It’s Much Worse than 2008

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I keep hearing the so-called experts say how much better shape the banks are in now than in the last financial meltdown of 2008. To that, I say horse hooey! Any expert worth his salt knows that nothing has been fixed in the financial system. The problems were papered over with fiat currency and the proverbial can kicked down the road—ting ting ting. You will know things are truly getting better when the banks start valuing the assets on their books at what they can be sold for today, not for what they hope to get for them a couple of decades in the future.

Even with what I call government sanctioned accounting fraud, the banks are still in just as much trouble as they were in 2008, and probably more. Lost in the cliff dive the markets took last week were the downgrades of three very big U.S. banks. There was zero talk of downgrades in 2008, and now Moody’s has cut the debt rating of Bank of America, Wells Fargo and Citigroup. Last week, Reuters reported, “The government is “more likely now than during the financial crisis to allow a large bank to fail should it become financially troubled,” said the rating agency, a unit of Moody’s Corp (MCO.N). ‘This is crystallizing the fact we’re in a new political reality,’ said Jason Ware, equity analyst with Salt Lake City-based Albion Financial Group.” (Click here for the complete Reuters story.)

The U.S. downgrades go nicely with the widely reported bank insolvency in Europe. One big banker there recently said “numerous European banks would not survive” if they had to value their assets at what they could get for them today. In other words, European banks are also being kept alive with phony accounting. That was not the case in 2008. So, now we have insolvent banks AND phony bookkeeping to make them appear solvent. EU finance ministers are taking criticism from around the globe because they are not printing enough money to bail out their banks. Yesterday, Reuters reported, “After a weekend of being told by the United States, China and other countries that they must get more aggressive in their crisis response, European officials focused on ways to beef up their existing 440 billion-euro rescue fund. Deep differences remained over whether the European Central Bank should commit more of its massive resources to shoring up Europe’s banks and help struggling euro zone member countries.” (Click here for more on this story.) Please keep in mind, the “440 billion-euro rescue fund” is more than $600 billion, and world powers way want more money printed!

In a story over the weekend, a headline in the Telegraph reports “Multi-trillion plan to save the eurozone being prepared.” The story goes on to say, “European officials are working on a grand plan to restore confidence in the single currency area that would involve a massive bank recapitalisation, giving the bail-out fund several trillion euros of firepower, and a possible Greek default.” (Click here for the complete story.)

Other factors that were not in play in 2008 are the multi-billion dollar lawsuits against big banks for selling toxic mortgage debt. There are dozens filed against U.S. banks from around the planet. The most recent settlement netted plaintiff a cool $8.5 billion from B of A. (Click here for more on that story.) Big banks will pay billions more to settle lawsuits in the future because there is no real defense for selling toxic mortgage-backed debt. One commentator described it as “selling a bucket of glass with a small diamond chip in it and claiming the entire bucket is full of diamonds.”

And let’s not forget the repossessed houses setting on the books of banks. One recent report shows banks clogged with nearly 3.5 million homes. Housingwire.com recently reported that more than “10 million more mortgages are set to default.” (Click here for the complete Housingwire.com story.) That, too, is a far cry from 2008.

Earlier this month, Treasury Secretary Tim Geithner said on CNBC, “. . . European cohorts won’t allow another bank to collapse like Lehman Brothers, a move that triggered the global financial crisis in the fall of 2008. They have the capacity to “hold this thing together,” Geithner said.” (Click here for more on that story.) They will “hold this thing together” with printed money and nothing else.

Jim Willie of Goldenjackass.com says big deficits, phony accounting, multiple quantitative easing programs (money printing), zero percent interest rates for years into the future, and all the desperate acts by central bankers are really just signs that the global financial system is breaking down. In his most recent post, Mr. Willie says, “The central bank franchise system is being recognized for its failure, ineptitude, helplessness. The system is saturated with debt. The solution to treat the excess of debt is to add to the debt levels and to let loose the dogs of monetary hyper-inflation. . . . The entire system from numerous different corners attempts to translate the list of ailments into simple terms of confidence and volatility. The actual watchwords are insolvency and deterioration, with momentum gathering toward systemic collapse.” (Click here for the complete GoldenJackass.com post.)

So you might ask, if we are so close to collapse, then why are gold and silver getting killed? Gold has sold off more than $250 since early September. Silver has lost more than 25% in the same time period. What gives? Call it profit taking, market manipulation or traders making a killing on the short side in a single day. No matter what you call it, long term, both gold and silver are insurance to protect your wealth when the printing presses are running full bore to save the status quo.

This is not about you and me or the economy. This is about power, and the folks that have it want to keep it. They will not keep the power if the global economy folds and gets sucked into a black hole. For those in power, there is only one answer to the enormous debt suffocating the world economy, and that is to pay some of it off with freshly minted fiat currency. Simply put, central banks will print to retain power. Hold on to your insurance because the financial calamity we face is much worse than 2008!

When the unprepared drive past their bank and see a line of people coming out the bank’s door and extending half way down the street, they will likely park their car and get in line. They will want to withdraw their money, too. The problem here is that there is precious little money at the bank. Go to your branch and ask them to produce $20,000 cash for you. They do not have it but they can “order it for you.” I have done it on two occasions, once for $7,000 and another request for $25,000. I don’t know how they function. Besides, they have lent out many times more than the the deposits they have taken in. When the news runs the story the panic will quickly achieve critical mass. These situations happen FAST. When this happens, the time for preparation has already passed. Sorry, Charlie.

Brad,

Good to know. Thank you.

Greg

Greg –

I respect your work and ability to go against the MSM and I understand your gold and silver position advice, but you and everyone else on the PM bandwagon don’t understand that what you are doing is also digging a hole for yourself.

When something happens that the non-MSM didn’t want to acknowledge or report on – they all act surprised and talk on how no one saw it coming.

What’s the difference with all the so-called PM experts?? No one saw this coming either…a total PM meltdown. As I type this Gold is $1571 and silver is at $26!!!!!!!!!

When the MSM says they didn’t see something coming…the non-MSM (like yourself) jump to their blogs to show how they knew it was in fact coming and show all of their posts on it.

MSM has been calling PM investors a bit over the top and a major correction was due…yet all you non-MSM’s said corrections will always happen, but not one saw this big of a take down coming.

Bottom line is that the MSM vs non-MSM…are all the same breed. Normalcy bias to their belief system without any insight outside of it.

I know, I know you will jump on me now and ask for my references as to why I am saying this and then you will reference sites to back up your beliefs or just tout the basic PM rhetoric that gold/silver have a 5,000 year history, etc, etc. – basically you will try to defend yourself because you have no the choice at this point, but to stand your ground while families are losing everything. What do I mean? Basically if there was an emergency right now and I needed to cash out of PM’s…I’m screwed. It could take years before PM’s reach numbers again that will enable to even breakeven and that really sucks!

I cashed out of my savings, sold my condo and deferred any type of large purchases due to what I thought was sound advice from people like yourself and where did it get me…at a loss that I would NOT have experienced if I stayed as I was before.

Here is what you don’t get, as you may like living your life on hold…I don’t. The US dollar may collapse, the entire banking system may collapse…but I am done living my life on hold.

And before you start touting something like, my investments are my fault or my only decisions…I agree. I am not blaming you or anyone else. I am just making a point that you guys DO NOT know anything more that what some other so-called preaches. They preach it and you pass it along as the gospel.

That my friend is bad business policy and a bad way to conduct their site! Basically what you like to do is pat yourself on your back when you do well and duck, hide and volley the blame back to the commenter when you feel threatened.

quentin xaviar,

Hold on a minute. I have said repeatedly that there would be big volatility in both directions in the PM market. As I type this gold is $1629.70 and silver is around $30, so my volatility point is well made in real time today. About 3 or 4 weeks weeks ago I said in a Kitco.com interview on their website there was a correction coming. You are looking at buying PMs as a “trading position and not a protection play.” This is not a site that gives trading instruction. I have also said many times that gold and silver (physical coins and bars) are an insurance play not a trading positing. I guess if you bought in the last run-up, then yes, you are sitting on losses. Please stop looking at this as some sort of easy money trading position, and see it for what it really is– insurance for the calamity we are still in. I have no normalcy bias here. WHAT IN THE HELL IS NORMAL ABOUT EUROPE GETTING READY TO LAUNCH A MULTI-TRILLION EURO BAILOUT FUND FOR THEIR BANKS? To top it off, 4 other central banks are going to help and that includes the FED. Please go long Federal reserve notes. You said, “I cashed out of my savings, sold my condo and deferred any type of large purchases due to what I thought was sound advice from people like yourself and where did it get me…at a loss that I would NOT have experienced if I stayed as I was before.” You must have just made this move. My question is what took you so long to act? If you want a guaranteed profit so you can sleep at night I nor anyone else cannot offer that to you. Nobody can predict the short term moves in any market but I predict you will be happy. Investing is tough. If it was easy, then we would all be rich. Listen if you think you are living your life on hold then get on the train track and start walking for that light you see at the end of the tunnel. I and going to stay off the tracks until the train passes. You say. “I am not blaming you or anyone else. I am just making a point that you guys DO NOT know anything more that what some other so-called preaches.” Yeah, you are blaming me and everyone else for “preaching.” I have a track record of being correct on this site. Please check the archives. I was correct when I was saying “ALL THE BANKS WERE IN TROUBLE” at the end of 2007 and beginning of 2008 while on CNN. Here’s the link: http://www.youtube.com/watch?v=4hqzCnNsmU0 I told people to buy gold way before it was at $900 an ounce as an insurance play. I think that call worked out pretty well. I stuck my neck out to warn people and I didn’t get my contract renewed at CNN, but that’s OK because I started this website and I get to hear from good people like you. Please don’t come on my site and tell me what is “bad business” my friend.

Greg

Hi,

Getting on the bandwagon late is always a tough call. But, better late than never. There are many more who will be left behind completely, and then you’ll be glad you sold all your stuff and have some real trading power to live on.

Joanna

Well said Joanna.

Greg

Amazingly, Quentin Xavier just spelled out the exact reaction the criminals are hoping for. Quentin is upset that he has lost fiat. Silver and Gold are money Quentin, you have not lost anything unless you trade your real money for fake paper dollars.

“We have now sunk to a depth at which restatement of the obvious is the first duty of intelligent men.” George Orwell

Xavier, ARE YOU SERIOUS? You think this is a horrible catastrophe for PMs? This is just something that happens to shake out people who buy too high and lack knowledge or commitment. It’s a normal 20% correction. Sorry if you bought gold at $1900 but you are only down about 15% now. Last I checked, almost every thing I invest in is down 15% or more at some point in any given year. Do you freak out when you have a $19 stock go to $16? If you really think it will take years for gold and silver to make a new high again then you don’t really know enough about economics and the monetary system to play with the big boys. If you don’t want to live your life “on hold” then sell all your silver and gold at the bottom here and put all your money back in the bank and start living “in real time.” LOLOLOL I don’t think you want to do that…

As for silver, more silver is demanded and consumed by industry and investors than is mined each and every year – been this way for decades and will continue for as far as the eye can see. Today, world silver inventories are at the lowest levels in human history. The US govt alone had over 10B ozs of silver in the 50s and today if Eric Sprott orders a mere 25M ozs it takes 3 months for new bars to be fabricated and delivered.

Naked paper shorting of metals is JUST A DAVID COPPERFIELD ILLUSION provided by the banksters. While you were freaking about about 1550 gold and 26 silver I was online at 2am ordering more bullion from Apmex.

Silly people, they think govt paper promises backed by NOTHING except trillions and trillions in unpayable debt are better than SOLID GOLD and SILVER. Need I remind you NO FIAT CURRENCY IN HUMAN HISTORY HAS EVER EVER EVER LASTED MORE THAN A FEW DECADES? There is a REASON gold and silver have been the backbone of monetary systems for thousands of years.

On a differen’t note, I thought about ordering online tonight from Apnex but then saw that they required me to fill out some personal information like cellular phone and cellular phone carrier.. .. .. and then I started thinking about the government confiscating my silver and decided that was a bad place to buy silver from.

Hi Greg, I wanted to contribute an article I just wrote which may give an additional reason why the world’s economy is in a stall. http://swarmthebanks.blogspot.com/2011/09/why-economy-wont-get-much-better.html

This is good stuff Alessandro. Thank you for posting a link to your content here!!

Greg

Hey Greg, thanks for the shout out, I polished the article a bit since I first wrote it.

Alessandro,

It was a good one!!

Greg

I see no sensible investing options other than buying more gold and silver, as in ACTUAL gold and silver in physical form, in my hand.

MSPA,

Amen brother.

Greg

People in power seldom give up their power without a fight. Look at Muammar Gaddafi. You may want to think that our system is different but just on the service. If our forefather saw the tyranny that oppress the citizen of these United States, they would have been more specific about things in the constitution. They did not foresee a people who fought so hard for their freedom willing subjugate themselves with our politicians and tax codes. Our forefathers did not have an “income” tax, that amendment was added by the progressives at the turn of the last century. They also gave us Prohibition , direct election of Senators and woman’s suffrage.

We need a 28th Amendment stating that Congress can not exempt themselves from laws that they pass and a 29th amendment repealing the Federal income tax and replace it with a structured, category driven national sales tax that can only be increased by national referendum.

We need to legalize marijuana…I am 50 and I have never smoked marijuana and would try it if it was legal. My taste runs with GOOD beer, mostly German and Belgium. However, if we tax it, let the cigar and cigarette companies make MJ cigs, we can stop the incentive for it being smuggled into the country. We get Tax revenue on income that is currently not taxed, organized crime and street gangs have to look for other profit centers. DEA can concentrate on Cocaine, Heroin and the people in jail for MJ can be released, and jail budgets can be cut.

They say we cannot build a fence to keep the illegal aliens out. What they mean is they do not want to. Illegal entry into our country should be a felony. It is in most countries. You don’t want a wall, landmine the frigging boarder (cheaper and effective) and offer some of us good ole’ boys a bounty on shooting felons that cross the illegally into the country. Yes, that is harsh but our nation is fighting for its survival. There is no God given right to illegally immigrate to our country. I

Ron Paul may be crazy but what have the latest crop of politicians got us. I would vote for a Ron Paul / Herman Cain ticket in a heart beat.

Let the NEW American Revolution begin. A true free country and not Obama’s slave state.

George,

Drastic change is coming like it or not. It cannot be stopped.

Thank you for your comment and content!

Greg

Obama was a kid when all these big plans were laid. The reason Obama got the vote he didn’t vote for the wars. Remember Obama was not wining on behind a better banker then McCain. He was in the lead when Bush did the bail out because of these useless WARS. These useless wars and the lies of 9/11 is why this country is F up. I’m not good at writing but a true history book made simple is needed. If a person been involved watch and reading sense Kennedy killing you understand it’s all fake the whole lot of BS. fake free trade, fake reasons for wars,fake international friends. The dollars is base on the power to control oil it’s that simple, we kill and murder for the black gold the dollar is back by. He who has the army controls the gold , it;s simple history stuff. Obama this are Obama that is just BS. but with a little luck Obama might be the guy to make new friends in the world. We are not that important to the money people of the world anymore so time is a changing. Has very little to do with one person, the seeds were cast years back. There was one little peanut farm who said we didn’t need to take this path but people like the big cars the American dream. PEACE

George,

I like the spirit of what you are saying, but I think that we should give the founding fathers more credit than this. The fact is that they knew more about tyranny and how to stop it than any of us today could even begin to comprehend. As a great philosopher once stated, “To remain ignorant and free is a possibility that never has been and never will be.”

Our founding fathers knew what it meant to have family members taken away in the middle of the night and to be burned out of their homes, tortured and executed for speaking out about it. But they also knew that all governments fail sooner or later. That’s why Benjamin Franklin, coming out of the Continental Congress when asked what form of government he had a part in creating replied, “A Constitutional Republic Sir, IF YOU CAN KEEP IT.” Franklin and all the founders had seen the entire cycle from apathy to tyranny and they were under no illusions and cut very little slack to those who become careless about it.

George,

Let me add that I do not agree with you on legalizing illicit drugs for recreational use even if I don’t like the way those laws are currently enforced which make the U.S. government the largest drug dealer on the planet. Drugs and drunkenness destroy entire populations. The only real answer for our country to survive the current crisis turn back to God in repentance. Everything else is like polishing brass on the Titanic. I won’t get into the womens suffrage issue except to say that it was the womens voting block and the gay voting block that elected Bill Clinton and BHO. You can figure it out from there.

“Simply put, central banks will print to retain power” is so true. That is where we are, period. The elite’s trick will be to print to pay down some of the debt without suffering the general economy with tremendous inflation which may backfire into collaspe of the system they are trying to retain. So far its been working but as was said things are different now, deeper debt, etc. than 2008. My guess is that they will overplay their hand and won’t control the inflation, but we are all watching to see if they can do it. Frankly, I will be amazed if they can pull it off again after 2008, but you can bet they will try.

Art,

They are in the process as we speak. I think they will put off the really bad stuff from happening at least until after Christmas but what do I know. That’s just a guess. Thank you man!

Greg

greg , your the only one iv read online that has explained why gold and silver has dropped.id like to learn more in detail. it seemed to me that gold and silver should had gone higher.

i see now that when the printing presses start up (it) will.

im going today to find more silver.

i might add, you kept your artical cleaner then i would have by calling it horse pooh.

thanks

Thank you James. I try to keep it simple and accurate.

Greg

Greg, the ECB can print a lot of currency and devalue the Euro in the process. The Euro can devalued by 30% and be just about where it was against the US Dollar in the fall of 2000.

While this may mean trouble for US exports to Europe, it will help European banks holding devalued assets, and help hold the Euro together. Greece may be the sacrificial lamb equivalent to Lehman Bros.

As for US banks, they will continue to do what they have been doing for the last 3 years, and no one is going to intervene or force a change, including the courts.

In the mean time, inflation continues in the shadows and taxes will follow. Commodity inflation has taken a pause while the emerging markets catch their breath and consolidate, but I agree the long term is good for them.

It looks a lot like 2008 to me also, but I don’t see a major bank failure.

Hoppe,

Stopping a bank failure is what this is all about. It is the fiat currency system that will fail in time. Thank you for weighing in.

Greg

Good Morning Greg, I love it when you open up a can of worms early Monday morning. The world’s greatest Ponzi scheme is coming apart at the seams. The current accounting rules are a joke and these rules will not be able to hide the size and scope of the banking systems fraud. Refinancing debt with more debt will not produce anything but more debt and it is designed to create economic bondage to the central banking system.

The central banking system needs to be scrapped and the government needs to “nationalize” the FED and hold the member banks accountable for the damage they have done to the world economy. I know that there is no way the current politicians would ever do this since almost all are owned by the banksters and the corporations. Bernanke said in his paper regarding the age of Japanese stagflation that sound accounting rules and a regulatory enforcement were key components of a quantitative easing strategy when trying to restart an economy. However, sound accounting and real regulatory enforcement are not part of the current quantitative easing programs.

Silver and gold prices have been hostages of the banksters who have flooded the markets with phony paper and they can not afford to let the price get too high. That said the FED does not see any correlation between the dollar and silver/gold and the massive money printing going on. Bernanke’s comment about gold not being money is what they actually think when it comes to gold/silver. They are wrong because the money supply affects all commodity prices.

Another issue I see is that Brananke pointed out that during the age of Japanese stagflation that the Japanses economy did not grow for 10 years and in Bernank’e mind this stopped the growing of the Japanese economy which led to a long term reduction in economic growth. Theis failed thinking is what has led us down this path of QE to “Inifinty” and beyond and Buzz Light Year would say. The reason this is such a failure in critical thinking is that the inflation created to combat stagflation is nothing more than a scam or psyop to make people think that have more money when they are actually losing buying power through inflation.

Greg, Please post Bernanke’s paper to the Kanas FED so your readers can understand what Helicopter Ben is thinking. If you need it email me and I can send it to you.

Mitch,

If you post it here I will put it up ASAP. That’s a good idea and good content! Thank you.

Greg

Don’t look now, but according to “The Telegraph”, the IMF needs more money. More money, more money, more money. It just never ends. Bet you old “Timmy Boy”, is going to let them have as much as they want. They say the truth hurts. It’s hurting the wrong people.

Wells Fargo, has hit our town. Can see their red signs everywhere. Like portraits of a dictator in some foreign land. An invasion I tell you!

Sling,

Not a good time to go long the dollar in a big way. Thank you for the comment and analysis.

Greg

A major problem continues to be the unwillingness to put a price on the bad debt that exists in the financial system. I said in 2008, that until this occurs, the “crisis” will not go away.

It seems to me that where we are today, the only real option is default. The only problem is, the bubble that has been created over the past 3-4 years is larger than the one that brought us here in the first place.

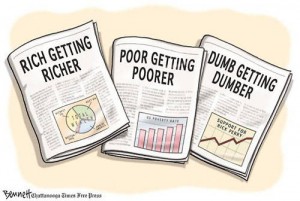

Nice article Greg, the cartoon is very appropriate.

Lew,

You are and were spot on my good man!!!!!

Greg

Greg, it’s not that I disagree with what you have written in your article – I agree with every word in it. However… Let me provide some alternative food for thought:

1) Market crashes/panics are NEVER widely anticipated. Never, ever. The occasional lonely voice of wisdom and the permabears don’t count. But nowadays I am hearing from left and right (and even from the MSM) – “it’s 2008 all over again”. It doesn’t work that way. If “everybody” is expecting a crash or panic, we won’t get one.

2) What we had in 2008 was a panic, not a crash. Panics are bizarre, wildly unpredictable events that shave a significant percentage of the market value (like, 50%) in a few weeks. They are extremely rare, too. Once in a century rare. The previous one was in 1907. No way we’re going to get another just 3 years later. No way.

3) That leaves a crash. Crashes shave off something like 20% of the market value in a matter of days. 1987 was a crash. Problem is, crashes happen during mature bull markets (usually – at the top, although not always). They don’t happen half a year into a bear market – assuming that a bear market began in April.

4) Yes, nothing has been fixed – the problems have just been papered over. But! What has been done is polishing the methods for papering them over. The “powers that be” now know what works and what doesn’t. “Let them fail” ala Lehman, obviously doesn’t. “Print trillions” seems to work – or at least to postpone the problem. Yes, yes. The interest rates are already low (unlike in 2008), there is widespread grumbling about the printed trillions and so on and so on. I know. Still, the intervention mechanisms have been polished and the central banks all over the world are ready to unleash them at the first whiff of “it’s 2008 again”.

5) “Phony accounting” is nothing new. Why do you think they did it? Because they’ve done it in the past and it worked back then. This is how the S&L crisis was eventually resolved – the banks were let to pretend that they were solvent for a while. This is how Japan managed to avoid a crash & burn default – sure, replacing it with a couple of decades of stagnation, but any politician would prefer “protracted problem later” to “catastrophe now”.

6) The reason why gold & silver (and oil, and the other commodities) are falling is because they were horrendously overbought. Silver was clearly in a speculative bubble, similar to the one of oil when it shot to $150. Gold was repeating almost exactly its parabolic move in 1980. These things never last. Yes, yes, I know all the fundamentals in favor of gold – I own a lot of the stuff myself. However, technicals beat fundamentals every time, which is why my gold position has been hedged in August. Plus, the dollar was overdue for at least a technical bounce. Plus, when people panic, they park their money in short-term Treasury bills – for which they need dollars, which causes the dollar to rally. They don’t really have a choice. You and I might buy gold because it is “better” than dollar-denominated assets, but you and I are small fish. Consider an institution with hundreds of billions of dollars in assets. If it gets spooked – where can it park its money? Only one place is large enough to swallow such an amount of cash without flinching – the US bond market. Try parking such an amount of money in gold – the market will explode and you’ll lose most of the money.

7) The US is definitely heading towards a recession, maybe it’s already in one. The rest of the Western economies are likely to follow. This is why the commodities are falling – because there will be less demand for them.

Vess,

Thank you for adding content and analysis to this post. The readers here love this stuff!!!

Greg

It must be getting easier for you to write about “Keynesian Logic” Greg! Their greed knows no limits. If it is the wrong thing to do, they will do it. Yet the banksters and corporate, military madmen scheme, then print and fire away at will. They waste their (our tax dollars) counterfeited fiat paper like the whole sham will turn out OK for themselves and the global economy. If the world can survive these fools, what will the historians say about these times of the “Keynesian Fraudsers”… I suspect it will be something like the truth…if only we listened to those advocating the virtues of the Austrian example at the Mises Institute. I now read that the Soviets and Venezuela are discussing starting their own “Central Bank?” Don’t know if it is true but…that ought to start some whining, feet stomping and general uncontrollable tantrums in the power monger elitist world. Yahoo for my gold and silver coin collection. Thanks Greg, keep up the great work.

Thank you Jerry, Brian and ONTIME.

Greg

I am left wondering how much electronic theft and fraud play into this mess as well, we are seeing with our own eyes banking high ups walk away with billions of freshly printed money in their pockets, but how many dollars are being printed to paper over the losses incurred from “grassroots” identity thieves? I suspect that the impact identitfy theft and electronic fraud has on the money supply is being under reported.

The government wants to get their hands on all that cash that biz is supposedly hoarding but won’t get out of the way, won’t repeal useless rgulation and won’t stand up for their share of the economic blame they have caused….our government is run by greedy sissies.

Surely one would think that 3 years after the crash of 2008 we are not still embroiled in a financial melt down? Haven’t some of the greatest,or so we are led to believe, financial minds on this planet, resolved these catastrophic problems affecting the world economy yet? Well the plain and simple answer is NO!

As many enlightened financial commentators will point out, we are only putting out the fires of this economic crisis, not dealing with the arsonists themselves.

Until these “great financial minds” of Legarde, Geithner, Zoellick and the rest, realise the problem they need to give attention to is the current FIAT banking system, debt based money and the endless creation of money from thin air, then sadly we are in a spiral of never ending debt bail outs, misery and financial chaos.

I hope websites like this, James Gibb Stuart’s Blog, my own and many others begin an awakening process in the public and politicians alike, an awakening to root out the core problem and change the banking system once and for all. End the Federal Reserve, End our Debt Based monetary system and put an end to the creation of money from nothing.

http://www.illuminatiworld.com/2011/09/financial-trouble-economists/

Less Jobs + More Unemployed + More QE + the power of exponential debt = Gold a safe haven in the long run. Yes you can make money in the short run with some puts on gold/silver. But you will get an equal snap back to the real value because the curtain has been revealed and we can all see the show going on in the wizard of oz. Its a world of illusion. The greedy will get so greedy the system may break.

Master,

The system is breaking now. It just looks like slow motion. At some point, it will look like a switch is flipped and we will have the crash in real-time. Thank you for your comment.

Greg

Greg, You are right, Jim Willie is right, & a whole lot of people are going to lose everything they have planned & saved for, because of this incredible destruction of our monetary system. The good news is, we are being offerred a really nice oportunity to pick up some more gold &/or silver at reduced prices now. So it would behoove everybody to take advantage of this opportunity to the fullest extent possible. Imagine, real money, gold or silver, for paper that is very soon to be good for nothing but wallpaper, toilet paper, or memories of former grandeur. Thank you for your continuing focus on the monetary problems facing us all, & the excellent, & informative articles, you continue to provide. Chuck Long

Chuck,

Buying more PM’s is reportedly what people are doing at Sprott Asset Management. Trillions in dollars and euros are being created as we speak. That is fact! Inflation here we come.

Greg

Good article, but I hasten to point out: it’s Dr. Willie, not Mr., as he pointedly informed me in an email some time back.

Rusty,

You are correct! He holds a PhD in statistics. I stand corrected. I think Dr. Willie is fantastic!!! Thank you.

Greg

Greg, this article/interview sums up how we got to the place we find ourselves in today as the worlds economic & monetary systems are all in decline & on their way to defaulting.

http://thedailybell.com/2991/Anthony-Wile-James-Bovard-on-his-Famous-Libertarian-Books-Americas-Failing-Freedom-and-Why-Life-Is-Too-Short-To-Drink-Bad-Beer.

His one liners are right on tarket as far as what the American public was feed by the corporate owned MSM. They covered all the lies that did not matter & hid the ones that did & now the results are comming to a end, a bad one at that. They may have took gold & silver down, but they did not clear out the trillions of worthless assets on the books of our great wall street banks. The debts will never be repaid & when the great reset comes & it will come, those holding PM’s will be glad they have them because all other paper assets always go to zero!

Thank you M Smith for the comment and content!

Greg

With all due respect Greg, this is not worse than 2008. In 2008 I was totally unprepared. Today I have gold, silver, food, water, first aid supplies, prescriptions stockpiled, chickens, rabbits, seeds, skills, guns and ammo and a plan. I won’t get caught unprepared, whereas in 08 I did not have a clue. I encourage others to do likewise.

Thanks so much for getting the word out to others Gregg. Best wishes to you and yours.

NCdirtdigger,

This makes me happy for you and your family!!! Thank you for sharing this with us all here at USAWatchdog.com.

Greg

Sitting here about ten or so minutes before market close listening to Bloomberg and they are talking about the possibility of government intervention in the gold markets for gold backed bonds or currencies

George,

Is this why it was knocked down? Thank nyou for the reporting!!

Greg

Greg,

I read the new article you posted about the IMF needed funds and the UK contribution was 4.5%. The US’s contribution is 17.71%. Who in the hell is going to approve that? Timothy F. Geithner

George,

We live in strangfe world don’t we?

Greg

Greg. The reason banks will not re-value their property holdings is because they would not be able to meet their liquidity requirements imposed by federal law. I’m sure you are aware of this situation and if they did re-value most of the banks would fold. This is perfectaly legal as the purchase values still on their books are their holding values. It would not be a wise move to change these values as this is the responsibility of the seller or purchaser via the market changes.

In any case I noticed in one state that most forclosed properties are selling 75% lower than their purchased values. When they do sell at current market values then creative accounting then kicks in and the banks can set their own agenda on their losses. I also noticed that some banks are showing losses against future selling on their own stock options. Jesus! This may be legal, but not wise. It would not take much for most of the banks to fold these days so in the future they will be forced to re-structure by closing branches and laying off employees. Like most businesses you have to adjust income vs expenses to keep your business in a operative mode and hope for the best towards a profit.

Harold Bell,

Thank you for your comment and analysis!!

Greg

Hi Greg,

If anyone believes that the financial systems are in anyway fixed; I’d like to sell them a bridge in the desert for about 500 billion dollars, since it is the world reserve. This would provide me with enough fiat currency to buy some pieces of gold and some silver.

Also, I would warn anyone that has money in a 401k retirement plan to look for congress to pass legislation that will prevent you from receiving the proceeds. I believe they will find a way to help themselves to all that money to “pay our debts” or keep the economy going for another year. They are already salivating and wringing their hands over it.

Best thing anyone can do in today’s economy is store food, water, and have gold and silver. Maybe some personal protection would also be good to have on hand.

Thank you Charles!! Good advice.

Greg

You and Jim Willie should be on 59Minutes/ that last minute I left out is for you and him… that about all the time you’ll have to get to your bunker! Another good post/Keep Hitting! N~

Thank you Norm for your support.

Greg

Called a friend of mine the other day about current events and having just gotten a job with the government he said, “We’ve got what it takes to take what you’ve got.” During the Roosevelt administration I believe was the the most recent time that was proven as with regards to personal holdings of Gold and other valuables. Lock boxes in banks were raided by government agents, in the name of national security of course and people were just told to turn it in.

Ok you say, “I’ll never put my gold in a lock box at the bank so no one will ever know that I have it.” Oh really? So what good will it do you to have it if you can’t spend it? As soon as the government declares that trading in anything except U.S. Dollars or other recently minted currency is illegal, then what will you do? The second you flash some gold in public to try to buy something the word is out and the agents are coming to your house. In fact, with current surveilance techniques, they’ll know what you are doing before you even pick up the phone to make a deal with someone.

I now deliver to you the words of the Honorable John J. Ingalls, Senator from Kansas from 1877.

The words of The Honorable John J. Ingalls, Senator from Kansas who

> delivered the following in 1877:

> “No enduring fabric of national prosperity can be built on gold.

> Gold is the money of monarchs; kings covet it, the exchanges of

> nations are effected by it. Its tendency is to accumulate in vast

> masses in the commercial centers, and to move from kingdom to

> kingdom in such volumes as to unsettle values and disturb the

> finances of the world. It is the instrument of gamblers and

> speculators, and the idol of the miser and the thief. Being the

> object of so much adoration, it becomes haughty and sensitive-and

> shrinks at the approach of danger, and whenever it is most needed,

> it always disappears. At the slightest alarm it becomes to look for

> a refuge. It flies from the nation at war to the nation at peace. No

> people in a great emergency ever found a faithful ally in gold. It

> is the most cowardly and treacherous of all metals. It makes no

> treaty that it does not break, it had no friend whom it does not

> sooner or later betray. Armies and navies are not maintained by

> gold. In times of panic and calamity, shipwreck and disaster, it

> becomes the chief agent and minister of ruin. No nation ever fought

> a great war by the aid of gold. . Gold paid no soldier nor sailor.

> It refused the national obligation. It was worth most when our

> fortunes were lowest. Every defeat gave it increased value. . But

> silver is the money of the people.”

1

Japanese Monetary Policy: A Case of Self-Induced Paralysis?*

Ben S. Bernanke

Princeton University

December 1999

* For presentation at the ASSA meetings, Boston MA, January 9, 2000. I

wish to thank Refet Gurkaynak for expert research assistance.

The Japanese economy continues in a deep recession. The shortrange

IMF forecast is that, as of the last quarter of 1999, Japanese

real GDP will be 4.6% below its potential. This number is itself a

mild improvement over a year earlier, when the IMF estimated Japanese

GDP at 5.6% below potential. A case can be made, however, that these

figures significantly underestimate the output losses created by the

protracted slump. From the beginning of the 1980s through 1991Q4, a

period during which Japanese real economic growth had already declined

markedly from the heady days of the 1960s and 1970s, real GDP in Japan

grew by nearly 3.8% per year. In contrast, from 1991Q4 through 1999Q4

the rate of growth of real GDP was less than 0.9% per year. If growth

during the 1991-1999 period had been even 2.5% per year, Japanese real

GDP in 1999 would have been 13.6% higher than the value actually

attained.1

Some perspective is in order. Although, as we will see, there

are some analogies between the policy mistakes made by Japanese

officials in recent years and the mistakes made by policymakers around

the world during the 1930s, Japan’s current economic situation is not

1 A major source of the difference in my calculation and the IMF

calculation is that the IMF bases its potential output estimate on the

actual current value of the capital stock. Relatively low investment

rates throughout the 1990s have resulted in a lower Japanese capital

stock than would have been the case if growth and investment had

followed more normal patterns. I thank Paula DeMasi of the IMF for

providing their data.

2

remotely comparable to that of the United States, Germany, and numerous

other countries during the Great Depression. The Japanese standard of

living remains among the highest in the world, and poverty and open

unemployment remain low. These facts, and Japan’s basic economic

strengths—-including a high saving rate, a skilled labor force, and an

advanced manufacturing sector—-should not be overlooked. Still, Japan

also faces important long-term economic problems, such as the aging of

its workforce, and the failure of the economy to achieve its full

potential during the 1990s may in some sense be more costly to the

country in the future than it is today. Japan’s weakness has also

imposed economic costs on its less affluent neighbors, who look to

Japan both as a market for their goods and as a source of investment.

The debate about the ultimate causes of the prolonged Japanese

slump has been heated. There are questions, for example, about whether

the Japanese economic model, constrained as it is by the inherent

conservatism of a society that places so much value on consensus, is

well-equipped to deal with the increasing pace of technological,

social, and economic change we see in the world today. The problems of

the Japanese banking system, for example, can be interpreted as arising

in part from the collision of a traditional, relationship-based

financial system with the forces of globalization, deregulation, and

technological innovation (Hoshi and Kashyap, forthcoming). Indeed, it

seems fairly safe to say that, in the long run, Japan’s economic

success will depend largely on whether the country can achieve a

structural transformation that increases its economic flexibility and

openness to change, without sacrificing its traditional strengths.

In the short-to-medium run, however, macroeconomic policy has

played, and will continue to play, a major role in Japan’s

macroeconomic (mis)fortunes. My focus in this essay will be on

3

monetary policy in particular.2 Although it is not essential to the

arguments I want to make—-which concern what monetary policy should do

now, not what it has done in the past—-I tend to agree with the

conventional wisdom that attributes much of Japan’s current dilemma to

exceptionally poor monetary policy-making over the past fifteen years

(see Bernanke and Gertler, 1999, for a formal econometric analysis).

Among the more important monetary-policy mistakes were 1) the failure

to tighten policy during 1987-89, despite evidence of growing

inflationary pressures, a failure that contributed to the development

of the “bubble economy”; 2) the apparent attempt to “prick” the stock

market bubble in 1989-91, which helped to induce an asset-price crash;

and 3) the failure to ease adequately during the 1991-94 period, as

asset prices, the banking system, and the economy declined

precipitously. Bernanke and Gertler (1999) argue that if the Japanese

monetary policy after 1985 had focused on stabilizing aggregate demand

and inflation, rather than being distracted by the exchange rate or

asset prices, the results would have been much better.

Bank of Japan officials would not necessarily deny that monetary

policy has some culpability for the current situation. But they would

also argue that now, at least, the Bank of Japan is doing all it can to

promote economic recovery. For example, in his vigorous defense of

current Bank of Japan (BOJ) policies, Okina (1999, p. 1) applauds the

“BOJ’s historically unprecedented accommodative monetary policy”. He

refers, of course, to the fact that the BOJ has for some time now

pursued a policy of setting the call rate, its instrument rate,

virtually at zero, its practical floor. Having pushed monetary ease to

2 Posen (1998) discusses the somewhat spotty record of Japanese fiscal

policy; see especially his Chapter 2.

4

its seeming limit, what more could the BOJ do? Isn’t Japan stuck in

what Keynes called a “liquidity trap”?

I will argue here that, to the contrary, there is much that the

Bank of Japan, in cooperation with other government agencies, could do

to help promote economic recovery in Japan. Most of my arguments will

not be new to the policy board and staff of the BOJ, which of course

has discussed these questions extensively. However, their responses,

when not confused or inconsistent, have generally relied on various

technical or legal objections—-objections which, I will argue, could be

overcome if the will to do so existed. My objective here is not to

score academic debating points. Rather it is to try in a

straightforward way to make the case that, far from being powerless,

the Bank of Japan could achieve a great deal if it were willing to

abandon its excessive caution and its defensive response to criticism.

Diagnosis: An Aggregate Demand Deficiency

Before discussing ways in which Japanese monetary policy could

become more expansionary, I will briefly discuss the evidence for the

view that a more expansionary monetary policy is needed. As already

suggested, I do not deny that important structural problems, in the

financial system and elsewhere, are helping to constrain Japanese

growth. But I also believe that there is compelling evidence that the

Japanese economy is also suffering today from an aggregate demand

deficiency. If monetary policy could deliver increased nominal

spending, some of the difficult structural problems that Japan faces

would no longer seem so difficult.

Tables 1 through 3 contain some basic macroeconomic data for the

1991-99 period that bear on the questions of the adequacy of aggregate

demand and the stance of monetary policy. The data in Table 1 provide

5

the strongest support for the view that aggregate demand is too low,

and that the net impact of Japanese monetary and fiscal policies has

been and continues to be deflationary. Columns (1)-(3) of the table

show standard measures of price inflation, based on the GDP deflator,

the PCE deflator, and the CPI (ex fresh food), respectively.

Considering the most comprehensive measure, the GDP deflator, we see

that inflation has been less than 1.0% in every year since 1991 and has

been negative in four of those years. Cumulative inflation, as

measured by the GDP deflator, has been effectively zero since 1991: In

Table 1. Measures of inflation in Japan, 1991-1999

(1) (2) (3) (4) (5)

GDP PCE CPI Nominal Monthly

Year deflator deflator deflator GDP earnings

(% change) (% change) (% change) (% change) (% change)

1991 2.89 2.43 2.30 6.36 2.84

1992 0.94 1.44 2.08 2.74 1.78

1993 0.44 0.96 0.91 0.92 1.82

1994 -0.62 0.60 0.50 0.81 2.70

1995 -0.38 -0.90 0.07 0.82 1.87

1996 -2.23 0.34 0.30 3.48 1.87

1997 0.82 1.55 2.23 1.85 0.81

1998 0.01 0.33 -0.32 -2.21 -0.10

1999 -0.66 -0.38 0.00 -0.97 NA

Notes: Columns (1)-(4): Alternative inflation rates and nominal GDP growth

are measured fourth quarter to fourth quarter, except for 1999, which (due to

data availability) is second quarter over second quarter for (1)-(2) and

third quarter over third quarter for (3)-(4). The CPI excludes fresh foods.

Column (5): The rate of change of nominal monthly earnings is measured fourth

quarter to fourth quarter. Data in all tables are from public sources.

6

the fourth quarter of 1991 the GDP deflator stood at 106, compared to a

value of 105 in the second quarter of 1999, the latest number I have

available.

Inflation has been slightly higher in the consumer sector, as

measured by the rate of change of the PCE deflator and the CPI, but

even there since 1991 inflation has exceeded 1% only twice, in 1992 and

in 1997. Moreover, according to all three inflation indicators, the

rate of price increase has slowed still further since 1997. Taken

together with the anemic performance of real GDP, shown in Table 2,

column (5), the slow or even negative rate of price increase points

strongly to a diagnosis of aggregate demand deficiency. Note that if

Japan’s slow growth were due entirely to structural problems on the

supply side, inflation rather than deflation would probably be in

evidence.

As always, it is important to maintain a historical perspective

and resist hyperbole. In particular, the recent Japanese experience is

in no way comparable to the brutal 10%-per-year deflation that ravaged

the United States and other economies in the early stage of the Great

Depression. Perhaps more salient, it must be admitted that there have

been many periods (for example, under the classical gold standard or

the price-level-targeting regime of interwar Sweden) in which zero

inflation or slight deflation coexisted with reasonable prosperity. I

will say more below about why, in the context of contemporary Japan,

the behavior of the price level has probably had an important adverse

effect on real activity. For now I only note that countries which

currently target inflation, either explicitly (such as the United

Kingdom or Sweden) or implicitly (the United States) have tended to set

their goals for inflation in the 2-3% range, with the floor of the

7

range as important a constraint as the ceiling (see Bernanke, Laubach,

Mishkin, and Posen, 1999, for a discussion.)

Alternative indicators of the growth of nominal aggregate demand

are given by the growth rates of nominal GDP (Table 1, column 4) and of

nominal monthly earnings (Table 1, column 5). Again the picture is

consistent with an economy in which nominal aggregate demand is growing

too slowly for the patient’s health. It is remarkable, for example,

that nominal GDP grew by less than 1% per annum in 1993, 1994, and

1995, and actually declined by more than two percentage points in 1998.

Again, as with the inflation measures in columns (1)-(3), there is

evidence of even greater deflationary pressure since 1997.

Table 2 provides some additional macroeconomic indicators for

Japan for the 1991-99 period. Columns (1) and (2) of the table show

the nominal yen-dollar rate and the real yen-dollar rate, respectively.

The yen has generally strengthened over the period, which is consistent

with the deflationist thesis. As I will discuss further below, even

more striking is the surge of the yen since 1998, a period that has

coincided with weak aggregate demand growth and a slumping real economy

in Japan. As column (2) shows, however, the fact that inflation in

Japan has been lower than in the United States has left the real terms

of trade relatively stable. My interpretation is that the trajectory

of the yen during the 1990s is indicative of strong deflationary

pressures in Japan, but that a too-strong yen has not itself been a

major contributor to deflation, except perhaps very recently.

Columns (3) and (4) of Table 2 shows rates of change in the prices of

two important assets, land and stocks. As is well known, the stock

market (column 4) has fallen sharply from its peak and has been quite

volatile. The behavior of land prices (column 3), which is less often

cited, is particularly striking: Since 1992 land prices have

8

Table 2. Additional economic indicators for Japan, 1991-1999

(1) (2) (3) (4) (5)

Yen/$ Real Yen/$ Land prices Stock prices Real GDP

Year rate rate (% change) (% change) (% change)

1991 129.5 72.2 0.55 2.38 2.41

1992 123.0 69.4 -5.11 -32.03 0.14

1993 108.1 62.4 -5.13 16.91 0.47

1994 98.8 58.5 -3.82 0.47 0.66

1995 101.5 61.5 -4.30 -4.90 2.49

1996 112.8 71.2 -4.43 5.47 4.66

1997 125.2 79.6 -3.62 -20.85 -0.61

1998 119.8 77.0 -4.38 -15.37 -2.94

1999 113.6 78.3 -5.67 23.00 0.91

Notes: Columns (1)-(2): Exchange rates are fourth-quarter average, except for

1999, for which nominal exchange rate is for third quarter and real exchange

rate is for second quarter. Real exchange rate is relative to 1978:1 = 100.

Columns (3)-(5): Land price is nationwide index, stock prices are TOPIX

index. Percentage changes are fourth quarter over fourth quarter, except for

1999 which is third quarter over third quarter.

fallen by something between 3% and 6% in every year. To be clear, it

is most emphatically not good practice for monetary policymakers to try

to target asset prices directly (Bernanke and Gertler, 1999).

Nevertheless, the declining nominal values of these assets, like the

behavior of the yen, are also indicative of the deflationary forces

acting on the Japanese economy.

So far we have looked at broad macroeconomic indicators. Table 3

provides some measures more directly related to the stance of monetary

policy itself. The first three columns of Table 3 show fourth-quarter

values (1991-99) for three key nominal interest rates: the call rate

(the BOJ’s instrument rate), the short-term prime rate, and the long9

Table 3. Monetary indicators for Japan, 1991-1999

(1) (2) (3) (4) (5)

Call Prime rate, Prime rate, Monetary base M2 + CDs

Year rate short-term long-term (% change) (% change)

1991 6.45 6.88 6.95 2.89 2.14

1992 3.91 4.71 5.59 1.39 -0.54

1993 2.48 3.29 4.05 3.94 1.56

1994 2.27 3.00 4.90 4.12 2.64

1995 0.46 1.63 2.80 6.20 2.93

1996 0.48 1.63 2.74 6.78 3.17

1997 0.46 1.63 2.35 8.18 3.22

1998 0.23 1.50 2.29 6.34 4.43

1999 0.03 1.38 2.20 5.61 3.51

Notes: Columns (1)-(3): Interest rates are fourth-quarter averages, thirdquarter

average for 1999. Columns (4)-(5): Percentage changes are fourth

quarter over fourth quarter, except for 1999, which is third quarter over

third quarter.

term prime rate. Prime rates are affected by conditions in the banking

market as well as monetary policy, of course, and they may not always

fully reflect actual lending rates and terms; but they are probably

more indicative of private-sector borrowing costs than are government

bill and bond rates. Columns (4) and (5) show, respectively, the

fourth-quarter-to-fourth-quarter growth rates of the monetary base and

of M2 plus CDs, the broader monetary aggregate most often used as an

indicator by the Japanese monetary authorities.

A glance at Table 3 suggests that the stance of monetary policy

has been somewhat different since 1995 than in the 1991-94 period. As

mentioned earlier, there seems to be little debate even in Japan that

monetary policy during 1991-94 was too tight, reacting too slowly to

10

the deflationary forces unleashed by the asset-price crash. Interest

rates came down during this period, but rather slowly, and growth of

both narrow and broad money was weak. However, one can see that there

has been an apparent change in policy since 1995: In that year the

call rate fell to under 0.5%, on its way down to effectively a zero

rate today, and lending rates fell as well. The fall in the nominal

interest rate was accompanied by noticeable increases in the rates of

money growth, particularly in the monetary base, in the past five

years.

Monetary authorities in Japan have cited data like the 1995-99

figures in Table 3 in defense of their current policies. Two distinct

arguments have been made: First, that policy indicators show that

monetary policy in Japan is today quite expansionary in its thrust—-

“historically unprecedented accommodative monetary policy”, in the

words of Okina quoted earlier. Second, even if monetary policy is not

truly as expansionary as would be desirable, there is no feasible way

of loosening further—-the putative liquidity trap problem. I will

address each of these two arguments in turn (the second in more detail

in the next section).

The argument that current monetary policy in Japan is in fact

quite accommodative rests largely on the observation that interest

rates are at a very low level. I do hope that readers who have gotten

this far will be sufficiently familiar with monetary history not to

take seriously any such claim based on the level of the nominal

interest rate. One need only recall that nominal interest rates

remained close to zero in many countries throughout the Great

Depression, a period of massive monetary contraction and deflationary

pressure. In short, low nominal interest rates may just as well be a

sign of expected deflation and monetary tightness as of monetary ease.

11

A more respectable version of the argument focuses on the real

interest rate. With the rate of deflation under 1% in 1999, and the

call rate effectively at zero, the realized real call rate for 1999

will be under 1%, significantly less than, say, the real federal funds

rate in the United States for the same period. Is this not evidence

that monetary policy in Japan is in fact quite accommodative?

I will make two responses to the real-interest-rate argument.

First, I agree that the low real interest rate is evidence that

monetary policy is not the primary source of deflationary pressure in

Japan today, in the way that (for example) the policies of Fed Chairman

Paul Volcker were the primary source of disinflationary pressures in

the United States in the early 1980s (a period of high real interest

rates). But neither is the low real interest rate evidence that

Japanese monetary policy is doing all that it can to offset

deflationary pressures arising from other causes (I have in mind in

particular the effects of the collapse in asset prices and the banking

problems on consumer spending and investment spending). In textbook

IS-LM terms, sharp reductions in consumption and investment spending

have shifted the IS curve in Japan to the left, lowering the real

interest rate for any given stance of monetary policy. Although

monetary policy may not be directly responsible for the current

depressed state of aggregate demand in Japan today (leaving aside for

now its role in initiating the slump), it does not follow that it

should not be doing more to assist the recovery.

My second response to the real-interest-rate argument is to note

that today’s real interest rate may not be a sufficient statistic for

the cumulative effects of tight monetary policy on the economy. I will

illustrate by discussing a mechanism that is highly relevant in Japan

today, the so-called “balance-sheet channel of monetary policy”

12

(Bernanke and Gertler, 1995). Consider a hypothetical small borrower

who took out a loan in 1991 with some land as collateral. The longterm

prime rate at the end of 1991 was 6.95% (Table 1, column 3).3 Such

a borrower would have been justified, we may speculate, in expecting

inflation between 2% and 3% over the life of the loan (even in this

case, he would have been paying an expected real rate of 4-5%), as well

as increases in nominal land prices approximating the safe rate of

interest at the time, say 5% per year. Of course, as Tables 1 and 2

show, the borrower’s expectations would have been radically

disappointed.

To take an admittedly extreme case, suppose that the borrower’s

loan was still outstanding in 1999, and that at loan initiation he had

expected a 2.5% annual rate of increase in the GDP deflator and a 5%

annual rate of increase in land prices. Then by 1999 the real value of

his principal obligation would be 22% higher, and the real value of his

collateral some 42% lower, then he anticipated when he took out the

loan. These adverse balance-sheet effects would certainly impede the

borrower’s access to new credit and hence his ability to consume or

make new investments. The lender, faced with a non-performing loan and

the associated loss in financial capital, might also find her ability

to make new loans to be adversely affected.

This example illustrates why one might want to consider

indicators other than the current real interest rate—-for example, the

cumulative gap between the actual and the expected price level—-in

assessing the effects of monetary policy. It also illustrates why zero

inflation or mild deflation is potentially more dangerous in the modern

environment than it was, say, in the classical gold standard era. The

modern economy makes much heavier use of credit, especially longer-term

3 And note that this rate was still 4.90% at the end of 1994.

13

credit, than the economies of the nineteenth century. Further, unlike

the earlier period, rising prices are the norm and are reflected in

nominal-interest-rate setting to a much greater degree. Although

deflation was often associated with weak business conditions in the

nineteenth century, the evidence favors the view that deflation or even

zero inflation is far more dangerous today than it was a hundred years

ago.

The second argument that defenders of Japanese monetary policy

make, drawing on data like that in Table 3, is as follows: “Perhaps

past monetary policy is to some extent responsible for the current

state of affairs. Perhaps additional stimulus to aggregate demand

would be desirable at this time. Unfortunately, further monetary

stimulus is no longer feasible. Monetary policy is doing all that it

can do.” To support this view, its proponents could point to two

aspects of Table 3: first, the fact that the BOJ’s nominal instrument

rate (column 1) is now zero, its lowest possible value. Second, that

accelerated growth in base money since 1995 (column 4) has not led to

equivalent increases in the growth of broad money (column 5)—-a result,

it might be argued, of the willingness of commercial banks to hold

indefinite quantities of excess reserves rather than engage in new

lending or investment activity. Both of these facts seem to support

the claim that Japanese monetary policy is in an old-fashioned

Keynesian liquidity trap (Krugman, 1999).

It is true that current monetary conditions in Japan limit the

effectiveness of standard open-market operations. However, as I will

argue in the remainder of the paper, liquidity trap or no, monetary

policy retains considerable power to expand nominal aggregate demand.

Our diagnosis of what ails the Japanese economy implies that these

actions could do a great deal to end the ten-year slump.

14

How to Get Out of a Liquidity Trap

Contrary to the claims of at least some Japanese central bankers,

monetary policy is far from impotent today in Japan. In this section I

will discuss some options that the monetary authorities have to

stimulate the economy.4 Overall, my claim has two parts: First, that—-

despite the apparent liquidity trap—-monetary policymakers retain the

power to increase nominal aggregate demand and the price level.

Second, that increased nominal spending and rising prices will lead to

increases in real economic activity. The second of these propositions

is empirical but seems to me overwhelmingly plausible; I have already

provided some support for it in the discussion of the previous section.

The first part of my claim will be, I believe, the more contentious

one, and it is on that part that the rest of the paper will focus.

However, in my view one can make what amounts to an arbitrage argument

—-the most convincing type of argument in an economic context—-that it

must be true.

The general argument that the monetary authorities can increase

aggregate demand and prices, even if the nominal interest rate is zero,

is as follows: Money, unlike other forms of government debt, pays zero

interest and has infinite maturity. The monetary authorities can issue

as much money as they like. Hence, if the price level were truly

independent of money issuance, then the monetary authorities could use

the money they create to acquire indefinite quantities of goods and

assets. This is manifestly impossible in equilibrium. Therefore money

issuance must ultimately raise the price level, even if nominal

interest rates are bounded at zero. This is an elementary argument,

15

but, as we will see, it is quite corrosive of claims of monetary

impotence.

Rather than discuss the issues further in the abstract, I now

consider some specific policy options of which the Japanese monetary

authorities might now avail themselves. Before beginning, I add two

more caveats: First, though I discuss a number of possible options

below, I do not believe by any means that all of them must be put into

practice to have a positive effect. Indeed, as I will discuss, I

believe that a policy of aggressive depreciation of the yen would by

itself probably suffice to get the Japanese economy moving again.

Second, I am aware that several of the proposals to be discussed are

either not purely monetary in nature, or require some cooperation by

agencies other than the Bank of Japan, including perhaps the Diet

itself. Regarding the concern that not all these proposals are “pure”

monetary policy, I will say only that I am not here concerned with fine

semantic distinctions but rather with the fundamental issue of whether

there exist feasible policies to stimulate nominal aggregate demand in

Japan. As to the need for inter-agency cooperation or even possible

legislative changes: In my view, in recent years BOJ officials have—-

to a far greater degree than is justified—-hidden behind minor

institutional or technical difficulties in order to avoid taking

action. I will discuss some of these purported barriers to effective

action as they arise, arguing that in many if not most cases they could

be overcome without excessive difficulty, given the will to do so.

4 For further discussion of monetary policy options when the nominal

interest rate is close to zero, see Clouse, Henderson, Orphanides,

Small, and Tinsley (1999).

16

Commitment to zero rates—-with an inflation target

In February 1999 the Bank of Japan adopted what amounts to a

zero-interest-rate policy. Further, to the BOJ’s credit, it has since

also announced that the zero rate will be maintained for some time to

come, at least “until deflationary concerns subside”, in the official

formulation. Ueda (1999) explains (p. 1), “By the commitment to

maintain the zero rate for some time to come, we have tried to minimize

the uncertainties about future short-term rates, thereby decreasing the

option value of long-term bonds, hence putting negative pressure on

long-term interest rates.” The announcement that the zero rate would

be maintained did in fact have the desired effect on the term

structure, as interest rates on government debt up to one-year maturity

or more fell nearly to zero when the policy was made public.

Government rates up to six years’ maturity also fell, with most issues

yielding under 1%.

The BOJ’s announcement that it would maintain the zero rate

policy for the indefinite future is a positive move that may well prove

helpful. For example, in a simulation study for the United States,

using the FRB/US macroeconometric model, Reifschneider and Williams

(1999) found that tactics of this type—-i.e., compensating for periods

in which the zero bound on interest rates is binding by keeping the

interest rate lower than normal in periods when the constraint is not

binding—-may significantly reduce the costs created by the zero-bound

constraint on the instrument interest rate.

A problem with the current BOJ policy, however, is its vagueness.

What precisely is meant by the phrase “until deflationary concerns

subside”? Krugman (1999) and others have suggested that the BOJ

quantify its objectives by announcing an inflation target, and further

that it be a fairly high target. I agree that this approach would be

17

helpful, in that it would give private decision-makers more information

about the objectives of monetary policy. In particular, a target in

the 3-4% range for inflation, to be maintained for a number of years,

would confirm not only that the BOJ is intent on moving safely away

from a deflationary regime, but also that it intends to make up some of

the “price-level gap” created by eight years of zero or negative

inflation. Further, setting a quantitative inflation target now would

ease the ultimate transition of Japanese monetary policy into a formal

inflation-targeting framework—-a framework that would have avoided many

of the current troubles, I believe, if it had been in place earlier.

BOJ officials have strongly resisted the suggestion of installing

an explicit inflation target. Their often-stated concern is that

announcing a target that they are not sure they know how to achieve

will endanger the Bank’s credibility; and they have expressed

skepticism that simple announcements can have any effects on

expectations. On the issue of announcement effects, theory and

practice suggest that “cheap talk” can in fact sometimes affect

expectations, particularly when there is no conflict between what a

“player” announces and that player’s incentives. The effect of the

announcement of a sustained zero-interest-rate policy on the term

structure in Japan is itself a perfect example of the potential power

of announcement effects.

With respect to the issue of inflation targets and BOJ

credibility, I do not see how credibility can be harmed by

straightforward and honest dialogue of policymakers with the public.

In stating an inflation target of, say, 3-4%, the BOJ would be giving

the public information about its objectives, and hence the direction in

which it will attempt to move the economy. (And, as I will argue, the

Bank does have tools to move the economy.) But if BOJ officials feel

18

that, for technical reasons, when and whether they will attain the

announced target is uncertain, they could explain those points to the

public as well. Better that the public knows that the BOJ is doing all

it can to reflate the economy, and that it understands why the Bank is

taking the actions it does. The alternative is that the private sector

be left to its doubts about the willingness or competence of the BOJ to

help the macroeconomic situation.

Depreciation of the yen

We saw in Table 2 that the yen has undergone a nominal

appreciation since 1991, a strange outcome for a country in deep

recession. Even more disturbing is the very strong appreciation that

has occurred since 1998Q3, from about 145 yen/dollar in August 1998 to

102 yen/dollar in December 1999, as the Japanese economy has fallen

back into recession. Since interest rates on yen assets are very low,

this appreciation suggests that speculators are anticipating even

greater rates of deflation and yen appreciation in the future.

I agree with the recommendations of Meltzer (1999) and McCallum

(1999) that the BOJ should attempt to achieve substantial depreciation

of the yen, ideally through large open-market sales of yen. Through

its effects on import-price inflation (which has been sharply negative

in recent years), on the demand for Japanese goods, and on

expectations, a significant yen depreciation would go a long way toward

jump-starting the reflationary process in Japan.

BOJ stonewalling has been particularly pronounced on this issue,

for reasons that are difficult to understand. The BOJ has argued that

it does not have the legal authority to set yen policy; that it would

be unable to reduce the value of the yen in any case; and that even if

it could reduce the value of the yen, political constraints prevent any

19

significant depreciation. Let’s briefly address the first and third

points, then turn to the more fundamental question of whether the BOJ

could in fact depreciate the yen if it attempted to do so.

On legal authority, it is true that technically the Ministry of

Finance (MOF) retains responsibility for exchange-rate policy. (The

same is true for the U.S., by the way, with the Treasury playing the

role of MOF. I am not aware that this has been an important constraint

on Fed policy.) The obvious solution is for BOJ and MOF to agree that

yen depreciation is needed, abstaining from their ongoing turf wars

long enough to take an action in Japan’s vital economic interest.

Alternatively, the BOJ could probably undertake yen depreciation

unilaterally; as the BOJ has a legal mandate to pursue price stability,

it certainly could make a good argument that, with interest rates at

zero, depreciation of the yen is the best available tool for achieving

its legally mandated objective.

The “political constraints” argument is that, even if