Mortgage Settlement Will Plunge Real Estate Values

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

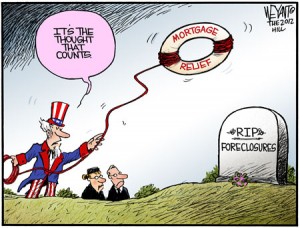

It is official. State and federal governments have condoned forgery, perjury and fraud in what’s been called the “robo-signing” foreclosure debacle. Last week, the five biggest banks in America signed on to a $26 billion deal that, basically, lets them off with a slap on the wrist for fraudulently foreclosing on homes in the last few years. I am not going to go on and on about how unfair and unjust this deal was or how the rule of law has been thrown down the stairs. I am going to focus on the fallout of this morally corrupt deal.

There is $700 billion in negative home equity with nearly half (11 million) of all houses underwater. Meaning, more is owed on the mortgage than the home is worth. This settlement may help a few folks, but it is a drop in an ocean of debt. Now that the deal is done, look for the pace of foreclosures to pick up speed and home values to take another cliff dive. If you thought the negative equity problem was at the bottom–forget it. The plunge in real estate prices is far from over, and it’s not going to turn positive anytime soon. Consider the latest Case-Shiller report where year-over-year declines in home values averaged 3.7% nationwide. This is despite 30-year mortgage rates at or below 4% and a big slowdown in foreclosures because federal and state governments were negotiating a deal for the past 16 months.

Banks are desperate for cash, and they are going to unlock all they can as fast as they can. After all, people can’t live in a house forever without paying. The banks are not going to enter a new age of morality when they just got a “get out of jail free” card from prosecutors. Rolling Stone’s Matt Taibbi wrote last week, “The only acceptable foreclosure deal had to bring about a complete end to robosigning and the other similar corrupt practices that grew up around it (like for instance gutter service, the practice of process servers simply signing affidavits saying they delivered summonses, instead of really doing it). But this deal not only doesn’t end robosigning, it officially makes getting caught for it inexpensive.” (Click here for the complete Taibbi post.)

The Obama administration said, last week, this deal will be good for “struggling homeowners.” It will be good if you are a speculator looking for a deal, but it won’t help out homeowners who have equity and pay their mortgage on time. Last week, a Bloomberg report said, “A surge of home seizures may drive down values, at least for a while, in a fragile market. The number of new foreclosure filings fell 34 percent last year, according to RealtyTrac, resulting in a backlog that now may flood the market with low- cost properties. About 1 million foreclosures will be completed this year, up 25 percent from 2011, according to the firm.” (Click here for the complete Bloomberg story.)

The new flood of foreclosures will depress prices, and more and more people will figure out they are sunk and will stop paying for a submerging investment. I say the fall will not be temporary. Declining prices will be the prevailing trend, especially when interest rates begin to rise. Mortgage interest rates cannot remain at these cut-rate levels forever and won’t. The Huffington Post reported last week, “. . . Amherst Securities Laurie Goodman noted that with our current housing trajectory, we can expect up to 10 million more defaulted mortgages over the next decade. These foreclosures impacts housing values, reduce consumer purchases, and costs municipalities money.” (Click here for the complete Huffington Post article.)

Housing prices are headed down. Most people cannot fathom year after year of declining prices. But, that’s what’s coming, and I see nothing that will stop the slide. Not only does this deal hammer home prices but pension funds and mutual funds that invested in mortgage-backed securities. Small investors and homeowners everywhere are stuck on the same bus staring down a steep hill, and this so-called “robo-signing” settlement just cut the brake lines.

Its all about power. If you control the game you always win as long as you like winning.

Greg,

U.S. News has an interesting article. It pointed out that the $26 billion mortgage settlement is only an illusion. (http://www.usnews.com/opinion/blogs/economic-intelligence/2012/02/10/mortgage-settlement-a-distraction-not-a-solution)

The whole fiasco shows us Money can buy everything and Wall Street has a lot of Money. If you or me commit similar “robo-signing”, we will definitely spend some time in jail.

The American system of checks and balances is broken. The Supreme Court allows the super PACs to corrode our elections and Wall Street lobbyists dominate both White House and Congress. How can we fix this country? Any idea?

Ambrose

Ambrose,

Thank you for extending the content of this post. The whole thing is a scam and rip-off. I only wanted to concentrate on the new foreclosures, but you bring up a very important point. Thank you for making it here and providing a link to back it up!!!

Greg

Was just introduced to your newsletter by a client – and have been browsing through the contents.

I am in the finance and real estate industry (much as it is nowadays) and one of the over used sources for real estate valuations (price) and sales is the Case-Shiller index.

I would like to point out that the Case-Shiller index is seriously flawed – as it only takes into their formulations single owner occupied homes – not condo’s or town homes, or investor properties – of course every reference to C/S fails to mention this!

C/S also records as a ‘sale’ flippers – who may purchase these homes in their own name, and then resell them in a short period of time – both of these ‘sales’ are then reported by C/S giving an unrealistic view of homes sales.

Without including a disclaimer to any published ‘facts’ the media – mostly controlled by Reuters and Associated Press and other ‘wire’ services that spew out anyone’s press release for a few hundred bucks – continue to spin misinformation to the public.

Without any research the mass media mindlessly repeats this misinformation to it’s audiences and readers.

The other ‘source’ of information on homes sales is the organisation that is paid by real estate brokers to manipulate the facts – The National Association Of Realtors – NAR.

This organization is corrupt to the core and is continually releasing false information through the same ‘news wire’ services and have continually published totally false information on home sales and prices.

When Dr. Bernanke states “that real estate may no longer be an investment opportunity” it is clear that homes are no longer going to be the ‘investment’ that our parents and even ourselves – witnessed prior to fraudulent banking practices that started in 1994 when sub prime mortgages were introduced, and then the erosion of laws to protect us from another recession / depression caused by central bankers.

Malcolm McLean,

Thank you for the information. So the Case-Shiller index makes things look better that reality and Case-Shiller data still shows declining prices. I think real estate will crash anew when rates startg going up and it is only a matter of time before they do. If there was better data than Case-Shiller I would use it but there is not is there?

Greg

Heard of 1776? no disrespect to the Native Americans

Greg.

Im glad my home is paid off, but looking back i see my stock investment lost thousands. The msm did not report the warnings sites like yours will do, so most people never know the falls before them.

Blessed are the ignorant for they know not what they are doing…for a time. Life always reveals the truth eventually. At todays property taxes i wish i had bought 20 ac of land with a cardbord box full of gold and food.

Thank you Jay for the comment. Having a house that is paid fopr is a really good thing!!

Greg

Greg

I ran across this and thought you may want to see it. no need to post it.interesting thig is i dissagree with this guy on most everything he says,but he nailed the media. http://youtu.be/4EKrXFcVyXE

Yup, and the victims of all this, what do they get? A measly $2,000. As if the banks can spare it.

Life must be nice, being a supporter of the liar-in-chief.

Great post Greg; but really just the tip of the iceberg. Unfortunately, too many do not understand that the housing crisis, in all probability, was an incrementally planned event, with the establishment of the fraudulent MERS Trust in 1995 coincidental to the Greenspan put and the subsequent push by community organizers to push the CRA and force the banks to issue mortgages of questionable (to say the least) backing.

Andy,

It is much more about OTC derivatives and mortgage-backed securities than poor people getting money they could not pay back. That was part of it, but if that’s all it was it would have been over long ago. You are probaly right on the money that it was “an incrementally planned event.” Thank you for weighing in.

Greg

Oklahoma”s Attorney General was the only one to vote against this fraud. Forty nine out of fifty chosed to compromise, or should I say, Plea Bargain. This is a demonstration of Towing the Line and nothing more. A reward to bad behavior and the removal of the specter of being politically Black Balled? The nations law makers and enforcers have no intestinal fortitude to do what is right.

Our nation, founded upon Judeo Christian values, embodied by a living Constitution, has faultered to the point, that the rule of law has diminished into a grey area where there is no Right and no Wrong.

A multitude of precedent cases of law which allows circumvention of the true meaning of the law. Technicalities, court debated circumstantial evidence and loop holes, are the instruments by which those of power bend the law to their favor. Of course this takes money and for you and I, we don’t have it, but the elite will find it. Even if they say it costs too much. Just how much will it costs us in the end, even as the mortgage default crisis stats run well passed 2016.

In any case, the whole world is watching. Crisis piled upon crisis and we reap the cause and effect of our actions or lack of action.

Nobody knows what General Custer’s last words were at the Little Big Horn. I’ll bet he was thinking, “Where in the hell did all the Indians come from”. Something our leaders should think about.

slingshot,

The Oklamoma AG is the only one with morals and guts.

Greg

The only thing that’s going to turn around the U.S. housing market is a reset of mortgages to reflect Fair Market Values. The White House — with or without congressional support — could work out just such a deal with the banks by allowing them to apply the resulting write-downs to their Net Operating Losses (NOLs) and use them as offsets to income over the next 3-5 years. The latter would also have the added benefit of giving the banks an incentive to keep more of their income in the U.S. rather than “laundering” it offshore. Barring pushing the “Reset” button, we’re looking at YEARS of continued stagnation and/or decline in housing.

There is absolutely NO reason for President Obama and USAG Schneiderman NOT to pursue a national mortgage balance reset … other than the fact that neither of them have the courage to stand up to Jamie Dimon (JPM), Wells Fargo, Citi, and BofA. This “National Mortgage Settlement” does absolutely nothing to benefit stuggling homeowners. It gives the banksters 6-9 months to postpone ANY sort of action and up to 3 years (!?) to actually do anything — enough time for hundreds of thousands, perhaps millions, more homeowners to give up hope and walk away or fall victim to foreclosure.

So if the mortgages are reset, when do I get my money back on the kmart stock I bought? I had to sit for 10+ years and listen to these people prattle on about what geniuses they were for buying 5000+ sq ft shoddy houses. Well, it turns out you can’t sustain 20% price increases every year, and in fact, believe it or not, speculative investments can go DOWN in value (hard to believe isn’t it?) If we are all adults, we can make life decisions and if you guessed wrong, you should bear the negative effects.

@Bill Ender

With all due respect to your view – the reset of mortgage balances to ‘fair market value’ will never work, as is not fair to the vast majority of home owners who have diligently worked towards paying off their mortgage.

Most, if not all of my clients – who are seeking a loan modifications, have repeatedly re-financed their home over the last decade or more, and taken out cash – spent it on their lifestyle, and now unable they say to service the loan.

It is not unusual that the above same homeowners have irresponsibly increased their credit limits on numerous credit cards to a point where many balances are in the $50K to $100K range.

This widespread irresponsibility is the primary cause of personal bankruptcies where the use of the BK courts is to extend the period of time the borrowers are not paying their mortgage payments – and in some cases I have clients that are referred to me – that have not paid a single mortgage payment, nor property taxes, nor credit card payment for anywhere between 12 months to 3 years!

Some have saved the money – and are hiding it in a PayPal Account or a relatives bank account, some have it in cash in a safety deposit box at the bank.

Sure – some have lost their jobs, some have had to take lower paying positions and some – especially in my industry – who are 1099 employees, have seen their incomes drop significantly!

However many clients referred to me are employed, and have decided that as their home is now ‘underwater’ because of their constant re-financing – that they are going to live there as long as they can, avoid all re-payments, property taxers and insurance, then walk away at the very end – taking the ‘cash for keys’ offered by the banks.

So there is full scale borrower fraud that needs to be addressed, as well as central banker and insurance fraud.

Malcolm McLean,

I know you are addressing Bill Ender but I would like to weigh in here. The BANKS are the cause of all of this. After All, they were the lender and made it possible to allow people to use their homes as ATMs. If there was good loan and appraisal practices going on, the banks would have made a lot less money and this would have never happen. Nobody forced them to give home equity loans. I am not saying it is right to walk away from a loan, but it is the lenders who could have policed this and they did not because of pure unadulterated greed. They are reaping what they have sown. By the way, I do really like your comments on real estate. I may not agree with you on every point but I still like what you have to say. There is no doubt you know what you are taking about, so please comment often, especially when it comes to real estate!!! Thank you for your participation

Greg

All hope is lost and it is time to prepare for civil war. This is the last act of a corrupt governmental system that changes the law just as the Nazis and Itialian Fascists did as they rose to power on a fake patrotic wave

Mitch Bupp. Your posting is at the heart of the problems in our country..WELL SAID

Hey Greg

Just saw this yesterday and thought what are the possibilities he will use this opportunity to make some changes on the home front based on the implementation of these presidential powers. What are your thoughts on the lack of limitations this news brings.

http://www.thenewamerican.com/usnews/foreign-policy/10825-new-iran-sanctions-president-signs-executive-order-citing-ndaa-authority

norcar survivor,

I have said this before in the site in a post more than a month ago. War with Iran is not an “if” but a “when.” This is just a road sign on the road to that end.

Greg

Greg:

Again I ask, if people simply don’t have the money to keep paying for these mortgages for the next 20, 30 or 40 years, what is this deal going to do for them?

The unemployment numbers are rising. Inflation is rising. People simply can’t afford it.

Does Obama realize this? People will just walk away since worrying about one’s credit score is no longer something to be ashamed of.

Hats off for Oklahoma, they can be proud of at least one of their own!

On another note Greg, the republicats just agreed to allow the payroll deduction to stay for another year and to place the difference added onto the national debt, talk about saying one thing and doing another. What is wrong with this country is that the political class has no morals and the middle class no balls.

I predicted elsewhere in 2008 that single family real estate will be sold to foreign investors in a similar manner to the selling of US infrastructure (toll roads, railways etc) to foreign investors. Now that the deck has been cleared, watch for these foreclosed properties to be bundled and sold. Soon Americans will be paying rent to China. Don’t expect the globalist Congress or the White House to lift a finger to prevent it.

What I really fear is that the USA is now Japan and we are facing 20 years or more of a sustatined drop in housing prices. Your right, Americans can’t fathom it. When I talk to some of my co-workers many say “prices have dropped so much, its a great time to buy”. Yet, they don’t stop to think that price and value are the same thing. Or that depsite the fall in prices houses are still very unfordable in many markets.

Unbelievable! The Psychopath’s/Sociopath’s strike another big win with no opposition. When you look at the real effects to savings, home values, stocks, unemployment, Families in the streets and trust in CEO’s/Government, this thing makes The Savings and Loan Scandel/Enron look microscopic. Was a Capitalist most of my life until 12 years ago and looked down on Socialism and Communism. Looking at the three today, seems corrupt Capitalism has had a more negative effect worldwide than the other two. This is hard for a Guy like me to swallow. Guess a man can only stay in denial so long before he has to call it what it is. All three systems choke the life out of the masses in the end. I see a few at the top controlling technology, resources, military, media, governments and people. The rest of us are treated as consuming slaves. Imagine what will be next for us if we stay comfortably numb through all that has happened just since 2001.

Capitalism had nothing to do with it. Corruption does. When you can drop the Adjectives, it’s just plain corruption. It flourishes under any system of government, eventually. What this country used to be under Capitalism, was ONE OF the best conditions to live under in history.

Bravo Wisefool, In true capitalism when you fail you fail and bankruptcy is your only option not a bailout for greed,incompetence and in some cases crime.

Greg

Greg, already this moring I have got 3 calls wanting to know what my rate was & I could refy with record low interest rates at no cost to me! I am on the no call list, how do these people get your name? I have not been on any site seaching for homes or any sort of refy site, what gives?

Also I have read that ‘pension funds will take a hit’ to cover the cost of this program. I can’t find the article but the banks got the deal of a life time. Now the head of JPM is on Fox Bix spouting off how JPM will be hiring & it’s strange they would do the interview in Florida, a place where tons of people have homes under water.

There will be a lot of pain for many & a big loss for many also. These banks may have got a deal, but this does not make them a safe place to park your money. Got Gold?

Thank you for the reporting from the front lines of the real world!

Greg

More from PIMCO, http://www.moneynews.com/StreetTalk/pimco-foreclosure-banks-pensions/2012/02/10/id/429048?s=al=&promo_code=E276-1. Think about this, your tell your kid you did a bad thing & I am fining you $10.00 for it , but if you steal $25 from your mom you can pay with that & all will be fine! This fits whay the States & Obama is doing & it will come back & bite all of us where it hurts, 401K’s, pensions & savings. Got Gold?

Mr. Hunter,, I have no idea where do you get your human courage to write about the facts as they are. I would not be surprised at all, if you are day sent to “a free room and board” based on the new law that Obama approved on December 31, 2011. May almighty God protect you all the time!

Thank you Miro. I hope I keep living where I am now.

Greg

== Behind the Learning Curve: Hindsight Doesn’t Trump Foresight ==

Yes, we Americans indeed are embroiled in class warfare.

I view it as the CRIMINAL class versus the NON-CRIMINAL class — the former consisting of the banksters, with their bought-out politicians, engaged in economic war against us disadvantaged, law-abiding taxpayers.

When the current depression matures into a pressure cooker about to explode upon the world scene, the messy consequences will prove that, once again, the U. S. government has chosen to learn nothing important from history.

Shouldn’t you be getting those FEMA camps ready for a Grecian holiday, Herr President? — Larry W. Bryant (13 Feb 12)

The immediate effect on the housing market will be negligible, as the FED and bank regulators will allow the assets (liabilities) to be carried on bank balance sheets at some contrived value and the property held off market for a period of time. This has been going on for a couple years already. My sister is VP or mortgages for a large regional bank. She is not the least bit worried. Then again, she wasn’t worried a month before her bank cut the dividends on the thousands of shares in her 401(k) either. Hmmm

Greg,

Just so you know, I sent you a very interesting private message that will literally blow your mind. It is a copy of a legal document filed on January 5, 2012. It has a lot to do with the current financial collapse about to occur.

Back to the article… My family lost a 40 year business worth close to $4 million. My sister and her husband have not paid a mortgage payment in 18 months or more. My 84 year old mother had to move in with them, because her home owes more than the value. My wife owns 2 homes. Thankfully, she has one rented. Yet that home is 18 years into the 2nd mortgage and today it is valued at what she owes on it!

It makes you sick to work your buns off all those years to get nowhere if we even tried to sell the home. two years ago December, my wife bought the second home after the market crash. She got a deal, or so we thought at the time. After reading your article, and looking at the local county property appraiser website to access our information, we are startled to see that our property value dropped even more than it did a year ago!

It seems that you are right once again. But let me say a few more bits of input before I close my comment.

In August of 2010, my wife and I decided to invest our last bit of cash assets into a solar energy system on our roof where we live now in the newer home. It was $35k on the bill of sale, then a $5k instant rebate deducted for not financing. The manufacturer (Blue Chip, Inc) gave us another $9k rebate after installation, which they get back from the 2008 Recovery Act funds. They qualify as a minority (foreigner) corporation.

The total amount paid in cash was $22.5k and we were given paperwork to file our own claim with the 2008 Recovery Act. My wife was refunded over $8k last year after filing taxes. This year she gets back $7,171 and that makes the overall investment exactly $11.8k with a lifetime exemption from any taxes (including school taxes).

Back to the shocking truth…

Our property value was lowered once again. The tax exemption we were to have been given at $30k, was listed at $25k and it behooves me how the local guys can get away with it! Not to mention our property value is now lower than what we paid for it by $10k, plus the solar panel assessment was never applied (which by law from the 2008 Recovery Act says the value can never depreciate).

So here is where I’m going with this…

The banks are telling lies to the Feds and the paperwork is being held back on purpose. The statistics that people like you and I and the public are being shown are fraudulent. Thew bottom IS going to fall out very soon. My opinion is that there is at my best guess…. probably 60 million more homes about to be foreclosed on, above and beyond the published count already known!

It is going to happen in March, and in Fall, look out for the dollar to collapse the world economy as well!

Ben Davis,

I got it thank you. Thank you for the comment too!

Greg

Greg,

Do your best effort in writing the biggest news story to ever be published in the history of America and the world to know!

That particular information is real, legal and validated. If my memory serves correct, the law says a response has to be done within 180 days!

That means June 5, 2012, is the day we see history change forever!

Ben

Thank you Ben.

It is a bought-and-paid-for “Get Out of Jail Free” card for the banksters.

First the banksters invented and pushed toxic mortgage programs that were destined, if not designed, to fail: interest only, negative amortization, no tax and insurance escrows, no qualifying, and teaser low beginning interest rates – all backed by a wink and a nod: “Don’t worry, if it gets tough, we’ll just refinance you into another lower rate.” Unsuspecting borrowers pushed to the bankster/realtor controlled title company had no one to look out for their interest. They believed the sales pitch and signed up. An inherently dangerous product was sold to the public as safe – much like the unsafe-at-any-speed Chevrolet Corvair. Evidence now suggests that a majority of the sub-prime loans were made to people who would have qualified for a decent loan but were pushed into the more-profitable, but toxic, sub-prime.

Second, the banksters packaged this garbage into bonds, paid for a AAA rating, then sold the stinking poo to unsuspecting investors while retaining the lucrative servicing rights for themselves.

Third, the banksters developed a scheme (MERS) that was supposed to keep track of the swirl of paperwork as they whipped these loans and bonds around the world while defrauding local courts of millions of dollars in transfer taxes. Talk about tax evasion!

Lastly, when the whole thing unravels, the banksters have lost the paperwork, don’t know who owns what, can’t understand how it all went so wrong and won’t negotiate to help people keep their homes.

I have no sympathy for the banksters and this settlement is just another example of crony capitalism.

Greg,

What happens when homeowners complete all their payments, and no one can send them a title because it was lost in the MERS? MERS was created to allow rapid securitization of mortgages, which usually means no one can prove clear title to the deed.

Caution to all of those doing the right thing. You’ll probably have to fight for your title in court!

Thanks again for all you’re doing!!

This bankers deal is enough to frost your cookies, but there are things I do not understand. It is impossible to guess how low prices will go to entice investors to step in and take the housing inventory off the banks hands. The banks refused to write down the mortgages for people, but they still lose because they will never recover thier bad loans. Does this mean another bank bail out down the road?

In the meantime, it will cost the banks a fortune to maintain all the vacant homes on the market. Investors will turn them into rentals and for REITS driving the rental housing market when they flood it will all the new rental inventory.

The commercial real estate market is up for a re-set next year too. There will be many bankrupcies for overbuilt malls without anchor tenents, condos that are now rentals and apartments. Commerical loans are for only five years at a time so this bubble will burst over our heads starting in 2013. I think refinancing will be hard to find even for solid mortgages that are not underwater of behind in payments.

Housing prices have plunged and will continue to plunge for years as they have in Japan. They crashed because the Federal Reserve pumped too much money into the system to accommodate those who believed that ‘housing prices always go up’ – which was just about everyone, home buyers and bankers included, in 2005. Even Time Magazine contributed to this idiocy with a big article about home buyers waiting for days to buy homes by lottery in 2005. The banks will lose billions if not trillions on this as will the home buyers. If anyone is serious about stopping these bubbles, they need to realize that bubbles won’t stop until the Federal Reserve is terminated.

Knowing and realizing that all of this is true, I guess my big question is what will be the circumstances by which real estate values bottom, or how will it all end?

As a homeowner that bought in NW suburban Chicago in 1998, and having paid off my home with no intention of moving anytime soon, I’ve witnessed RE values in our neighborhood drop almost 40% from the high. No one can sell, and buyers are virtually non-existent now.

With so much money at stake one assumes that some combination of threats and promises was used to get the AG’s to sign off, such as “You do want to have a job when you leave office, don’t you?”

Sam,

Good point.

Greg

More duckspeak from the Obama Whitehouse. If George Orwell and Ayn rand had live to see this happen, I do not know which would be laughing the hardest trying to cover the tears of a prophet who knew what was coming and trying to warn us. We just don’t think any more…we believe things we hear on TV without giving it though. IF we do give it thought, it is impossible for us to believe it. Oh well, maybe the next time we will get it right.

Was there ever a doubt about this? I mean, really, who would have stopped it from happening? Certainly no one in our gov’t. No one. In order to stop this sort of thing from happening, there has to be at least one live brain cell still functioning, which of course there isn’t in WADC. Stick it to the american taxpayers again – with frosting this time. Can we open a new planet?

If people borrow money, they should pay it back. The banks did nothing wrong. Nothing but try to collect from deadbeats who borrowed on their home to flip another property, or they borrowed on their house 10 years in a row to vacation at the beach. The banks’ shareholders were blackmailed by their regulators — the federal government.

Jack,

“The banks did nothing wrong.” You have to be kidding. Try mortgage application fraud, appraisal fraud, “liar loans,” packaged such “liar loans” into securities, rated securities AAA when in fact they were not and when it all blew up committed forgery and perjury to fraudulently foreclose on houses the banks should have never loaned money for in the first place. You are wrong Jack and the facts have been documented in many court cases across the country. This is a completely false narrative you have bought by Democrats and Republicans. By the way, not a word about all this from our fearless leaders on BOTH sides of the aisle. As proof I offer the cesspool of Fannie and Freddie. Both are laced with mortgage fraud and neither party says a peep.

Greg

The thing that sets a bannana republic apart from the rest of the world is contempt for the rule of law. welcome to the latest and largest bannana republic the world has ever known.

yugosno,

Bing, bing, bing!!! You are correct sir!!!

Greg

Endgame- Uncle Sam via Fanny/Freddie/FED/JPM etc. will own it all and rent back to the cattle as low income housing, which will be exempt from all the new regs and taxes put on existing property owners. Then the benevolent bureaucrats will tell you where you will catch the local green electric communal bus to work. No car, no property, and no money left after you pay your dues to the company store. I fear most cattle will actually put up with it, as long as it comes with DirecTV and a big screen.

I live in staten island NY and all i can say is house property has not come down that much over here and places around me. Maybe 15%-20% on average? Totally overvalued still in my opinion and i would feel like a sucker if i bought a house over here. Now places like Nevada, Florida, Arizona ect have had 500% decreases in home values. This i would think is a good buy. I could buy for 120K a 4 bedroom house in las vegas. I really hope house properties around me get to that level so i can acually afford a house. Any one have any insight on property prices around me?

Jflan,

My theory is Wall Street got bailed out and that means New York area got much of the benefit of all the money pumped into the big banks located in NYC. When this thing reaches critical mass and funny money not longer works–look out below in the Tri-State area. Thank you for your comment and question.

Greg

From Attorney Jeff Barnes Blog 2/13/2012

We have been receiving literally dozens of e-mails from homeowners inquiring as to what effect the bank settlements with various attorneys general will have on their foreclosure cases. Answer: NONE, for several reasons.

First, the Attorney General claims were just that: claims by attorneys general against the banks. Private litigants were not parties to the litigation, so they are not parties to any settlement. In fact, it has already been reported that the settlements have no effect on and do not preclude an individual pursuing legal relief against a lender.

Second, the settlements are not even finalized yet. They have to be filed in court, and once they are, the states which filed the lawsuits will be free to enact whatever procedures, processes, requirements, etc. they wish as to whether a homeowner “qualifies” for any settlement proceeds. As we all know from the loan mod scam, this process can take months or even years, and there are a million ways that a homeowner can be found to ultimately not “qualify”.

Third, and perhaps most revolting and insidious, is that several of the states have ALREADY announced that portions of the settlements will be diverted to state budgets. Specific instances include Wisconsin’s announcement that it plans to use $25.6 million of the settlement money to “plug holes in the state’s budget”, while Missouri has announced that it plans to put $40 million of the settlement money into the state’s “general fund”.

So, once again, the homeowners get nothing. In fact, it has been separately announced that because the attorney general lawsuits have been resolved that the banks will be ramping up individual foreclosures, obviously now because they will not have state governments and attorneys general examining what they do. Sad, but unfortunately true.

Jeff Barnes, Esq., http://www.ForeclosureDefenseNationwide.co

James Goeke,

Thank you for extending the content of this post.

Greg

Greg,

With all the “lies,damn lies,and statistics” around how do you pick the biggest? Well- I will go with one that John Williams of Shadowstats would wholeheartedly agree with– that being — the CPI numbers. As Daniel Ammerman describes in his brilliant pieces on building true wealth from the past to the present, the underlying specter of inflation and taxation are never mentioned. Certainly the Dow when measured in gold instead of dollars for the last twelve years is significantly down throw in capital gains taxes for the lucky few and you are even down further. Buying a house now at these interest rates makes enormous sense as the interest charged against the actual rate of inflation makes the banks loan a net gain to the borrower. There is no doubt that the homebuilders today are working with very thin margins and are cutting corners on quality which ultimately will raise the value of existing homes over time. My home could not be built for what I could get for it right now- but – eventually when inflation overcomes the Central Banks best laid plans the materials alone will cause prices to rise.

If you are lucky enough to have some cash or access to credit I would be a buyer. Between a rising rental market and (at least for now) interest deductibility Real Estate may be in a once in lifetime super buy mode.

If nothing else it is a contrarian investment.

Martin,

For the savvy real estate investor flush with cash there is probably opportunity. For the most Americans this is an unqualified disaster that is far from over. A friend of mine told me last week he has had a rental house open for months. It’s not he can’t rent it, he told me he can’t find a qualified renter with a definable income stream to meet the rent payments. Being a landlord is great as long as they get their rent checks and the renter doesn’t overhaul a short-block Chevy motor in the kitchen.

Greg

Greg,

That’s what drop cloths are for. The tenant needs to do the overhaul to raise the dough to pay his rent. I got a chuckle out of your short block reference, because I actually did rebuild my first engine in my girlfriend’s kitchen, when I was first venturing into self employment and spending my capital on tools rather than shop rent. Landlord never knew, because there wasn’t any mess. Made money on the deal & went on to own a successful shop in the Denver area…Amazing what one can do if one is hungry enough. Didn’t need food stamps either- good old fashioned initiative would solve most of our current problems, as I’m sure we’ll get to learn again soon, for the first time in several generations. An earlier poster asked about economic solutions; I would recommend folks check out Catherine Austin Fitts, and also Google “Slow Money”. Basically, they both advocate putting investments into local enterprises that you personally patronize and trust (and can actually keep an eye on), rather than shipping it to Wall Street/China/Etc… I enjoy your posts- keep up the good work.

Thank you Ed for your comments and your support.

Greg

Greg,

How is this corrupt? I see it 180 degrees differently;that this was a shakedown of the financial industry. This “deal” has extorted money from them, and sent a clear message about the power of the federal government. First, Clinton’s “Big Tobacco” was shaken down, then major manufacturers, now the financial industry. Everybody gets the point, Herr Obama and the growing central government are truly in charge! Want to talk corruption, how about the over-the-weekend bankruptcy farce that left stockholders with pennies, and gave the thug unions 19% of GM? So the reviewing officer in the banks robo-signed what the loan officers already went over with the consumer…BIG DEAL! EVERYBODY getting those loans knew what the loan amounts were for, the terms of their loans, the payments, etc. They failed to make their payments! Americans do not save a penny, live month to month, and want to complain when the reality of economic downturn parks at their doorstep! I am sorry for everyone who lost a home, but most people are still not saving, instead spending more than what they earn. Why should I feel sorry for them, and why should we jump on Obama’s bandwagon and villianize the banks? I don’t, and won’t. Grow up America, and live like adults!

RetiredPara,

“So the reviewing officer in the banks robo-signed what the loan officers already went over with the consumer…BIG DEAL! EVERYBODY ” You are wrong on the facts and the law. You do not know what you are talking about. “Robo-signing” was in reality forgery and perjury. The banks made up and forged documents and then told the court they were authentic. In many cases the bankers were forging “promissory notes.” You think you pay for the house after 15 or 30 years? No, you paid for the house when you signed the promissory note. “NOTE” indicates a financial instrument just like a Federal Reserve “Note.” Can you copy or create a Federal Reserve Note and go to 7-11 and buy a Slurpee? This is a “big deal” and it was reportedly $13.5 trillion dollar fraud settled for $26 billion. If the banks want to recklessly loan money great, but don’t come to the Fed and taxpayers for a bailed out when the whole mess explodes. This is what bankruptcy is for and no one on either side of the aisle wanted to cut of their precious campaign funds from the banks. The Fed pumped out more than $7 trillion just for the banks both foreign and domestic in the wake of the 2008 meltdown. There is a much bigger issue here than people not paying back money they should have never been given from the banks in the first place. The bailouts are so big that the quality of the U.S. dollar and credit rating of the U.S. has been forever stained. The dollar is losing value every day and soon it will pick up speed. Both have been trashed by this incredible fraud. This whole mess was started under the Bush administration. Back in 2004 the FBI was waved off mortgage application fraud cases. The Bush Administration also allowed the banks to leverage up 40 to 1 and of course TARP was a product of Hank Paulson Treasury Secretary under 43. Obama Administration is just as bad and has blown up the budget when he should have put an end to the bailouts but they kept on going and still do today. The country is going down and both Republicans and Democrats will suffer greatly. Don’t feel sorry for these borrowers, feel sorry for the once great country you are living in. Thank you for your comments. Good men can disagree

Greg

Um, when these loans started, the government leaned real hard on the banks to either make loans in “red-lined” areas, and to “disadvantaged” borrowers, or face being jack booted by the regulators, the IRS, the civil rights gang, and every other agency within shouting distance, leading most of the banks to acquiesce to what appeared to be the least of many evils in a bad situation. This is not to say the banks were innocent, we all know better, but it’s still pretty much a case of the pot calling the kettle black. The bottom line is that they took advantage of the poor fools who thought they could get something for nearly nothing- greed vs. greed revealing its true lose/lose nature, and now they’re all crying “foul” on being outed. Boo Hoo…

Greg,

Before you blast me for being “wrong”, as you did someone above, know that I am NOT talking about securities packaging, derivatives, etc. I am talking about what a bank MUST do when people do not pay. No one was forced to take a loan, and if the appraisal was too high, I doubt the homeowner/applicant balked or complained. When doing cash-outs, most people WANTED a high appraisel to get more money! Enough of the “evil bank” garbage. We live in an irresponsible age, can’t you at least admit that?

An excellent article. But the decline in home prices will be illusory. Just as glucometers for diabetics are practically given away- they get you with the test strips- so it is with homes- the cost of repair and maintenance is skyrocketing in line with the inflation that always accompanies massive new debt creation. I visited Home Depot- common sheetrock screws are over $5/lb, and copper pipe is $12(compared to the metal price of under $4): ditto paint, carpeting, etc. And in the end, new construction prices will inexorably rise regardless of rising interest rates. The thing about staghflation is it does not care if you cannot afford to live