Latest Posts

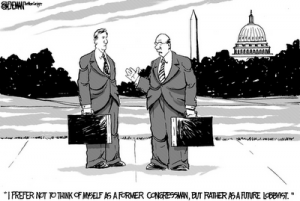

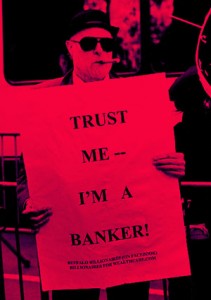

The Left Right Paradigm is Over: Its You vs. Corporations

I love the article you are about to read because it is very much in line with some of what this site is about. USAWatchdog.com is neither “Democrat nor Republican, liberal or conservative.” I just want to connect the dots and find out what’s really going on, no matter which party is in power. (more…)

I love the article you are about to read because it is very much in line with some of what this site is about. USAWatchdog.com is neither “Democrat nor Republican, liberal or conservative.” I just want to connect the dots and find out what’s really going on, no matter which party is in power. (more…)

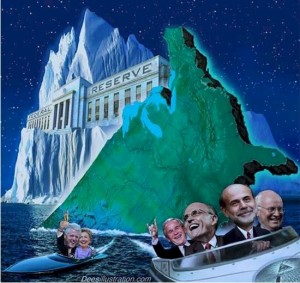

The Fed Bought Fraud

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

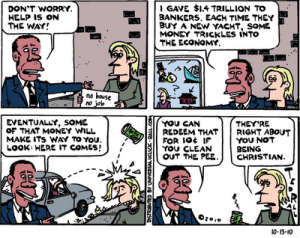

In the wake of the financial meltdown of 2008, the Federal Reserve announced it would buy mortgage-backed securities, or MBS. The January announcement by the Fed said it would buy MBS from failed mortgage giants Fannie Mae and Freddie Mac in the amount of $1.25 trillion. At the time, the Fed said in a press release, “The goal of the program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally.” (more…)

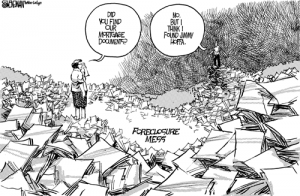

The Six Trillion Dollar Problem

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

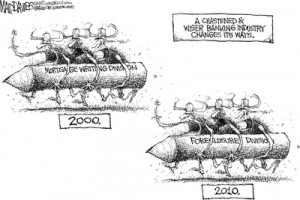

When I was an investigative reporter at the networks, the first question we would ask when trying to decide if we wanted to do a story was: How many? How many people have been hurt by a defective product? How many defective products of a certain kind were in use? How many dollars will it take to fix the problem? In the case of the recent mortgage crisis – “Foreclosuregate,” the question of how many has been answered. (more…)

The Perfect No-Prosecution Crime

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

Did you know that in the aftermath of the Savings and Loan (Thrifts) scandal there were more than a thousand felony convictions of financial elites? The cost of the wrongdoing associated with the rip-off and closure of nearly 800 Thrifts cost taxpayers more than $160 billion. The current sub-prime/mortgage-backed security scandal is 40 times bigger according to Economics professor William Black. That means the size of the crime is $6.4 trillion by my calculation. (more…)

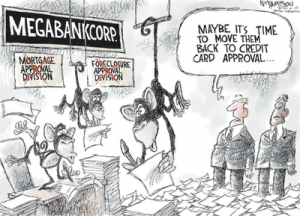

Time to Break Up the Too-Big-To-Fail Banks?

In January of 2009, I wrote a post called “Default Option.” My outrageous plan was to simply let the banks fail. Some people told me that was an unthinkable way to handle the financial meltdown, but I still think otherwise. Yes, it would have been rough. Bondholders and shareholders would have been wiped out, unemployment would have shot up, and lots of people would have lost money. Back then, I wrote, “In short, the incompetent banks would be liquidated and competent banks would take over the assets that are left behind. (more…)

In January of 2009, I wrote a post called “Default Option.” My outrageous plan was to simply let the banks fail. Some people told me that was an unthinkable way to handle the financial meltdown, but I still think otherwise. Yes, it would have been rough. Bondholders and shareholders would have been wiped out, unemployment would have shot up, and lots of people would have lost money. Back then, I wrote, “In short, the incompetent banks would be liquidated and competent banks would take over the assets that are left behind. (more…)

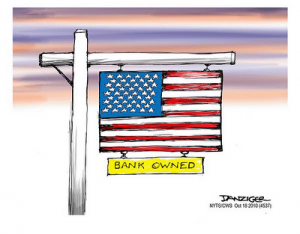

Who Really Owns Your Home?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There are some big questions facing the real estate market after the foreclosure fraud story exploded in the last few weeks. The number one question for anyone who has a mortgage is “Who really owns your home?” This would be simple to answer before the mortgage-backed security (MBS). These MBS’s were mortgages that were bundled together and sold to investors such as pension and bond funds by big banks. (more…)

Could a Dollar Crash Be Coming Soon?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It’s official. The economy is in trouble. The Fed seems to be hitting the panic button and is sending numerous clear signals that it will print more money to push up the economy. The Fed has already printed $1.7 trillion to buy mortgage-backed securities in the past year or so. New money printing (Quantitative Easing) will be done to buy U.S. Treasuries, or America’s own debt. (more…)

Bank Shot

What a week for real estate! The mortgage document fraud investigation kicked into high gear with all 50 state attorneys general opening investigations. There are calls for criminal investigations, and trial attorneys smell blood over allegations of fraud many say will be easy to prove. (more…)

What a week for real estate! The mortgage document fraud investigation kicked into high gear with all 50 state attorneys general opening investigations. There are calls for criminal investigations, and trial attorneys smell blood over allegations of fraud many say will be easy to prove. (more…)

Fear, Desperation and Doom Describe the Housing Market

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It has been called foreclosure gate, robo signing, foreclosure fraud or just sloppy paperwork; but no matter what you call it, it’s signaling a new financial meltdown for the U.S. economy. The securitized mortgage debt created in the real estate bubble is being called the “largest fraud in the history of capital markets” by people like renowned gold expert Jim Sinclair.

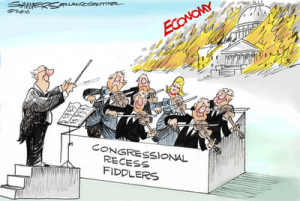

What is Happening Now and Where are We Going?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gerald Celente is the founder of The Trends Research Institute. He’s been forecasting future trends since 1980. Today’s financial economic and political climate is volatile and unpredictable for most of us, but not Celente. He has made many correct predictions over the past 3 decades. Some of his more recent predictions include the panic and meltdown of 2008, and he says the “Collapse of 2010” is well underway. (more…)

Did Congress try to Legalize Foreclosure Fraud?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A bill that will make it more difficult to challenge improper foreclosure is going to be Vetoed by President Obama according to a Wall Street Journal story. The bill quietly slipped through the Senate last week with a unanimous vote. (The House passed the bill in April.) There was no public debate. No one spoke up for the people fraudulently foreclosed on by big banks. The bill got through because of a special Senatorial procedure. Both Democratic and Republican leaders thought it was a good idea to make it harder for the average homeowner to fight the banks in foreclosure. (more…)

Record High Gold all about Fear

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There has been one record high after another for gold. They say the markets are ruled by fear and greed. In this case, it is simply fear that is driving the yellow metal higher day after day. There is a perfect storm of doom in the economy right now. The biggest problem is debt. It just went parabolic with the revelation that the banks are stuck with trillions of dollars in worthless mortgage backed securities. I wrote all about this Monday in a post called “Could Foreclosure Fraud Cause a Banking Calamity?” The U.S. government is going to come to the rescue and bailout the banks once again. (more…)

Could Foreclosure Fraud Cause Another Banking Meltdown?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This weekend, Bank of America became the latest lender to delay all foreclosures in 23 states because of possible problems with the necessary documents needed to repossess a home. GMAC Mortgage and JP Morgan Chase have had similar problems recently with documents that prove the bank has the right to foreclose. (more…)

The Fallacy of ‘Bailing Out’ U.S. Cities and States

I want to revisit something banking analyst Meredith Whitney said this week on CNBC about the huge financial insolvency problems facing many U.S. states. She said, “You have to look at the states and the risk that the states pose, because the crisis with the states will result in an attempt at least for the third near-trillion-dollar bailout.” I feel there is no way Whitney reveals this possible $1,000 billion boondoggle unless she has some inside information or insight. This is a lose-lose proposition. (more…)

I want to revisit something banking analyst Meredith Whitney said this week on CNBC about the huge financial insolvency problems facing many U.S. states. She said, “You have to look at the states and the risk that the states pose, because the crisis with the states will result in an attempt at least for the third near-trillion-dollar bailout.” I feel there is no way Whitney reveals this possible $1,000 billion boondoggle unless she has some inside information or insight. This is a lose-lose proposition. (more…)

When Meredith Speaks, You Should Listen

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was pulling up to a store yesterday in my car, listening to CNBC on XM Radio, when an interview with banking analyst Meredith Whitney came on as a guest. I shut the car off and listened because, over the years, I have learned when Whitney talks, everybody should pay attention. There are only two reasons why I think this way: (1) Whitney has a track record of many good calls on the economy and banking. (2) Her predictions are usually spot on.