Latest Posts

U.S. Financial Death Spiral – John Rubino

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

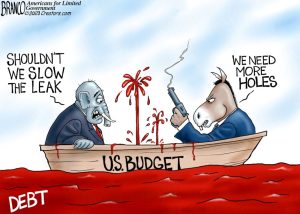

Analyst and financial writer John Rubino has a new warning about being fooled into thinking the economy is improving because inflation and interest rates have fallen some recently. Rubino says, “If the U.S. government is running crisis level deficits, which it is right now, borrowing money and paying interest on it means we are in a financial death spiral. The debt goes up, the interest on the debt goes up and that raises the debt even further, and you just spiral out of control. We are there right now. The official U.S. debt is $33.5 trillion. It’s growing by $1.7 trillion a year, and $1 trillion of that is interest costs. Interest costs are rising as the overall debt goes up. Then throw in this incredibly reckless military spending in the guise of foreign aid, and you get a society that has completely lost control. (more…)

Gaza Cease-Fire, Joe out Gavin In, US Treasury Bonds Not Safe

By Greg Hunter’s USAWatchdog.com (WNW 608 11.17.23)

By Greg Hunter’s USAWatchdog.com (WNW 608 11.17.23)

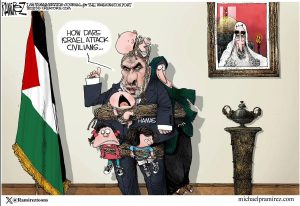

The cries are getting louder for a so-called ceasefire with the Israeli/Gaza war that started October 7th. There is more proof coming out that Hamas is using hospitals and other civilian areas to conduct war while holding Israeli hostages. That does not seem to matter much to the people demanding the killing be stopped. Even the UN, which is notoriously against everything Israel, has passed a resolution demanding a ceasefire in Gaza. Meanwhile, reports fighting on the Israel/Lebanon border with Hezbollah is at a point not seen in nearly two decades. Hezbollah is backed by Iran and is much better trained and equipped than Hamas in the south. Is this the calm before the WWIII storm or will the ceasefire put an end to the fighting? (more…)

America Attacked on All Fronts, WWIII Underway – Steve Quayle

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Renowned radio host, filmmaker, book author and archeological dig expert Steve Quayle says just about every aspect of American life is under attack by Deep State demonic globalists who want to “take down America.” Let’s start with the U.S. banking system that is teetering on insolvency and locked in a growing liquidity crisis. Quayle explains, “This is a watershed moment in the world today. In the world of financial happenings and events, we are watching the takedown, breakdown and total onslaught by multiple nations, namely the BRICs nations with total abandonment of the U.S. dollar. World War III is underway. . . . It’s happening before our eyes, and the mainstream media, which is an accessory to genocide, do not report anything accurately. . . . For the first time in the history of federal banking, the ACH (automated clearing house) problem happened . . . multiple millions of people, from my sources, were waiting to get paid their paychecks. (more…)

Banking Crisis Coming, War Coming, More CV19 Vax Deaths Coming

By Greg Hunter’s USAWatchdog.com (11.10.23 WNW 607)

By Greg Hunter’s USAWatchdog.com (11.10.23 WNW 607)

Big banks are in trouble, but you are not going to hear about it until it’s too late. Banks are losing deposits at an alarming rate. Meanwhile, they have big losses on the books because of rising interest rates. This is all causing the biggest liquidity problems since the Great Recession. In other words, the banks need money to cover losses and conduct business. Record government interest payments mean Washington does not have the money for a bailout. The problem is not going to get better anytime soon, and it is getting worse by the day. You have been warned. (more…)

Terrorists Blowing Up Stuff gives Excuse for Martial Law – Martin Armstrong

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Legendary financial and geopolitical cycle analyst Martin Armstrong began 2023 predicting “chaos” would be coming around the world. We have a bloody war in Ukraine, a new conflict with Gaza and Israel, and a wide open U.S. border with the FBI predicting huge terror attacks coming to America. Is this kind of destabilization a coincidence or is it a Deep State globalist plan? Why are the demonic dark powers taking peace from the earth and forecasting big terror events coming to America? Armstrong contends, “It is very simple. Basically, we are looking at a sovereign default. Governments are pushed to the limit at this stage. You even had Fed Head Jay Powell come out last week and say ‘the spending is unsustainable.’ The Biden Administration is a complete corrupt absolute disaster. It’s not really Biden . . . he’s just there to sign whatever they stick in front of him.” (more…)

Yemen Widens War, Terror Coming to US, Matthew Perry Vax Murder

By Greg Hunter’s USAWatchdog.com (WNW 606 11.3.23)

By Greg Hunter’s USAWatchdog.com (WNW 606 11.3.23)

A new country has declared war on Israel –Yemen. Actually, it is the Houthis beating the war drums, and they are supported by Iran. So, Iran is using its proxies to widen the war against Israel. In Lebanon, Hezbollah is starting to attack Israel. They are also puppets of Iran. Meanwhile, Hamas in Gaza is vowing another terror attack like the October 7th massacre. The war in the Middle East is getting bigger and spinning out of control. Everybody in the world has an opinion with many anti-Israel comments on the rise. (more…)

Jonathan Cahn gives the Biblical breakdown of Israel-Hamas End-Time Mystery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This video was done by Jonathan Cahn about two weeks ago. It has received 1.3 million views–so far. It is a stunning piece of Biblical analysis on Israel and Hamas that only 7-time best-selling author Jonathan Cahn can deliver. Did you know the word Hamas is in the Bible? Did you know Israel was attacked from what is now known as Gaza in ancient times? Did you know the Biblical giant Goliath came from Gaza in ancient times? (more…)

CV19 mRNA Vaccines Were Meant to Harm & Kill People – Dr. Michael Palmer

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Dr. Michael Palmer MD was a biochemistry professor at University of Waterloo, Ontario, Canada, and was fired from his job in 2022 when he refused the CV19 so-called “vaccine.” He now helps run Doctors4CovidEthics.org. It is a website dedicated to warning people of the dangers of the CV19 mRNA vaccines. Dr. Palmer has just written a book called “mRNA Vaccine Toxicity.” Dr. Palmer has well over 1,000 hours of personal research conducted on the mRNA vaccines, which he calls “poison.” Dr. Palmer also has an impressive list of contributors to his recent book that include world renowned microbiologist Dr. Sucharit Bhakdi (MD) and Catherine Austin Fitts, to name a few. Dr. Palmer says the CV19 vax was an “intentional murder program.” Dr. Palmer explains, “It was clear in 2020 that the risks that were being taken were completely unreasonable. It normally takes many years to develop a vaccine. . . these years were condensed into just a few months. . . . If you combine the radical shortening of time for testing, which on its own creates a huge risk, combined with a new technology (mRNA) that means the risk is incalculable. So, it’s completely irresponsible. . . .After the beginning of the vaccination campaign, and the first few weeks with disastrous results, it would have been necessary to immediately stop this campaign. What we have seen instead is relentless coercion, relentless censorship, relentless lying by the authorities about the safety and effectiveness of these vaccines. This must have been a necessity for these vaccines. This must be a deliberate policy to harm and kill.” (more…)

Biden Still At 9.5%, Middle East Boiling, More Vax Murders

By Greg Hunter’s USAWatchdog.com (WNW 605 10.27.23)

By Greg Hunter’s USAWatchdog.com (WNW 605 10.27.23)

9.5% Biden approval rating is the number behind most of what you see going on. Yes, the Lying Legacy Media says Biden’s approval ratings are much higher, but why do you think I call them the Lying Legacy Media (LLM)? My sources say everybody knows Biden sucks, and this was before the Hamas/Israel conflict and before Ukraine was decimated. When you have poll numbers this low, you prosecute your political enemies, let new illegal voters into the country by the millions, cover up vax deaths and injuries by the millions and start a huge war. Any of this sound familiar? Again, 9.5% actual rating. (more…)

2 Billion Will Die in New War Cycle – Charles Nenner

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned geopolitical and financial cycle expert Charles Nenner has been warning a once every 120-year war cycle is coming, and with hostilities in the Middle East, it is clearly here. This cycle is for big wars such as WWI and WWII. These two wars were part of one big war cycle according to Nenner, and history is now repeating. Keep in mind, this war cycle comes with many countries in possession of nuclear arsenals. Nenner explains, “If you do cycles on war games and war cycles, you can calculate how many people are going to die in such a war. We discussed this in the past, and it now looks ugly. We are talking about a lot of people. There are so many things bad going on in the world, so I would like to not to tell you the number.” (more…)

Mathematically, Financial System Is Going Down – Bill Holter

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Precious metals expert and financial writer Bill Holter warned in August of financial trouble coming to America sooner than later. He gave a long list that now includes a global war. Even without war, there is no stopping the financial fall that is coming. Central banks are, once again, the biggest buyers of gold this year. What is going on? Holter says, “The central banks fully understand the math behind the financial system of the West is broken. The Western financial system cannot survive the math. . . (more…)

Middle East Headed for War, Economy Headed for Total Collapse

By Greg Hunter’s USAWatchdog.com (WNW 604 10.20.23)

By Greg Hunter’s USAWatchdog.com (WNW 604 10.20.23)

Everywhere you look in the Middle East, you see signs of a brewing war. The world is divided over the Hamas and Israel fighting. It is the most violent division in the world that has not been seen for a very long time. The U.S. Navy has aircraft carriers off the cost of Israel, and Russia is threatening to sink them with hypersonic missiles. Now, the terror looks like it is coming to America with it’s wide-open Southern border. FBI Director Chris Wray is warning a terror attack could likely happen in America in the not-so-distant future. I guess the FBI is not going to go after Catholics and Trump supporters and focus on real terrorists for a change. (more…)

Is a Biblical Nuke War Coming? – Steve Quayle

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Renowned radio host, filmmaker, book author and archeological dig expert Steve Quayle says what is happening with the Hamas/Israel war is going to have Biblical consequences. Quayle says, “This time you will not just be a spectator. You will be a participant or a target. . . . Peace has been taken from the earth.” (more…)

Fear Not, No WWIII Yet – Bo Polny

By Greg Hunter’s USAWatchdog.com (Special presentation of Weekly News Wrap-Up WNW 603 for 10/13/23)

By Greg Hunter’s USAWatchdog.com (Special presentation of Weekly News Wrap-Up WNW 603 for 10/13/23)

Biblical cycle timing expert and geopolitical/financial analyst Bo Polny predicted last month on USAWatchdog.com that “chaos was coming in early October.” The Hamas/Israel war that started on October 6th proved him right. The situation seems to be intensifying and spinning out of control by the hour. Israel has called up 300,000 troops in the war with Hamas terrorists that murdered, wounded or kidnapped thousands of Israelis in a surprise attack last Friday. Hamas is calling for a “global Jihad, invasion of Israel and to attack Jews worldwide on Oct. 13.” Even though this is already a bloody conflict that will, no doubt, get much worse, Polny predicts this is not going to be WWIII, at least not just yet. Polny explains, “If you truly understand the times we are living in today, do not fear World War III. It is not the time for it. That time point is Revelation 16, verse 12. It says the Euphrates River dries up, and armies prepare for Armageddon. I repeat, we are not at Revelation 16.” (more…)

CV19 Vax Causes ‘Turbo Cancer’ – Dr. Ryan Cole

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Dr. Ryan Cole is a Board-Certified pathologist. Dr. Cole is an expert in postmortem examination and has treated more than 500,000 patients. He has a prestigious resume, including a five-year stint at the Mayo Clinic. Dr. Cole has been fighting the CV19 narrative from infection to injection from the very beginning and told people not to get the CV19 vax. For this, Dr. Cole was attacked by the globalist Deep State until he was forced to sell his medical diagnostic business that staffed around 80 employees. Cole has been put out of work for telling the awful truth about the deadly CV19 vax. More than a year ago, Dr. Cole called the global CV19 vax “Absolute Insanity,” and the data today says he was correct. (more…)