Pedro’s Nightmare BP Scenario

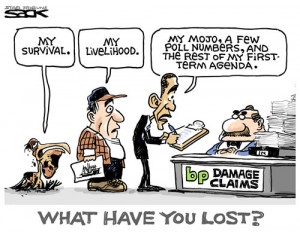

The possibility of a BP bankruptcy because of the ongoing Gulf oil spill is very real. Since the oil spill disaster on April 20, the company’s share price has been cut in half. BP has lost $90 billion in value for shareholders. The company dividend has been diverted to help pay for stopping the out-of-control well, cleanup and damages. At the beginning of this month, the President said, “Untold damage is being done to the environment — damage that could last for decades.” This broken well is spewing out an Exxon Valdez every 4 or 5 days, and experts say it will be at least 2 months before it is stopped. I talked about the possibility of a BP bankruptcy and its monster liabilities in a post three weeks ago called “Damage that Could Last for Decades.”

I am not the only one contemplating an insolvent BP. Two weeks ago, renowned oil analyst Matthew Simmons said on CNBC, “BP won’t last the summer.” Simmons is one of the best in the oil patch, but if he’s correct, what would be the fallout? (Click here for the article.)

A regular commenter to JSMineset.com thinks it would be worse for the world than the Lehman Brothers collapse! His code name is “Pedro.” Jim Sinclair, the creator and owner of JSMineset.com, told me “Pedro” is a major personality in the over-the-counter derivative side of energy. He also said “Pedro” has impeccable credentials but uses a code name for fear of causing problems for his firm and himself for speaking the truth. If BP goes under, Sinclair says the world economy will fall into a “black hole.” I think this is one of the most important things you will read this year. Mr. Sinclair personally gave me permission to share it with the readers of USAWatchdog.com. The letter below, to Jim Sinclair, reveals what is being talked about at the highest levels in the financial world. Please take the time to read it all.

Dear Jim,

The BP crisis in the Gulf of Mexico has rightfully been analyzed from the ecological perspective. People’s lives and livelihoods are in grave danger. But that focus has equally masked something very serious from a financial perspective, in my opinion, that could lead to an acceleration of the crisis brought about by the Lehman implosion.

People are seriously underestimating how much liquidity in the global financial world is dependent on a solvent BP. BP extends credit – through trading and finance. They extend the amounts, quality and duration of credit a bank could only dream of. The Gold community should think about the financial muscle behind a company with 100+years of proven oil and gas reserves. Think about that in comparison with what a Bank, with few tangible assets, (truly, not allegedly) possesses. (No wonder they all started trading for a living!) Then think about what happens if BP goes under. This is no bank. With proven reserves and wells in the ground, equity in fields all over the planet, in terms of credit quality and credit provision–nothing, can match an oil major. God only knows how many assets around the planet are dependent on credit and finance extended from BP. It is likely to dwarf any Banking entity in multiples.

And at the heart of it all are those dreadful OTC Derivatives–again! Banks try and lean on major oil companies because they have exactly the kind of credit-worthiness that they themselves lack. In fact, major oil companies, conversely, spend large amounts of time both denying Banks credit and trying to get Bank risk off of their books in their trading operations. Oil companies have always mistrusted Bank creditworthiness and have largely considered the banking industry a bad financial joke. Conversely, Banks plead with oil companies to let them trade beyond one year in duration. Banks even used to do losing trades with Oil Companies simply to get them on their trading register…a foot in the door so that they could subsequently beg for an extension in credit size and duration. For the Banks, all trading was based on what the early derivatives giant, Bankers Trust, named their trading system: RAROC- or – Risk Adjusted Return on Credit. Trading is a function of credit bequeathed, mixed with the risk of the (trading) position. As trading and credit are intertwined, we might do well to remember what might happen to global liquidity and markets if BP suffers what many believe to be its deserved fate of bankruptcy. The Intercontinental Exchange (ICE) has already been and will be further undermined by BP’s distress. They are one of the only “hard asset” entities backing up this so-called “Exchange”.

If BP does go bust (regardless of it is deserved), and even if it just badly wounded and the US entity is allowed to fail, the long-term OTC Derivatives in the oil, refined products and natural gas markets that get nullified could be catastrophic. These will kick-back into the Banking system. BP is the primary player on the long-end of the energy curve. How exposed are Goldman…Morgan Stanley and JPM? Probably hugely. Now credit has been cut to BP. Counter-parties will not accept their name beyond one year in duration. This is unheard of. A Giant is on the ropes. If he falls, the very earth may shake as he hits the ground.

As we are beginning to see, the Western pension structure, financial trading and global credit are all inter-twined. BP is central to this, as a massive supplier of what many believe(d) to be AAA credit. So while we see Banks roll over and die, and Sovereign entities begin to falter… we now have a major oil company on the verge of going under. Another leg of the global economic “chair” is being vicious kicked out from under us. Ecological damage is not just an eco-event on its isolated own. It has been added to the list of man-made disasters jeopardizing the world economy. The price tag and resultant knock-on effects of a BP failure could easily be equal to that of a Lehman, if not more. It is surely, at the very least, Enron x 10.

All the counter-party risk associated with the current BP situation means the term curve of the global oil trade has likely shut down. Here we have yet another credit-based event causing a lock-up in markets that will now impede trade and commerce. It looks like an exact replication of the 2008 credit market seizure could ensue all over again – and it could probably be a lot worse. The world is in a far more delicate state now. Although never really discussed, the world is highly reliant on BP’s provision of long-term credit to many core industries. Who makes good on all the outstanding paper that so many smaller oil, gas and electricity companies, airlines, shipping companies, local bus, railway and transportation networks that rely on BP’s creditworthiness and performance for? It doesn’t take a genius to figure out how this could all unwind. If BP has to be bailed-out, like a bank, the system will have to print even more unimaginable amounts of money.

The market, intellectually lazy and slow to realization, as it often is, probably has not woken up to it yet – but the BP crisis could unleash damage similar to the Banking crisis. A BP failure through bankruptcy could make Lehman look small in comparison, and shake the financial house of cards we live in even more severely. If the implicit danger of the possibilities embedded in such an event doesn’t make an individual now turn towards Gold at full speed, it is likely that nothing will.

Respectfully yours,

CIGA Pedro

(CIGA stands for Comrades in Golden Arms)

This crisis will continue in its effects for quite awhile. It is likely that every one in the USA, certainly, will feel this. My brother lives in Clearwater Fla. and has been laid off due to tourists cancelling their reservations; I’m sure he is not alone. The article demonstrates just how ubiquitous this situation may become.

The President, for short term political gain, has probably guaranteed another financial crisis from which we cannot recover. People are acting like scared rabbits instead of thinking and considering their plight.

Hard assets now, before they become too expensive, seems to be the best course of action. All the geniuses on Wall Street are beginning to look like the clownish stockbroker on the Scott Trades advertisements.

John,

You are correct.

Greg

BP’s bankruptcy would also saddle the American taxpayer with the entire cost of the cleanup. I have seen recently that the well is unlikely to get capped anytime soon due to the velocity of the oil spewing out. It is coming up the 4.5 mile deep well at the speed of sound. Oil has also been reported to be leaking through fissures 11 kilometers from the main well as a result of this spill. The dispersants they are using are more toxic than the oil itself and all it will take is a hurricane to pick that up from the ocean and hurl it into vegetation in the southeastern states. The well is 40% methane when normal wells are 5% and the depth makes this highly pressurized. A concern of a growing methane bubble under the sea floor is their biggest concern right now.

http://www.youtube.com/watch?v=s3_23PFnTZ8

Some say the only way to cap this well is to detonate a nuke at the ocean floor. They haven’t gone this route not for the environmental concern but the concern this could cut off access to drilling in most of the gulf which is where 40% of the United States oil production comes from. Can you say $20 per gallon if we are lucky?

This is much worse than the public is being made aware of and I can’t say I disagree with keeping us in the dark.

Stephen

Stephen,

You have made some good points here. Thank you.

Greg

This is extremely frightening.

The USA has grown soft, very soft and another great depression would bring unspeakable pain, havoc and great suffuring. I just can not see the light at the end of this tunnel. As an engineer myself, the problems and challanges with the “oil volcano” is daunting to the extreme. BP is operating on the cutting edge of engineering and technology and if BP goes bankrupt, the situation is very dire indeed. Just one small huricane in the Gulf this year could set the stage for Great Depression II. Pray hard America!!

I’m praying everyday Ray. Thank you.

Greg

It troubles me when I speak to colleagues who express that they wish BP would go under. For many anecdotal reasons of my own, now very firmly backed by the analysis provided in this piece, I have been strongly concerned with BP’s health.

Assuming that BP does go bankrupt, even they sold off their holdings and assets to pay for short-term ecological recovery, the effects of this catastrophe will last indefinitely. Some one will have to pick up that tab.

From an investment perspective, BP is at a 13-year low, so a risk-loving investor could pick up stock for a steal. If BP managed to plug the hole quicker than two months down the road, that could give some confidence back in their longevity.

Trouble is that they may not plug the hole in even two months. And with years of lawsuits and criminal investigations to come, the outlook is bleak.

dan

Dan,

If this was an air plane you’d be hearing “brace for impact” in about 3 minutes. I hope you are protecting yourself. Don’t doubt yourself. You got it right!! This is a math problem and the math is telling us things are very bad. Thank you for your support. And finally if BP plugged the hole today there is still cleanup and lawsuiits and damages. Forget it. It’s way too risky.

Greg

http://www.accuweather.com/blogs/news/story/33093/risk-of-tropical-storm-hurrica-1.asp

High Risk of a tropical Storm in Gulf Next Week?!

Hi Greg,

You are certainly correct in stating that ‘things are very bad’. Each day it appears that many issues are coming to a head. Well, many of us have expected this for some time huh?!

I wonder how many (and who) in our current Gov’t administration had/have sold their BP stock just before this rig blew up?

FYI. This story puts the info of how bad this is into a easy to understand package. D.

How the ultimate BP Gulf disaster could kill millions

by Terrence Aym

Disturbing evidence is mounting that something frightening is happening deep under the waters of the Gulf of Mexico—something far worse than the BP oil gusher.

Warnings were raised as long as a year before the Deepwater Horizon disaster that the area of seabed chosen by the BP geologists might be unstable, or worse, inherently dangerous.

What makes the location that Transocean chose potentially far riskier than other potential oil deposits located at other regions of the Gulf? It can be summed up with two words: methane gas.

The same methane that makes coal mining operations hazardous and leads to horrendous mining accidents deep under the earth also can present a high level of danger to certain oil exploration ventures.

Location of Deepwater Horizon oil rig was criticized

More than 12 months ago some geologists rang the warning bell that the Deepwater Horizon exploratory rig might have been erected directly over a huge underground reservoir of methane.

Documents from several years ago indicate that the subterranean geologic formation may contain the presence of a huge methane deposit.

None other than the engineer who helped lead the team to snuff the Gulf oil fires set by Saddam Hussein to slow the advance of American troops has stated that a huge underground lake of methane gas—compressed by a pressure of 100,000 pounds per square inch (psi)—could be released by BP’s drilling effort to obtain the oil deposit.

Current engineering technology cannot contain gas that is pressurized to 100,000 psi.

By some geologists’ estimates the methane could be a massive 15 to 20 mile toxic and explosive bubble trapped for eons under the Gulf sea floor. In their opinion, the explosive destruction of the Deepwater Horizon wellhead was an accident just waiting to happen.

Yet the disaster that followed the loss of the rig pales by comparison to the apocalyptic disaster that may come.

A cascading catastrophe

According to worried geologists, the first signs that the methane may burst its way through the bottom of the ocean would be fissures or cracks appearing on the ocean floor near the damaged well head.

Evidence of fissures opening up on the seabed have been captured by the robotic submersibles working to repair and contain the ruptured well. Smaller, independent plumes have also appeared outside the nearby radius of the bore hole itself.

According to some geological experts, BP’s operations set into motion a series of events that may be irreversible. Step-by-step the drilling team committed one error after another.

Congressmen Henry Waxman, D-CA, and Bart Stupak, D-MI, in a letter sent to BP CEO Tony Hayward, identified 5 missteps made by BP during the period culminating with the explosion.

Waxman, chair of the Congressional energy panel and Stupak, the head of the subcommittee on oversight and investigations, said, “The common feature of these five decisions is that they posed a trade-off between cost and well safety.”

The two Representatives also stated in the 14-page letter to Hayward that “Time after time, it appears that BP made decisions that increased the risk of a blowout to save the company time or expense.”

Called by some insiders investigating the ongoing disaster a “perfect storm of catastrophe,” the wellhead blew on the sea floor catapulting a stream of mud, oil and gas upwards at the speed of sound.

In describing the events—that transpired in a matter of seconds—they note that immediately following the rupture the borehole pipe’s casing blew away exposing a straight line 8 miles deep for the pressurized gas to escape. The result was cavitation, an irregular pressure variance sometimes experience by deep diving vessels such as nuclear submarines. This cavitation created a supersonic bubble of explosive methane gas that resulted in a supersonic explosion killing 11 men and completely annihilating the drilling platform.

Death from the depths

With the emerging evidence of fissures, the quiet fear now is the methane bubble rupturing the seabed and exploding into the Gulf waters. If the bubble escapes, every ship, drilling rig and structure within the region of the bubble will instantaneously sink. All the workers, engineers, Coast Guard personnel and marine biologists measuring the oil plumes’ advance will instantly perish.

As horrible as that is, what would follow is an event so potentially horrific that it equals in its fury the Indonesian tsunami that killed more than 600,000, or the destruction of Pompeii by Mt. Vesuvius.

The ultimate Gulf disaster, however, would make even those historical horrors pale by comparison. If the huge methane bubble breaches the seabed, it will erupt with an explosive fury similar to that experienced during the eruption of Mt. Saint Helens in the Pacific Northwest. A gas gusher will surge upwards through miles of ancient sedimentary rock—layer after layer—past the oil reservoir. It will explode upwards propelled by 50 tons psi, burst through the cracks and fissures of the compromised sea floor, and rupture miles of ocean bottom with one titanic explosion.

The burgeoning methane gas cloud will surface, killing everything it touches, and set off a supersonic tsunami with the wave traveling somewhere between 400 to 600 miles per hour.

While the entire Gulf coastline is vulnerable, the state most exposed to the fury of a supersonic wave towering 150 to 200 feet or more is Florida. The Sunshine State only averages about 100 feet above sea level with much of the coastline and lowlands and swamps near zero elevation. [Elevation map] A supersonic tsunami would literally sweep away everything from Miami to the panhandle in a matter of minutes. Loss of human life would be virtually instantaneous and measured in the millions. Of course the states of Texas, Louisiana, Mississippi, Alabama and southern region of Georgia—a state with no Gulf coastline—would also experience tens of thousands, if not hundreds of thousands of casualties.

Loss of property is virtually incalculable and the days of the US position as the world’s superpower would be literally gone in a flash…of detonating methane.

Report about the Late Paleocene Thermal Maximum (LPTM), which occurred around 55 million years ago and lasted about 100,000 years. Large undersea methane caused explosions and mass extinctions.

http://www.sciencedaily.com/releases/2001/12/0112101 63439.htm

This explores the controversial paper published by Northwestern University’s Gregory Ryskin. His thesis: the oceans periodically produce massive eruptions of explosive methane gas.

http://www.youtube.com/watch?v =25BE42PzZZc&feature=player_embedded

Youtube videos discussing the underground methane deposit

http://www.youtube.com/watch?v =wki74yAYrqA&feature=related

http://www.youtube.com/watch?v =z4hfGY6i75w&feature=related

Learn more about this author, Terrence Aym.

Click here to send this author comments or questions.

http://www.helium.com/items/1864136-how-the-ultimate-bp-gulf-disaster-could-kill-millions? page=3

Thank you D. To my readers: I have only partically confirmed this but it poses some very interesting ideas so I am going to post this and let you all read it for yourselves. Here nis a Reuters story that give some credence comment. The story is titled:Methane in Gulf “astonishingly high”: U.S. scientist Here is the link: http://www.reuters.com/article/idUSTRE65L6IA20100622

Greg

As a geologist, I too found this interesting. I did some research, and could find nothing to substantiate any of this. At least Greg’s link is to an article about a genuine scientific study where preliminary results are presented. But this pertains to methane within the ocean, so doesn’t really lend anything to the scenario described by T. Aym and others. One of the “others” is an article on HuffPo (http://www.huffingtonpost.com/dk-matai/gulf-of-mexico-danger-of_b_619095.html) which at least includes scientific references at the bottom. None of those references are relevant to the Deepwater Horizon well situation, though.

This is what happens when there’s so much secrecy, spin and obfuscation; the public is left to fill in the blanks themselves.

Here is one article that does do a very good job of providing a credible (and substantiated) description of what is truly going on, and the implications for what may unfold in the months to come:

http://axisoflogic.com/artman/publish/Article_60341.shtml

Thank you Geofizz!!!!

“But this pertains to methane within the ocean, so doesn’t really lend anything to the scenario described by T. Aym and others.”

I should qualify the above sentence with a further elaboration. It’s not that Kessler’s study is irrelevant when it comes to Aym’s article. Rather all it shows is that yes, there is indeed large quantities of methane coming out of the Deepwater Horizon oil well and being concentrated within the lower depths of the Gulf. That alone does not lend any credence to the idea of there being a huge subsurface methane bubble.

Greg,

Is relating this to lehman a little over the top. I understand the undetermined potential liability, but the assets BP has real assets and not mbs or bankrupt loans, that do not match what the bank levered itself against? Also if Stephen Clifton is right, at $20 a barrel this stock could be a steal. Kidding on the last point of course, but just wondering about the thoughts. I do not have enough knowledge of BP to assume what liabilities they have with or without the potential cleanup costs, but I thought Pedro seems a little over the top.

Thanks

Chris

Chris,

This is a disaster unlike the world has ever known, and it is ongoing!! The liabilities are mind boggling. Oil man, T. Boone Pickens told Larry King recently that he “would not buy BP stock”. I sold mine at $51 dollars. This is not a deal at any price given BP’s long term liabilities which are not fully known at this time. Ignore “Pedro” at your own peril. Thank you for reading USAWatchdog.com.

Greg

By the way, in early 2008 I said on CNN repeatedly that ALL the banks were in trouble. People thought that was over the top at the time.

Good luck my friend.

I said $20 per gallon, not barrel.

Stephen,

My bad, so sorry for missing that.

Greg

Hi Greg –

The idea of BP failing makes me think of Creditanstalt Bankruptcy of 1931 and how it facilitated the Great Depression worldwide. Plus ça change, plus c’est la même chose.

Otter

If you undetand how money is created by the US Banking fractional reserve system you will understand the impact of BP’s money exiting the system.

George,

Good point. Could you give us a short explanation? Thank you for your contribution!!

Greg

Hi Greg,

Here it how Fractional Reserve banking create money. As of 2006, banks have been required to hold reserves of 10% on transaction deposits (Demand Deposit accounts aka checking accounts) and 0% on time deposits (Savings account, Money markets & CD’s).

Let’s say you are cleaning out your attic and find $100,000. You deposit this windfall in your checking account at First Bank. First Bank is required to add $10,000 to their reserves and now have $90,000 they can lend. I want to buy that Ferrari I’ve always wanted and I borrow the $90,000 from First Bank. You still have the $100,000 in your checking account and I spend $90,000 that did not exist until your deposit. The act of lending out excess of funds over a bank’s mandatory minimum reserves creates money. Your $100,000 deposit could create an additional $900,000 with a 10% fractional reserve. Bear in mind that if you put it in a CD, savings account or money market fund, the reserve is 0% and they can loan out the full $100,000

With this in mind, you can see how easily a bank can become insolvent. Bad loans are written off and that impacts owner’s equity and/or reserves. Or in a short period of time people withdraw more than 10% of the banks deposits also known as a “run” on a bank.

It’s scary; most people think the Fed Reserve makes all the money. Your local banker is doing his fair share of it and most are none the wiser.

So, say BP pulls the twenty billion dollars out of the system that it had been using to extend credit could have a far reaching impact on credit.

Thank you George from all of us.

Greg

Greg,

I appreciate the short sighted response.

I was asking honestly if since they had assets it was much different than that of Lehman who was backed by bad loans and levered 8 to 1 against them.

Obviously the tradgey is still ongoing and to put a price on the liability is absurd. Also i was unware of everyone (especially after reading pedro’s piece) knew the systemic risk a alrge E&P had. My apaologies to you all.

As for the stock, as I said I was joking, but i guess your genius is not in comedy. Also the nuclear blow up of the gulf and $20 gallon of oil was a joking positive of the assets of BP.

I do enjoy your wits and outlook and really am here learning greg, so thank you for reading and responding.

Chris,

I apologize for my lack of humor and coming off harsh. I’ll work on both fronts when commenting back to readers. Thank you for reading USAWatchdog.com. Please forgive me.

Greg