Latest Posts

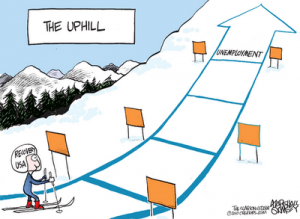

Recovery Hype and Fed Audit

It seems everyday I watch mainstream media there is a discussion about the ongoing so- called “recovery.” Yesterday was no exception. I was watching an anchor on MSNBC ask a guest why the “recovery” is so uneven and why it was hard to maintain upward momentum? I yelled out to my TV, “Because there is no recovery!” (more…)

Do the Opposite of Ben Bernanke

Fed Chairman Ben Bernanke gave testimony to the U.S. House Budget Committee a couple of days ago. His preposterous statements seemed to go unquestioned by the Committee. So, I am going to tackle the highlights, ask a few questions and make several statements of my own that I think should have been made by our Congressmen. (more…)

Gold’s Flashing Warning Sign

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gold hit another all-time high yesterday! According to gold website Kitco.com, “. . . investors continue to seek out the precious yellow metal as a safe-haven asset amid heightened financial, economic and geopolitical uncertainty. One market watcher in a wire service report summed up nicely gold’s recent price action, saying “it’s a warm blanket on a cold day.” August Comex gold closed up $4.80 an ounce at $1,245.60 after hitting a new high of $1,254.50 in early trading.” (more…)

Downturn Coming, Not Recovery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A buddy of mine, who is a business broker, recently told me, “I have never in my life seen more broke people.” I told that little quote to a car salesman I was talking with over the weekend, and he told me, “Don’t I know it! I am in the car business, and I see it all the time.” Those are not the words you hear from the front lines of business that say a so called “recovery” is at hand–quite the opposite. (more…)

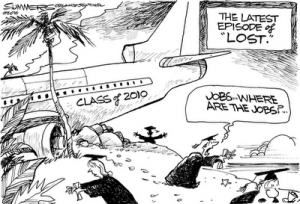

The Job Picture Is Not Improving as Much as You Think (Updated)

There was a lot of talk this week about an improving job market. It seems everybody is talking up a turnaround in the labor market. Some CNBC anchors, yesterday, put their usual optimistic spin on the topic of May payroll and unemployment numbers due out today. Guess what? The numbers are already looking pretty good but not that good! (more…)

Damage that Could Last for Decades

President Obama finally took ownership of the oil gusher in the Gulf yesterday. A National Commission on the BP oil spill has been formed by the White House and will be headed by former Senator Bob Graham of Florida and former EPA Administrator Bill Reilly. In prepared remarks, the President said the ongoing calamity off the coast of Louisiana, “. . .is now the greatest environmental disaster of its kind in our history. Their job, along with the other members of the commission, will be to thoroughly examine the spill and its causes, so that we never face such a catastrophe again.” (more…)

Remember the Fallen

By Greg Hunter’s USAWatchdog.com

Please remember the men and women of the U.S. Military who paid the ultimate price for the country on this Memorial Day. Their sacrifice and that of their families makes our freedom possible.

Dire Predictions

I am seeing increasing chatter and stories on the Internet about a coming collapse or calamity. Below is a list of dire predictions put together on Rense.com. I have started with just the first two. The people making the predictions are legitimate and big thinkers. (more…)

Freeze BP’s Assets Now!

The runaway gushing oil well in the Gulf of Mexico is an unmitigated national emergency. The mile deep, broken well is vomiting oil at a rate of at least 56,000 barrels a day according to Steven Wereley, an associate professor of mechanical engineering at Purdue University. That is 10 times higher than BP’s 5,000 barrel a day estimate. (more…)

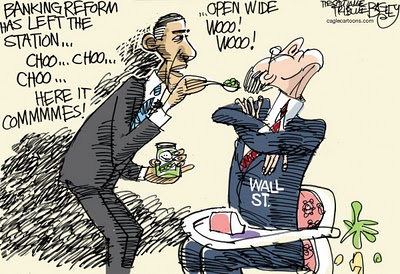

Too Big to Fail Means Too Big to Exist

Both the House of Representatives and the Senate have passed their versions of financial reform legislation. Now, the process of reconciliation takes place between both bodies of Congress to iron out a final bill the President can sign into law. There is plenty in the bill such as new consumer protection, increased power given to regulators to prevent systemic risk, and new powers to oversee the $600 trillion derivatives market. (more…)

FDIC Insurance Fund Still $20 Billion in the Hole

While the stock market was beginning its 376 point plunge yesterday, the Federal Deposit Insurance Corporation was quietly putting the best face it could on a banking system in serious trouble. (more…)

There Are Some People You Just Can’t Help

A producer friend of mine from my investigative correspondent days at ABC used to say, “There are some people you just can’t help.” I think it meant that some people were in so deep, were so blind, or were just too block-headed to listen to reason that no matter what you did, or how hard you tried, you would not be able to help them. My friend is an excellent journalist and producer. He also has a law degree from Duke University. I have always been a lot more impressed with his degree than he was. (more…)

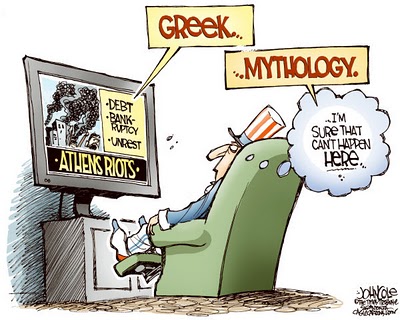

The Same Big Fat Greek Problems are Coming to America

We would all like to think the U.S. will not suffer the same problems as Greece. I am talking about drastic spending cuts to just about everything. Teachers, police pensions and social programs are all going to take big cuts whether the Greeks like it or not. It is not just the Greeks in financial trouble, but all of Europe. You know it is bad when former Fed Chief Paul Volcker says, “You have the great problem of a potential disintegration of the euro.” (Click here to see the full Reuters story.) There is no way a pro like Volcker would say that if it was not already a distinct possibility. (more…)

Is the Financial System Corrupt?

Recent headlines coming out of the financial world have been jaw dropping. Here are a few: US faces same problems as Greece, says Bank of England (The Telegraph), World markets rattled by Goldman fraud (The Economic Times), Goldman Sachs faces criminal investigation (Guardian UK), Government Probe into Wall Street Sales Widening (Fox Business), (more…)

Gold Is Money

The Western financial world is officially in full panic mode. A nearly $1 trillion bailout of Greece confirms that fact. Our very own Federal Reserve is providing billions to the effort, but this is much more than a bailout for Greece. It is a bailout for banks holding Greek debt and the debt of other European nations teetering on default. (more…)