Latest Posts

Headlines Confirming Troubled Times Are Here

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Some people see the Internet as an electronic world of wires and computers run at speeds measured in nanoseconds. I tend to see the Internet as an electronic extension of human biology. Sample enough of the Internet in the right places and you can get a snapshot of what people are generally feeling. One of my own readers, Alyce, commented recently, “It’s easy for people to become lulled into a false sense of security. (more…)

You Should Rent Instead of Own a Home

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? (more…)

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? (more…)

Everything is Under Control?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There are some big messages being put out by the government that appear to be for the sole purpose of reassuring the public that everything is under control. Bernanke appeared on “60 Minutes” 10 days ago to tell the public that he is “100 percent” sure inflation is not going to be an issue, and that it’s a “myth” the Fed is “printing money.” I am not going to touch on the veracity of his statements. (more…)

More on CBS, Bernanke and New Tax Law

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

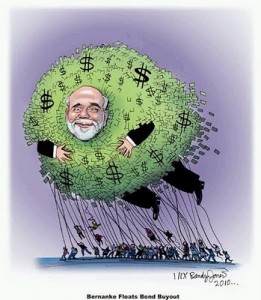

I want to share with you two videos that will surely enlighten and maybe even enrage you. The first is from “The Daily Show.” It seems a comedy show that repeatedly claims to do “fake news” was the only mainstream media outlet to call BS on Fed Chief Ben Bernanke’s BS. Bernanke stated on “60 Minutes” last Sunday that the Fed was “not printing money.” (more…)

Greg Hunter On The Edge With Max Keiser

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was on French TV last week on a show called “On The Edge with Max Keiser.” Keiser is a former Wall Street broker with inside knowledge of how fat cats claw out insane profits and rip off the public. He had me on to talk about the mortgage fraud and the securitized debt mess. (more…)

CBS Allows Fed to Spread Disinformation Unchallenged

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It appears the CBS TV show 60 Minutes is the Federal Reserve’s go-to place to get its message out to the country. Fed Chief Ben Bernanke, basically, told America last night that the trillions he pumped out into the world economy, because of the 2008 financial meltdown, was necessary to save us all from a depression. Ben also reassured America and the world Quantitative Easing (QE), or printing vast amount of dollars, will not have an inflationary downside. He told 60 Minutes reporter Scott Pelley he is “100%”sure inflation will remain under control and will not soar higher. (more…)

Exposing the Fed’s Incompetence

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

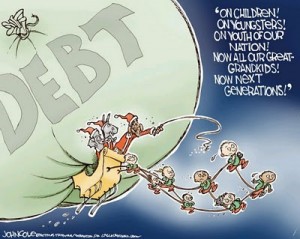

The Federal Reserve made a stunning revelation this week. It admitted to pumping $9 trillion into the economy because of the financial meltdown in 2008. It provided overnight loans to big U.S. banks with most of the trillions of dollars deployed to keep the system from imploding. Yes, the Fed is credited with saving the world from apocalypse, but how incompetent and corrupt does an institution have to be to let things get this far out of control? This should not be considered as a grand victory but a magnificent failure. (more…)

Foreclosure Bombshell

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

With all the attention stories such as WikiLeaks and Irish bailout have gotten the last few days, a bombshell judgment against Bank of America in a New Jersey foreclosure case has been overlooked. The judgment happened 2 weeks ago in a case involving the home of John T. Kemp. His original mortgage company was Countrywide, but B of A bought Countrywide a few years back and, in turn, also acquired servicing rights to Kemp’s mortgage. (more…)

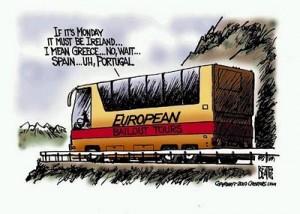

Ireland Is Not Iceland

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It is official. Ireland was bailed out yesterday by the European Union with a financial package totaling more than a $112 billion. This money bails out Irish banks but coincides with steep cuts in the Irish budget. Marketwatch.com is reporting, “This program is absolutely essential for the country,” said Irish Prime Minister Brian Cowen at a press conference in Dublin. “We have carefully considered all available policy options. (It’s) the best available deal for Ireland.” (more…)

What Is Really Behind QE2?

The article you are about to read is from Ellen Brown. She writes a good post here, but I disagree with one of her main points. She says Quantitative Easing (QE) will not cause inflation because of “$15 trillion in write-downs in collateral and credit.” To refute this, I quote Nobel Prize winner Milton Friedman who said, “Inflation is always and everywhere a monetary phenomenon.” If a country could simply buy its own debt with zero downside, I say we should have been doing this all along. The rest of Brown’s article is very good and puts a clear focus on this round of QE. She correctly points out it is being used to mainly finance the U.S. government over the next 8 months. (more…)

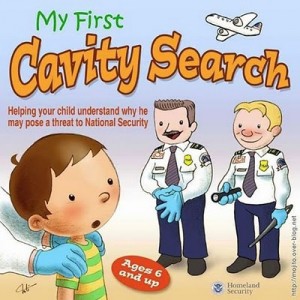

Is the TSA Out of Line?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

When I Google the phrase “TSA outrage,” I find 2 million search results. I can only view this as a black eye for the Transportation Security Administration. I know these folks have a tough job trying to keep the country safe from terrorists, but who reins them in when they go too far? What do I mean by too far? Some examples include being arrested by the TSA over applesauce, a bladder cancer survivor being left covered in urine after an aggressive pat-down at the airport and TSA child molestation – children being strip searched and fondled in public by agents. If you do not submit to the radiation of full body TSA scanner images then you get the pat-down check from the TSA. (more…)

Banks Should Face Bankruptcy, Just Like GM

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

General Motors started trading publicly last week in what is being called one of Wall Street’s most successful Initial Public Offerings (IPO) in years. The automaker took in $20 billion selling newly minted shares of this iconic American company. That is only part of the $50 billion price tag in the bailout, but letting GM go under would have been far worse. (more…)

As Banks Go, So Goes the Economy

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

FDIC Chairman Sheila Bair gave a speech to the securities industry in New York City this past Wednesday. In her opening remarks, she said, “Now, as a tentative economic recovery continues to build, and as the earnings of banks and other financial companies begin to recover, we must resist the natural impulse to return to business as usual. Instead, now is the time to carry through with our work to strengthen financial market practices and products and sharpen our approach to financial regulation.” Apparently, the Financial Standards Accounting Board (FASB) wants to do just that and return to fair market accounting. (more…)

What is America Thinking Coast to Coast?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was on the nation-wide radio show, Coast to Coast AM, for 3 hours early Monday morning. Ian Punnett filled in for the regular host, George Noory. Punnett is a pro, and he guided me through many subjects I have been writing about for the past several weeks on USAWatchdog.com. I write about the economy, politics and the mainstream media the most, and we covered them all in my interview. The comments and emails in the last 24 hours have been massive and daunting. (more…)

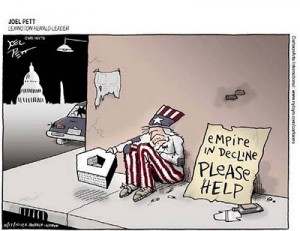

Insanity or Ingenious?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

What is happening in the economy is signaling enormous changes for the U.S. and the world. The scale of what the Federal Reserve is doing is unparalleled in human history. No country has ever produced so much money and so much debt in such a short amount of time. The Fed has embarked on another round of money printing (Quantitative Easing or QE2). (more…)