Latest Posts

They Just Take Turns Ripping Us Off

Many people think that there is a big difference between Democrats and Republicans, but I think there’s not much difference at all. I have long said, the left and the right are really one body with two heads–they just take turns ripping us off. Both parties are not all bad. There are a few good eggs on both sides of the isle but only a few. Gerald Celente, founder of Trends Research, thinks much the same way as I do. Celente is famous for making many spot on predictions about the future based on trends of today. He is predicting that Congressman Ron Paul could win the Presidency in 2012. (more…)

Many people think that there is a big difference between Democrats and Republicans, but I think there’s not much difference at all. I have long said, the left and the right are really one body with two heads–they just take turns ripping us off. Both parties are not all bad. There are a few good eggs on both sides of the isle but only a few. Gerald Celente, founder of Trends Research, thinks much the same way as I do. Celente is famous for making many spot on predictions about the future based on trends of today. He is predicting that Congressman Ron Paul could win the Presidency in 2012. (more…)

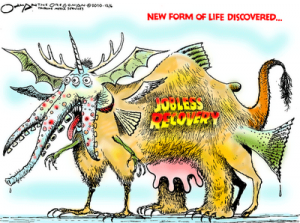

There is No Recovery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It seems every week in the mainstream media there are multiple references to the so-called economic recovery 2011. There has been some good news about profits at Ford, Chrysler and General Motors in recent weeks, and GM plans on spending $2 billion to update plants and hire more than 4,000 workers. I am happy the Big 3 car companies are doing well even though two of them went through bankruptcy. (more…)

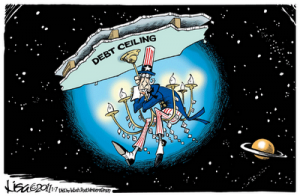

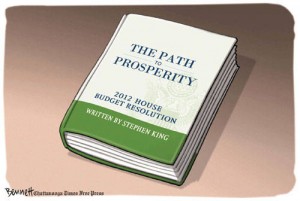

$2 Trillion Mile Marker on Road to Perdition

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This week, Treasury Secretary Tim Geithner proposed raising the debt ceiling by $2 trillion. I thought, this should be big news! After all, a trillion is a thousand billion. This adds up to 2 thousand billion over the next 2 years!! The mainstream media greeted this story with a great big yawn. (more…)

Bin Laden is Dead—Now What?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Osama Bin Laden Dead! Now what? The death of Osama Bin Laden is probably the biggest story of the year, and maybe the biggest since 9/11. There are so many angles being covered such as the burial at sea, play-by-play details of the assassination operation from the White House Situation Room and the surprise announcement by Barack Obama last Sunday night of Osama Bin Laden’s death. (more…)

Never Ending Money Printing

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Federal Reserve held its first press conference in its 97 year history last week. In my mind, it did this because it recognizes the deep financial trouble the U.S. is in. It wants to put a positive spin on the mess it largely created and/or allowed to happen. After all, it was Tim Geithner who was the head of the New York Fed during the go-go years of the mid 2000’s. He was supposed to regulate the big Wall Street banks. You see how well that worked out—the entire system melted down and Geithner got a promotion to Treasury Secretary. (more…)

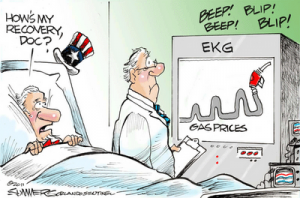

The Roller Coaster Ride of Oil Continues

Gas prices 2011! Oil prices are on the rise. The price per barrel rose again yesterday, and so did gas prices. According to AAA, the national average price of unleaded gasoline added a penny, climbing to $3.879 per gallon. It is already more than $4.00 a gallon on the east and west coast, and don’t expect the price to go down before it goes way up. (more…)

Gas prices 2011! Oil prices are on the rise. The price per barrel rose again yesterday, and so did gas prices. According to AAA, the national average price of unleaded gasoline added a penny, climbing to $3.879 per gallon. It is already more than $4.00 a gallon on the east and west coast, and don’t expect the price to go down before it goes way up. (more…)

Everything’s OK with Economy, Go Back to Sleep

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It appears economist Paul Krugman thinks the budget and the economy are not in that bad of shape because he thinks the dire warnings are overdone. In his latest Op-Ed piece this week, he said, “When I listen to current discussions of the federal budget, the message I hear sounds like this: We’re in crisis! We must take drastic action immediately! And we must keep taxes low, if not actually cut them further! (more…)

Happy Easter

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I am taking Monday off as part of my Easter Holiday. I am putting up some pointed but humorous Easter cartoons for your review. I want to thank all of my loyal readers for your patronage. The site would be nothing without your support and comments! I’ll be posting a new article in a few days. Enjoy the cartoons. — Greg Hunter– (more…)

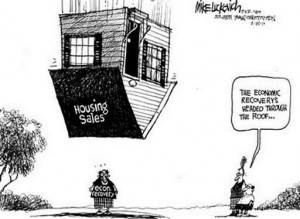

Mainstream Media Puts Good Spin on Bad Real Estate Market

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

More and more, I am finding stories produced by the mainstream media where the headline doesn’t jibe with the actual story that follows. A USA Today (newspaper) story from the “Money” section yesterday is a great example of what I am talking about. The headline read “Rising home sales point to a recovery.” (more…)

Warning Signs of a Coming Currency Crisis

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gold hit an all-time high this week—again. The yellow metal briefly topped $1,500 an ounce before falling back down a few dollars. The world has become increasingly nervous about the size of the growing U.S. debt. Just this week, America’s debt topped $14.3 trillion (also an all-time high) which is close to the limit Congress can legally borrow. (more…)

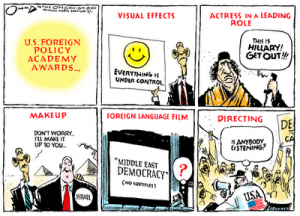

Is There More to Libya than Removal of Gadhafi?

Just last week, the U.S., Britain and France renewed their pledge to keep military pressure on Moammar Gadhafi with the war in Libya. What started out as a humanitarian mission has clearly turned into “regime change.” An Associated Press story reported last week, “In a joint declaration, President Barack Obama, British Prime Minister David Cameron and French President Nicolas Sarkozy say they will not stop the campaign and will ‘remain united.’ (more…)

Just last week, the U.S., Britain and France renewed their pledge to keep military pressure on Moammar Gadhafi with the war in Libya. What started out as a humanitarian mission has clearly turned into “regime change.” An Associated Press story reported last week, “In a joint declaration, President Barack Obama, British Prime Minister David Cameron and French President Nicolas Sarkozy say they will not stop the campaign and will ‘remain united.’ (more…)

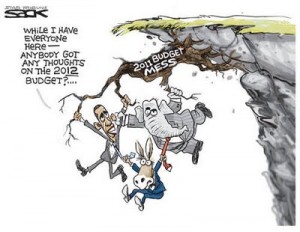

Get Ready for Federal Budget Gridlock

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This week, President Obama gave a speech outlining his plan for long term deficit reduction. He invited the Republican leadership for what many thought would be some sort of bi-partisan federal budget 2011 solution. In reality, it was kind of a St. Valentine’s Day massacre because right off the bat, Mr. Obama pulled out the Presidential tommy-gun and started shooting. (more…)

Mainstream Media Buries the Lead, Again

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The headline in yesterday’s USA Today read “The World to the Rescue.” It was followed by the sub-headline, “Japan crisis showcases social media’s muscle.” When I saw this, I immediately thought that the nuclear crisis was under control and folks were using the Internet to help the island country recover.

The story said, (more…)

When Honest Americans are Cast as Criminals

There are those who feel some of the leadership of America has sold us down a river of ruin. After all the bailouts, corruption and malfeasants that has brought a financial catastrophe to America, not a single financial elite has been indicted, let alone gone to jail. Crimes have surely been committed, but it appears the U.S. Justice Department has turned its back on prosecuting anyone. (more…)

There are those who feel some of the leadership of America has sold us down a river of ruin. After all the bailouts, corruption and malfeasants that has brought a financial catastrophe to America, not a single financial elite has been indicted, let alone gone to jail. Crimes have surely been committed, but it appears the U.S. Justice Department has turned its back on prosecuting anyone. (more…)

Government Shutdown Far More Dangerous Today

By Greg Hunter’s USAWatchdog.com

It is looking more and more like the budget showdown between the Democrats and Republicans will turn into a government shutdown 2011 by this weekend. The Obama administration has already started to inform federal workers who will be required to still come to work and those who will be told to stay home.

(more…)