Latest Posts

Libya’s Questionable Future

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

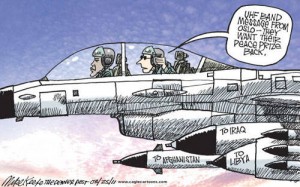

Gaddafi’s reign is over. I am happy for the people of Libya, but I am not as jubilant as the crowds I see partying in the streets. I wonder if the country will go from a dictatorship to a theocracy steeped in radical Islam. I say this because in the early days of the rebellion, there were many reports that connected the rebels with al-Qaeda. (more…)

Where Are We?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

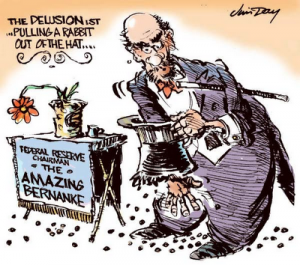

Yesterday, the Dow was up more than 300 points, and gold hit another all-time high before dropping nearly $100 an ounce. You would think the stock market was back and the gold trade was over. Wall Street is excited about recent bad economic news that just may force Fed Chief Ben Bernanke to start a third round of quantitative easing (QE3). I hate to break it to Wall Street, but QE3 is already underway in the form of 2 years of guaranteed near 0% interest rates. (more…)

Debt Downgrade part of Bigger Plan?

The debt downgrade of the U.S. debt has caused much calamity and confusion. The stock market has sold off several hundred points since S&P took the action earlier this month. Is it a big deal? You bet, but it is not the immediate end of the line when talking about the U.S. Treasury market. Brilliant economist Martin Armstrong recently said, “When you deal in REAL money, there is a problem. How do you store it? You can’t just put a billion on deposit at a bank. (more…)

Good News in Libya Won’t Last

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It looks like the end of power for tyrant Muammar Gaddafi. He’s been in power 40 years, but what will take his place? Remember when stories broke out a few months ago about Libyan rebel al-Qaeda links? It is a fact that was reported in one of many publications such as The Telegraph back in March. The story headline read “Libyan rebel commander admits his fighters have al-Qaeda links.” (more…)

Weekly News Wrap-Up 8/19/11

Greg Hunter’s USAWatchdog.com

Another 400 point drop in the Dow yesterday and all I can say is here we go again! Many are asking what’s going on? It is two big things. Nothing has been fixed since the financial meltdown of 2008, and there is way too much debt on both sides of the Atlantic. There is little wonder why gold is hitting all-time highs. The economy is tanking and inflation is picking up. All this and a lot more on the “Weekly News Wrap-Up” for Friday August 19, 2011. (more…)

Here We Go Again!

By Greg Hunter’s USAWatchdog.com

It was another 400 point loss on the Dow today. Manufacturing is contracting according to the latest reports, and Europe is in very big trouble with sovereign debt (especially with Spain and Italy). If the Euro falls apart, then the dollar will be the big near term beneficiary. So, the buck could actually strengthen for a short while because it would be the prettiest ugly girl in the currency room. If stocks (especially the banks) keep getting pounded and the economy keeps sinking, then the fed will be forced to act or let the economy and the market fall off a cliff. (more…)

0% Interest Rates Lock in Inflation

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The decision by the Fed, last week, to keep a key interest rate at near zero percent for 2 years is historic because the Fed has never done this before. This action will have profound negative effect on the U.S. dollar and its buying power. It also signals that even the Fed thinks the economy is not going to get better for at least 2 years. This action will affect every American and telegraphs a policy of inflation by the government. (more…)

What’s Going On with Silver?

Even though silver and gold are both up around 25% for the year, silver has been lagging gold’s recent spike. Plenty of folks have been asking what’s going on. In the big picture, what is happening is fiat money is in the process of dying. Can governments save the fiat system with austerity? I don’t think so because there is simply too much debt in the world. What I do know is the rich are turning to physical assets for protection from calamity and inflation. Silver is used for storing wealth and industrial production. It is only a matter of time before silver catches up with gold, and most experts say it will go up in price on a percentage basis much more than gold. (more…)

Why Does Mainstream Media Disrespect Ron Paul?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Watching the Sunday talk shows and looking at the reporting from this weekend’s Republican straw poll, you would not think that Congressman Ron Paul even participated in the event. Paul came in a very close second to Representative Michele Bachmann in a field of Presidential Candidates. Bachmann received 4,823 votes; Paul received 4,671 votes, which represents a margin of just 152 votes. (more…)

Weekly News Wrap-Up 8/12/2011

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The stock market had a wild ride this week. It was more like a bucking bronco than a way to save and invest your hard earned money. The market seems to have turned into a violent casino, only the Wall Street sharks and short sellers will come out on top. Riots in the UK are so out of control that the British government is thinking about spraying rioters with purple dye to identify them later. (more…)

There’s A Lot Less Real Money Out There

A while back, I made a prediction that something bad was going to happen before the end of 2011. I think the recent stock market plunge qualifies as “something bad.” Where have all the trillions of dollars gone from the stock market? I think Wall Street is up to its old tricks and harvested the public’s hard earned 401-k money—again. The stock market has been an awful place for the “buy and hold” investor to park his money for the past 11 years. The little guy has been fleeced time and again by the short selling sharks. (more…)

Don’t Bet Against Gold or Silver

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

You have to respect the power of the Federal Reserve when just a statement can turn the entire stock market around in a day. Yesterday, the Fed admitted the economy was not good and in a statement said, “. . .downside risks to the economic outlook have increased.” Because the economy is tanking, the Fed promised to keep a key interest rate at near 0% for “. . . at least through mid-2013.” (more…)

Ramifications of a U.S. Debt Downgrade

The U.S. debt downgrade is really more than a tiny one notch cut in the credit worthiness of the U.S. One talking head on television said yesterday that there was never any question that the U.S. would repay its debt because the country can print money. The talking head is correct but does not take into consideration the future buying power of the repayment dollars. Printing money at the rate the Fed has been doing devalues the currency and, in effect, allows the government to default with dollars with reduced buying power. This is precisely why Bill Gross, head of the world’s biggest bond fund, PIMCO, said recently that people who invest in Treasuries will “get cooked.” (more…)

Brace for Impact

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“Brace for Impact.” I have thought about this economic collapse title for months. I held onto it and figured I would know when the right time was to put it out there. Today is the day. Watching mainstream media (MSM) this weekend, you would think a one notch downgrade to America’s debt doesn’t really matter. For example, former CNBC anchor Erin Burnett said Friday night on CNN the downgrade was “already priced into the market.” The panel spoke as if the first U.S. debt downgrade in history was no big deal. To that I say, positively absurd! (more…)

Weekly News Wrap-Up 8/5/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big drop in the Dow is the result of a global solvency crisis. The U.S. is spending money by the trillions, and Europe is headed for a crash touched off by Italian debt. The economy is stalling. The Federal Reserve, no doubt, is contemplating another round of money printing to bail everybody out—again! Even gold and silver sold off. Is the Bull market in precious metals over? It’s all covered by Greg Hunter in the “Weekly News Wrap-Up” on USAWatchdog.com. (more…)