Latest Posts

Print More Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The second round of quantitative easing (QE2) is scheduled to end June 30, and already there are calls for more financial stimulus to keep the economy from falling off a cliff. The latest call came from Larry Summers, former head of the Obama Administration’s financial team. In an Op-Ed piece that ran on Reuters last Sunday, Summers pitched the idea of a $200 billion cut in the payroll tax. (more…)

The Most Predictable Financial Calamity in History

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

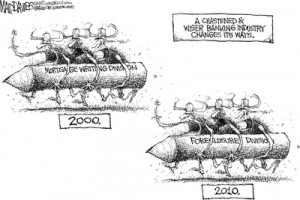

In November 2010, the Federal Reserve announced a second round of economic stimulus commonly referred to as Quantitative Easing (QE2). The reason, according to the Fed, was “progress toward its objectives has been disappointingly slow.” So, to try and turn the economy around, the Fed said, “. . . the Committee intends to purchase a further $600 billion of longer-term Treasury securities (more…)

Back to Reality

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

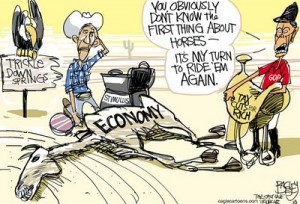

Now that the mid-term elections are over, it is time to get back to reality. Just because House Minority Leader John Boehner is taking over for Nancy Pelosi as Speaker of the House doesn’t mean the economy will get better. Yes, the Republicans can now, pretty much, put the kibosh on the Obama agenda with big victories in the House and Senate, but is that enough to turn things around? In a word–no. (more…)

Fear, Desperation and Doom Describe the Housing Market

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It has been called foreclosure gate, robo signing, foreclosure fraud or just sloppy paperwork; but no matter what you call it, it’s signaling a new financial meltdown for the U.S. economy. The securitized mortgage debt created in the real estate bubble is being called the “largest fraud in the history of capital markets” by people like renowned gold expert Jim Sinclair.

Is Gold in a Bubble?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

With gold hitting all time nominal highs this week, the recurring question is “Is gold in a bubble?” The yellow metal has been flirting with the $1,300 an ounce mark, and some folks are getting a little worried it has gone too far too fast. If anything, gold has not gone far or fast enough if you compare it to the U.S. debt and future commitments. According to Boston University economics professor Laurence Kotlikoff, the U.S. is “bankrupt.” (more…)

The Elephant in the Room

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There has been a flurry of proposals this week on how to get the economy growing again. The President has been giving speeches across the country offering up plans for more infrastructure spending, business tax cuts and credits. The Republican plan includes keeping all the Bush tax cuts in place and rolling back spending to 2008 levels. Basically, the Democrats want more stimulus spending and some tax cuts, and the Republicans want more tax cuts and some spending reduction. (more…)

Why is the U.S. Government Protecting BP?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A little more than 2 weeks ago, the government said nearly 75% of the oil from the worst environmental disaster in history was gone! Government scientists claim most of the oil had dissolved, dispersed or been removed. Now, government scientists are defending their claims against a new report from University of Georgia scientists. (more…)

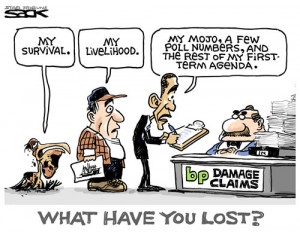

Pedro’s Nightmare BP Scenario

The possibility of a BP bankruptcy because of the ongoing Gulf oil spill is very real. Since the oil spill disaster on April 20, the company’s share price has been cut in half. BP has lost $90 billion in value for shareholders. The company dividend has been diverted to help pay for stopping the out-of-control well, cleanup and damages. At the beginning of this month, the President said, “Untold damage is being done to the environment — damage that could last for decades.” This broken well is spewing out an Exxon Valdez every 4 or 5 days, and experts say it will be at least 2 months before it is stopped. (more…)

The U.S. Dollar Falls by Fall

Last week, three stories acted as signposts for the direction of the U.S. Dollar value. The first is about a letter President Obama sent to members of the G20 (Group of 20 major industrial countries) in advance of next weekend’s meeting in Canada. The President’s letter asked members to “reaffirm our unity of purpose to provide the policy support necessary to keep economic growth strong.” (more…)

Limited Fed Audits Will be Part of Financial Reform

It’s not exactly the kind of audit Congressmen Ron Paul and Alan Grayson wanted in their original legislation, but it looks like their wish to peel away some of the Federal Reserve’s secret deals in lending and the securities market will be exposed for the first time in history. The House and Senate are working to reconcile two similar bills and make them into one to put on the President’s desk. (more…)

Fraud, It’s Much Bigger Than Goldman Sachs

By Greg Hunter’s USAWatchdog.com

Goldman Sachs was charged with fraud last week by the Securities and Exchange Commission. The investment bank says the charges are “unfounded in law and fact.” Regulators allege “Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party,” SEC Enforcement Director Robert Khuzami said in a statement. In other words

What the Big Headline Should be Today

By Greg Hunter’s USAWatchdog.com

The headline today will probably be something like “Big Republican Wins on Election Day!” Bob McDonnell won the Virginia Governor’s job and Chris Christie (left) unseated Democrat Jon Corzine for Governor in New Jersey. I am sure there are going to be many stories about the revived party of Lincoln. Some will proclaim the health care plan is dead or the Democrats will lose control of at least the House or the Senate in 2010. Fact of the matter is, it’s not going to make much difference whether Democrats or Republicans are in power. The economy is in deep trouble because America is drowning in debt. Many experts say the economy and the dollar are doomed to fall further in the future.

Today the Price of gold hit a new all time high! It closed at $1,084.90! What the headline should be is “Gold Flashing Warning Signal At New All-Time High.” What caused the $30 run up in a single day? India bought 200 metric tons of the yellow metal from the International Monetary Fund. India buying gold is dollar negative and is just a small part of a world in the process of moving away from the U.S. Dollar.

According to Bloomberg…“This will encourage other countries and other investors, especially Indians, who are big buyers anyway, to jump into the market,” said Leonard Kaplan, the president of Prospector Asset Management in Evanston, Illinois.

The Reserve Bank of India paid $6.7 billion for the bullion, which it bought from Oct. 19 to Oct. 30. It was “the biggest single central-bank purchase that we know about for at least 30 years in such a short period,” said Timothy Green, the author of “The Ages of Gold.” “The only comparable event was the U.S.’s steady purchases in the 1930s and 1940s.” (The complete Bloomberg story)

The “other countries and other investors” include China and Russia. China has already been a big buyer in the gold market. Earlier this year, it disclosed it secretly increased the country’s gold holdings by 75%. China is also the world’s biggest producer of gold and is keeping every ounce it produces. Russia backs a partial return to the gold standard to help resolve the financial crisis that started in 2007.

The entire world sees a weaker dollar in the future. The big question is how much weaker? The feeble dollar will spell inflation and some say hyper-inflation is a real possibility. Talk about the depreciating dollar seems to be everywhere. Here is an excerpt from a Forbes article that came out yesterday: “…Make no mistake about it: Central banks have not been liquidating their gold. This sale by the IMF (to India) is therefore an extraordinary event at a time when there is little gold supply to meet the burgeoning demand by investors wary of paper currency. Trillions of dollars have been injected into the financial system to save it from Armageddon; they must find a home somewhere.

Just listen to Buffett. Back in May, he warned, “No one can know the precise level of net debt to GDP at which the United States will lose its reputation for financial integrity.” In other words, printing money can degrade the integrity of the dollar, making gold look like an attractive alternative to Treasuries that yield 3.5%….” (click her for the complete Forbes article)

I made the case for a much weaker dollar or even a dollar collapse in my early September post, “Something Wicked This Way Comes.” As the dollar goes down in value, gold will go up in price. Gold expert Jim Sinclair (jsmineset.com) has been predicting gold at $1,650 on or before January 2011 for at least 3 years. He has said many times that his original prediction will be on the low side and that gold will go much higher in price. The lower dollar will have a devastating effect on America’s standard of living. The Republicans had a big day yesterday, but big inflation is on the way no matter who is in control.

Currency Crisis Coming

By Greg Hunter’s USAWatchdog.com

Everybody is wondering where all of the bailouts and spending are going to take us? Just a few of the big companies the government has bailed out to keep them from going bankrupt are: General Motors, Chrysler, AIG, Citigroup, Bank of America, Wells Fargo, (all the big banks got some kind of bailout) Fannie Mae and Freddie Mac. According to Pro Publica, 721 companies have received some sort of financial help from the taxpayer. If the economy does not improve, many of these companies will require more money to stay afloat.

There were several stimulus programs. The biggest is the 787 billion dollar spending bill passed by Congress earlier this year. Also, there was “Cash for Clunkers.” It was designed to give people with old gas guzzling vehicles up to $4,500 towards a new fuel efficient model. Remember the $8,000 credit for first time home buyers? It looks like the government is going to extend the program. Let’s not forget the trillions of dollars that the Federal Reserve has given away in secret to the big banks. Congress wants to audit the Fed to find out where the money went and why even foreign banks got a half trillion dollars! Meanwhile, Congress is talking about giving every newborn $500 to fund a retirement account. I kid you not! (Click here for the story.)

One respected news source recently claimed we have spent or committed 19 trillion dollars during the financial crisis. Another government source said the final tab for the financial crisis could come in at 23.7 trillion dollars. Who knows how much this will cost? One thing is for sure, the final tab will be big, as in many trillions of dollars. No country in all of history has ever bailed out itself with this much printed money. We are clearly in uncharted territory. We have spent more on the financial crisis than all of these financial expenditures below, combined!

• Marshall Plan: Cost: $12.7 billion, Inflation Adjusted Cost: $115.3 billion

• Louisiana Purchase: Cost: $15 million, Inflation Adjusted Cost: $217 billion

• Race to the Moon: Cost: $36.4 billion, Inflation Adjusted Cost: $237 billion

• S&L Crisis: Cost: $153 billion, Inflation Adjusted Cost: $256 billion

• Korean War: Cost: $54 billion, Inflation Adjusted Cost: $454 billion

• The New Deal: Cost: $32 billion (Est), Inflation Adjusted Cost: $500 billion (Est)

• Invasion of Iraq: Cost: $551b, Inflation Adjusted Cost: $597 billion

• Vietnam War: Cost: $111 billion, Inflation Adjusted Cost: $698 billion

• NASA: Cost: $416.7 billion, Inflation Adjusted Cost: $851.2 billion

TOTAL: $3.92 trillion (Click here for the complete story)

There’s an old saying, “When you find yourself in a hole, stop digging.” But in America, we keep shoveling and piling on the debt. A perfect example of an agency that keeps on digging is the Federal Housing Administration. The FHA is involved in its own version of the bailout game by continuing to make loans to people with very shaky credit. The down payment for its new loans is just 3.5 percent. A recent New York Times article showed the FHA sinking further into trouble in an effort to keep housing prices from falling. The Times said, in part, “The number of F.H.A. mortgage holders in default is 410,916, up 76 percent from a year ago, when 232,864 were in default, according to agency data. Despite the agency’s attempt to outrun its fate by insuring ever-larger amounts of new loans…the current rate is over a billion dollars a day. 7.77 percent of the portfolio is in default, up from 5.6 percent a year ago.

Barney Frank, the Massachusetts Democrat who is chairman of the House Financial Services Committee, said in an interview that the defaults were, in essence, worth it. “I don’t think it’s a bad thing that the bad loans occurred,” he said. “It was an effort to keep prices from falling too fast. That’s a policy.”

The FHA, which insures 675 billion in mortgages, will likely need a bailout of it’s own in as little as 24 months according to some experts. I say the FHA will need help much sooner because the housing market will get worse before it gets better. I talked about why real estate prices will continue to fall in an August post called, “Real Estate at a Bottom…NOT!”

And let’s not forget the two wars we are fighting in Afghanistan and Iraq. Did your taxes go up to pay for that? Of course they didn’t! The only people sacrificing for the war efforts are the men and women of the armed forces and their families! We are paying for all the bailouts and expenditures by simply printing the money!

The world is noticing what we are doing in our financial house. Foreign governments are getting nervous about the creation of all these dollars. There have been calls by many in the international community for a “Super Sovereign Currency.” This would not replace the dollar but compete with it.

Gold is also in competition with the Buck. That’s why the yellow metal hit all time highs last week. Gold is not replacing the dollar but it is competing with it. In a recent interview, gold expert Jim Sinclair said, “Gold is a competitor to currency.” Unlike dollars, it is “hard to expand gold” supplies quickly. Investors are turning to gold as an alternative to the dollar.

The same is true for oil. Despite some pretty healthy supplies, the price is trading around $70 a barrel. Everyone in the oil field knows there is a good quantity of oil, and that is why some have repeatedly predicted a steep decline. A roll back in the oil price has failed to materialize. The high price of oil, relative to supply, is reflecting the fact there is a huge supply of dollars. More dollars are printed out of thin air everyday.

So what does this mean to you? In the end, there is going to be a currency crisis. I am not talking about a problem for the grandkids but a crisis in the here and now. I quoted several experts on this issue in a post last month called, “Something Wicked This Way Comes.”

The bailouts and the spending are going to continue because that, in the short run, that will get politicians re-elected. In the long run, the massive money printing will ruin the buying power of every dollar you have. Expect some deflation as we have right now in the real estate market but also expect big inflation. Yes, deflation and inflation at the same time! A weaker dollar is coming and there will be no way to avoid the inflation it will bring with it.

Can The Financial System Really Be Fixed? Some Say No.

By Greg Hunter’s USAWatchdog.com

Every time I see a speech on the economy, such as President Obama’s on Monday, I rarely see someone cut to the heart of the problem. There is too much debt! That is the simple answer to what is wrong with the economy. The President really did not address that issue. He basically just scolded Wall Street for needing a bailout. We have spent or committed 13 trillion dollars and we are nowhere near out of the woods.

Here are a few examples of the debt problems American is facing that I have talked about in a previous post. Let’s review: We just paid people $4,500 a pop to trade in their “clunker” and buy a new car because it was the only way to pull the auto industry out of a tailspin. America is in the hole and going deeper by the day. The second week in September, the government sold 70 billion of our national debt. That is 70 billion dollars in Treasuries in a single week to finance our needs! 2009 will produce a record deficit of 1.58 to 1.84 trillion dollars of red ink. That’s nearly 4 times what the Bush administration ran up in 2008. The Treasury Secretary also thinks we will not be coming out of this economic mess anytime soon, and he admitted as much in early September at a Congressional Hearing on TARP spending. Foreclosures are up, and it’s forecast by the Treasury Department that “millions more are coming.” Speaking of real estate, those lucky enough to stay in their homes are going to continue to be hit with falling prices. Commercial real estate is in free fall. Banks are failing at a rate we haven’t seen since the Savings and Loan crisis. The government is printing money to buy its own bonds to artificially suppress interest rates. Finally, unemployment is at 21% and rising (using shadowstats.com computations). There is no way the worst is behind us, quite the opposite. That said, the President has to try to put lipstick on this pig of an economy.

When President Obama entered office, he installed Tim Geithner as Treasury Secretary. This was the guy who sat at the top of the New York Fed and watched silently as all the big banks took on enormous amounts of debt. In many cases, leverage at the banks was 40 to 1. In a word, insane. Geithner’s punishment for letting that happen on his watch? A promotion to Treasury Secretary! Ben Bernanke was just reappointed by the President for his job as Chief of the Federal Reserve. The Fed and Bernanke basically caused the debt meltdown problem with their interest policies and guidance. The Fed Chief has been hailed as the man who saved the system from financial collapse. That is like a drunk driver causing an accident with a bus full of children. After the crash, the drunk stumbles over and pulls the kids out of a burning bus and is then hailed as a hero!

How did these banks load up on way too much debt? It was done with a security called an Over the Counter derivative or OTC derivative. Over the Counter means from a seller to a buyer and not done on an exchange. Wall Street bundled up debt like car loans, credit cards, and mortgages into securities and made big commissions selling these bundles of debt around the planet. Currently, there is no public market for OTC derivatives, contrast that with the Chicago Board of Trade. That is a public market. Take for example what happens when a bushel of corn is sold on the CBOT. There are standards for how much a bushel weighs. You cannot pour dirt, ball bearings or water into the bushel to make weight. There are rules and regulations that guarantee a “clean” delivery with universal value. Remember OTC derivatives have no public market. That means there are no standards, no guarantees, no regulation and most importantly, no price discovery. A pricing mechanism is the hallmark of a bid/ask public market.

The price for an OTC derivative is whatever the seller says it is. There was little equity in most of these “securities” because, after all, there were no regulations. Why put money into a security when the seller could put money in his pocket instead? When the economy went sour, many people stopped paying their car loans, credit cards and mortgage payments. What do you suppose happened to the value of OTC derivatives when people stopped paying their bills? According to the Bank of International Settlements, or BIS, there are 592 trillion dollars of OTC derivatives. What do you suppose would happen if there was a public market now? We would find out what this stuff is really worth and it would not be pretty! According to famed investor Jim Sinclair at JSMineset.com , there is no way most of the 592 trillion dollar ball of debt can be priced. Sinclair thinks the BIS is underestimating the size of the OTC market. Sinclair contends it is really more than a quadrillion dollars. (A quadrillion is a thousand trillion!)

Sinclair recently wrote,”Unless financial contracts have standards there is no way to clear them.

Unless financial instruments have accurate means of daily valuation, there is no way to clear them.

OTC derivatives outstanding from 1991 to 2008 have no standards.

OTC derivatives outstanding from 1991 to 2008 have no sound means of true valuation in any time frame…”

Sinclair goes on to say,“ With this being the incontrovertible set of facts: The Bank for International Settlements is for the first time proposing the world’s central banks take over the financial risk of the entire mountain of more than one quadrillion one hundred and forty four trillion dollars (valuation before the change to “value to maturity” method valuation of nominal value of OTC derivatives) of OTC derivatives created from 1991 to 2008. The reason is simple. This unchanged in size mountain of weapons of mass financial destruction as still sitting there ready to explode in the second chapter of the greatest double dip depression of 2007 – 2009.”

So, now the BIS is proposing that central banks backstop the entire global OTC derivative market. It was recently reported by Bloomberg News,” Regulators are pushing for much of the $592 trillion market in over-the-counter derivatives trades to be moved to clearinghouses which act as the buyer to every seller and seller to every buyer, reducing the risk to the financial system from defaults.”

Still, the debt is not really going away under this plan or any other we have seen so far. The mistakes of greedy bankers are being transferred to the public by massive money printing on a scale never seen before in history. Who knows how this will turn out. My predictions: it will not end well for the U.S. dollar and most people will suffer from enormous inflation.

Something Wicked This Way Comes

By Greg Hunter’s USAWatchdog.com

I am not a gold bug, but I can spot a warning sign when I see one. Gold is near an all time high and this is no fluke! High prices are the result of big demand from monster players who are afraid of a dollar crash. My fears all center around Fed Chief Ben Bernanke’s announcement in mid-August of plans to end Quantitative Easing. QE is a program where the Fed used more than 300 billion in “printed money” to buy Treasuries to artificially hold interest rates down. The Fed wants this program phased out by the end of October. Oh really! Bernanke is going to stop buying debt and allow interest rates to spike! Not a chance. Interest rates could go up dramatically, and any homeowner with an adjustable rate mortgage would be hit with higher payments…much higher. I, and many other people, think The Fed will be forced to keep “printing money” and that creates an even bigger problem for the dollar. Martin Hutchinson at the Prudent Bear revealed his prediction in a recent article called “October Surprise,” …” Given the current predilections of the world’s central bankers, it is likely that when the T-bond bubble bursts, they will rush to the printing presses, the Fed buying Treasuries in a frantic attempt to stabilize the bond market. In all but the shortest term, that is unlikely to work; it will cause a spiraling increase in gold, oil and other commodities…” Hutchinson goes on to say,”If October 2009 fails to produce a full-scale T-bond rout, it will not be long delayed thereafter…”

He’s not the only one feeling something bad is coming. New York University Professor Nouriel Roubini, who predicted the financial crisis, said recently,“If markets were to believe, and I’m not saying it’s likely, that inflation is going to be the route that the U.S. is going to take to resolve this problem, then you could have a crash of the value of the dollar.”

Nassim Taleb, author of the runaway best seller “The Black Swan,” said in mid-August on CNBC ,”The risk is still there and we are probably worse off than we were before.” You definitely cannot call Taleb a market cheerleader and he is clearly not comfortable with this so-called “recovery.” You can check it out in the video below.

I think when Taleb says, “worse off” , he means the economy is worse now than when Secretary of the Treasury Hank Paulson told members of Congress last year that there was risk of “systemic failure.” Right after that Congress voted for TARP money to bail out the banks.

Even easy Al Greenspan is a little worried about the dollar. “Unless we roll in this whole degree of expansion, we will be in trouble,” the former Chairman of the Federal Reserve told a conference in Mumbai via videoconferencing. “I am not talking 3-5 per cent inflation, I am talking double-digit inflation in the US.”

Finally, there is John Williams at shadowstats.com. Just last week, he correctly predicted there would be a “negative surprise” with the unemployment number. He was right on target, it was worse than expected. Now he says,”With both the economic and systemic solvency crises, I believe the worst

still is ahead of us.”

How far ahead of us is my question? Famed gold investor Jim Sinclair thinks the dollar will take a big hit,”in the middle of the fourth quarter.” Sinclair also thinks the Fed will once again be forced to “print money” to buy Treasuries when the QE program ends. When that happens, the dollar will fall hard and all hell will break loose.

Just like the famous book “Something Wicked This Way Comes,” there will be horror. Who knows how it will all turn out, but there will be no happy ending and gold will sell at a much higher price.