Latest Posts

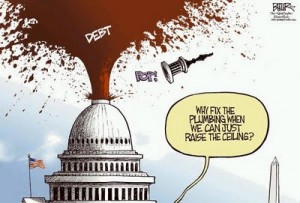

Gloves Come Off in Debt Ceiling Fight

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

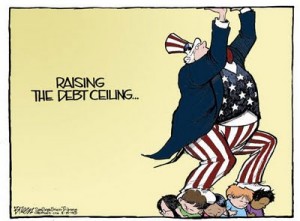

The gloves came off in the fight over raising the debt ceiling yesterday. On CBS News, the President basically threatened to cut off Social Security checks by August 3rd if a deal was not reached. Mr. Obama said to veteran newsman Scott Pelly, “I cannot guarantee that those checks go out on August 3rd if we haven’t resolved this issue, because there may simply not be the money in the coffers to do it.” (more…)

Bad Unemployment Report Tangles Debt Deal

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

If the debt ceiling deal wasn’t complicated enough, Friday’s terrible unemployment report poured sand into the gears that ground negotiations to a halt. Nothing came out of Sunday’s meeting of Congressional leaders at the White House on resolving America’s debt crisis. (more…)

The Weekly News Wrap-Up 7/8/11

By Greg Hunter’s USAWatchdog.com (Updated and revised)

By Greg Hunter’s USAWatchdog.com (Updated and revised)

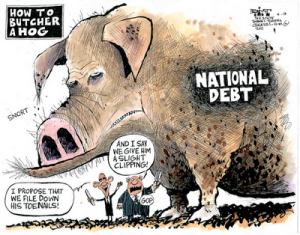

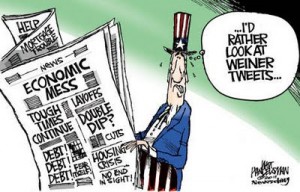

It is amazing that so few people know or want to know about the debt ceiling negotiations going on in Washington D.C. this weekend. It has been reported the raise is in the neighborhood of $2.4 trillion. That’s 2,400 billion bucks, and please remember a billion is 1,000 million. On the other hand, the public is being bombarded with every tiny detail about the Casey Anthony case by the mainstream media. (more…)

The People Fiddle as the Country Burns

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Thank goodness the Casey Anthony case is over! The jury thinks she is not guilty of murder. I don’t know if they got right or wrong, but I do know many dollars and much air time was devoted to a story that will have zero effect on the lives of 99.999% of Americans. I think the discovery of a walking, talking Martian would have gotten about the same attention. (more…)

Plunging Fuel Prices Will Not Last

Towards the end of June, the International Energy Agency (IEA) announced a plan to release 60 million barrels of oil to combat the high prices brought on by the Libyan crisis. That’s about 2 million barrels a day since June 23. It looks like prices have already hit bottom, and most think the cheap gasoline and diesel fuel will not last. I think this could be a dress rehearsal for this time next year, just before the 2012 elections–but what do I know? (more…)

Towards the end of June, the International Energy Agency (IEA) announced a plan to release 60 million barrels of oil to combat the high prices brought on by the Libyan crisis. That’s about 2 million barrels a day since June 23. It looks like prices have already hit bottom, and most think the cheap gasoline and diesel fuel will not last. I think this could be a dress rehearsal for this time next year, just before the 2012 elections–but what do I know? (more…)

Weekly News Wrap-Up 7/1/11

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Greece is back in the news again because it voted for tax hikes and government cuts to pay back the greedy bankers. It has been widely reported that this simply buys time. Many experts say Greece will default in time because the debt is simply too great. Speaking of debt, there is a battle raging between Democrats and Republicans over raising the debt ceiling some $2.4 trillion. (more…)

Bankers vs. People

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

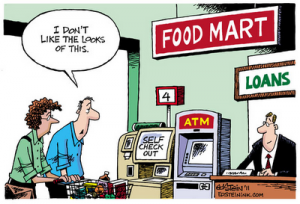

The entire crisis in Greece (and the rest of the world) all comes down to bankers vs. the people. The bankers made crazy, reckless loans to this tiny country. If you look back to when the loans were first offered, it’s hard to believe the banks did not know what they were doing. Did they not know that most people in Greece did not pay taxes? Did they not know many retired at 50 years old? (more…)

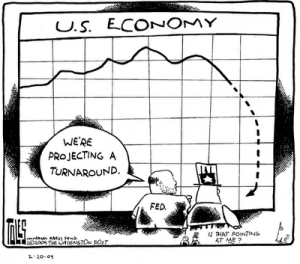

Federal Reserve Secrets and Lies

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Federal Reserve has been a clandestine organization since its inception. It is not really part of the federal government; it is merely a subcontractor for monetary policy. The Fed is basically a cartel of both U.S. and European banks. It has pulled the levers in the economy from behind a curtain of secrecy since 1913 and has always enjoyed a certain degree of respect and admiration. (more…)

The Weekly News Wrap-Up 6/24/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

From Greek debt to U.S. debt the world is struggling to pay it’s bills. In Greece it is really a battle between bankers who made reckless loans and people to become debt slaves to pay them back. In America the debt battle continues with the latest talks breaking down over taxes. You just cannot forget the Middle East and Northern Africa. (more…)

Playing with Debt Nukes

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The situation in Greece is bleak. Sure, the Prime Minister, George Papandreou survived a confidence vote yesterday, but he is a long way from solving the debt crisis in his tiny country. The public debt totals $500 billion. The plan is to add another $150 billion or so in debt. It will be a second bailout package to keep the country afloat. (more…)

What is Money?

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

The Weekly News Wrap-Up 6/17/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

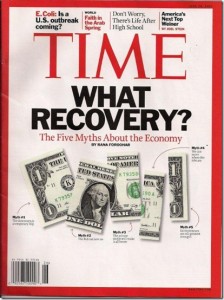

There is a lot to cover in the Weekly Real News Wrap-up this week. First off, Greek debt problems look like they are going to get ugly, and this could spell problems for Europe and the world. Looks like Greece will default, we just don’t know how bad it will be. Bill Gross says the U.S. is in worse shape! There is a showdown between Congress and the White House over Libya. Congress wants oversight and the President says it is not necessary. There was a big defeat for the bankers in the foreclosure world. It also looks like the mainstream media is finally catching on that the economy is really bad. The cover of Time Magazine is the latest of the MSM to finally tell you there is NO RECOVERY. (more…)

Print More Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The second round of quantitative easing (QE2) is scheduled to end June 30, and already there are calls for more financial stimulus to keep the economy from falling off a cliff. The latest call came from Larry Summers, former head of the Obama Administration’s financial team. In an Op-Ed piece that ran on Reuters last Sunday, Summers pitched the idea of a $200 billion cut in the payroll tax. (more…)

Mainstream Media Signals Economy Getting Bad

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It seems the mainstream media (MSM) is waking up from its long sleep. The dream world of “green shoots” and “recovery” is fading into staggering unemployment and plunging home prices. Most of us in the real word have known for some time that there is no recovery. People are not optimistic no matter how many times they are told things are getting better, and a recent poll by the Daily Beast and Newsweek proves it. (more…)

The Weekly News Wrap-Up 6/10/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I am going to be putting a new segment on the site called the Weekly News Wrap-up. I will be highlighting the important news you need to be watching. I will not be covering things such as Anthony Weiner and his lewd twitter pics. I frankly do not care about crap like that and you shouldn’t either. (more…)