Latest Posts

“Where Should I Invest My Money?”

By Greg Hunter’s USAWatchdog.comI was a featured guest on the nationwide overnight radio show “Coast to Coast AM” last week. The show airs on more than 500 radio stations. “Coast to Coast AM” has a huge audience. So, after my appearance, I was flooded with emails. Many people who contacted me said they were “scared” of what is happening in the economy and wanted to know what to do with their money to keep it safe. I want to share a couple of excerpts from the emails with you: (more…)

By Greg Hunter’s USAWatchdog.comI was a featured guest on the nationwide overnight radio show “Coast to Coast AM” last week. The show airs on more than 500 radio stations. “Coast to Coast AM” has a huge audience. So, after my appearance, I was flooded with emails. Many people who contacted me said they were “scared” of what is happening in the economy and wanted to know what to do with their money to keep it safe. I want to share a couple of excerpts from the emails with you: (more…)

What is Money?

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

Why Can’t We Have Honest Money?

By Greg Hunter’s USAWatchdog.com

Back in the late 60’s and early 70’s prime interest rates averaged 6 or 7 percent. Back before 1971 it was possible to save money at a reasonable guaranteed rate of return and easily keep ahead of what little inflation there was in the U.S. economy. That was the beauty of honest money that held its value and paid a real rate of return. In 1971 all that changed when President Richard Nixon took the country off the gold standard and went to a total fiat currency. A few years later the Employee Retirement Income Security Act (ERISA) was sign into law and that made possible the 401K plan. It allowed people to save in a brand new way largely through the stock market. The stock market is an invaluable tool of capitalism. It is how many companies raise capital and create jobs and prosperity. But what most people do not realize is a 401K is not a savings plan but an investing plan. When you save money, you put it away and get a guaranteed return. In an investment plan the money is put away but not guaranteed. Most people I know do not really understand their 401K plan. Folks are repeatedly told “invest for the long term.” They are also told there is really no other way to save for the future because if you simply save your money inflation will eat up your returns. By and large, working people are pushed into 401K’s. In the right business cycle with the right demographics (as in lots of baby boomers investing in stocks at the same time such as the 80’s and 90’s when business and inflation were stable) the 401K is a not a bad deal especially when you consider that companies often match or contribute funds to make the investment plan advantageous to participants. But in the wrong part of the business cycle (aging baby boomer population and big government bail outs of every big bank) the 401K can provide some gut wrenching lessons about “investing.” People are painfully finding out with every statement that these plans have not been such a good “long term” investment deal. The S&P 500 is back at levels not seen since 1998. And that doesn’t really account for companies whose share prices have been wiped out or bankrupted. A few examples spring to mind such as AIG, WaMu, Wachovia, Bear Stearns, GM, Ford, Fannie, Freddie, Lehman, Enron and World Com. Also, factor in a nearly 30 percent drop in the U.S. Dollar Index and how are people in 401K’s making money for retirement? The short answer: They are not!!! If you would have simply invested in money markets (and taken the company match) back in 1998 with your 401K you would have been hit with inflation but at least you would have a positive nominal return. Most people did not take that route. Now, to help fund the multi trillion dollar bailout of Wall Street, the Fed has announced a new policy of “Quantitative Easing.” That means “printing money” to us simple folk. So getting any kind of return on cash will be impossible to do because the government will be printing it faster that you or anyone else can save it. Nobel Prize winner Milton Friedman said it best, “inflation is always and everywhere a monetary phenomenon.” Printing lots of fiat currency is going to produce an ugly phenomenon for most people. I see a continuing freak show of bailout and default. If you are an investor then the stock market and all its risks and rewards are for you but if you are a saver then maybe you should have other options. Wouldn’t it be easier for most people to save if we just had honest money? Someday honest money will be necessary for the county and our citizens to survive.

Stocks Most Expensive Ever – Greater Depression Coming – Michael Pento

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager and economist Michael Pento says if you think the worst is over in the stock market, think again. Pento explains, “Now, the valuation of stocks today are the most expensive in history, not around or tied or close. We are now 155% of GDP when you look at the market cap of equities. Stocks have never been more expensive.” (more…)

Cheap Money Not Going to Work Anymore – Charles Nenner (#1)

By Greg Hunter’s USAWatchdog.com (Click here for Part #2)

By Greg Hunter’s USAWatchdog.com (Click here for Part #2)

Renowned geopolitical and financial cycle expert Charles Nenner says forget what the mainstream financial channels are saying about more Fed easy money policies pushing the markets higher. Nenner explains, “The clever institutions I work with were selling all the time when the S&P was around 3,000, and the small investor and public were buying, buying and buying. The clever money was so happy then . . . . The small investor buys and all the time they (clever money) get a chance to sell, sell and sell until they are finished selling. Then, suddenly something happens. (more…)

Weekly News Wrap-Up 9.5.14

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Once again, the Ukraine crisis is the top story. There is a cease-fire between the pro-Russian separatists and Ukraine. I hope this is a legitimate effort and not a tactic to stall for time until NATO can send in more troops. I hope this is not a way to say well, we tried to talk to Russia, and it did not work out, and now we have an excuse for wider war. Anyone who thinks Russia is not heavily involved is dreaming. (more…)

Fed Laundering Treasury Purchases to Disguise What’s Happening-Paul Craig Roberts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In his latest article, former Assistant Treasury Secretary Dr. Paul Craig Roberts says, “The Fed is the great deceiver.” Why is he making this shocking accusation? The reason is tiny Belgium’s whopping purchase of $141 billion in Treasury bonds earlier this year. Dr. Roberts explains, “We know that Belgium didn’t have any money to buy $141 billion worth of bonds over a three month period. That sum comes to 29% of the Belgium GDP. So, they don’t have a surplus in their budget that is 29% of their GDP, and they don’t have trade or current account surplus in that amount. In fact, everything is in the red. (more…)

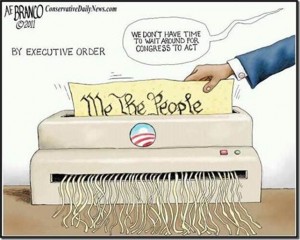

It’s All About Control

By Greg Hunter’s USAWatchdog.com (Revised)

By Greg Hunter’s USAWatchdog.com (Revised)

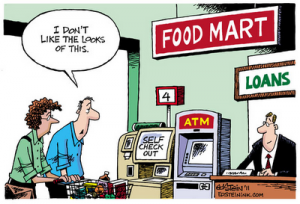

Ever since the original Patriot Act was passed by Congress in 2001, American civil liberties have steadily shrunk and government control has steadily grown. In a financial crisis, your bank or brokerage can severely restrict the amount of money you can withdraw from your accounts. The government can now assassinate so-called terrorists anywhere in the world, including on U.S. soil. (more…)

We Don’t Have Honest Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

My nephew, Luke, called me the other day vexing over the materials used in our coins. He is a finance major in grad school and was researching money when he discovered that pennies were 97.5 percent zinc and nickels were mostly copper with only a nickel coating. (more…)

The Smell of Money Harvesting is in the Air!!!

By Greg Hunter’s USAWatchdog.com

There are so many reasons why this stock market should be hitting a wall. Just a few are: high unemployment, plummeting tax revenues, major real estate declines, defaults in both residential and commercial properties, hundreds of banks are expected to fail this year and next, cities and states going broke and wars fought on 2 fronts. There is no end or resolution in sight for any of these problems.

Yet, the stock market has “climbed a wall of worry” to produce one of the biggest bear market rallies in history. The DOW is up about 50% in just 5 months. The market by most standards is not cheap. So is everybody crazy? Well, apparently corporate insiders are not. They were dumping their stocks at a rate of 30 to 1 during the month of August according to TrimTabs Investment Research. That means for every insider buying shares of stock, there were 30 insiders selling shares of stock! According to TrimTabs, that is a record. Take a deep breath…that is the smell of the money harvesting Wall Street machine revving it’s engine! Nowhere is the buy low and sell high mentality more apparent than in this chart of the S & P 500 below :

The S&P 500 is at about the same level as it was in 1997. And consider this, people have been stuffing around 5 to 10 percent a year into their pre-tax retirement accounts (which amounts to hundreds of billions of dollars.) So shouldn’t the market be much higher? Where did all that cash go? The money was ” harvested” by insiders, hedge funds and big banks! These folks sold high, took your contributions and left you holding the losses. All the while, “the experts” told you to be a “long term investor” and be “diversified.” What happened in the last 12 years? Isn’t that enough time to make some money? Isn’t a group of 500 top stocks diversified? Well look at the picture above and any 3rd grader can see THAT DIDN’T WORK!!! You could have beaten S&P 500 returns by a mile by just putting your money in an FDIC insured bank account during the last 12 years!! On top of that, you would not have paid a management fee (1 percent on average) which would have saved you another 12 percent! What a rip-off!!!

Also, consider the fact there are a whole lot of companies that are no longer in the S&P 500 because they have either gone bankrupt or the share price has evaporated. That means the “investing” picture for the little guy is actually a whole lot worse than the S&P shows. Let’s name just a few companies in the past 11 years that delivered a big loss to anyone holding them: Lehman, Bear Stearns, Fannie, Freddie, AIG, GM, Chrysler, Enron, WorldCom, Adelphia, Wachovia and WaMu. That is only a few I can name off the top of my head. I think you get the point.

Fast forward to today and reconsider the 50% increase in the market in just 5 short months. Still, most people are down at least 30 percent from the high. If you are a trader or insider, you love this market! If you are a “buy an hold” investor, get ready to sit on another big loss in the old 401k or sell some stock and you too can harvest some money just like the big guys!