Latest Posts

The One Surefire Economic Prediction

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The one surefire economic prediction I can make is we are going to have big inflation. Already, (real) inflation is running at 9.4% according to shadowstats.com (calculated the way Bureau of Labor Statistics did it in 1980). The mainstream media seems to be finally catching on to this theme. In the last week or so, Forbes ran a story called “Prepare for inflation.” (Click here for the Forbes article.) Just last week, CNN penned an article called “The coming inflation wave.” (Click here for the CNN story.) Whether it is the exploding federal deficit or famed investor George Soros doubling his gold holdings, it seems all the signs are flashing more inflation is baked into the economic cake. (more…)

Don’t Let The Facts Get In The Way Of A Recovery

By Greg Hunter’s USAWatchdog.com

For awhile, the term “green shoots” was the buzz word for the economic rebound. Remember that? The “green shoots” have now turned into a “recovery” almost every time the economy is mentioned. It seems we are constantly bombarded with stories of how the economy is turning around when the facts say otherwise.

I do want to be positive, but some of the spin I am hearing would make “Baghdad Bob”(Mohammed Saeed al Sahaf) proud. (more…)

Will the U.S. Dollar Survive?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Alf Field has been called the “world’s best gold analyst.” He is best known for his many spot-on predictions in the precious metals market. Field has written extensively on debt, the dollar and has predicted the gold price per ounce will reach $10,000. Before you laugh, the “paper” gold market was cited as a “Ponzi Scheme” at last week’s Commodity Futures Trading Commission hearing on increased transparency for the market. A recent story on “Zero Hedge” covering the CFTC hearing documents the big bomb dropped about the London Bullion Market Association (LBMA). (more…)

Inflation Is Going To Get Worse

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

One of my consistent views on this site is “real” inflation is much higher than what the government is telling us. For example, recently the Bureau of Labor Statistics announced February’s inflation number (CPI) was “unchanged” at a 2.1% annual rate. Over the years, the BLS has changed the way it calculates inflation by using accounting gimmicks that understate what most people would consider the true cost of living. So, the government inflation numbers of today make inflation look much lower than it really is for main street America. (more…)

Truth Has Fallen and Has Taken Liberty With It

This is a sobering article written by Paul Craig Roberts, a former Deputy Treasury Secretary under the Reagan Administration. It is the last one Roberts, who has been writing syndicated columns for years, says he will write! I emailed Roberts to get permission to reprint his work, and I also asked him why he is, in his words “signing off”? Roberts sent back this two line reply, “Yes, you can reprint. I signed off because I came to the conclusion that it is futile to protest war and the police state as long as the 9/11 myth holds.” The article is riveting– please take time to read it. Greg Hunter

————————–

Guest Writer for Greg Hunter’s USAWatchdog.com

During times of universal deceit, telling the truth becomes a revolutionary act. George Orwell (more…)

What Is America Thinking Coast to Coast?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was a guest yesterday on the nationally syndicated radio show, Coast to Coast AM. It airs on 500 radio stations in America, Canada and Mexico. I received several dozen emails and comments, along with thousands of new visitors to the USAWatchdog.com site as a result of the appearance. (more…)

Health Care Reform Passed By House, Now What?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It took some arm twisting, political payoffs and a promise not to publicly fund abortion to get health care reform passed. There is still plenty to do on what is called the “fix” to the bill in the Senate. This “fix,” whether or not passed, will not stop the biggest social legislation since Medicare to be signed into law. There are several state attorneys general that will challenge this new reform under the Tenth Amendment (States Rights). I am not sure legal action can stop this new law, but look for that story to unfold this week. (more…)

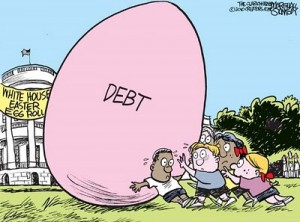

Health Care Reform Battle Rages While U.S. Burns

The Health Care Reform Reconciliation pakage making its way through Congress is shaping up to be an enormous battle. The amount written and said about this legislation could fill a wing in the library of Congress. The Republicans think it is “too expensive” and point out every accounting gimmick used to get the cost under a trillion dollars. The Democrats say, “Passage of health care reform is of paramount importance” and point to a $138 billion deficit reduction over 10 years. (more…)

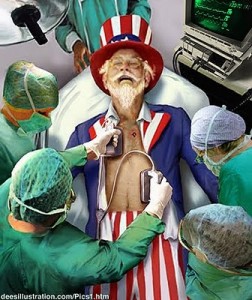

Tomorrow Is Here Today

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In December of 1997, the National Center for Policy Analysis ran this headline on their website “Social Security Problems Accelerating.” The article stated, “A recent General Accounting Office report warns that the long-term prospects for the Social Security system may be even worse than we think. It is already well-known that by 2014 current tax revenues will be insufficient to pay current benefits . . .” Looks like the GAO was right. (more…)

Meet the New Boss, Same as the Old Boss

By Gene Tunney Guest Writer for Greg Hunter’s USAWatchdog.com

By Gene Tunney Guest Writer for Greg Hunter’s USAWatchdog.com

If you are my age, you know that the title is from a 1971 song by The Who titled “Won’t Get Fooled Again.” I was certainly fooled in the last Presidential election.

Even though I was a registered Republican at the time (2008), I could not vote for Senator John McCain. McCain called off his campaign to go bail out his banker buddies. Barack Obama voted the exact same way. Even so, I voted for Barack Obama because I wanted to vote for real change. (more…)

Has Anything Changed on Wall Street?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Whistleblower Harry Markopolos is on the stump promoting his new book titled “No One Would Listen.” It is about how it took 8 ½ years for the Securities and Exchange Commission to crack down on the Bernie Madoff scam. Markopolos says he sent letters to the SEC that were “too many to count” in an effort to expose the fraud. In an interview on “The Daily Show” this week, Markopolos said something about the SEC that really caught my attention. He said, “They still have all the same people there. They haven’t fired anybody, that’s the problem.” (more…)

What Is the True Cost Of Health Care Reform?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Congressional Budget Office says Health Care reform will Cost $1 trillion over the next 10 years. The White House says it will “save “money. Republican Senator Mitch McConnell said just a few days ago the tab will be $2.5 trillion over the next decade! Who is right? I don’t think anybody really knows. When it comes right down to it, everybody’s guessing.

The Taxpayer Club

Guest Writer for Greg Hunter’s USAWatchdog.com

You and I are in the Taxpayer Club. We are the working class of America; you know, the part that has to pay for the stimulus programs and Wall Street bailouts. We are the club that gets stuck paying the bill for excessive government. We have to work thirty or forty years to retire while bailed out bankers knock down million dollar bonuses. While the Taxpayer Club is getting poorer, there is another club in America getting wealthier– the Government Club. (more…)

New Real Numbers

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It appeared one of the President’s top economic advisors, Larry Summers, was trying to do a preemptive strike against what may be some bad unemployment numbers. If unemployment is up, blame harsh winter weather! John Williams, an economist from shadowstats.com (also known as Shadow Government Statistics), feels just the opposite. (more…)

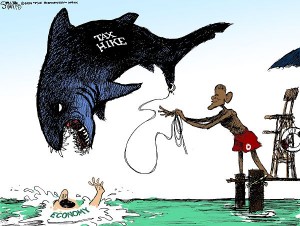

Backdoor Tax Hike

Guest Writer for Greg Hunter’s USAWatchdog.com

I love working in talk radio; the audience is so smart it’s scary.

President Obama’s 2010 budget had just been released, when, at the conclusion of a broadcast, a passionate caller named Madeline told me about the backdoor tax increase contained in our nation’s financial plan. (more…)