Latest Posts

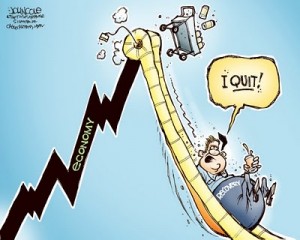

Recession Not Over, Double-Dip or Worse Coming

Just last week, I ridiculed a group of academic economists for calling an end to the longest recession since World War II. The National Bureau of Economic Research proclaimed the recession we STILL find ourselves in ended in June of 2009. The NBER is the official arbiter of the timing of the U.S. business cycle. Well, I’m not the only person who thinks the NBER’s ascertainment of the economy defies all statistical evidence. (more…)

Is Gold in a Bubble?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

With gold hitting all time nominal highs this week, the recurring question is “Is gold in a bubble?” The yellow metal has been flirting with the $1,300 an ounce mark, and some folks are getting a little worried it has gone too far too fast. If anything, gold has not gone far or fast enough if you compare it to the U.S. debt and future commitments. According to Boston University economics professor Laurence Kotlikoff, the U.S. is “bankrupt.” (more…)

The Recession is Over? Really!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was dumbfounded by the headline “Recession Ended in June 2009” that came out earlier this week. The National Bureau of Economic Research (NBER), which is a panel of academic economists, called an end to the longest recession since WWII. (more…)

We Don’t Have Honest Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

My nephew, Luke, called me the other day vexing over the materials used in our coins. He is a finance major in grad school and was researching money when he discovered that pennies were 97.5 percent zinc and nickels were mostly copper with only a nickel coating. (more…)

Treasury Bills: The New Opium

About this time last year, I heard financial expert Jim Rickards say on CNBC, “Federal Reserve needs to cut US Dollar in half over next 14 years.” He followed that up by saying, “If the market sees that playing out which it probably will, you could have a very rapid collapse of the dollar.” Fast forward to today with gold hitting all-time highs, his scenario may be beginning to play out. Rickards is a heavyweight in the world of finance. He is Senior Managing Director for Market Intelligence at Omnis, Inc., and co-head of the firm’s practice in Threat Finance & Market Intelligence. He is a big thinker that peers into the future for a living. (more…)

Tap Dancing on A Land Mine

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The economic “recovery” talk picked up some speed yesterday as retail sales for August were announced. The government said sales were up a whopping .4%. It seemed everybody on financial TV was talking like the worst is now behind us, and there was no chance of a dreaded “double-dip” in the economy. (more…)

The Elephant in the Room

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

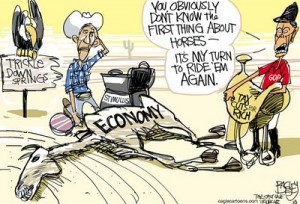

There has been a flurry of proposals this week on how to get the economy growing again. The President has been giving speeches across the country offering up plans for more infrastructure spending, business tax cuts and credits. The Republican plan includes keeping all the Bush tax cuts in place and rolling back spending to 2008 levels. Basically, the Democrats want more stimulus spending and some tax cuts, and the Republicans want more tax cuts and some spending reduction. (more…)

Death By Globalism—Economists Haven’t A Clue

The President is kicking off another new jobs creation campaign this week. He has just proposed spending more than $50 billion on infrastructure over the next six years and $300 billion in business tax cuts and credits for the future. The White House says the plan will not add to the record U.S. deficit. The Obama Administration plans to work with Congress to get it done. Congress, by the way, is enjoying a sub 10% approval rating these days. The Guest Writer today is Paul Craig Roberts. He was Assistant Treasury Secretary in the Reagan Administration, so he knows something about money and stimulus plans like the President is pushing. Roberts lays out why stimulus plans will not work for the American economy as it stands today. –Greg Hunter— (more…)

The President is kicking off another new jobs creation campaign this week. He has just proposed spending more than $50 billion on infrastructure over the next six years and $300 billion in business tax cuts and credits for the future. The White House says the plan will not add to the record U.S. deficit. The Obama Administration plans to work with Congress to get it done. Congress, by the way, is enjoying a sub 10% approval rating these days. The Guest Writer today is Paul Craig Roberts. He was Assistant Treasury Secretary in the Reagan Administration, so he knows something about money and stimulus plans like the President is pushing. Roberts lays out why stimulus plans will not work for the American economy as it stands today. –Greg Hunter— (more…)

Job Headlines Paint False Rosy Picture

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Headlines released after a better than expected jobs report painted a very optimistic picture. Bloomberg’s headline read “Recession Concerns Ease on August Jobs Data.” The story said, “Companies in the U.S. added more jobs than forecast in August, easing concern the world’s largest economy is sliding back into a recession. (more…)

Skidding Toward Fall

The following article was written by James Howard Kunstler. Mr Kunstler wrote a book in 2008 about post-oil America called “World Made By Hand.” Fossil fuel and issues surrounding it are a natural fit for this writer. He wrote the article in early August when President Obama was touting General Motor’s new electric car. –Greg Hunter– (more…)

The following article was written by James Howard Kunstler. Mr Kunstler wrote a book in 2008 about post-oil America called “World Made By Hand.” Fossil fuel and issues surrounding it are a natural fit for this writer. He wrote the article in early August when President Obama was touting General Motor’s new electric car. –Greg Hunter– (more…)

Little Growth Means Big Trouble

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Second quarter GDP growth numbers were revised down last week to a paltry 1.6% from 2.4%. Wall Street celebrated because some were expecting “growth” to be revised even lower. The stock market shot up on this news, but should everyone feel relieved because the U.S. got at least some growth? (more…)

Ground Zero Mosque is a Distraction

By Greg Hunter’s USAWatchdog.com I think the problems we face as a nation are much more important than building a mosque in lower Manhattan. The only reason I am writing about this is because it is an issue that I feel is being used to distract the country from the PROFOUND financial problems we face. They have now got the attention of the military. Adm. Mike Mullen, Chairman of the Joint Chiefs of Staff, warned last week that the national debt is the single biggest threat to national security! (more…)

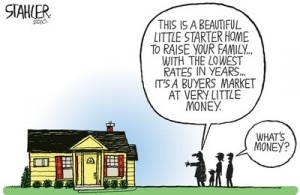

Housing is Dragging the Economy to Hell

A little more than two months ago, banking analyst Meredith Whitney said on CNBC, “Unequivocally, I see a double-dip in housing. There’s no doubt about it . . . prices are going down again.” I’d say unequivocally she was spot on. A few of the hellish headlines dragging the economy down include: Existing home sales dropped 27.2 percent from June. That is a record drop and a 15 year low. One in ten mortgage holders in America face foreclosure, according to a new report by the Mortgage Bankers Association. U.S. home prices fell 1.6 percent in the second quarter from a year earlier as record foreclosures added to the inventory of properties for sale. (more…)

Standing Up When It’s Too Late

This article is comparison between America and another great empire faced with rot in high office and a decline of state—Rome. The writer, JR Nyquist, artfully points out it’s not the big events that sink an empire but many seemingly little ones. You could call what is happening to the U.S. “death by a thousand cuts.” Except in this story, people are not really aware how deep the cuts are and exactly who is doing the cutting. I loved this piece, and I hope you do as well. Greg Hunter (more…)

This article is comparison between America and another great empire faced with rot in high office and a decline of state—Rome. The writer, JR Nyquist, artfully points out it’s not the big events that sink an empire but many seemingly little ones. You could call what is happening to the U.S. “death by a thousand cuts.” Except in this story, people are not really aware how deep the cuts are and exactly who is doing the cutting. I loved this piece, and I hope you do as well. Greg Hunter (more…)

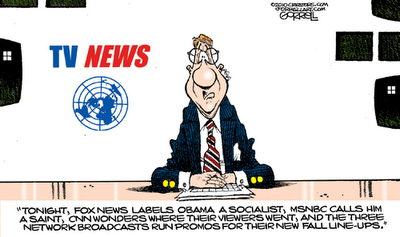

Mainstream Media is Crushing Public Confidence

By Greg Hunter’s USAWatchdog.com

Recently, a new Gallup poll delivered some bad news to mainstream media–only one fourth of people asked believe what it says. The Gallup story said, “Americans continue to express near-record-low confidence in newspapers and television news (more…)