Latest Posts

Belgium Terror Just the Beginning of Insecure World-Egon von Greyerz

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial expert Egon von Greyerz (EvG) says terror attacks, like the one that just happened in Brussels, can destabilize the entire world. EvG, who lives in Switzerland, explains, “This is obviously a very sad day for our friends in Belgium, but at the same time, we know this is just the beginning, not only in Europe, but with the whole world. We are going to see a much more insecure world. It is worldwide. We know that the refugee problem has included a number of potential terrorists. . . . The problems that will be in the west were created by the U.S. and Europe. The problems that were created in the Middle East and North Africa will lead to more of this. There is anarchy in Libya. There is anarchy in Iraq, and the West has created this. So, they are paying us back, and I don’t think this is finished. We will see a less secure world, and it is not just Europe. The U.S. will see similar problems.”

Global Economy Dying Pig-No More Rate Hikes-Rob Kirby

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

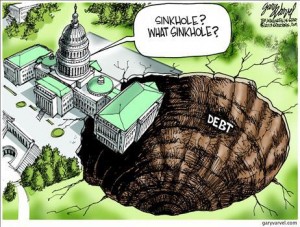

Macroeconomic researcher Rob Kirby predicted the Federal Reserve’s interest rate increase late last year “would be one and done.” Kirby explains, “They had no business raising rates in the first place because the economy was not exhibiting enough strength to warrant any rate raises whatsoever, and there won’t be any more interest rate raises because the economy continues to roll over. Doctored economic data cannot make the sick pig that the global economy really is look any better. It doesn’t matter how much lipstick you put on that dying pig. It’s still a dying pig.”

Weekly News Wrap-Up 3.18.16-Greg Hunter

By Greg Hunter’s USAWatchdog.com WNW 231 3.18.16

By Greg Hunter’s USAWatchdog.com WNW 231 3.18.16

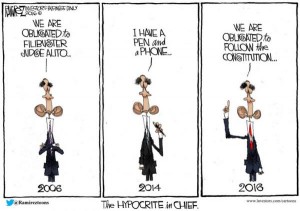

The mainstream media (MSM) is at it again, this time trying to trash Trump on a big primary day. It didn’t work because trump won just about every contest. The MSM also tried to bolster Hillary Clinton. USA Today was particularly blatantly unfair and biased. This is nothing more than telling people how to vote and the USA Today trying to thought shape and distort the election process for its political criminal cronies. When this happens, it is not journalism, and USA Today ceases being a bona fide news organization. You have to be fair and objective to call yourself a news organization, and the front page of the USA Today on the second so called “Super Tuesday” of the 2016 election cycle was anything but fair and objective. It is outrageous that anyone calling themselves a journalist would do this, and that means top management of USA Today, in my view, is either stupid or corrupt. I do not think they are stupid.

Record Swings of Deflation and Inflation Coming-Michael Pento

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Michael Pento says the Fed and other global central banks are “not going to stop manipulating the markets.” Pento explains, “There is no escape from the manipulation by central banks and manipulation of asset prices. There is no escape of manipulation of interest rates, of money supply growth, of stock values and of bond prices. They can never stop. . . . Just a hint that this massive manipulation of all markets and asset classes might end someday sends them crashing. So, there is no escape in Japan, China, Europe and the United States. That means we are headed for massive bouts of wild swings between inflation and deflation, the likes of which we have never before seen in the history of economics.”

Fed’s ‘Cocaine and Heroin Injection’ a Criminal Act-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Trends forecaster Gerald Celente says former Fed President Richard Fisher dropped an ominous truth bomb last week on CNBC. Celente says, “Last week, when it was a celebration of . . . 2009 and the markets started going up, Fisher says, quote, ‘We injected cocaine and heroin into the system to enable a wealth effect . . . and now we are maintaining it with Ritalin.’ Fisher also said, a few weeks ago, that ‘the Fed is a giant weapon that has no ammunition left.’ Let’s take his quote, and this is very important, ‘We injected cocaine and heroin into the system.’ You go back to our 2010 alert, and we said this was no recovery. It was a cover-up. What Fisher just said was a criminal act. Injecting cocaine and heroin into the system was a criminal act by the banking gang.”

Iran & North Korea Missile Tests, Trump Trashed by MSM, Fed Economic Fraud

By Greg Hunter’s USAWatchdog.com (WNW 230 3.11.16)

By Greg Hunter’s USAWatchdog.com (WNW 230 3.11.16)

Iran is back in the news for testing ballistic missiles with the words “Israel should be wiped off the Earth.” It is widely reported that Iran has test fired two ballistic missiles. Iran says it was a show of “deterrent power,” and that it is “defensive.” Iran says this does not violate the recent nuclear deal. Might I continue to point out that nobody signed any “deal.” Others say it totally violates a U.N. resolution that says Iran should not be carrying out ballistic missile tests, but there is no real ban on missile launches. Nice “deal” John Kerry!

Market Meltdown Already Underway-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader/analyst Gregory Mannarino says forget about the recent market rally, the markets “have nowhere to go but down.” Mannarino explains, “According to the charts, something big has already begun. This is not a ‘maybe this will happen,’ this has already started. The market averages have gained over the past few weeks, but we had an abysmal start to the year. The only reason we have seen this stock market rally is on speculation of crude oil. They will not allow crude oil to drop anymore because it is a currency. There are too many things linked to it. . . . Nothing has changed fundamentally. What does this mean? This has been a fool’s rally.”

Pyramid of Lies Could Implode-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial expert Catherine Austin Fitts has correctly predicted no financial collapse year after year. Now, she is not so sure one can be avoided. Fitts explains, “In theory, it is easily possible to manage through the election. It doesn’t have to blow up, but if you look at what is going on in the campaign and in Washington, the leadership is blowing up. If the leadership doesn’t manage it properly, anything is possible. I think what the global economy and the U.S. economy needs is the rule of law. So, if we have to have this conversation to bring an end to this secrecy and privilege and get back to the rule of law so we can support productivity, then I say let’s have a mess. I’d rather deal with our civilization and our governance system now than later. The sooner we get back to productivity the better.”

We the Cronies vs. We the People, Hillary Aid Granted Immunity, How MSM Lies to Help Establishment

Greg Hunter’s USAWatchdog.com (WNW 229 3.4.16)

Greg Hunter’s USAWatchdog.com (WNW 229 3.4.16)

The attacks on Donald Trump come down to one simple fight. It’s “We the People” against “We the Criminal Crony Class.” Forget calling them the “establishment” because they are, in fact, a bunch of law breaking weasels in BOTH parties. Democratic Presidential contender Bernie Sanders would be getting much the same treatment as Donald Trump if he would have done as well as Trump on Super Tuesday. Examples of the crony class include the law breaking bankers convicted of fraud with LIBOR, FOREX and mortgage fraud to the tune of trillions of dollars, and yet nobody EVER goes to jail. I love how the so-called conservatives sit and say nothing while their crony donors break law after law and only pay fines. (more…)

World Economy Has Never Been Worse-Andy Hoffman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer Andy Hoffman says we are getting to the end of the road for the fantasy economy. Hoffman explains, “I shy away from predictions as much as possible and . . . when things will happen. When will the gold cartel break? When will the big one will happen? It’s an unknowable thing in a manipulated world, but if you listen to me lately, I have never been more passionate that I don’t think things can make it through this year, and people like David Stockman (former White House Budget Director) think the same. There are just too many things coming to a head right now. The economy of the world has never been worse quantitatively and qualitatively. The political and social ramifications going on because of the bad economy have never been more tenuous.”

Default on Global Monetary System Coming-Bix Weir

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial analyst Bix Weir says the mother of all money meltdowns is a sure thing. Weir contends there is one big question everybody should be asking. Weir says, “What’s the dollar going to be worth? What’s fiat money going to be worth after the banks crash?”

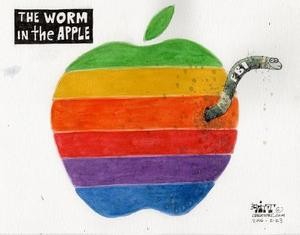

Syria Cease-Fire & Safe Zone-Not, South China Sea Heats Up, Apple & DOJ Spar Over Unlocking I-Phone

By Greg Hunter’s USAWatchdog.com (WNW 228 2.26.16)

By Greg Hunter’s USAWatchdog.com (WNW 228 2.26.16)

A cease-fire is supposed to begin on Syria Saturday. Many geopolitical experts are skeptical that it will ever take place. It was negotiated by the U.S and Russia. With Secretary of State John Kerry doing the negotiation for America, I don’t have any faith in it being a success. John Kerry says if the cease-fire does not hold, he may push to partition Syria. I say the odds of that happening are slim to none. Even though it is reported that Kerry is thinking about making some sort of “safe zone” in Syria, it will require as many as 30,000 U.S. troops.

Perfect Storm of Financial Collapse and WWIII-Michael Snyder

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Journalist and book author Michael Snyder says the collapse is not an event, but a “process.” Snyder explains, “I believe it is already in the process of coming apart. . . . One fifth of global stock market value is already gone. That means we only have four fifths left. At one point this month, $16.5 trillion had been wiped out from global stock markets since mid-2015. So, this started last year. We saw oil collapse. We’ve seen junk bonds collapse. We’ve seen commodity prices collapse. The $16.5 trillion I just mentioned is just for stocks, and when you add up the other losses, that’s trillions of dollars more wealth that has been wiped out all over the world. What we have seen already has been extraordinary, but we are still in the process. People want to think of it as an event or a single day or a month, but this is a process.”

Cash Ban is All about Control-Bill Holter

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer Bill Holter says there is a good reason some are pushing the idea of doing away with cash. Holter contends, “It’s not about the drug trade. It’s not about tax evasion. It’s really about capital controls. It’s about corralling the public’s funds into the banks. Then you go one step further, and they already put bail-in legislation into effect pretty much throughout the West. So, what they are doing is ring fencing your capital. If they really do away with all cash and all your funds have to be in the banking system, then basically you are completely controlled. . . . Individuals can be shut off because the state doesn’t like them.”

Could WWIII in Middle East Start Soon, Even MSM Knows Economy Tanking, Trump vs Pope

By Greg Hunter’s USAWatchdog.com (WNW 227 2.19.16)

By Greg Hunter’s USAWatchdog.com (WNW 227 2.19.16)

The top story is the Middle East and the possibility of WWIII. I am not exaggerating here as both Saudi Arabia and Turkey have strongly suggested that their countries would invade Syria. Saudi Arabia and other Middle East countries have reportedly amassed 350,000 troops on the Syrian border. Russian President Vladimir Putin says any troops entering Syria without the permission of Syria would be considered an “Act of War.” This would be huge and, no doubt, would go nuclear. Maybe this is the reason why Russia dispatched a brand new cruise missile ship to the Eastern Mediterranean last week.