Latest Posts

The 2.5% GDP Growth Spin Job

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Last week, the government announced the economy (gross domestic product, GDP) grew at a 2.5% rate. The mainstream media (MSM) hailed this as some significant turnaround. Businessweek.com reported, “Buoyed by a resurgent consumer and strong business investment, the economy expanded at an annual rate of 2.5 percent in the July-September quarter, the government said Thursday. (more…)

Weekly News Wrap-Up 10.28.11

By Greg Hunter’s USAWatchdog.com

Stocks soared this week as the EU agreed on a deal that will address its sovereign debt crisis. The Dow was up nearly 340 points to 12,200, but is the debt problem really fixed? NO WAY!!! There is just too much debt to deal with. Any solution will need mountains of freshly printed currency. That’s why gold and oil were also up big this week. (more…)

Is the EU Sovereign Debt Problem Really Fixed?

By Greg Hunter’s USAWatchdog.com

When I first heard of the deal to fix the European debt crisis, I thought, “Is the EU Sovereign Debt Problem Really Fixed?” This is a complicated solution and mainly addresses sour Greek debt. Bankers are supposed to take a 50% cut in value of their bonds, which means taxpayers in Europe will subsidize the rest of the losses. There is also a new agreement on the European Financial Stability Facility (EFSF) or bailout fund that should raise it up to around $1.4 trillion (1trillion euros). Of course there are really no real details on where that money is coming from. (more…)

Unknown Territory

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was surprised to see the Dow only off a few hundred points yesterday considering all the problems European Union finance ministers are having getting a sovereign debt rescue plan together. A 200 point loss on the Dow dramatically underestimates the amount of damage that could be done if the EU debt crisis goes haywire. Maybe everyone is thinking the Federal Reserve will ultimately backstop Europe but, then again, the Fed can’t bail out every bank. (more…)

Inflation Up Globally

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The meeting yesterday in Europe to come up with a plan to stem the sovereign debt crisis turned sour. Zero was accomplished, except to put even more fear into the world over an impending financial meltdown that will likely be worse than the 2008 mushroom cloud. (more…)

Weekly News Wrap-Up 10/21/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It only cost one or two billion bucks to get rid of Libya’s leader, Muammar Gaddafi. Was it worth it? He pled for his life, but was killed anyway. Did NATO want him dead? Would a war crime trial embarrass the West? We will never know. The EU sovereign debt crisis is at an impasse. The debt of Spain was downgraded and France may be next in line for a cut. Some very big French banks are in trouble. (more…)

The Age of Bank Failures

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The U.S. stock market surged yesterday on news the European Union (EU) would deploy a two trillion euro rescue fund to help get its sovereign debt crisis under control. This news was so good even battered Bank of America stock jumped more than 10%. Crisis averted? Hold on, not so fast. (more…)

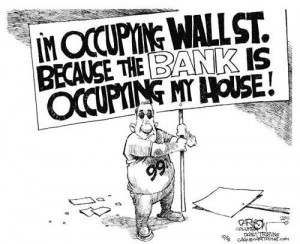

Should There be a Public Option for Banking?

Things are not looking good for European banks or, for that matter, U.S. banks. Bankers are cutting expenses and laying off workers in droves as their profits go up in smoke. The bankers got what they wanted years ago—almost all regulations cut. They ran wild, and it blew up. This has brought the world to the brink of insolvency. Many banks are going to fail as governments can’t save them all. One of the things that will likely emerge from the ashes of failed private banks will be public banks. In this scenario, some banks will be re-engineered to be more like utilities. (more…)

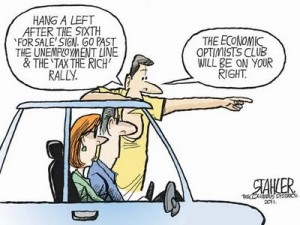

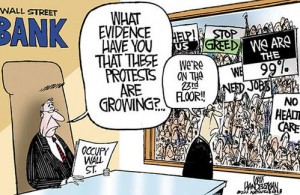

Everyone Now Identifies With Protesters

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

What started out as a little insignificant protest that the mainstream media tried to ignore (or at least downplay) has turned into a global phenomenon in a little less than a month. One of the many headlines that featured the protesters of the Occupy Wall Street (OWS) movement this past weekend said “From Tahrir Square to Times Square: Protests Erupt in Over 1,500 Cities Worldwide.” (more…)

Weekly News Wrap-Up 10.14.11

By Greg Hunter’s USAWatchdog.com The alleged Iranian plot to kill the Saudi Ambassador in Washington D.C. has put everyone on edge even though it was foiled. Secretary of State Hilary Clinton says it is a “dangerous escalation.” The U.S. government considers this an act of terrorism and this could spark another war. This could cause $200 barrel oil almost overnight and wreak havoc on the fragile world economy. Speaking of the economy, Europe is a mess and it appears that the EU is going to have to print lots of money and let some banks fail as it braces for a Greek default. (more…)

By Greg Hunter’s USAWatchdog.com The alleged Iranian plot to kill the Saudi Ambassador in Washington D.C. has put everyone on edge even though it was foiled. Secretary of State Hilary Clinton says it is a “dangerous escalation.” The U.S. government considers this an act of terrorism and this could spark another war. This could cause $200 barrel oil almost overnight and wreak havoc on the fragile world economy. Speaking of the economy, Europe is a mess and it appears that the EU is going to have to print lots of money and let some banks fail as it braces for a Greek default. (more…)

Republican Debate Focused on Economy and Cain

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I don’t know who won the October 11, 2011 Republican debate last night, but Herman Cain sure got a lot of attention for his 9-9-9 tax plan. That’s short for 9% tax on business, 9% tax on personal income and 9% sales tax. I am sure the Republican field loves the first two, but a 9% sales tax seems like a complete downer for the party of Lincoln. Michele Bachman (who is a tax attorney) hit Mr. Cain in the face with verbal cream pie when she said (more…)

Where is Occupy Wall Street Going?

I have to applaud the “Occupy Wall Street” movement even if their message is a little disjointed. I think the message will sharpen in time. I hope the main focus continues to be the ongoing market manipulation and crime that has gone unpunished. I know folks on both sides of the spectrum are criticizing these folks. I am not surprised because, after all, both parties have been bought off by the Wall Street bankers. (I am behind anyone who is exercising their First Amendment rights.) (more…)

I have to applaud the “Occupy Wall Street” movement even if their message is a little disjointed. I think the message will sharpen in time. I hope the main focus continues to be the ongoing market manipulation and crime that has gone unpunished. I know folks on both sides of the spectrum are criticizing these folks. I am not surprised because, after all, both parties have been bought off by the Wall Street bankers. (I am behind anyone who is exercising their First Amendment rights.) (more…)

When?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

When? That’s the question that is on the minds of people following the economy. When will the “you know what” hit the fan and we start another global meltdown. I am not going to string you along. I will tell you right now, I don’t know. I will tell you the headlines I read and the things I am hearing from people in power around the globe say we are in deep danger. The time is close. (more…)

Weekly News Wrap-Up 10.7.11

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

The big financial story this week comes from Europe. To print or not to print, that is the question. The answer is the EU will print money to bail out their banks. Now Chancellor Merkel and Germany are on board along with the ECB and the IMF. Heck, even the UK has started printing money again. Ben Bernanke was grilled by a big Congressional economic committee in Washington this week. (more…)

What was Steve Jobs Secret to Life?

By Greg Hunter’s USAWatchdog.com

The passing of Steve Jobs is like losing the Alexander Graham Bell or Thomas Edison of our day. He was truly brilliant. His thoughts and inventions changed the way we live. What was his secret? Is it something we all could incorporate into our lives? I stumbled upon Steve Jobs’ 2005 Stanford UniversityCommencement Speech a few weeks ago. I watched from beginning to end because it was riveting. He gave his secret to success and life in this speech. Please watch it. I think you will find it just as enjoyable, and it is in his own words. Peace –Greg Hunter– (more…)