Record High Gold all about Fear

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

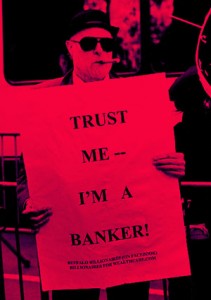

There has been one record high after another for gold. They say the markets are ruled by fear and greed. In this case, it is simply fear that is driving the yellow metal higher day after day. There is a perfect storm of doom in the economy right now. The biggest problem is debt. It just went parabolic with the revelation that the banks are stuck with trillions of dollars in worthless mortgage backed securities. I wrote all about this Monday in a post called “Could Foreclosure Fraud Cause a Banking Calamity?” The U.S. government is going to come to the rescue and bailout the banks once again. The problem is so enormous that a government bailout will not be big enough to fix the problem, but merely put off an inevitable financial collapse. This will cause the dollar to die a not so slow death and cause massive inflation (or hyperinflation) which, in turn, will also kill the economy.

Famed gold investor Jim Sinclair has been saying for years on his website, JSMineset.com, that derivatives (including mortgage backed securities) were going to blow up someday and become worthless. It looks like that day is now here. Recently, Sinclair said, “Racketeering suits (RICO), now as civil class action suits in two states, have hit the nail on the head. The civil suit says the banks do not have proper title to the homes on which they are foreclosing. This by direct inference questions if securitized debt on mortgages have real collateral behind them. Simply stated a long time ago by Marie McDonnell and myself, THEY DO NOT. That means legacy assets are cooked, dead, and worthless, yet are now marked up in value to cost and above.”

Sinclair also says, “It is all over. Gold is going to and through $1650.” So who is buying all this gold?–The rich of course. You see, they want to stay rich and not be stuck with funny money that the government printed (out of thin air) to bail out the banks, again. A recent Reuters headline said, “Super-rich investors buy gold by ton.” The story went on to say, “The world’s wealthiest people have responded to economic worries by buying gold by the bar — and sometimes by the ton — and by moving assets out of the financial system, bankers catering to the very rich said . . .” (Click here for the complete Reuters story.)Little people (like you and me) should do what the rich do. If you cannot buy gold, then buy silver. It is a much better deal right now. Also, it was announced last week that central banks in Europe stopped selling gold. A recent CNBC story gave the reason, “The shift away from gold selling comes as European central banks reassess gold amid the financial crisis and Europe’s sovereign debt crisis.” “Financial crisis”– this is a fear trade done for preservation of wealth and nothing else. (Click here to read the complete CNBC story.) Suspension of European central bank gold sales will take hundreds of tons of supply off the market and send prices higher.

You say you still just don’t understand why the rich are fearful? I just received this comment yesterday from one of my readers named Jon, who wrote, “This is the last straw for me. I am no longer paying mortgage. If others are getting off the hook, I might as well too. There is nothing to lose by acting disobedient in this system anymore. In fact, bad behavior is rewarded! I saw this loophole last year but have decided now is the time to stress-test the system. If everyone joins in the movement to get free homes, there will be too much work for the thugs to deal with. Everyone’s doing it! Jump on the bandwagon and get our country back from these evil souls who stole it.”

Now amplify Jon’s plan of action times millions of homeowners who feel the same way– cheated by the banksters. I don’t blame Jon for thinking this way, but if he and millions like him stop paying for their homes en masse, then the system will crash. The government will feel forced to step in with funny money and try and stop the banks from failing. These are the reasons why I say, “Record high gold is all about fear—not greed.”

Gold is going much higher, silver too. Hyper-inflation is baked in the cake and when the FED cuts the interest rate back to zero, there will be a decision of savers to keep funds in the bank earning nothing, or in gold going up 35% a year for the last 5 years?

Gallen,

I agree. Thank you for the comment.

Greg

Well Greg people can only take so much gloom and doom. So far nothing has happened to cause the average person to regret not preparing for a desolate future. I have been reading blogs where posters have said that they will not make their mortgage payments and will buy precious metals until they are forced to resume house payments. Fine, but that is bubble country too.

Every day when I am out and about I feel like a member of a parallel universe observing the petri dish of humanity. Everything looks and feels “normal”; no disaster bacteria evident. If the system crashes as is predicted by almost all the blogosphere it must be a nearly instantaneous feeling event. Such a thing would leave a landscape resembling a very large natural disaster with no functioning services and plenty of aimless, bewildered citizens with guns.

Thank you John Bernard.

Greg

What would be the ethical response of a homeowner/mortgagee who had just received a letter from his bank asking for his help in documenting the note?

It is looking increasingly more likely that without the mortgagee’s help in providing documentation, the note will be wiped out, along with the corresponding collateralized debt obligation security that the note is supporting.

Good points Dave and PRice.

Greg

I can understand why people would want to cease making payments on their morgage (especially if they’re under water), but in the long run, if they keep paying on the loan they will eventually have an asset that can be sold or borrowed against.

Those borrowers that wish to act like spoiled children by not making payments will regret it when they realize that they could have a paid off home in 10 or 15 years, but now cannot sell it due to defaulting and not even knowing who owns the title…

Keep making your payments, it isn’t worth shafting the banks in the long run.

Hey Greg,

Perceptoin rules in politics. In many cases though, the perception is wrong. Take this statement: ‘Sinclair also says, “It is all over. Gold is going to and through $1650.”’

Gold is not “…going…through $1650.” A true statement is: The dollar’s value is free-falling while the value of gold stays stable.

Here is another popular perceptive myth: “…cheated by the banksters.” The banksters did not get Bill Clinton, Barney Frank, and Chris Dodd to force the evil banksters to loan money to people who did not have a job or adequate income (I must be fair, Bush 43 and republicans did not reverse these regulations which is just as bad).

Rich people aren’t buying gold because of FEAR. Rich people are buying gold because they use their eigth-grade-math-skills to conclude that the dollar is not stable. Gold always is.

And now I am OT. The banks that don’t have clear title to the properties that they are disposing of should be charged with fraud. If the bank lost the title, or did not record the mortgages properly (which is the issue; nobody cares what paperwork the bank has; we only care what the county recorder’s office has in its files) the bank cannot foreclose and loses their investment.

thanks,

markm

MarkM,

Thank you for the comment and perspective.

Greg

Greg,

As always a great job. I do, however, take issue with Jon’s actions. He signed on the dotted line and took on the responsibility.

I lay more blame at the feet of the banks. They knew many of these mortgages were junk but knew they were selling them off.

In the end there can never be enough laws to regulate an immoral society.

Will

Will,

It is not right but more and more people will be doing what Jon is going to do. Take the info and think “protection.” Thank you for your comment, I would not stop paying my mortgage but I am not passing judgment.

Greg

Greg,

I won’t pass judgement on Jon, or anyone else. That’s above my pay grade. OTOH, as a society where is the line?

As a small business owner we have issues with customers trying to rip us off with some regularity. People lie to my face, when confronted with the truth (irrefutably in writing) they switch to the next lie without missing a beat. Of course the majority are honest, which ones cause all the ‘silly’ rules and regulations?

In the end I would not want to be affliated, in a financial sense, with someone who walked away from a mortgage they had the ability to pay. When would they decide our deal wasn’t worth living up to?

I believe, somewhat because of your excellent work, that things are going to get much much worse. I may someday be broke, hungry and homeless. But my word will still be my word.

Will,

The world needs more people like you! Thank you for your comment.

Greg

check it out!

R

Greg, as usual, a wonderful piece; keep churning them out.

Some say that, today, fear is what is driving the gold market and, to a certain extent, I’d have to say they are right. However, not all fear is unfounded; in 1944, a German living in Berlin had good reason to fear the Allied landings in Normandy. The real question is whether or not it is irrational fear.

What gold is, ultimately, is money. The dollars in your pocket are not money, but currency whose value is determined by government fiat. Since money is what evolved to replace barter, and barter is nothing more than an exchange of labor between parties, then money is the physical representation of labor. If this is so, then for something to be money, it must also be created by labor.

Further, if I have excess labor (savings), the value of it should not fluctuate outside of normal supply and demand dynamics.

As fiat currency can be created without labor, and the value of it (and my savings) can be eroded by political whim, while it may facilitate trade, when enforced by legal tender laws, it cannot be money.

Some will say that gold has no true intrinsic value while ignoring 5,000 years of human history to the contrary (isn’t there something about those not learning from history?). It was just over 2,000 years ago when three wise men visited a new born child and delivered three gifts to Him; one of them was gold. It had value then, it has value now, and it will have great value amid the future smoking ruin of the empire of paper created so recklessly by a government, and its people, so untethered to reality.

Allow me to add this anecdote: after becoming a “goldbug”, in 2005, I shifted my investment philosophy. At first, it was difficult to get my wife on board. One of the main points of contention was a six figure account that I wanted to close and convert a substantial portion into gold. That account had been averaging 10% per year since 1995. My wife didn’t believe we should give up a “sure thing” for something as “risky” as gold. As I continued to watch gold advance, I made the unilateral decision to close the account and redistribute it into gold assets. As you can imagine, that decision caused a stir in our household. However, exactly one year later, my wife proclaimed she would never doubt me again. It was the morning we woke up to find Bernie Madoff under investigation. That is where my account was held (so much for a sure thing).

The “risky” asset, gold, has never been worth zero. It is the world’s lowest risk asset class. Indeed, should it ever be worth zero, then the only “precious” metal you should own is lead and something with which to hurl it at great velocity.

When someone loses their job. that’s a terrible thing. When your home loses value, that’s a terrible thing. But, when money loses value that’s, the most terrible thing of all. With what passes for leadership in Washington, I think it’s safe to conclude there will be a lot more dollars created in the future than there will be ounces of gold; a simple supply and demand function tells us that their respective values will be inversely correlated.

Thank you Nelson for the comment and kind words.

Greg

Hi! My Fellow Americans:

The last time I looked @ an attomic chart Au was there but I could

never find paper but what has that got to do with either fear or

greed? Gold is gold! Paper is, well, just paper. Gold can be used

to make a wedding ring; while no bride ever wanted a ring made out of

paper have they? If a bride can see the difference without being

either fearful or greedy but just by her own common sense; why can’t

we do the same?

Cheers From California

RUSS

Russ,

I like the way you think!!

Greg

Greg –

Indeed, the hope was to be able to ‘ratchet-down’ the dollar and spread out the inflationary results over a period of time, so as to not scare the horses. That assumes of course, that one has control of all levers and all external (known and unknown) circumstances at all times.

Of course, this is unrealistic. But who knows – the crafty and clever moneychangers have been plying their trade for thousands of years. They likely have a few more clever schemes in the playbook to bamboozle the public, all the while they secure themselves and their assets.

How much longer can this all hold together before the inevitable crash and subsequent social disorder begins is anybody’s guess at this point.

When the general populace finds that their political leaders are not only corrupt, but willfully robbing from them to maintain their own order and power structure, that is when the bearings fry and the wheels begin to come off. As many others have already suggested, the only question is: How much longer?

Agent P,

Very good question.

Greg

what a myopic USA centric view. ALL countries save for one are weakening their currency, and every country save for one are having economic problems. savers around the world – individuals and governments are buying hard assets – look at the CRB Indexes – ALL HIGHER – people are not stupid – they want THINGS that will hold value and are afraid of banks and their paper and digits “money” which can be flushed at a whim. I don’t call that fear based, i call it flight to quality – a noble pursuit. In China (the one exception) the government suggests they buy gold and silver as investment – when is the US Government going to tell us there is a bump in the road??? about 6 months after our car axle is ripped off…

BW,

I guess you did not see where I included the European central banks. You do make some good points in your comment though. Thank you.

Greg

Greg,

What you fail to mention is that the super rich aren’t really super rich! They themselves were bailed out when the mega banks were bailed out, this depression is all about power. The super rich, who are now buying gold, would have lost all of their power and money had the banks been forced to write down the value you of all their garbage. I mean who would have donated all that money to Obama if they had no money to donate? Capitalism is essential to democracy or a republic, because money is a mean’s to power. So if you are a part of the elite class and you are friends with the central banker from the good ole day’s at Harvard, then yes you will get a bailout. The problem is even wider then that, you could trace it back to the great depression but now is neither the time or the place. You should write more articles explaining how both republicans and democrats are irreversibly corrupt, and how central banks are the exact opposite of a free market. Time to resurrect Andrew Jackson

Trent,

I did not mention it in this post but I have in the past. The super rich were bailed out, you are correct. Everyone from Buffett, to hedge funds, to private individuals received some sort of government largeness. This makes me sick!!! No help for the little guy!!! “Let them eat cake.” Thank you for the good comment!!!

Greg

Move along people, nothing to see here..

If you put a frog in a pot of boiling water he will jump out. If you put a frog in a pot of water and slowly bring the tempature up to boiling he will slowly boil and never jump out.

If you take away peoples money they will revolt. If you slowly take away their house, cars, jobs etc they will eventually be to weak and hungry to revolt.

My two cents.

Wilfong,

Your two cents were worth reading!!

Greg

“And one day what was done in the dark will be brought to the light.” And to think that the little people will once again take the biggest hit. Nothing has changed in 8000 years. Great job greg, as always.

Brian,

All folks can do now is use this time to prepare for what is surely coming. Thank you for your comment and encouragement.

Greg

My question is, will the use of RICO laws ever produce any of the top political & bankers to get real jail time for the evil deeds they did & are still doing? Or will they cover their butts by starting more wars to keep the heat off of them for the crimes they have done!?

M Smith,

It sure doesn’t look that way, but hundreds if not thousands of bankers and Wall Street traders should go to jail.

Hey Greg, Do you remember the movie “Trading Places” with Eddie Murphy? If I recall the basic premise was how outraged Eddie’s character was to find out that his entire life had been totally messed with and manipulated behind closed doors by a couple of rich, elitist jerks(The Snerds) over 1 fake U.S. Dollar. HHHHHMmmmmmmmmmmmmmmm……………..

Tom H,

Good visual!!!

Greg

The point that everyone is missing is that absent foreclosure and banks holding properties for resale $100’sTrillions in OTC derivatives are now without any asset base, ie they are in default. Those damn things have been sold worldwide, mainly, but not exclusively, by Wall Street.

That is the elephant in the room as far as global systemic financial collapse is concerned.

I see no effort on the part of US, UK, EU, military to pull in their horns, indeed the US is intensifying efforts in the “Stans” to destabilize the area (to pressure Russia and China)in the same way that the nations comprising Yugoslavia were pressured and destabilised, and split, following Tito’s death. Several more “Narco” states, like Afghanistan, are the likely intended outcome.

There will be blowback.

I note with interest that the Taleban spent 3 years in New York, pre 9/11, negotiating with the administration, basically offering whatever pipelines, minerals, etc the US required. In the event the Taleban made the mistake of cutting the CIA finance line by solving the Narcotics problem, so, we are where we are. The need arose for a common enemy. The Afghan Pres. is a CIA placement…ex gun and drugs runner, his brother runs the central bank.

West German Pharma provide the chemicals, precursors, hardware, etc for regionally fragmented manufacture of 8,000 tonnes annually, into 800 tonnes pure. That is 800 million grammes.

You ever wonder that the only news we hear is about the cops finding a few grammes here and there, never anything large?

I do.

But to return.

Nations representing 65% of global GDP are now engaged in currency debasement, one way or another. Everyone wants to be an exporter.

The freeze up of foreclosures alone will destroy Wall Street, via the derivatives, in addition to legal costs and asset collapse..(much of it on the Feds balance sheet), also attracting extensive international legal action. I wouldn’t rule out RICO actions bouncing about for years, involving all parties, including the Fed, and US Admin, plus major blow backs at international levels.

So where do we go?

I think…

Devaluation of ALL paper against gold. The higher gold rises in value against paper, the easier coceptually it will be to monetize gold, several nations are now issuing gold coins as currency.

From the lower base against gold, a further massive US devaluation against other paper currencies, with varying rates of devaluation between differing nations. A rebalancing…hopefully cordinated as the plaza accords, but I have doubts…there are large areas of friction between the US Fed, and the BIS…..the BIS regard the FED as having blown their dirty little secret…through manifest greed and stupidity. We’ll see…

Germany will leave the EU, taking several stonger nations with them, leaving the south to fail. Totally pissed with marxist thinking.

A joining with Russia is likely, Russia bringing raw materials to the German table of manufacturing excellence. The common currency will probalbly be gold backed, and purchasers of materials/manufactures will need some sort of gold element….that part is hazy right now.

Movements of capital/goods between Russia/China will not involve the US dollar from that point. Shortly after this will apply to other BRICS and other emerging nations. Meetings, moves, planning, happening NOW

Rare Earths mean 2 things at the moment.

1) The IMF won’t sell gold to China. China responded!

2) Rare Earths and Japan speak to the oil and gas in the South China Sea.

Global finance fractures, with US UK hegemony falling as competing centres emerge..Moscow, China, Dubai, etc and the evolution of several “regional currencies”.

BIS is either restuctured or is finished. What will replace it?

US/UK, and western banking hegemony, through fraud and criminality is the target. Fiat currencies enrich those nearest the source, and steal from all others.

In a non-fiat, debt based world, deflation is the natural order, and increased wealth accretion for everyone, as technological innovation reduces the costs of everything and “money” buys more.

Bankers have reversed all that, and hidden it from everyone but a few, by means of distorted economics and false education.

Their time is ending.

It cannot come soon enough.

I pray the transition will be smooth.

I fear it won’t be.

Iron mountain was serious, not a joke!

UKguy,

You sound like a pro. I think everybody should read this comment. It is full if good insight and information. Thank you for taking the time to write it for our readers!!

Greg

The Hidden Meanings in the New $100 Bill!

http://www.roadtoroota.com/public/261.cfm

Yes that’s right.

Buy Gold and you definitely cannot lose. It’s guaranteed to go up because all the gold pundits say so and they must be right. Besides if everyone else is doing it then you should be too and you need to get in before the really big rush. Right? Oh, and Gold will never go down now – you are safe – because it’s all different this time round. It really is.

If you believe that then you really are headed for a fall. Yes the fundamentals are strong for gold, especially as the US Govt is continuing to trash the value of the US dollar and various other Governments are effectively engaging in currency printing thereby diluting the value of their currencies and creating inflation.

However there is no such thing as a guaranteed positive investment in any unit that is freely traded and subject to price moves up and down. Gold trading is subject to the same pressures as other traded commodities and to the same speculative and fear/greed characteristics. And the professional buyers and sellers are all following their own tried and true trading signals.

Go and look at history of gold prices – not 20 years but back to the last bubble in the late 70s. History does repeat itself and it will be no different this time. You could not lose then either.

The reality is that NO ONE knows how high the gold price will go before it finally breaks – and it inevitably will. The gold pundits will tell you they know but they are not God either. Gold is being talked up(hardly surprising), it will inevitably go into a bubble phase and the bubble will burst. All bubbles do.

Go back and read the forecasts of the gold pundits 3-4 years ago and they were saying that gold would be at $US2500 per oz and more by now. (Since then it has been both up and down). That’s before all the substantial and damaging currency dilution on a global scale that has occurred (since the GFC) which the pundits never predicted to the degree that has been witnessed. They did not predict either the GFC or the inflationary policies adopted since then which has been largely responsible for the big move in the gold price since.

By all means buy physical gold if you believe it’s a sound investment but do not assume you cannot lose. You had better apply the same stop loss measures you would to any other investment, have your hand on the sell button and have a clear exit strategy. It’s easy to buy but have you a clear process to sell off your physical gold fast at market price when you need to be out? The professional traders certainly have.

Finally would you buy gold or an essential commodity:

– which the world cannot do without

– is in high and ever growing demand

– is slowly running out

– is also priced in US dollars?

I am not criticizing your article Greg but just offering another perspective.

I fear a lot of people are going to get burned eventually when the market finally turns against them.

Sean,

Physical gold is NOT an investment. It is an insurance policy that does not expire. Anyone trading physical or paper gold for profit in this enviroment is a fool. Thank you for offering another perspective. It is always welcome.

Greg

I do not wish to judge either, but I do agree with Will. At the end of the day, the last face I see in the mirror is my own.

The term we need to rid the country of is “career politician” after the second term, they no longer work for the people, but for the party and the special interest. The power of the special interest is amazing. One “special” makes grants to the tune of a $165,000.00 a year for interns to work with lawmakers, advising them and helping to write legislation. Guess who those laws and legislation favor. This is out and out lobbying, but because a non profit foundation that owns millions of dollars of the special interest stock is paying the interns, it is not counted as lobbying. Go figure!

The system is beyond broken, we can start fixing this by voting out career politicians in November.

Jan and GrannyB,

Good points by both of you!!

Greg

◄$$$ A COMMENT ON GERMANY REINSTATING THE D-MARK CURRENCY, A PERSPECTIVE ON A NEW CURRENCY ENTRY NEXT YEAR, POTENTIALLY TO DISRUPT THE MONETARY SYSTEM IN A SEVERE WAY. BUT MAYBE NOT AT ALL, AS THE POWERZ, BOTH ANGLO AND EASTERN, FAIL TO INSTALL ANY SYSTEM TO REPLACE THE CURRENT SYSTEM. $$$

Two weeks ago, a fellow contacted me, a man with less reliable past information, but with some impressive connections in the USMilitary experience and Security Establishment, even Homeland Security contacts. He passed word that in 45 days, the end of October, Germany would revert to the DMark currency. He had no other information except its reliable source. He asked me to inquire with my deep excellent German banker source. My personal belief is that Germany might revert to the DMark, but only to make ready the New Nordic Euro currency, which will take longer than expected. The timeframe mentioned was June 2011 for the introduction of the partially gold-backed New Nordic Euro currency. Note the brief comment below on the infeasible new Euro currency, a disappointment to me. No New Nordic Euro will hatch or launch. Instead, the global financial system will apparently attempt to maintain its structural integrity centered on the USDollar, but it will fail into a spectacular monetary system breakdown. A new currency requires a significant critical mass, one that the new Euro apparently lacks. Deep violent divisive horrible times are coming, as the current system collapses atop itself. No precedent exists in modern times. The European nations will revert to native former currencies, the DMark, Peseta, Lira, Franc, Escudo, and others. Wild devaluations will occur.

My deep German banker source came through with a full length comment, more than asked, filling in the complicated background. He wrote, “Nothing for a DMark return in the next 45 days. I will say that things start coming apart in November centered in the US, with an eventual collapse. The concept of the new Nordic Euro planned for mid-2011 will change, too difficult to implement, and then go away for a number of technical reasons. You need to accept the fact that riding the wave carries can carry you to new heights and to safety, and it is done with Gold and Silver. People cannot comprehend, at least the people living in Western societies, that they will lose everything since they lost their values, spirituality, and regenerative powers a long time ago. The Western world and its political & economic system is a giant juicer that has turned people into revenue units to be violated non-stop by the system. The societies in Africa & Asia have maintained a vibrational level and social hygiene long lost in the West. The questions you ask are irrelevant to what is unfolding… Yes, the Euro will be toast by the end of 2011 and the countries will have returned to clearly identifiable national currencies. The US will implode and the violence triggered will be enormous. The stabilization will come out of certain states that will collaborate and take things into their own hands. There are many very good honest Americans out there who have the will and strength to rebuild locally and regionally from the bottom up. The coming earth changes will push this process forward with the force required to make that come about. I suggest you watch three movies to refresh your memory 1) Sword Fish with John Travolta, 2) Postman and 3) Waterworld both with Kevin Kostner. All these three movies are very relevant to understanding where things are heading.” He left out Mad Max. He describes a de-centralized new monetary world. The Globalists will be blocked from their haughty plan.

◄$$$ FALLOUT FROM THE GOLD PRICE WILL BE ENORMOUS. IMPACT SHOULD BE DIRECTLY FELT BY THE BIG FOUR BANKS INVOLVED IN REGULAR PRICE SUPPRESSION, OF THE MOST ILLEGAL TYPE. SOME BIG BANKS WILL DIE BEFORE LONG. $$$

The Big Four banks are JPMorgan, Goldman Sachs, HSBC, and Bank of America. It is hard not to include Citigroup and even Wells Fargo in the select corrupt group of leading US banks. They are the core of the fascist banking cabal, the agents of systemic failure. When the gold price ripped through $1250, and the silver price ripped through $20, damage was guaranteed to the big banks due to their massive short positions. Worse, in two of the last four monthly expiration events for gold futures options, the gold cartel was crushed. Typically, in the week of such options expiration, a sudden nasty decline with gusto comes, the direct result of huge naked shorts by the Big Four banks, who add to their losing huge short position. If already busted, it makes sense to add to the losing positions, since the USGovt might someday bail them all out, or bail out the designated winner harlot. The gold cartel might benefit from a massive hidden bailout using AIG, for instance.

A Jackass inquiry went to an experience gold banker. The question was “Is any particular bank in line for deep losses from the gold & silver runup in price? Some bank must be close to death from the gold price move. My guess is Bank of America, which is in a search to dump assets. A short squeeze is on, a powerful one, sure to produce important victims.” His reply was “JPM/Chase, HSBC, Deutsche Bank, UBS, and TD Canada Trust will not survive. Watch the strong silver price move between now and October 3rd.” Some shock events are due, with only a brief time lag between price move and consequence on the bank portfolios. The tumultuous events should come in October sometime.

Willie

Lucdog,

Thank you for posting the content from Jim Willie!

Greg

Since the job of the federal reserve was to remove 100% of the wealth from this country in 100 years(or was it 99), and they’ve removed 96%(I hear), so far, then they are pretty much on target for when their contract/charter expires in 2012 or 2013.

All your property, everything you think you own-including your own bodies and your childrens, is pledged against the national debt. The corporation known as US Government went bankrupt in 1933 and was taken over by its creditors. We’ve been operating in receivership ever since. That’s why our courts are no longer common-law. It’s a foreign owned corporation, not a government.

Kiss your “money” bye-bye. Look into getting rid of your debt and “paying” for things with your birth cert. Learn about “Accepted For Value” and use your FRN’s to buy precious metals, food, etc.

Bildo,

Good infor and analysis!

Greg