Weekly News Wrap-Up 11.18.11

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

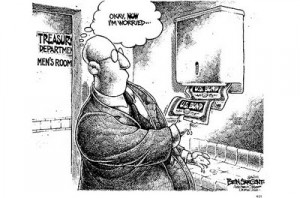

Occupy Wall Street is 2 months old and is gaining speed. Thousands protested in dozens of cities yesterday, and hundreds were arrested. It’s all about the Wall Street bankers who cheated and rigged the game, not against the wealthy. Democrats love this issue because they have a bad economy. The OWS movement directs the argument to how do you want this fixed– the Democrat way or Republican way? Is Syria headed for civil war? It sure looks that way. The Arab League has rebuked the leadership of Syria because of the violent reaction to protests over the past few months. Will Syria be another Libya for NATO? The EU debt crisis is getting worse, not better. It is reported the wealthy are moving their money out of Italian banks.

The MSM is oblivious to this. Meanwhile, the fallout from MF Global’s bankruptcy is ballooning. Traders fear the commodities futures market is not safe and the system may lock up. Jim Willie predicts before it’s over, COMEX will be cash and carry only. MF Global bankruptcy is an unfolding disaster. A new report by Shadowstats.com says the annual deficit is not $1.3 trillion. If GAAP accounting was used, the U.S. annual deficit would be north of $5 trillion. Williams says the government deficit is out of control and not sustainable. Finally, the U.S. announced this week it is putting troops in Australia. 2,500 will be stationed there in the next few years. That means more military might with access to the South China Sea. There are important shipping lanes and natural resources there. China is not happy, and tensions between the U.S. and this communist country are increasing. These stories and more from Greg hunter’s USAWatchdog.com in the Weekly News Wrap-Up.

Greg, the irony of the occupy movement is that many within the occupy movement don’t trust either the democrats or the republicans, although more probably believe that the democrats are the lesser of the two evils. Republicans are presently trying to get pizza declared as a school lunch vegetable after receiving funding from the frozen pizza industry.

How about a comment on Nancy Pelosi looking straight into the camera and lying about taking stock offerings from Visa at the same time that a credit card bill was dying in the house of representatives? It was on the 60 minutes insider trading segment that ran this past Sunday.

The best ever, Greg.

What is your opinion on Credit Unions? Are they more stable or do they have the same risk as major banks? I know that people are transfering their money to them, adding to their balance sheets. They are also covered by a different issurance other than FDIC.

Do you think that the transfer of money to smaller banking institutions has hurt the larger banks? Would Credit Unions be able to withstand bank runs or bank holidays since they are local?

TIA

Sling,

I like credit unions very much but they are still under the Fed and trade in dollars.

Greg

I believe that until justifiable debt restructure does not require a credit default, things will only get worse, and Greg is right, credit unions are no different than the banks when it comes to loaning money or helping people renegotiate an existing debt.

You can track much of th occupy movement from http://www.occupynews.net.

I have a futures account with TradeStation and I know they bank with JP Morgan. I want to compose a letter to TradeStation with my concerns, but I’m not sure what exactly to ask. Based on their response, I will decide to close out the account or not.

The reason the banks get away with it is that they have political coverage, i.e., politicians at the state and federal levels cover their backs. A lot of people demonize Wall Street (like the OWS movement) but they are demonstrating against the wrong target. Nothing will change until politicians change. Elections will change nothing unless we elect citizens that remember their responsibility to the people. I think nothing will change until the knockout punch crisis around 2016, and even then it might not be a change for the better.

Greg, when people expose the dirt on corporations & politicians they are called villains by our government, but when a man sells corporations & the government every thing about you for billions, he called man of the year. Now apply the same to MF Global, the CME, SEC, CFTC and the courts and there is no difference. Even after being caught red handed the crooks have continued to walk free. Now if you are a lady in Miss. who lied on a food stamp app & caught, even after paying back the money she received to feed her kids, the judge gives her 3 years in prison to set a example. This is what our nation has been turned into, congress may trade on insider info to make millions & if you or I did it we go to jail.

This was a week where all need to re-think how good is your plan that protect yourselves & family from what we know is coming.

M Smith,

You are correct. Make your plan as robust as possible.

Greg

bcm collapse sees the usa/oboma admin as oligarchy.

http://barnhardt.biz/

Jay,

This is a real problem and it will get worse!!! Thank you.

Greg

When you have a band of pirates kidnapping people and then throwing them overboard to the sharks, who do you blame for the tragedy? The sharks or the pirates? This is where most people get it wrong. The pirates are the politicians and their bureaucrats, the people are the 99%, the sharks are the capitalists and banksters. I think you solve the problem by getting rid of the pirates, not the sharks. JUST STOP FEEDING THE SHARKS!

My comment is not meant to denigrate traditional capitalism – which from a Libertarian perspective no longer exists – It has morphed into monopolism aided and abetted by bought and paid for politicians.

i love this idea. greg what happens if we/all americans just takeout our cash from banks,stocks…ect…? starve the sharks.

then vote a constitutionalist in office. say like ron paul

Thank you Greg for your meaningfull articles. Do you have an idea why jsmineset.com is down (Jim Sinclair site)?

Thanks a lot for your work!

Carmen,

I do not know why JSMineset.com is down. I hope Jim is back up soon. We need his voice!

Greg

Sling,

My 2 cents. No matter what “bank” you put your money in, there are two things to think about. What are they invested in? Stocks, funds, real estate – all bad deals IMHO. That’s most “banks” and you’ll lose your shirt. The second is that the feds have gone into banks that were in trouble and confiscated ANYTHING of value from safe deposit boxes and skimmed off the top from accounts. PMs for me are the only way to go. You also need food for long term and protection to keep what you have. … SHHH … and don’t tell any one about it! Scout motto – Be Prepared! The financial global world is about to fall apart, it’s just a matter of how long they can keep it propped up.

Best Regards

Hi Greg,

The following letter should give credence to what you have been sharing with us about the coming financial collapse. Ann Barnhardt has skin in the game. She sacrificed her business in the interest of protecting her customers. I believe this is a significant signpost along the road we are traveling…

Source: http://barnhardt.biz/

Dear Clients, Industry Colleagues and Friends of Barnhardt CapitalManagement,

It is with regret and unflinching moral certainty that I announce thatBarnhardt Capital Management has ceased operations. After six years ofoperating as an independent introducing brokerage, and eight years of employment as a broker before that, I found myself, this morning, for the first time since I was 20 years old, watching the futures and options markets open not as a participant, but as a mere spectator.

The reason for my decision to pull the plug was excruciatingly simple: I could no longer tell my clients that their monies and positions were safe inthe futures and options markets – because they are not. And this goes not just for my clients, but for every futures and options account in the United States.The entire system has been utterly destroyed by the MF Global collapse. Giventhis sad reality, I could not in good conscience take one more step as acommodity broker, soliciting trades that I knew were unsafe or holding fundsthat I knew to be in jeopardy.

The futures markets are very highly leveraged and thus require an exceptionally firm base upon which to function. That base was the sacrosanct segregation of customer funds from clearing firm capital, with additional emergency financial backing provided by the exchanges themselves. Up until a few weeks ago, that base existed, and had worked flawlessly. Firms came and went, with some imploding in spectacular fashion. Whenever a firm failure happened, the customer funds were intact and the exchanges would step in to backstop everything and keep customers 100% liquid – even as their clearing firm collapsed and was quickly replaced by another firm within the system.

Everything changed just a few short weeks ago. A firm, led by a crony of the Obama regime, stole all of the non-margined cash held by customers of his firm.Let’s not sugar-coat this or make this crime seem “complex” and “abstract” bydrowning ourselves in six-dollar words and uber-technical jargon. Jon Corzine STOLE the customer cash at MF Global. Knowing Jon Corzine, and knowing the abject lawlessness and contempt for humanity of the Marxist Obama regime and its cronies, this is not really a surprise. What was a surprise was the reaction ofthe exchanges and regulators. Their reaction has been to take a bad situation and make it orders of magnitude worse. Specifically, they froze customers outof their accounts WHILE THE MARKETS CONTINUED TO TRADE, refusing to even allow them to liquidate. This is unfathomable. The risk exposure precedent that has been set is completely intolerable and has destroyed the entire industry paradigm. No informed person can continue to engage these markets, and no moral person can continue to broker or facilitate customer engagement in what is now a massive game of Russian Roulette.

I have learned over the last week that MF Global is almost certainly themere tip of the iceberg. There is massive industry-wide exposure to European sovereign junk debt. While other firms may not be as heavily leveraged as Corzine had MFG leveraged, and it is now thought that MFG’s leverage may have been in excess of 100:1, they are still suicidally leveraged and will likely stand massive, unmeetable collateral calls in the coming days and weeks as Europe inevitably collapses. I now suspect that the reason the Chicago Mercantile Exchange did not immediately step in to backstop the MFG implosion was because they knew and know that if they backstopped MFG, they would then be expected to backstop all of the other firms in the system when the failures began to cascade – and there simply isn’t that much money in the entire system.In short, the problem is a SYSTEMIC problem, not merely isolated to one firm.

Perhaps the most ominous dynamic that I have yet heard of in regards to this mess is that of the risk of potential CLAWBACK actions. For those who do not know, “clawback” is the process by which a bankruptcy trustee is legally permitted to re-seize assets that left a bankrupt entity in the time period immediately preceding the entity’s collapse. So, using the MF Global customers as an example, any funds that were withdrawn from MFG accounts in the run-up to the collapse, either because of suspicions the customer may have had about MFGfrom, say, watching the company’s bond yields rise sharply, or from purely organic day-to-day withdrawls, the bankruptcy trustee COULD initiate action to “clawback” those funds. As a hedge broker, this makes my blood run cold.Generally, as the markets move in favor of a hedge position and equity builds in a client’s account, that excess equity is sent back to the customer who then uses that equity to offset cash market transactions OR to pay down a revolving line of credit. Even the possibility that a customer could be penalized and additionally raped AGAIN via a clawback action after already having their customer funds stolen is simply villainous. While there has been no open indication of clawback actions being initiated by the MF Global trustee, I have been told that it is a possibility.

And so, to the very unpleasant crux of the matter. The futures and options markets are no longer viable. It is my recommendation that ALL customers withdraw from all of the markets as soon as possible so that they have the best chance of protecting themselves and their equity. The system is no longer functioning with integrity and is suicidally risk-laden. The rule of law is non-existent, instead replaced with godless, criminal political cronyism.

Remember, derivatives contracts are NOT NECESSARY in the commodities markets. The cash commodity itself is the underlying reality and is not dependent on the futures or options markets. Many people seem to have gotten that backwards over the past decades. From Abel the animal husbandman up until the year 1964, there were no cattle futures contracts at all, and no options contracts until 1984, and yet the cash cattle markets got along just fine.

Finally, I will not, under any circumstance, consider reforming and re-opening Barnhardt Capital Management, or any other iteration of a brokerage business, until Barack Obama has been removed from office AND the government of the United States has been sufficiently reformed and repopulated so as to engender my total and complete confidence in the government, its adherence to and enforcement of the rule of law, and in its competent and just regulatory oversight of any commodities markets that may reform. So long as the government remains criminal, it would serve no purpose whatsoever to attempt to rebuild the futures industry or my firm, because in a lawless environment, the same thievery and fraud would simply happen again, and the criminals would go unpunished, sheltered by the criminal oligarchy.

To my clients, who literally TO THE MAN agreed with my assessment of the situation,and were relieved to be exiting the markets, and many whom I now suspect stayed in the markets as long as they did only out of personal loyalty to me, I can only say thank you for the honor and pleasure of serving you over these last years, with some of my clients having been with me for over twelve years. I will continue to blog at Barnhardt.biz, which will be subtly re-skinned soon,and will continue my cattle marketing consultation business. I will still be here in the office, answering my phones, with the same phone numbers. Alas, my retirement came a few years earlier than I had anticipated, but there was no possible way to continue given the in evitability of the collapse of the global financial markets, the overthrow of our government, and the resulting collapse in the rule of law.

As for me, I can only echo the words of David:

“This is the Lord’s doing; and it is wonderful in our eyes.”

With Best Regards-

Ann Barnhardt

Thank you Bryan for posting this. Everyone should read this to get a feeling just how serious the MF Global bankruptcy is to the commodities and even securities market.

Greg

Hey Greg, I can live without the crude and vulgar bankster video made by a bunch of kids who goof off at wall-street (note: police arrests logs show most are from well to do family’s). I would take a Herman Cain who values work and honest bankers (… not the crony bankers that profits from government ties) over these useless kids any day.

G,

Sorry to offend you. Do you really think a former Federal Reserve banker is going to get his Justice Department (if elected President) to prosecute the immense crimes of bankers that have gone unpunished? I don’t, and that is what is needed to fix the system. Also, to fix the system we need real accounting by the banks (FASB was suspended the mark to market accounting rules for banks in 2009) and we need real law enforcement in the markets. People need confidence in the financial system and that is falling apart now, especially with the MF Global money grab. Cain’s 999 plan is not going to fix the country. Thank you for your comment. “Good men can disagree.”

Greg

Greg,

Thanks for another week of great reporting. I think we are all being naive about the OWS movement. They claim to have no leaders, yet they act in unision across the nation. In our area they seems to want to monopolize police resources. They get into enough minor scuffles with a few arrest for each action. They sometimes take a walk about unannouces, but meandering in traffic. There is enough mischief the police must cover them in force, just in case they get out of line. Our local police overtime budget has been entirely used up by OWS. It makes me wonder what services will need to be cut to keep the police babysitting them?

I don’t know who is behind the curtain but there is an agenda. I believe this will proceed as a resource sucking agenda that could very well bankrupt some cities. Then what? Does OZ there behind his curtain hope to grow the movement when the cities can no longer fund other services and angry people then join because they lost their services?

On the EU Germany is being asked to surrender some of their soveriengty to save the EU. Yikes, that cannot be good.

I found this very interesting on Glenn Becks the blaze.

http://www.theblaze.com/stories/going-galt-hedge-broker-shuts-down-firm-with-chilling-letter-about-the-market/

Ann Barnhardt describes herself as a an “an old-school commercial hedge broker specializing in CATTLE and GRAIN.” And she just shut down her business by delivering a passionate and chilling open letter posted on her website.Part of her letter is below. It supports what you said a couple of weeks ago to the T.

The reason for my decision to pull the plug was excruciatingly simple: I could no longer tell my clients that their monies and positions were safe in the futures and options markets – because they are not. And this goes not just for my clients, but for every futures and options account in the United States. The entire system has been utterly destroyed by the MF Global collapse. Given this sad reality, I could not in good conscience take one more step as a commodity broker, soliciting trades that I knew were unsafe or holding funds that I knew to be in jeopardy.

This a shocking alert from inside the battle lines of this economic war of words and deeds.

More troops. Great. I wonder if we’ll ever stop this…

Actually, I wonder how many military contractors we’re paying around the world and if any are stationed in Australia.

It seems to me that the switch to contractors serves more than just the goals of military dominance and corporate profiteering (both through the high paying gig, and through extracted resources.)

When the collapse occurs we won’t be able to pay our military, and we may not even be able to bring some of them home. There will also be quite a few angry voices calling out to those who’ve made off with the loot. The criminals will need protection, and mercenaries will be lookin’ for work.

What better way to ensure dominance after a collapse than to:

1. Steal a bunch of wealth

2. Establish control over necessary resources.

3. Build huge military bases with high security and plenty of weapons to maintain wealth and control.

4. Shift military personnel and actions to contractors (mercenaries) who are loyal to you because you pay them well (and you’ll be one of the few who has any money left to pay…)

5. Leave other military forces high and dry by bankrupting those who pay them (maybe you’ll shift the loyalty they once had from the place they were born, to whatever place you want them to perform for you. After all, you provide the only game in the strange town they’ve been placed in amongst people whose friends/family they’ve killed, and they can’t get back home anyway.)

Will it really matter if we’re angry when the real collapse occurs? Will they even need a global fiat currency to wield power over us?

They’ve taken steps to ensure that most of the tangible wealth is under their control.

They have powerful weapons and dutiful personnel.

They control communication and satellites.

They’re moving to ensure their control over oil.

We may assume we can get these things back under our control, but how will we do that? It’ll be David and Goliath all over again, but this time there will be no pretense of doing “what’s good for the country” wherever it may be.

It’s obvious those who’re pulling the strings have no interest in indulging us any longer than they have to. When they have no need to maintain the curtain (or the curtain is pulled down), they’ll simply sit in their inaccessible fortresses and sic drones on us.

Skynet, here we come!

Greg,

I don’t think either Democrats or Republicans will fix any problem – not unemployment, not national debt, not inflation, and definitely not the economy. The Shadowstats report reveals the basic problem. Our government has been manipulating various data to deceive the American public for too long. The people who run the country don’t use “realistic” data to plan their policies. Even if miracle happens and some legislators find a way to reduce the national debt, how can a policy targeted at a $1.3 trillion annual debt solve a $5 trillion debt problem?

Here are some interesting articles from last week:

47% or 249 Congressional members are among the wealthy 1%. (http://abcnews.go.com/blogs/politics/2011/11/47-of-congress-members-millionaires-a-status-shared-by-only-1-of-americans/)

Former Speaker of the House Nancy Pelosi was accused of inside trading with Visa. (http://www.cbsnews.com/8301-503544_162-57325148-503544/new-details-on-visas-attempt-to-influence-pelosi/)

Former House Speaker Newt Gingrich was accused of lobbying for Freddie Mac. (http://www.washingtonpost.com/blogs/fact-checker/post/newt-gingrich-and-freddie-mac-is-he-being-misleading/2011/11/16/gIQAiAvNSN_blog.html)

Millionaires receive billions in federal ‘welfare’. (http://www.washingtonpost.com/blogs/2chambers/post/millionaires-receive-billions-in-federal-welfare-coburn-says/2011/11/14/gIQAGLK5KN_blog.html)

After reading the above articles, I learned several things.

– If you want to be a millionaire, be a Congressional member. (47% is a very good probability.)

– If you want to get the best deal from Wall Street, be the Speaker of the House.

– Millionaires like the poor, need welfare too – that is equal opportunity. Next time Congress want to cut welfare spending, please think of the rich who will suffer.

Have a great weekend!

Ambrose

Ambrose,

Thank you for your comment and content!

Greg

dear sir

I am purchasing gold as per crisis and recommendations and articles on gold.indian 50 rupees is equal to one dollar.

Will it be profitable if usa DEVALUES dollar by 60percent or so in future.

Pls elaborate .

NEERAJ MATTA

neeraj MATTA,

Please stop thinking this as a trade in dollars or rupees. This should be a long term core asset and a store of wealth. It is not dollar weighted trade. The world is an uncertain place. I think you are much better off with this as a core asset than not having any at all. If you are thinking of this as mearly a trade then trade something else. That’s all I got. Thank you for reading and supporting this site.

Greg

Someone please remind Newt that no matter if he approves or disapproves of the “Occupy” movement. The protesters are practicing their constitutional right to petition their government. Not violate the constitution as Newt did back in 94 pulling off the Contract With America.

Agent X,

You are correct sir!!! But you are always welcome whether I agree or not. Thank you.

Greg

FLASH, retired Seattle police chief sides with the protesters. He was the chief during the Battle in Seattle. He said the police have become more like troops then police. It’s going to be a interesting week. PEACE