You Cannot Doubt the Gold Bull Market

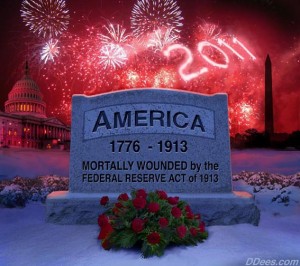

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. That’s according to economist John Williams of Shadowstats.com. For you silver investors, to equal the former 1980 high of $50 per ounce, silver would be more than $450 per ounce. The numbers say we have a long way to go before the gold and silver bulls turn into bears. People around the world are waking up to the fact that gold and silver are real money, and Federal Reserve Notes (printed like confetti) pale in comparison.

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. That’s according to economist John Williams of Shadowstats.com. For you silver investors, to equal the former 1980 high of $50 per ounce, silver would be more than $450 per ounce. The numbers say we have a long way to go before the gold and silver bulls turn into bears. People around the world are waking up to the fact that gold and silver are real money, and Federal Reserve Notes (printed like confetti) pale in comparison.

Today’s guest writer is an old favorite. He’s Brandon Smith from the website Alt-market.com. Smith is here to get in the face of the naysayers. He gives no quarter in this well written golden tour de force! Please enjoy!–Greg Hunter

—————————————————————————————

Gold And Silver: We Were Right – They Were Wrong

By Brandon Smith

Guest Writer for USAWatchdog.com

Only now, after three years of roller coaster markets, epic debates, and gnashing of teeth, are mainstream financial pundits finally starting to get it. At least some of them, anyway. Precious metals have continued to perform relentlessly since 2008, crushing all naysayer predictions and defying all the musings of so called “experts”, while at the same time maintaining and protecting the investment savings of those people smart enough to jump on the train while prices were at historic lows (historic as in ‘the past 5000 years’).

Alternative analysts have pleaded with the public to take measures to secure their hard earned wealth by apportioning at least a small amount into physical gold and silver. Some economists, though, were silly enough to overlook this obvious strategy. Who can forget, for instance, Paul Krugman’s hilarious assertion back in 2009 that gold values reflect nothing of the overall market, and that rising gold prices were caused in large part by the devious plans of Glen Beck, and not legitimate demand resulting from oncoming economic collapse:

http://krugman.blogs.nytimes.com/2011/07/19/the-glenn-beck-debeers-connection/

To this day, with gold at $1600 an ounce, Krugman refuses to apologize for his nonsense. To be fair to Krugman, though, his lack of insight on precious metals markets is most likely deliberate, and not due to stupidity, being that he has long been a lapdog of central banks and a rabid supporter of the great Keynesian con. Some MSM economists are simply ignorant, while others are quite aware of the battle between fiat and gold, and have chosen to support the banking elites in their endeavors to dissuade the masses from ever seeking out an alternative to their fraudulent paper. The establishment controlled Washington Post made this clear with its vapid insinuation in 2010 that Ron Paul’s support of a new gold standard is purely motivated by his desire to increase the value of his personal gold holdings, and not because of his concern over the Federal Reserve’s destructive devaluing of the dollar!

http://www.washingtonpost.com/wp-dyn/content/article/2010/06/13/AR2010061304881.html?hpid=topnews

So, if a public figure owns gold and supports the adaptation of precious metals to stave off dollar implosion, he is just trying to “artificially drive up his own profits”. If he supports precious metals but doesn’t own any, then he is “afraid to put his money where his mouth is”. The argument is an erroneous trap, not to mention, completely illogical.

Numerous MSM pundits have continued to call a top for gold and silver markets only to be jolted over and over by further rapid spikes. Frankly, it’s getting a little embarrassing for them. All analysts are wrong sometimes, but these analysts are wrong ALL the time. And, Americans are starting to notice. Who beyond a thin readership of mindless yuppies actually takes Krugman seriously anymore? It’s getting harder and harder to find fans of his brand of snake oil.

Those who instead listened to the alternative media from 2007 on have now tripled the value of their investments, and are likely to double them yet again in the coming months as PM’s and other commodities continue to outperform paper securities and stocks. After enduring so much hardship, criticism, and grief over our positions on gold and silver, it’s about time for us to say “we told you so”. Not to gloat (ok, maybe a little), but to solidify the necessity of metals investment for every American today. Yes, we were right, the skeptics were wrong, and they continue to be wrong. Even now, with gold surpassing the $1600 an ounce mark, and silver edging back towards its $50 per ounce highs, there is still time for those who missed the boat to shield their nest eggs from expanding economic insanity. The fact is, precious metals values are nowhere near their peak. Here are some reasons why…

Debt Ceiling Debate A Final Warning Sign

If average Americans weren’t feeling the heat at the beginning of this year in terms of the economy, they certainly are now. Not long ago, the very idea of a U.S. debt default or credit downgrade was considered by many to be absurd. Today, every financial radio and television show in the country is obsessed with the possibility. Not surprisingly, unprepared subsections of the public (even conservatives) are crying out for a debt ceiling increase, while simultaneously turning up their noses at tax increases, hoping that we can kick the can just a little further down the road of fiscal Armageddon. The delusion that we can coast through this crisis unscathed is still pervasive.

Some common phrases I’ve heard lately: “I just don’t get it! They’re crazy for not compromising! Their political games are going to ruin the country! Why not just raise the ceiling?!”

What these people are lacking is a basic understanding of the bigger picture. Ultimately, this debate is not about raising or freezing the debt ceiling. This debate is not about saving our economy or our global credit standing. This debate is about choosing our method of poison, and nothing more. That is to say, the outcome of the current “political clash” is irrelevant. Our economy was set on the final leg of total destabilization back in 2008, and no amount of spending reform, higher taxes, or austerity measures, are going to change that eventuality.

We have two paths left as far as the mainstream economy is concerned; default leading to dollar devaluation, or, dollar devaluation leading to default. That’s it folks! Smoke em’ if you got em’! This train went careening off a cliff a long time ago.

If the U.S. defaults after August 2nd, a couple of things will happen. First, our Treasury Bonds will immediately come into question. We may, like Greece, drag out the situation and fool some international investors into thinking the risk will lead to a considerable payout when “everything goes back to normal”. However, those who continued to hold Greek bonds up until that country’s official announcement of default know that holding the debt of a country with disintegrating credit standing is for suckers. Private creditors in Greek debt stand to lose at minimum 21% of their original holdings because of default. What some of us call a “21% haircut”:

http://www.reuters.com/article/2011/07/22/us-greece-iif-idUSTRE76K6VX20110722

With the pervasiveness of U.S. bonds around the globe, a similar default deal could lead to trillions of dollars in losses for holders. This threat will result in the immediate push towards an international treasury dump.

Next, austerity measures WILL be instituted, while taxes WILL be raised considerably, and quickly. The federal government is not going to shut down. They will instead bleed the American people dry of all remaining savings in order to continue functioning, whether through higher charges on licensing and other government controlled paperwork, or through confiscation of pension funds, or by cutting entitlement programs like social security completely.

Finally, the dollar’s world reserve status is most assuredly going to be placed in jeopardy. If a country is unable to sustain its own liabilities, then its currency is going to lose favor. Period. The loss of reserve status carries with it a plethora of very disturbing consequences, foremost being devaluation leading to extreme inflation.

If the debt ceiling is raised yet again, we may prolong the above mentioned problems for a short time, but, there are no guarantees. Ratings agency S&P in a recent statement warned of a U.S. credit downgrade REGARDLESS of whether the ceiling was raised or not, if America’s overall economic situation did not soon improve. The Obama Administration has resorted to harassing (or pretending to harass) S&P over its accurate assessment of the situation, rather than working to solve the dilemma:

http://news.yahoo.com/obama-officials-clash-p-over-downgrade-threats-200358261.html

Ratings company Egan-Jones has already cut America’s credit rating from AAA to AA+:

Many countries are moving to distance themselves from the U.S. dollar. China’s bilateral trade agreement with Russia last year completely cuts out the use of the Greenback, and China is also exploring a “barter deal” with Iran, completely removing the need for dollars in the purchase of Iranian oil (which also helps in bypassing U.S. sanctions):

http://uk.reuters.com/article/2011/07/24/china-iran-oil-idUSLDE76N0DJ20110724

So, even with increased spending room, we will still see effects similar to default, not to mention, even more fiat printing by the Fed, higher probability of another QE announcement, and higher inflation all around.

This period of debate over the debt ceiling is liable to be the last clear warning we will receive from government before the collapse moves towards endgame. All of the sordid conundrums listed above are triggers for skyrocketing gold and silver prices, and anyone not holding precious metals now should make changes over the course of the next month.

What has been the reaction of markets to the threat of default? Increased purchasing of precious metals! What has been the reaction of markets to greater spending and Fed inflation? Increased purchasing of precious metals! The advantages of gold and silver are clear…

European TARP?

The MSM blatantly glossed over the EU decision on the latest Greek bailout, as many pundits heralded the plan as decisive action on the part of Europe. But, what was the EU solution to the possibility of Greek default? In the end, their solution was to LET GREECE DEFAULT! Brilliant!

http://blogs.reuters.com/felix-salmon/2011/07/21/greece-defaults/

EU proponents of the plan for Greece are calling the solution a “selective default”, which I suppose, is meant to make it sound less default-ish. However, this is, indeed, a default, and many Greek bondholders are going to lose substantial sums of money as the Greek government decides who they are going to pay back, and who they are going to give the finger. Strangely, this plan also includes the creation of a kind of European Monetary Fund, or a European TARP. This means a broader strategy is being put into motion that involves continuing bailouts and fiat injections of Euros, not just into Greece, but into other countries as well, including Ireland, Portugal, Spain, and even Italy:

http://www.zerohedge.com/article/goldmans-complete-summary-european-council-decisions

Extended printing of Euros means devaluation, and devaluation means greater international interest in gold and silver. The EU Council plan is a blinding flashing neon sign telling us to BUY PRECIOUS METALS, while we still can.

Stock Market Facade Is Over And Inflation Is Here

The “great bull run” over the past two years has been somewhat successful in fooling a certain percentage of Americans into believing all the recovery talk was real. The fundamentals, though, show that this run is entirely fabricated. Besides a static real unemployment rate of around 20%, housing market hellfire, and crushing inflation in commodities, trading volume in stocks is also at a three year low:

This means that the overall value of the Dow is being driven by a much smaller pool of investors. A smaller pool of active investors means a more volatile market, with a greater chance of wild swings or inflated values. This lack of stock participation also leads one to question the validity of the bull run as a whole. What, we might ask, has really been holding the markets up for so long, if so few people are feeding the machine?

We must keep in mind that since the credit crisis began the Fed has held interest rates at near zero. That’s almost 3 YEARS of near zero interest rates; far beyond the predictions of many mainstream analysts. The reason? Easy fiat from the Fed is the only thing keeping markets alive. Without it, they would crumble. We hear only of the fiat pumped into the system through bailouts and quantitative easing, but rarely do we hear about all the printing that goes on in-between these public events. The extent of Fed currency creation is made more apparent by the St. Louis Fed’s Adjusted Monetary Base:

According to the Fed publication ‘Monetary Base In An Era Of Financial Change’, the AMBSL is an index measuring the central bank balance sheet, including open market operations, statutory reserve requirements, and foreign exchange market interventions. The index, though, includes only what is reported by the fed, and without an audit, it is impossible to determine its accuracy. In all likelihood, it actually under-reports the amount of fiat being flooded into markets.

Can the Fed prop up the markets forever? No. The volume versus value conflict is too revealing, and I believe we have reached a point at which the weight of negative data is preventing any further significant climbs in the Dow even in the face of manipulation. A kind of critical apex is created; a point at which two forces once balanced meet and derail each other. Stocks, at this time, are very vulnerable, especially when they are supported by a central bank induced fiat framework

When investors realize that the bull run is fake, not to mention over for a very long time, that dollar devaluation is a certainty, and that bonds are a deathtrap, where will they turn to protect their savings? That’s right…gold and silver. The price potential for metals going into the final half of 2011 is extremely high. Lows can strike abruptly, and they do often under such volatile circumstances, but unlike MSM talking heads, we look well beyond week to week progressions. The long term trend is really what matters, and the long term trend for gold and silver has been impressively positive.

To those who chose not to take my advice over the past three years, or the advice of countless other alternative analysts and economists, I can only say we stand by our record. Our purpose is to help you secure the safety of your buying power as much as possible in these dangerous days. That is all. It is not too late to establish a foundation in precious metals, and it is not too late to accept the reality of our country’s quandary. Warnings, though, are just a small window in time, and they are only useful, so far as they are heeded.

You can contact Brandon Smith at: [email protected] His excellent website is called Alt-market.com.

I think the point that most people need to understand is that gold has not skyrocketed in value since 2008 or since 1408. The value of gold is the value of gold. The most glaring illustration of what the liars and criminals that we elect have done to our dollar is that it takes three times as many dollars to buy an ounce as it did just three years ago.

“Gold is the money of kings; silver is the money of gentlemen; barter is the money of peasants; but debt is the money of slaves.” ~Norm Franz

Thank you Bryan abd Art.

Greg

Love this quote.

.

Outstanding hallmark !!!

re-mar-ka-ble !!!

Thanks, Baja Bryan !!!

.

Greg, B. Smith’s discussion about the stock market is right on, its been a fraudulent bull market since 2008, artificially inseminated by the Fed and the MSM through their recovery propaganda. I would like to predict a large “bear” rally immediatly (shortly) after the announcement of a debt ceiling raise deal, probably in the range of 500 to a 1000 points. The elite after about 50 percent of that “bear rally” will purchase shorts in futures and hold them adding to the shorts each day until the rally turns negative. At that time you will see the scenerio Mr. Smith discusses come out of the closet in earnest and for every point downward in the Dow you can add a dollar to gold. Frankly stated, there is no way out of this situation, all routes arrive at the same station; third world status with large guns. Finding a place to have a war will be the next big congress debate.

Dear Greg,

Very good, although Mr. Smith left out a few items.

First, fiat is NOT money, it is a receipt for gold and silver that can be traded AS money. Proof? Before the Civil War, people could deposit their gold and/or silver and receive a receipt from a bank, which could be traded for goods and services. The holder of the receipt then could lay claim to the precious metals (I have such a receipt from a bank in North Carolina, dated 1846, for the sum of $2.50).

Second, this fiat is UNCONSTITUTIONAL. The founders expressly made clear that money was to be gold, silver, nickel, and copper; and that any paper fiat COULD BE EXCHANGED FOR gold and silver (the Founders had some trouble in their time with a fiat call the Continental, which quickly became worthless).

However, it should also be explained that people WORLDWIDE are fleeing to precious metals because they do not have faith in THEIR OWN CURRENCIES, whether it be the pound, Euro, yuan, rouble, or whatever.

In short, after the market has been interfered with by governments, it is finally resetting itself. Those who hold fiat will lose.

Physical money is where it’s at! Paper money backed by the paper it is printed on and a house of cards back by a country that is subjugated by those who issue the currency. I have noticed that this is a recurring theme in the debt enslavement of the world by the banksters. There is a reason our founding fathers only allowed corporation to be temporary entities. They found through their experience with the East India Trading Company and the British monarchy that it created a threat to free people and free enterprise. Today, we are under that threat again by the same systemic model of corporate governance through trade, tax policy and corporate fascism by the business community and government.

Here is something I have questioned for years… The futures market began with farmers who bargained with the local market to give an advance to plant a crop or buy cattle. This concept of what I term as “forward selling” actually means that the producer is so poor that his business is not self-sustaining and he is actually being underpaid because he has no profit and must borrow against his future crops… hence, the futures market. Now, this forward selling of products has gotten so big that it encompasses every imaginable commodity. This is creating much inefficiency in our markets and it is skimming money off the top of the economy preventing any real economic increase for the producers as the intermediaries scrape off the cream and trickle down the rest.

Thanks Greg and Brandon

Thabk you Mitch, Vess and Kenny.

Greg

“Plan also includes the creation of a kind of European Monetary Fund, or a European TARP. This means a broader strategy is being put into motion that involves continuing bailouts and fiat injections of Euros, not just into Greece, but into other countries as well, including Ireland, Portugal, Spain, and even Italy:”

Currency investors must know something more than we do if the Euro keeps heading higher than the USD even with the above statement is true.

Sobering piece. Thanks Greg (and Brandon).

Greg, Brandon Smith does a great job explaining the many reasons to hold gold & silver. Yes Obama & the republics are clueless of how to stop the train wreck that has already happen. They just are just like the terrorist who sets off one bomb & has another one ready to go off when rescue workers come to help the wounded! They are no difference. If a politician ask someone for advice and the lives of 1000 people are on the line he will take the right advice to save the people as long as he/she gets the fame & recognition for doing the right thing, but if he/she sees nothing in it for them, the people will die. That were we are at. Gold & silver protects any assets we have left & when the default/reset does take place gold /silver will be your protection from what politician’s do.

I like Armstrong’s version of what gold is & what is not! It makes sense after you read it a few times. FDR broke contracts, Obama did the same, FDR gave the Seventy-Third Congress a windfall of 2 billion dollars when he devalued the dollar & Americans got screwed. Readers should decide for themselves; http://armstrongeconomics.files.wordpress.com/2011/07/armstrongeconomics-we-print-bonds-not-money-072211.pdf.

Greg, this is off subject but still concerns gold & silver. The daily coin news I read had some great info on the 1oz silver Panda Chinese Proof Like Coins Minted between 1989 & 2011, it seems the 2000,2003,4,5,6 are highly sought out coins by collector because of low mintages & collectors in China pay big money for the coins. I had bought some years ago & had forgot all about then until I read the article, folks if you have these coins they could make you some good profits & you can add to your insurance big time if you have them graded by PCGS or NGC. My invoices showed just how much these NGC MS69 coins had increased in value! If any one holding these hot Silver Pandas you should consider selling them now. The 2000 NGC MS69 Panda sells way over $600.00 or more, if using EBAY don’t buy raw coins, a lot of fakes out there, get the NGC,PCGS graded ones and you will find the prices are cheaper late in the night, many do not keep up with the collectors markets & sell these NGC graded for $25-30 over melt. A local dealer had 5 NGC MS69’s 2000 & I picked then up for $20 over spot & had a buyer at $600 each just a fews miles from home. Of course he had a buyer & the price keeps moving up! There is still ways to find deals if your willing to keep up to date of what hot & whats not in the coin Markets. Many dealers deal in such high volume, they forget about staying current with world coin collecting news. With more in China becoming millionaires, they have set the Chinese coin markets on fire & if you have time to stay current while the big dealers are to busy, you gains could be huge. Pre 1933 U.S.$20 Gold Coins graded by NGC & PCGS in MS65 are being sold very close to melt, this was un heard of until Gold hit $1600.00, these dates will always hold a value of $1500.00 or more even if gold drops to $150.00 a oz! I know not every one can afford to load up on 10 or 20 of these rarities, but one or two put back for your grand children some day could pay off big time for them!

PAST politicians spent until they have destroyed the system that was flawed in the first place & pass on all the pain to the people. They will protect their ability to keep on spending even if it destroys the Republic & a market that has been manipulated for so long no one in there right mind would trust to park their wealth in it. The politicians & bankers see it as their cash cow & when it no longer gives the milk they need, they go after the nations retirement accounts. Have you seen any banks or politicians give up any of the perks or put their wealth on the line? NO & you want. The less you let the gov knows about your private wealth the better chance you will be able to weather all the wild crap the political class sling at the problems they created and can never fix. We saw what happen to the folks who took the their Coins to the Mint to see if they were real, the lawyers for the Gov twisted the words so the jury did not think like free people. Coin news said if the jurors had not been tarnished by a court system which no longer sides on the side of the innocent people, but will always side with the well connected bankers & politicians because the judges are appointed by politicians and protect their own kind,bankers & politicians! These are the same judges who let prosecutors to go for the hardest penalty to gain as much attention from the press & MSM to further their careers while the crooks remain free & the innocent are forced into a plea to lesser crime they never committed in the first place. This happens in NYC courts daily, you saw how the head of the IMF was tried & convicted by the talking heads of the MSM who said the lady was raped with out any true evidence except what was made up by the MSM. His life was ruined by the political machine, this proves that freedom is only for the few!

I heard the awful news the treasury was thinking of using the 6 or 8000 tonnes of gold reserves to get a loan from the Federal Reserve, at $42 a oz this would be nuts. If all manipulations were to stop & gold was allow to go to the true market price which is way past $1650 a oz it would still never fix a broken system. We have sovereign debt crisis that is truly a ongoing contagion. The financial crisis is right over the hill & it’s not just the U.S. in trouble, it’s the whole world. Our system of debt is collapsing & if they cut every program to the bone & and the debt will still increase as long as we keep borrowing. If you have prayed for something, please PRAY for common sense to show up.

Thanks M. Smith and Master Luke!

Greg

Greg is right, gold and silver have a long way to go. Why? Because the economic hardship has just started.

During the depression investors knew to exit the stock market when the everday worker (uneducated with lack of income shoeshiners) were talking about their stock portfolios to their bosses, while shining their shoes. In relation to this, the average worker is not interested in a gold portfolio in the U.S. This “Gold Rush” is in its infancy.

Also, the people who put these comments should realize that gold is also a hedge for default. The U.S. has already partially defaulted due to its unability to pay its full debts.

If the U.S. Fiat currency is dropped internationally as the world reserve currency then it losses more value. Gold has a lot more plus reasons to invest in then not to invest in.

Hi Greg and fellow watchdogs,

House minority leader Nancy Pelosi looks so cute on TV saying, “What we’re trying to do is save the world from the Republican budget. We’re trying to save life on this planet as we know it today”. I hate to break the news to Nancy but she’s a little late; the world as we knew it ended yesterday.

Thank you George!!

Greg

Mr. Hunter, If I am not mistaken didn’t the federal gov confiscate gold from the people during the depression? If I was to buy any precious metals I would make sure it wasn’t traceable. And what about the other precious metals? Cold Hard Steel and lead? I am also investing heavily in Tin(canned goods). It seems no me most are worried, and rightfully so, about their future. But you should also worry about physical security and basic needs. I just sold the last of my small amount of Silver to pay my property tax that is due in september. (Just an observance from the trenches of economic chaos.)

Thank you Mike and Tomas.

Greg

Mike is so right. Buying gold from an untraceable sousrce is a good first step. However, selling to an untraceable buyer is, therefore, essential. Currently, gold is is considered a collectible, and the tax rate on profit from collectibles is 28%, I believe. It’s unfair that protecting purchasing power gets taxed so heavily.

Finding an untraceable buyer may be harder than finding the untraceable seller. If the source and disposition of gold can’t be traced, you bypass the tax man… not that I would ever encourage unlawaful tax-avoidance behavior. We’re just talking facts now.

If you’re reading this, Mike, please tell us how you sold your silver, and if you had to divulge anything that might subject you to the IRS colletibles tax.

…ikb

The problems our country faces today exist because the people who work for a living are outnumbered by those who vote for a living.

US Currency should be tied to precious metals primarily on these two statements.

1). So a wealthy elite group do not have control over the U.S. monetary policy (Private Insitution Federal Reserve).

2). To promote the free market.

Less government control = less private control when the two are equal.

.

dear Master Luke,

That is perfect, but … bringing down the powers to be …

It´d take a civil war to gain it !!!

by :

Master Yoda 😉

Just a quick thank you for the advice you gave me last year about buying gold and silver. I followed your advice (about what type and size) to buy and have had no regrets; quite the opposite. Even at $1600 plus, I intend to buy more of both as I think, at this point in time, there is no ceiling. Also, despite everyone’s advice, including my financial advisor’s, I pulled out of the market completely. In this terrible time of chaos and uncertainity, I feel confident and peaceful that I made the correct financial decisions for myself. So, again, thank you Greg and continue to keep us well informed.

kc ramone

kcramone,

Just keep in mind this market can and will have big corrections along the way. Thank you for giving me an update and I am happy it worked out for you. The best thing is you have taken out an insurance policy for calamity and inflation. All the best to you.

Greg

.

Greg,

Congratulations !

The level of guys he is just pristine !

.