Latest Posts

Jonathan Cahn gives the Biblical breakdown of Israel-Hamas End-Time Mystery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This video was done by Jonathan Cahn about two weeks ago. It has received 1.3 million views–so far. It is a stunning piece of Biblical analysis on Israel and Hamas that only 7-time best-selling author Jonathan Cahn can deliver. Did you know the word Hamas is in the Bible? Did you know Israel was attacked from what is now known as Gaza in ancient times? Did you know the Biblical giant Goliath came from Gaza in ancient times? (more…)

CV19 mRNA Vaccines Were Meant to Harm & Kill People – Dr. Michael Palmer

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Dr. Michael Palmer MD was a biochemistry professor at University of Waterloo, Ontario, Canada, and was fired from his job in 2022 when he refused the CV19 so-called “vaccine.” He now helps run Doctors4CovidEthics.org. It is a website dedicated to warning people of the dangers of the CV19 mRNA vaccines. Dr. Palmer has just written a book called “mRNA Vaccine Toxicity.” Dr. Palmer has well over 1,000 hours of personal research conducted on the mRNA vaccines, which he calls “poison.” Dr. Palmer also has an impressive list of contributors to his recent book that include world renowned microbiologist Dr. Sucharit Bhakdi (MD) and Catherine Austin Fitts, to name a few. Dr. Palmer says the CV19 vax was an “intentional murder program.” Dr. Palmer explains, “It was clear in 2020 that the risks that were being taken were completely unreasonable. It normally takes many years to develop a vaccine. . . these years were condensed into just a few months. . . . If you combine the radical shortening of time for testing, which on its own creates a huge risk, combined with a new technology (mRNA) that means the risk is incalculable. So, it’s completely irresponsible. . . .After the beginning of the vaccination campaign, and the first few weeks with disastrous results, it would have been necessary to immediately stop this campaign. What we have seen instead is relentless coercion, relentless censorship, relentless lying by the authorities about the safety and effectiveness of these vaccines. This must have been a necessity for these vaccines. This must be a deliberate policy to harm and kill.” (more…)

Biden Still At 9.5%, Middle East Boiling, More Vax Murders

By Greg Hunter’s USAWatchdog.com (WNW 605 10.27.23)

By Greg Hunter’s USAWatchdog.com (WNW 605 10.27.23)

9.5% Biden approval rating is the number behind most of what you see going on. Yes, the Lying Legacy Media says Biden’s approval ratings are much higher, but why do you think I call them the Lying Legacy Media (LLM)? My sources say everybody knows Biden sucks, and this was before the Hamas/Israel conflict and before Ukraine was decimated. When you have poll numbers this low, you prosecute your political enemies, let new illegal voters into the country by the millions, cover up vax deaths and injuries by the millions and start a huge war. Any of this sound familiar? Again, 9.5% actual rating. (more…)

2 Billion Will Die in New War Cycle – Charles Nenner

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned geopolitical and financial cycle expert Charles Nenner has been warning a once every 120-year war cycle is coming, and with hostilities in the Middle East, it is clearly here. This cycle is for big wars such as WWI and WWII. These two wars were part of one big war cycle according to Nenner, and history is now repeating. Keep in mind, this war cycle comes with many countries in possession of nuclear arsenals. Nenner explains, “If you do cycles on war games and war cycles, you can calculate how many people are going to die in such a war. We discussed this in the past, and it now looks ugly. We are talking about a lot of people. There are so many things bad going on in the world, so I would like to not to tell you the number.” (more…)

Mathematically, Financial System Is Going Down – Bill Holter

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Precious metals expert and financial writer Bill Holter warned in August of financial trouble coming to America sooner than later. He gave a long list that now includes a global war. Even without war, there is no stopping the financial fall that is coming. Central banks are, once again, the biggest buyers of gold this year. What is going on? Holter says, “The central banks fully understand the math behind the financial system of the West is broken. The Western financial system cannot survive the math. . . (more…)

Middle East Headed for War, Economy Headed for Total Collapse

By Greg Hunter’s USAWatchdog.com (WNW 604 10.20.23)

By Greg Hunter’s USAWatchdog.com (WNW 604 10.20.23)

Everywhere you look in the Middle East, you see signs of a brewing war. The world is divided over the Hamas and Israel fighting. It is the most violent division in the world that has not been seen for a very long time. The U.S. Navy has aircraft carriers off the cost of Israel, and Russia is threatening to sink them with hypersonic missiles. Now, the terror looks like it is coming to America with it’s wide-open Southern border. FBI Director Chris Wray is warning a terror attack could likely happen in America in the not-so-distant future. I guess the FBI is not going to go after Catholics and Trump supporters and focus on real terrorists for a change. (more…)

Is a Biblical Nuke War Coming? – Steve Quayle

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Renowned radio host, filmmaker, book author and archeological dig expert Steve Quayle says what is happening with the Hamas/Israel war is going to have Biblical consequences. Quayle says, “This time you will not just be a spectator. You will be a participant or a target. . . . Peace has been taken from the earth.” (more…)

Fear Not, No WWIII Yet – Bo Polny

By Greg Hunter’s USAWatchdog.com (Special presentation of Weekly News Wrap-Up WNW 603 for 10/13/23)

By Greg Hunter’s USAWatchdog.com (Special presentation of Weekly News Wrap-Up WNW 603 for 10/13/23)

Biblical cycle timing expert and geopolitical/financial analyst Bo Polny predicted last month on USAWatchdog.com that “chaos was coming in early October.” The Hamas/Israel war that started on October 6th proved him right. The situation seems to be intensifying and spinning out of control by the hour. Israel has called up 300,000 troops in the war with Hamas terrorists that murdered, wounded or kidnapped thousands of Israelis in a surprise attack last Friday. Hamas is calling for a “global Jihad, invasion of Israel and to attack Jews worldwide on Oct. 13.” Even though this is already a bloody conflict that will, no doubt, get much worse, Polny predicts this is not going to be WWIII, at least not just yet. Polny explains, “If you truly understand the times we are living in today, do not fear World War III. It is not the time for it. That time point is Revelation 16, verse 12. It says the Euphrates River dries up, and armies prepare for Armageddon. I repeat, we are not at Revelation 16.” (more…)

CV19 Vax Causes ‘Turbo Cancer’ – Dr. Ryan Cole

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Dr. Ryan Cole is a Board-Certified pathologist. Dr. Cole is an expert in postmortem examination and has treated more than 500,000 patients. He has a prestigious resume, including a five-year stint at the Mayo Clinic. Dr. Cole has been fighting the CV19 narrative from infection to injection from the very beginning and told people not to get the CV19 vax. For this, Dr. Cole was attacked by the globalist Deep State until he was forced to sell his medical diagnostic business that staffed around 80 employees. Cole has been put out of work for telling the awful truth about the deadly CV19 vax. More than a year ago, Dr. Cole called the global CV19 vax “Absolute Insanity,” and the data today says he was correct. (more…)

CV19 Bioweapon/Vax an Extinction Level Event – Dr. Ana Maria Mihalcea

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Dr. Ana Maria Mihalcea (aka Dr. Ana) is a Medical Doctor who also holds a PhD in pathology. Dr. Ana has been examining the blood of both the CV19 “vaccinated” and the unvaccinated. She calls the CV19 vax a bioweapon and points out she is finding nano technology, heavy metals and all sorts of biotech garbage in many people she examines. Dr. Ana sees this as an unfolding catastrophe for all of humanity because of the CV19 bioweapon vax that people were tricked, coerced or forced to take. Dr. Ana explains, “The Epoch Times just ran a story where 17 million people’s deaths with all-cause mortality have been attributed to these shots. This is just the beginning because this is a slow kill. . . . (more…)

McCarthy Out, Putin Warns, CV19 Vax Keeps Killing

By Greg Hunter’s USAWatchdog.com (WNW 602 10/6/23)

By Greg Hunter’s USAWatchdog.com (WNW 602 10/6/23)

In a stunning vote, Speaker of the House Kevin McCarthy was voted out of office. Matt Gaetz and 10 other House Republicans sent him packing when Gaetz forced a vote. McCarthy agreed on not funding Ukraine war spending but cut a side deal to do it anyway. That, along with other things, got some Republican House members so mad they simply voted McCarthy out in a vote that surprised almost everyone including the Deep State. Now, Representative Jim Jordan looks like the leading candidate for Speaker, especially after Trump endorsed him for the job. Trump was considered as a Speaker candidate, but Trump is running for President and has too many other witch hunt court cases on his plate to do the job. (more…)

Short America & Go Long BRIC Countries – Charles Nenner

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Renowned geopolitical and financial cycle expert Charles Nenner has been warning his war cycles were turning up. Nenner says, “It happens like clockwork in the second decade of a new century.” Nenner says it’s a lot like the stock market running out of gas, and he warns, “It’s like a stock market that is topping. First, the weak stocks go down. Then, the indexes are still holding up, and then the big ones go down. Now, you see for instance, Apple also came down, but first, the small stocks came down. It’s already happening, but you only see the results suddenly when the whole thing crashes. . . .Americans seem to have no worries about the war that could be coming. (more…)

Trump Wins & Loses, Biden Impeachment, More Ukraine War

By Greg Hunter’s USAWatchdog.com (WNW 601 9.29.23)

By Greg Hunter’s USAWatchdog.com (WNW 601 9.29.23)

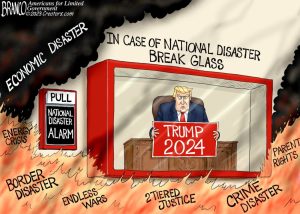

President Trump won the Republican debate this week without showing up. This is according to a Daily Mail poll after the GOP debate that Trump stayed away from. Meanwhile, Trump’s business license has been revoked in New York by a judge to punish him for fraud BEFORE a case being brought by the NY Attorney General Letitia James. Trump is appealing that ruling and going to court in New York on the NY fraud case on October 2nd. (more…)

Somebody is Still Trying to Kill You, Don’t Let Them – Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

The data is out on the CV19 bioweapon vax, and it is crystal clear it did not help a single person. In fact, the CV19 vax is causing massive death and disability, and it will continue for years to come. Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), says, “I said literally on the first day way before they had a vaccine, I said don’t worry about Covid, worry about the injection. I said that immediately because I could see it coming. The goal of this thing was to get people injected. The other goal was to steal a huge amount of assets, which they did quite successfully. (more…)

Biden Backlash, US Russia War, Economic Warning Signs

By Greg Hunter’s USAWatchdog.com (WNW 600 9.22.23)

By Greg Hunter’s USAWatchdog.com (WNW 600 9.22.23)

This is the number that explains it all — 9.5% Biden approval rating. No, the Lying Legacy Media (LLM) will not tell you this, but the people at the top know the real approval rating and it’s 9.5%. My private sources that compute this number also are seeing a huge Biden backlash for everything from the Ukraine war, wide open borders, huge inflation, CV19 vax and being forced to think drag queens are really women. These are just a few of backlashes brewing and brewing big. (more…)