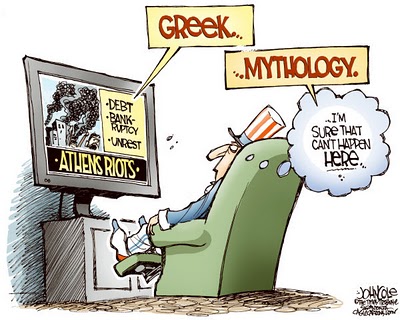

The Same Big Fat Greek Problems are Coming to America

We would all like to think the U.S. will not suffer the same problems as Greece. I am talking about drastic spending cuts to just about everything. Teachers, police pensions and social programs are all going to take big cuts whether the Greeks like it or not. It is not just the Greeks in financial trouble, but all of Europe. You know it is bad when former Fed Chief Paul Volcker says, “You have the great problem of a potential disintegration of the euro.” (Click here to see the full Reuters story.) There is no way a pro like Volcker would say that if it was not already a distinct possibility.

The fact is we already are dealing with too much debt and not enough money here in America. Recent stories show the cracks in our economy getting bigger, not smaller, as the “recovery” camp would have you believe. There are now 40 million U.S. citizens on food stamps—a new record. It was reported just last Friday that “Up to 300,000 Public School Teachers May Lose Their Jobs This Year Due to Local Budget Cuts.”

Remember, states cannot print money; so, the Obama Administration is going to try to save teaching jobs with an emergency federal spending bill. It will mean an additional $23 billion to the deficit. Illinois has reportedly stopped paying its bills! Contractors are owed $4.4 billion, and nonpayment may cause a wave of bankruptcies in that state. There are nearly 3 dozen other U.S. states facing similar severe budget problems. These are just a few stories from the last week or so showing the slow motion train wreck of a debt saturated economy.

In the latest report from Shadowstats.com, economist John Williams says look out for another nasty downturn in the economy because the money supply (M3) is shrinking. Williams writes, “. . . near-term economic activity will turn down, with major negative implications for the federal budget deficit, U.S. Treasury fundings, systemic solvency and the U.S. dollar. Such developments should place significant upside pressure on domestic inflation. U.S. difficulties eventually should dwarf the European sovereign solvency concerns. . .”

So, what will perform well in this environment? You better start looking for an exit if you are holding dollars, stocks or bonds. According to Williams, “. . . the long-term outlook for the U.S. dollar and U.S. equity and credit markets remains bleak, while the long-term outlook for gold and silver remains extremely strong.”

All the spending for things such as $23 billion to save teachers jobs is mushrooming the deficit in this country. According to Williams, from March 31 to April 30, 2010, the government added $175.6 billion in debt. Let me say this again, $175.6 billion in debt was added in a single month! Because of high unemployment, tax collections are imploding. This is not what you want to see while spending and money printing are exploding.

Meanwhile, Nobel Prize winning economist Paul Krugman takes the opposite point of view. Krugman wrote an op-ed piece last week called, “We’re not Greece.” He says, “In short, we’re not Greece. We may currently be running deficits of comparable size, but our economic position — and, as a result, our fiscal outlook — is vastly better.” He also says, “So here’s the reality: America’s fiscal outlook over the next few years isn’t bad. We do have a serious long-run budget problem, which will have to be resolved with a combination of health care reform and other measures, probably including a moderate rise in taxes. But we should ignore those who pretend to be concerned with fiscal responsibility, but whose real goal is to dismantle the welfare state — and are trying to use crises elsewhere to frighten us into giving them what they want.” (Click here for the complete Krugman op-ed.)

These are just “crises . . . to frighten us into giving them what they want.” You have got to be kidding. When this blows up, and it will sooner than later, I wonder if the Nobel people will ask for their prize back?

I guess Mr. Krugman proves the point that being a Nobel Laureate just isn’t what it used to be. Fortunately for him the Newspapers will be out of business soon and he will be able to take advantage of the welfare state.

John,

You are clever and funny!

Greg

Greg,

You mention that Krugman has a Nobel prize. So what? Obama got one from the same place and for what? Most Nobel Prizes are given for political reasons not achievement. Krugman may have deserved his at the time but he has since sold his soul to the devil. A real economist would not be spouting such gibberish and only the main stream media is printing this. Krug did an op-ED espousing his political beliefs not an economic piece. Krugman is saying the American economy is like the Wile E Coyote cartoon character; if you don’t know the law of gravity, it can’t affect you.

Is it lost on anyone that the IMF, of which we are paying 17% of the bill, is demanding Greece dissolve its great pension, high government worker pay and shudder…government healthcare.

Tunney,

Great points. I did not know including Mr. Krugman in this post would strike such a nerve. Thank you.

Greg

Sooner rather than later for sure. The bad news re: our economy continues to compound. Mathematically, it is getting ready to explode …. I don’t see any other result.

David,

Thank you David!!

Greg

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, is a Central Banking award. The official name is the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. It is not one of the Nobel Prizes established by the will of Alfred Nobel during 1895, but is commonly identified with them. The Prize in Economics, as it is referred to by the Nobel Foundation, was established and endowed by Sveriges Riksbank, Sweden’s central bank, during 1968 on the Bank’s 300th anniversary.

This “Nobel” is, indeed, a Central Bank prize. As a staunch defender of the economics of central planning, Krugmann is a worthy recipient; far from recinding his award, they will probably erect a statue of him while the rest of the world burns his ilk in effigy.

The effect of introducing the Central Bank in the terms that our country chose, not only reduced average citizens to ignorant children, but also reduced members of Congress and the media elite to a similar role: cranky, powerless children.

By the end of this decade, if there is hope at all, it will be when Americans are as familiar with monetary policy and, indeed, the nature of money itself, as they are with American Idol.

Nelson,

Thank you so much for this information. I know the readers od this site will also find this interesting!!

Greg

Thanks for correcting us on the Nobel aspect. It still does mean that what he said has any basis in math or that what he wrote was nothing more that a political kiss to the President. I understand monetary policy fine. Don’t spend more than you take in. Don’t pretend to take money in and then issue worthless treasuries against the debt that you owe me later on. Don’t rob me to pay someone to sit on his a$$ and don’t rob every citizen to bail out the labor unions and greed bankers. Stop the illegal aliens from stealing from me by being put up in public housing and getting welfare [like Obama’s Auntie?] Is it really more complex than that?

Great information on Krugman. I am astonished how anybody who is intellectually honest with themselves can support central planning? US Citizens don’t realize how much more money and less debt they had 100 years ago because the transition from a free market capitalist society to a socialist welfare state has taken that long. It is called “Fabian Socialism”.

The Fabian Society is a British intellectual socialist movement, whose purpose is to advance the principles of social democracy via gradualist and reformist, rather than revolutionary, means.

Why this is important? When rights and money are stripped from the citizen over 25 years they will remember what life was like prior to the governments confiscatory and oppressive policies. When it happens over 100 years, the working people of today have no basis for real comparison.

“Banking institutions are more dangerous to our liberties than standing armies.”

Thomas Jefferson

Stephen

Thank you again Stephen.

Greg

John Bernard, Tunney, David Conrad, Nelson, and Greg:

Great jobs! I enjoyed reading this thread and I learned a few things.

Progressives will never accept blame for their policies. When our economy nose-dives again, they will blame the opposition who did not allow them to fully implement their central-planning policies.

markm

Mark,

From all of us, Thank you!

Greg

“In the latest report from Shadowstats.com, economist John Williams says look out for another nasty downturn in the economy because the money supply (M3) is shrinking.”

Is that true? Money supply has never once shrunk before.

“Let me say this again, $175.6 billion in debt was added in a single month!”

So how can money supply shrink is 175 billion in money supply is added.

I am interested to know about M3 data just to clarfiy things for myself because I dont think its even possible for it to shrink, because we cannot pay off debt, unless the procedure is for debt to written off the books and then money supply contracted in accordance but I do not think it works that way instead the bad debt is added to the good debt so to speak which is the diluting effect on the value of money which of course is only units of account for the underlying debt.

Dan,

The official M3 money supply figure was discontinued in March of ’06. Shadowstats recreates this number the way the Fed used to do it. Acording to Economist John Williams, money supply can shrink and this is not the first time that has happend. He has the charts and graphs to prove it on his (subscription based) website and newsletter. The $175.6 billion number is new “debt” issued, not money supply. I hope this helps. Thank you for myour question and comment.

Greg

Yea kind of, the M3 data that was available until discontinued never declined.

Debt issued IS money issued they are exactly identical, this is why Money supply does not shrink because people pay debt with money meaning they pay debt with debt meaning they do not pay at all they discharge and rollover new debt into the future, this is not some fabricated opinion this is how it works, “modern money mechanics” is a good publication from the federal reserve explaining money and its supply.

Personally I am interested in if money supply is shrinking as in total money supply how was the debt paid in order to make it shrink when there is no means within the public to pay debt.

Thank you Dan,

Greg

Just an aside on the Nobel Prize for economics.

I remember when Friederich von Hayek won it in 1974. He won it for work done in the 1930’s, building on the theories of Ludwig von Mises. He deserved it of course but they could not give it to him while Mises was alive. Ludwig von Mises died in 1973 and was von Hayek’s teacher, mentor, and friend but was far above him in economics.

Remember too that Hayek shared the prize with Gunnar Myrdal – a socialist. Talk about confusion on the part of the Nobel committee. Krugman with the prize in Economics is equivalent to Yasser Arafat winning the Peace prize.

Fred

Fred M,

Thanks for the info and the comment.

Greg