Latest Posts

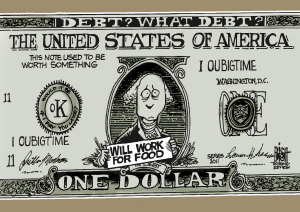

Dollar and America on the Road to Ruin

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

In the last week or so, I’ve noticed an unusual amount of really well written and researched articles warning of impending doom and financial horror. These articles are not written by a bunch of angry uneducated bloggers but by money managers, investors and financial writers. All are people who got it right leading up to the meltdown of 2008, and my bet is they are right again. (more…)

Is the World Spinning Out of Control?

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

More Europe bailout news. Last week, the world was elated with news that the Federal Reserve and five other central banks got together to prop up Eurozone banks drowning on sour sovereign debt, but the crisis is far from over. The latest scheme is for countries to trade sovereignty over their budgets in return for more bailout money. (more…)

It’s All About Gold Now

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

At the beginning of this month, the G20 met in France to try to find a way to solve the European sovereign debt crisis. It ended with world leaders in disarray over a way to come up with a solution. At first blush, it appears that nothing of any importance came of the meeting of the 20 leading economies of the world, but that is not the case. (more…)

The Age of Bank Failures

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The U.S. stock market surged yesterday on news the European Union (EU) would deploy a two trillion euro rescue fund to help get its sovereign debt crisis under control. This news was so good even battered Bank of America stock jumped more than 10%. Crisis averted? Hold on, not so fast. (more…)

The Fed’s Inflation Play

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I have been saying repeatedly that the one thing you can count on is inflation. If you take housing out of the picture, that is exactly what we have been getting. The Fed wants inflation and loathes deflation. Ben Bernanke and other Fed officials have consistently said they want to support “asset prices.” (more…)

Will Market Manipulation Stop Gold and Silver from Rising?

By Greg Hunter’s USAWatchdog.com

There are plenty of folks flocking to the internet these days to tell the world why gold and, particularly, silver are finished as an investment and wealth protection opportunity. Some are even screaming to sell now before gold and silver prices tank. To give you an example of what I am talking about, I want to share a comment with you from a reader named Michael. (more…)

Is America Going Back to a Gold Standard Someday?

By Greg Hunter’s USAWatchdog.com

America went off the gold standard in 1971 when Richard Nixon closed the “gold window.” That meant the U.S. didn’t have to pay foreigners with gold, only dollars. President Nixon created the first world reserve currency that was officially backed by nothing. The U.S. has gotten to print money at will until this very day, but nothing lasts forever. Recently, Steve Forbes (President and Chief Executive Officer of Forbes and Editor-in-Chief of Forbes magazine) predicted that a return to a gold standard is likely “in the next five years.” (more…)

Never Ending Money Printing

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Federal Reserve held its first press conference in its 97 year history last week. In my mind, it did this because it recognizes the deep financial trouble the U.S. is in. It wants to put a positive spin on the mess it largely created and/or allowed to happen. After all, it was Tim Geithner who was the head of the New York Fed during the go-go years of the mid 2000’s. He was supposed to regulate the big Wall Street banks. You see how well that worked out—the entire system melted down and Geithner got a promotion to Treasury Secretary. (more…)

The Most Predictable Financial Calamity in History

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In November 2010, the Federal Reserve announced a second round of economic stimulus commonly referred to as Quantitative Easing (QE2). The reason, according to the Fed, was “progress toward its objectives has been disappointingly slow.” So, to try and turn the economy around, the Fed said, “. . . the Committee intends to purchase a further $600 billion of longer-term Treasury securities (more…)

Insanity or Ingenious?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

What is happening in the economy is signaling enormous changes for the U.S. and the world. The scale of what the Federal Reserve is doing is unparalleled in human history. No country has ever produced so much money and so much debt in such a short amount of time. The Fed has embarked on another round of money printing (Quantitative Easing or QE2). (more…)

Treasury Bills: The New Opium

About this time last year, I heard financial expert Jim Rickards say on CNBC, “Federal Reserve needs to cut US Dollar in half over next 14 years.” He followed that up by saying, “If the market sees that playing out which it probably will, you could have a very rapid collapse of the dollar.” Fast forward to today with gold hitting all-time highs, his scenario may be beginning to play out. Rickards is a heavyweight in the world of finance. He is Senior Managing Director for Market Intelligence at Omnis, Inc., and co-head of the firm’s practice in Threat Finance & Market Intelligence. He is a big thinker that peers into the future for a living. (more…)

The Canary is Dead

By Greg Hunter’s

In the early days of coal mining, canaries acted as a warning that odorless poisonous gas was present. If there was a dangerous gas build-up, the canary would be the first to keel over. You can use the “canary in a coal mine” metaphor to describe the situation in today’s financial world. Greece is the canary. (more…)