceptions such as Ron Paul and Alan Grayson. As far as the big banks, they need to be broken up before they suck all the life out of the country. Thank you for your comment.

Greg

I agree with your choices of Ron Paul and Alan Grayson.. they speak truth to power and get demonized as being radicals from the far right and far left…

Robert,

I agree. I have quoted both men here on this site. They tell me there is still hope for America!

Greg

Sometimes I read this blog and I think that you guys are either crazy or you are going to be completely right.

I was in downtown Boston this weekend. The restaurants and shopping malls were packed. Are people crazy? I’m sure some have money, but what I’m seeing isn’t adding up.

Peter Schiff’s logic was that since people are already so far down the line in debt they have decided to go out with a bang – i.e. max out their credit cards on things they love, knowing that they’ll never pay them back anyway.

Either Peter and you guys are right or it’s not as bad as you are saying it is.

nm,

I can assure you we are not crazy.

Greg

SYSTEMIC BREAKDOWN AT HAND

◄$$$ SYSTEMIC BREAKDOWN EVENTS ONLY DAYS OR WEEKS AWAY. A TRIGGER IS COMING THAT WILL OVERLOOKED FOR ITS POTENTIAL TO PRODUCE A POWERFUL IMPACT. EVENTS WILL OCCUR IN A CHAIN REACTION THAT GATHERS TREMENDOUS MOMENTUM, AND THEN GLOBAL IMPACT. THE SEQUENCE WILL USHER IN THE THIRD WORLD STATUS FOR THE UNITED STATES. $$$

Out of the blue, a very important insider contact within the banking world sent an email last week. Its significance stems from its unsolicited nature. He was privy to some critical but sensitive information, and shared the news of its imminence. He was not at liberty to divulge the exact nature of the event in progress, but shared that we are at the doorstep of major events. It could have been as simple as gigantic gold demand to strike. He has significant obscure foreign security agency contacts, including from Britain and Russia. He wrote on September 8th, “It appears to be prudent to fasten your seat belts and batten down the hatches. Watch out for a trigger event incident, like the assassination of Archduke Franz Ferdinand in Sarajevo which led to WWI. It will appear to be insignificant but will trigger an avalanche that will make the entire system collapse onto itself. I have strong indications that this is only a week away from happening, in any case before this year draws to an end. Do not ask me for specifics, since I cannot share them with you. Regarding your list of potential events, any combination thereof is likely.” The last line pertained to my immediate query.

The Jackass shot back a message with a list of potential events, all of which appear possible. Here is my laundry list, which given its length and not outrageous likelihood should be alarming unto itself. For example, something like A) a debt default by an EU member nation, or B) a big bank failure within an EU member nation, or C) a big bank failure event by a big US bank, or D) a phony story like a big inventory theft at London Metals Exchange to cover up absent metal, or E) a revealed major fraud from inside the USGovt (like with Fannie Mae), or F) a decision to permit certain markets to find proper equilibrium level (which sets off a giant mudslide), or G) a lawsuit against the SPDR Gold Exchange Traded Fund (GLD) for fraudulent leasing, or H) a credit derivative breakdown centered upon the Interest Rate Swap that manages to hold in place the near 0% official rate, or I) arrests made of some respected US bankers for bond fraud. That is long list of potential deep crisis events to trigger chaos, each highly likely.

◄$$$ MAJOR TIDBITS ON DEADLY BANKING DEVELOPMENTS MUST BE SHARED. THEY ADDRESS THE ABOVE WARNING OF SHOCK WAVE EVENTS. DEVELOPMENTS BEHIND THE CURTAINS AND MARBLED OFFICES ARE IN PROGRESS, SOME IN PREPARATION. EXPECT A BANK OF AMERICA FAILURE SOON, MUCH LIKE LEHMAN BROTHERS. $$$

Bank of America had a bank failure on July 24th. It was fixed right away by a massive infusion of USFed money, as they pulled BOA out of the fire at great cost. The banking community heard about the event, but the public did not. A bank run at BOA was averted. Such a failure will most assuredly happen again, since the big bank is both dead and having great difficulty with liquidity demands. Later, either JPMorgan or Goldman Sachs will acquire the entire bank, their entire depository accounts, their wrecked derivative books (like Gold futures and Interest Rate Swaps), including their teetering accounts held by gumbands and baling wire to the USDollar, USTreasurys, Gold, and Silver. Signs of desperation creeping in have come from reports of BOA attempting to sell $billions in assets, the source being analysts and fund managers who recently attended meetings with BOA executives. Deep concerns over its bloated damaged $2.3 trillion balance sheet have come to the fore. BOA middle and upper management expects a collapse, just a matter of time. A failure and merger of Bank of America would light the crisis fires again, and even focus attention on the Gold price, which is well understood to be suppressed by BOA as part of the corrupt Big Four Banks.

Willie

Luc,

Thank you for sharing Mr. Willie’s work. His web site is goldenjackass.com. It is also called the Hat Trick Letter.

Greg

Greg,

I appreciate your sound and truthful journalism. As a young man now quite 30, I find this whole financial mess quite depressing and have found myself in a conundrum. Where do I go from here? Do I stay in Peru with my wife? Do I go back to school in the States? After reading your posts and many other brilliant websites its hard to find the light at the end of the tunnel. Any advice from you or other readers would be greatly appreciated.

Thanks,

Ben

Ben,

If you come to the U.S. please have a plan to better yourself. You should also have some sort of savings or income stream. Don’t go to school just to kill some time. That is my best advice.

Greg

Are you talking about the Grayson in Fla. that was the greatest supporter of the Obamacare? Also why is it that in this blog all the blame seems to be with the party of big R…didn’t Wall street supported Obama last election? If wealthy are not for the big D, then why are they in power?

Chow,

Yes I am. I did not agree with Grayson on Healthcare but I do agree with him on cosponsoring HR1207 (Audit the Fed). Good men can disagree. Also, I have said many times on this site that the two parties are one body and two heads. They just take turns ripping us off. Thank you for your comment.

Greg

It’s getting messier and more loused up. Now the country (world?) has to deal with the foreclosure disaster in which the ownership to the liens on the properties are totally in a state of confusion. Also, many are licking their chops about the launching of QE II – and QE III, QE IV … I read an article that claims that $500B is already baked into the cake. $ 500B may be baked into the cake but it will definitely not pass muster. There is absolutely no way that the Treasury / Fed can disburse this money or any money in a way that will be fair, orderly, effective and timely. Realistically, the funds that will jump start the economy – along with other measures, otherwise they might as well send the money directly to China – is $ 5 trillion. Giving the money to the banks has failed miserably and doing nothing is a recipe for disaster.

Stanley,

Tha big banks should be broken up. It is as simple as that. As it is now they are sucking capital away from business that will produce jobs.

Greg

I’m reading The Dollar Meltdown by Charles Goyette. His logic is ironclad as far as I’m concerned.

Greg, http://www.jsmineset.com post at 3.42 pm 18 Oct,2010 says all we need to know,half way down the post, is a video on the fraud used by the banksters & rating agents & their bosses, 2 Trillion in MBS & all those Toxic Derivatives. This is so bad.

MSmith,

I saw this and it is worth watching. Thank you.

Greg

Let’s not just blame corporations for shipping jobs overseas. Government regulations have made it very expensive, the unions have added to the cost and the American consumer want low, prices. The corporations are beholden to their shareholders.

The banks? Our dollar? All of this makes my head spin. I appreciate this site for its honest reporting of the depth of this crisis. We are in deep trouble. I keep thinking we are Americans, we are better than this and we will rise to meet the challenge. As soon as more people have their backs against the wall, they will come out fighting and that is what has made America great.

Thank you Jan.

Greg

Jan, im sure your aware that wages have gone realistically nowhere compared to inflation and ceo earnings for the last 30 years. That is why we want cheap prices….but ask me….what do i want to pay for an item? WHAT IT IS WORTH. if its a hyundai, or a kia, i dont want to pay 50,000 obviously. If it is a handmade guitar amplifier like the ones made in the MATCHLESS factory in california, i will pay exactly what it costs, which is around 4,000 dollars. Because YOU GET WHAT YOU PAY FOR. However, with fewer and fewer americans actually GRADUATING college with degrees in science or some other big earner, we have nothing to bring to a job interview which demands higher pay. I know this because Im a mechanical engineering student at the university of houston and there are exactly 16 students out of 389 that are natural born u.s. citizens (the Dean and I are tight)…we simply do not push our kids to be anything great anymore…we are turning into softies….

“turning into…”

ROFL…

way way way way past that point.

Thank you Red for all the comments.

Greg

Maybe all you Americans should emigrate up here to Canada. Especially you small business owners while the going is good. You can own all the precious metals you want without fear of it being confiscated. You will soon be able to buy it at a discount (US dollar vs Cdn dollar). We have free health care – well sort of – it’s buried in our federal income tax. We welcome all imigrants with open arms. Were loved the world over. Finally the view is great as we watch history in the making – the decline of the American empire.

Dan S.

Toronto

Daniel S,

When the dollar crashes Canadians will be affected too. Maybe not as much as the U.S., but you will feel some pain. I love Canada, beautiful country with nice people.

Greg

sorry dan, but if it werent for us yall would have been conquered a very long time ago. With no army or anything protecting your borders, you should be thanking us for your prosperity. Although i am very jealous of the way yall get to live, your royal mounties are no match for someone with an attitude and a tank. Can i homestead on your property??hehe

Not being an expert in complex national affairs, all I can say is that this article AND the first response hold TERRIFYING implications should things unfold as described.

Average Blue Collar Guy,

Buy Silver Eagles or Junk silver for protection. If you can afford it, buy some Gold Eagles too. Then you will not feel so terrified. Peace Bro

Greg

…until they are either a) confiscated (again), or b) taxed to oblivion…

Greg i just dont get it. I heard on MSLSD the other day that the economic research institute declared the recession has been over for a while now?? You….oh my….you dont think…gasp….they would LIE do you??????HEHE.

TO THE AMERICAN PEOPLE: EXPERIENCE IS SOMETHING YOU GAIN THE MOMENT AFTER YOU NEEDED IT. LET THIS BE A LEARNING EXPERIENCE FOR ALL OF US TO TEACH OUR UNBORN CHILDREN…THAT ONE DAY THEY TOO WILL PAY DEARLY FOR THE CRIMINAL ACTIONS OF OUR POLITICIANS……UNLESS WE TEACH THEM WHAT THIS COUNTRY IS SUPPOSED TO STAND FOR……HARD WORK AND FREEDOM…NOT SCAMMING EVERY SINGLE PERSON YOU MEET. THIS COUNTRY HAS BEEN OVERRUN BY THE SAME RACE THAT HAS BEEN KICKED OUT OF EVERY COUNTRY THEY’VE EVER INHABITED….and we all drank the koolaid!!!

Brian,

You are too funny and correct.

Greg

it’s not about race, it’s about human nature…and a fallen world, and that human nature is, well, not so dandy after all is it?

For Heaven’s sake, Mr. Hunter, what a tepid headline. “Could A Dollar Crash Be Coming Soon?” More like “How Has The Dollar Managed To Avoid Crashing Already?”

But I quibble, I suppose. And to either headline, yours or my rewrite, I say “fait accompli”. Or, if you’re a pastry chef, “Baked into the cake.”

So, once again I urge all with the capacity to comprehend:

Stand back. Let it crash! Or, rather, let THEM crash! ( the Dollar AND the economy ).

The faster everything is in ruins, the sooner the rebuilding can start.

You’re NOT a patriot for trying to play King Canute here.

Good luck on the Other Side.

ManAboutDallas,

Good to have you comment again.

Greg

Regarding Grayson, whom btw, I admire for his speaking out, the question one might ask is “how long have you known about this mortgage fraud activity?”

According to Deninger of the Market Ticker, Alan’s known about this fraud for 2 years. Deninger and his staff have been communicating with Grayson’s office about this issue for that long.

http://market-ticker.org/akcs-www?post=168090

DYODD: Do your own due diligence. When considering our next “representatives”, remember, actions speak louder than words.

My take on this issue is that the banskters/Wall St. will never see the inside of a court room or jail as they should. They own our “representatives” with the exception of a few like Paul. I respect Kucinich too, although I was disappointed that he caved on Obamacare. Congress is changing the laws to protect them. We, the taxpayers, are going to pay for this mess. It’s only just begun.

I hope Grayson will stand up for his constituents and the American people whose lives are being destroyed by this foreclosuregate – with his actions, not his words.

Bottom line: don’t believe all the PR spin, especially right before an election.

Bible: Revelation 6

5 ¶ And when he had opened the third seal, I heard the third beast say, Come and see. And I beheld, and lo a black horse; Zech. 6.2, 6 and he that sat on him had a pair of balances in his hand.

6 And I heard a voice in the midst of the four beasts say, A measure of wheat for a penny, and three measures of barley for a penny; and see thou hurt not the oil and the wine.

All day labor for a little subsistance, inflation and high prices.

The time is near….

The states are about to take another big hit. It is almost property tax time. If people a living in foreclosed homes, I doubt they will be paying the property taxes. Do the banks pay property taxes on the homes they now own?

This could be a tipping point for many states.

good question. I wonder if the TBTF banksters DO pay property taxes on foreclosed properties. Then again, recall, that the banksters are “buying” (taking, fraudclosuring on) properties with MONEY that they CREATED out of THIN AIR as a BOOK LEDGER…

so in effect, if a $500,000 “valued” house is foreclosed on for (whatever), say even $200,000, the bank just “created” $200,000 in real assets they now own out of THIN AIR. Ah, the life of a bankster.

@nm: Peter Schiff and Greg are right and more simply you can’t get hurt listening to their advice, only ignoring it. What you are seeing now is “Therapeutic shopping”. The additional liquidity is due to people no longer paying their mortgages, credit cards, moving in with their parents and other unhealthy / illusionary increases of disposable income.

@ Luc: Webster Tarpley is reporting a lot of turmoil inside the white house and the possibility of a Cold cou via the 25th amendment. This event would probably come from the Clinton front. Supposedly Barrack Obama is not dealing with the pressures of the office well and it is still unclear if he is vulnerable to any serious legitimacy attacks on his citizenship.

This would be suicidal for the elites to attempt in my opinion but they have shown little restraint, no interest in the people’s will and are pot committed in their plans. This is the type of left field it can’t happen here stuff that could set the market into free fall and begin a market chain reaction dollar dump.

Barring that I think they will keep the market in the 10,000 – 12,000 range through the next presidential election. The Fed is out of bullets and is going to its nuclear options through POMO, electronic gold / silver suppression and other types of morphine monetization.

If you can’t get silver or gold go with pre 1982 pennies, rice, lentils, spam, bunnies, seeds and .410 shot gun shells. A Taurus Judge and a .410 reloader would be nice also. Worst case scenario you’ll have to buy some new cookbooks, go camping / hunting a lot and need to give away a crap load of bunnies to kids during Easter. Excuse my gallows humor = )

Keep up the good work Greg and take care / prepare everyone

Another spot on article.

Is a crash coming? I think some might say the the USD has already commenced its journey towards near crash proportions but it is always impossible to predict exchange rates.

In my view the more USDs that are thrown out to the private sector the more that will be traded for hard currencies and invested in stable foreign countries with sound economies. If you expect the dollar to fall further this is your best option. As selling USD, and buying select foreign currencies gathers additional momentum, the dollar will potentially be forced ever lower.

The more money printing that goes on to finance Government operations the more that will be wasted in unproductive endeavours or otherwise inefficiently utilized.

A lower dollar will increase import prices and massive domestic currency expansion can surely do nothing but progressively dilute the value of the USD. This is blatant USD printing with no production or wealth generation behind it. How can massive inflation, pure and simple, not be the result of such destructive and irresponsible management by the FED? Government and Treasury is no less irresponsible.

The Government is not acting in the best interests of the country because it has been “bought” by vested interests. The FED pretends it is acting responsibly and produces all the usual public spin to justify it’s actions – to the extent that it is prepared to make public what it is doing. It is clear however that the FED is doing nothing more than taking actions it considers will best fit the requirements of the banking sector. The needs of the economy come a very poor second and where there is a conflict between national interest and the banking sector interests, as there is now, the latter will always prevail.

Sean,

Good stuff. You sound like a pro. Thank you.

Greg

Sean, do you think the government might just be keeping things propped up to maintain civility amongst the masses? I know the bar owner near my home see a direct correlation in how the stock market is hyped and pumped to his level of business.. It really slows down when the commentary is doom and gloom.. He’s had a lot more business lately than he did this summer when the market was tanking..

What the Fed is doing might not be what’s good for the country accounting wise, but in terms of keeping the peace and people hopeful, it seems the best thing to do… I dont want to see riots let alone have to pass through them to get my daily business done..

Alan Grayson……??…..Are you serious……! Your articles are prescient but you jeopardize your credibility with that beltway politician….it’s all just a, ‘everybody look at me now trying to put out a big fire I helped start, am I not a good guy,’ before people want to take a baseball bat to politicans……where was all his help before the fire started. In fact, where were any (besides Ron Paul) politicans help before this whole thing blew up! I’ve been reading about this for months, and this whole thing was called by many non politicans long before it hit main street media. Politicans are great at appearing to fix messes that in fact they themselves created, and in the end, only making bigger messes with their fixes! Greg-please don’t fall for that stuff….!

BigTom,

Yes, your criticisum is valid, but I am using Grayson as a source. If I wait for the perfect source, I will not be able to pass along critical information and analysis. Please do not hold this against me. In this case what Grayson is saying is true, but I am well aware of his sins. Thank you for your comment and support.

Greg

No I don’t Robert.

IMHO the Government is motivated by:

1. Influence by the vested interests that lobby them non-stop. All those obscene millions donated to candidates and Parties buys access and influence. The donors want return on their investment otherwise the big donations will dry up.

2. What is politically expedient, especially in the near term and this is also related to 1. What is good politics and a good decision by politicians in the national interest will not often coincide. Where there is a conflict, good politics will almost always prevail.

3. Staying in power and, in the case of individual candidates, keeping their seat in the next election even if their Party fails to win a majority.

4. In the priority rankings, decision making solely in the long term best interests of the Country seemingly comes a poor 4th place.

As for the “independent” FED – well just look at who their masters are and who is fighting to keep the Feds operations less than transparent in what is supposed to be an open economy.

IMHO what the Government and Fed are doing now will simply result in serious “stagflation”, ie zero or close to zero real productive growth combined with serious levels of inflation. This is not consistent with keeping the electorate content and for the most part people will not find this result tolerable. But this will not be a near term consequence so from what you see now no one seems to care. It’s all short term thinking as usual.

Greg’s article quite rightly points to serious levels inflation in years ahead which is likely to be quite negative to a limping economy, severely reduce consumers buying power and be very destructive to the value of savings – just to name a few negatives. Just how the authorities think they are going to be able to hold down interest rates in such an environment is another of life’s mysteries.

You can have cheap interest rates an inflation at the same time in a free trade world because labor is what controls money and China controls labor. Labor has always been the honest money broker not banks not DC. No interest rates no easy wealth no pensions, no good paying jobs no taxes no big government. You trade with one country you end up being just like that country.

Bob,

Good stuff man!

Greg

There is a proverb (22:3)which states: “A prudent man foresees the difficulties ahead and prepares for them; the simpleton goes blindly on and suffers the consequences.” We are now in the preparation phase folks, but how long we have who knows? NOW is the time to prepare your family for the coming hard times.

Irene,

This is what this site is all about right now. Thank you so much.

Greg

200 million people hooked on prescription drugs

Everyone from Kindergarten to Great Grand Mom,

with 1.3% of their population incarcerated,

with another 1% watching them.

A welfare nation with no work ethic,

self centered lazy & now unemployable.

I believe that when the dollar collapses & is replaced as the stanrdard of buying & selling in the world, there will be

blood shed on the streets of America.

Americans against Americans,

Cripts against Bloods

Blacks against Whites

& An Army thats Unarmed & out of country, A National guard that will turn tail & run, An unprepaired unarmed people except for the outlaws.

Why bother bombing America?

Give them what they want,

GIVE THEM MORE PILLS!!!

Lunesta? Ambien? Weary Leg Syndrome, Extends, Viagra or Postivac? Late Night TV? Oh & waiting for your huvverround or you skooter from the skooter store. Give them what they want give them Bigger Shopping Malls, Big Screen TV’s in their gov subsidised dwellings & Fancy cars Give them a credit line.

The United States should put a white flag on the pentagon lawn. Salute your new flag America

RITE AID

I just loved this article!! It reminds me of a conversation I had with a couple of woman in the supermarket checkout line. There was magazine in the magazine rack about buying Gold as a safety net in case the economy crashes, one of the woman stated that she and her husband had been moving their portfolio heavily in that direction. A reply from her friend was “we really need to do that also”When I asked why they would do that, they told me (as if I were a neophyte to investments) that if the dollar crashes then you can’t buy food, gas or anything that you will need to live. My reply is I think there is a better precious metal that does the same thing and costs far less…………….Lead! In a world that you and other economists are “predicting” Lead is the best investment. Then food. With lead one will be able to keep their food, house, and keep their family safe. It will also allow them to find more food! Am I wrong?