Latest Posts

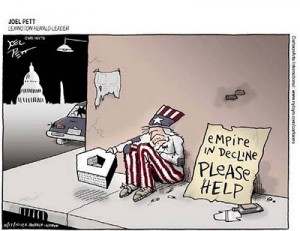

The Next One will be the Big One

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I don’t see how anyone could say the financial system is stable. The facts say it is anything but well-balanced and steady. The Western world is in crisis with Europe leading the way over the financial cliff. Pick a country in the EU. France, Greece, Spain or Italy are all capable of causing the next financial panic. I can’t tell you how many times I’ve heard or read the word “collapse” in reporting on this spiraling financial crisis. (more…)

Weekly News Wrap-Up 5.25.12

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big meeting, this week, in Iraq concerning Iran’s nuclear program was a big bust. The meeting, once again, ended the same way the last one did—with a date for another meeting. The next one is in Russia, next month, and will involve all the same world powers (U.S. UK, France, Germany, Russia, China and Iran).

The West wants Iran to stop enriching uranium to high levels for fear of turning it into a nuclear weapon. (more…)

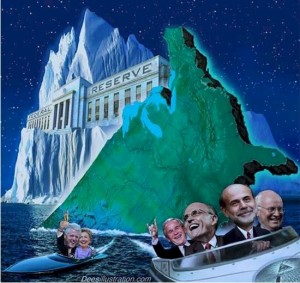

JP Morgan Tip of Iceberg

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

William K. Black is one of my heroes. He is a former bank regulator, professor and an outspoken critic of the part of Wall Street that crashed the financial system in 2008. His big beef is there were zero prosecutions of financial elites. A thousand big wigs were convicted (including a sitting governor) in the wake of the Savings and Loan crisis in the early 1990’s. (more…)

Can Ron Paul Win as a Third Party Candidate?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In a new poll, out yesterday, 7 out of 10 Republicans and right leaning independent voters believe Mitt Romney will be the GOP nominee for President. (Click here for that poll.) Does that mean it’s over for Congressman Ron Paul? I think it is safe to say it is probably a long shot he will be the Republican nominee, but what about a third party run? Can Ron Paul win as a third party candidate? (more…)

No Laws Were Broken

By Greg Hunter’s USAWAtchdog.com

By Greg Hunter’s USAWAtchdog.com

It looks like the EU is getting a bailout from the IMF that could be nearly $800 billion. Gold is going straight up, and I am sure global stock markets will also surge on the bailout news. This will not really fix what is wrong. It will also not put an end to the chronic crisis mode Europe and the U.S. have been in for the past 3 years. I mean, if all the global bailouts didn’t fix the problem, including $16 trillion pumped out by the Fed after the 2008 meltdown, what’s another $800 billion going to do? (more…)

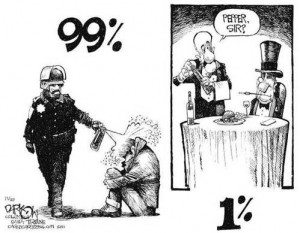

Peaceful Wall Street Protesters Pepper Sprayed?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

You got to wonder what kind of country we are living in when people protesting Wall Street greed and corruption are pepper sprayed. Meanwhile, the crooks that caused a global meltdown sit and look out their plush offices and collect fat bonuses. You wonder why people are protesting? How about the fact that not a single high-ranking Wall Street banker has gone to jail over this calamity, let alone been investigated. (more…)

Fed Stress Test a Farce

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Last Friday, the Federal Reserve announced it completed its so-called Fed stress test on 19 of the country’s largest banks. Improved financial health allows some banks to “increase or restart dividend payments, buy back shares, or repay government capital.” The news was met by some mainstream media outlets with jubilation, even though the Fed did not disclose which banks did well and which banks did not. (more…)

Mainstream Media Spins Dimon

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Monday, we started out the week with a front page story on USA Today that was more like a public relations stunt than real journalism. The headline read “Dimon sees good times in 2011.” The story was mostly an interview with JP Morgan CEO Jamie Dimon by CNBC news reader Maria Bartiromo. I could not find any objectivity or tough questions put to the Chairman and CEO of one of the nation’s top financial institutions. Please keep in mind J P Morgan was bailed out by taxpayers to the tune of $260 billion during the financial crisis. (more…)

Egypt Diverts Media Attention from U.S. Economy

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The revolution in Egypt has been going on for nearly two weeks. It is intensifying. There are reports of gunfire, beatings of foreign journalists and looting. It is a riveting story because so much is at stake for America. However, the Egypt saga is sucking up resources and attention away from other stories that are also very important for America. (more…)

2011 Prediction Follow-up

The 2011 Predictions post garnered more than 100 comments and several hundred predictions. I want to thank everyone for taking the time to make a prediction or comment. Your involvement is what makes this site come alive. I put together a few of your predictions below. I thought they were, for the most part, deductive and rational. Here are a few of the highlights from USAWatchdog.com readers: (more…)

The 2011 Predictions post garnered more than 100 comments and several hundred predictions. I want to thank everyone for taking the time to make a prediction or comment. Your involvement is what makes this site come alive. I put together a few of your predictions below. I thought they were, for the most part, deductive and rational. Here are a few of the highlights from USAWatchdog.com readers: (more…)

B of A Settlement, Another Taxpayer Rip-off

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In case you have not heard, Fannie and Freddie (also known as Government-Sponsored Enterprises or GSE’s) settled a big lawsuit with Bank of America Monday. The case was settled for cents on the dollar, even though the GSE’s had had a strong case to force B of A to buy back billions in sour mortgage-backed securities (MBS.) (more…)

Banks Should Face Bankruptcy, Just Like GM

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

General Motors started trading publicly last week in what is being called one of Wall Street’s most successful Initial Public Offerings (IPO) in years. The automaker took in $20 billion selling newly minted shares of this iconic American company. That is only part of the $50 billion price tag in the bailout, but letting GM go under would have been far worse. (more…)

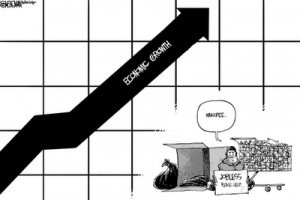

As Banks Go, So Goes the Economy

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

FDIC Chairman Sheila Bair gave a speech to the securities industry in New York City this past Wednesday. In her opening remarks, she said, “Now, as a tentative economic recovery continues to build, and as the earnings of banks and other financial companies begin to recover, we must resist the natural impulse to return to business as usual. Instead, now is the time to carry through with our work to strengthen financial market practices and products and sharpen our approach to financial regulation.” Apparently, the Financial Standards Accounting Board (FASB) wants to do just that and return to fair market accounting. (more…)

Foreclosuregate Could Force Bank Nationalization

The piece you are about to read is from our friend, Ellen Brown. Her posts are on the long side, but heavy on detail and fact. This is what I love about her—she backs up her work. This piece is a great addendum to the post I did Monday called “The Fed’s Biggest Fear.” Their biggest fear is, also, the biggest financial problem facing America. It is the mortgage mess and the layers of fraud, taxpayer rip-offs and the extremely leveraged banks. (more…)

The piece you are about to read is from our friend, Ellen Brown. Her posts are on the long side, but heavy on detail and fact. This is what I love about her—she backs up her work. This piece is a great addendum to the post I did Monday called “The Fed’s Biggest Fear.” Their biggest fear is, also, the biggest financial problem facing America. It is the mortgage mess and the layers of fraud, taxpayer rip-offs and the extremely leveraged banks. (more…)

The Fed Bought Fraud

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In the wake of the financial meltdown of 2008, the Federal Reserve announced it would buy mortgage-backed securities, or MBS. The January announcement by the Fed said it would buy MBS from failed mortgage giants Fannie Mae and Freddie Mac in the amount of $1.25 trillion. At the time, the Fed said in a press release, “The goal of the program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally.” (more…)