Mainstream Media Puts Good Spin on Bad Real Estate Market

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

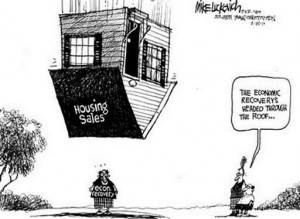

More and more, I am finding stories produced by the mainstream media where the headline doesn’t jibe with the actual story that follows. A USA Today (newspaper) story from the “Money” section yesterday is a great example of what I am talking about. The headline read “Rising home sales point to a recovery.” On the very next line, just under the headline, the sub-headline read “Prices expected to keep falling 5% to 7% this year.” So we have a recovery but prices are falling? What kind of a recovery is that? The story goes on to say, “Sales of existing homes rose slightly in March but prices fell as the U.S. housing market continues to struggle.” (Click here to read the complete USA Today story.) What are the writer and editor at USA Today thinking or even trying to say? This sounds like a story about a struggling real estate market and, in fact, all the evidence says the market is struggling. It is certainly not recovering.

For evidence of a struggling real estate market, I look no further than the USA Today story. It said, “Yet median prices in March dropped 5.9% from March 2010 to $159,600. Distressed homes accounted for 40% of sales, up from 35% a year ago, the NAR says. Distressed homes, such as those in foreclosure, typically sell at a 20% discount and pull down market prices.” Let me get this straight, “median prices in March dropped 5.9% from March 2010,” and the USA Today story is projecting prices will fall another “5% to 7% this year.” How is this a recovery in real estate? On top of that, the “Rising home sales” are comprised of “40% distressed homes.” That’s up “35%” from last year. That means 4 out of every 10 home sales are a foreclosure, and that seems to account for much of the increase in sales. This is a recovery?

Mind you, I have done no research for this story. I got all the material so far from the USA Today story. Here’s the kicker. The story ends by saying, “High unemployment and underwater mortgages are also hurting demand. Almost 25% of homeowners with a mortgage owe more than their homes are worth. ‘This means many households that want to move can’t,’ Dales says. (Paul Dales is a U.S. economist at Capital Economics.) Home sales may rise this year, but ‘a meaningful recovery is a few years away,’ he says.”

“A meaningful recovery is a few years away.” Then, why is USA Today doing a story touting a “recovery” in real estate? This is obviously good spinning on a terrible real estate market. According to a Realty Trac report earlier this year, a “Record 2.9 Million U.S. Properties Receive Foreclosure Filings in 2010 Despite 30-Month Low in December.” (Click here for the complete Realty Trac report.) Banks took back a record 1 million homes, and the company is expecting another record foreclosure year in 2011. Last month, the Thefiscaltimes.com reported, “Foreclosures are a necessary part of the healing process,” says Mark Zandi, chief economist at Moody’s Analytics. “And over the next two years, we’re going to experience a considerable spike in them.” Though some estimates are much higher, Zandi thinks 2 to 3 million more foreclosures will come through the system in the next two years. “The most severe ones are going to hit this year and in 2012,” he says.” (Click here for the complete Thefinancialtimes.com report.) With two to three million more foreclosures in the works for the next two years, I don’t see how USA Today can report there is a “recovery” in housing.

Housing starts are also in the tank with the rest of the so-called “recovery.” In his latest report, economist John Williams of Shadowstats.com said, “Like a ball bouncing down a hill, the regularly volatile housing starts series remained in downtrend despite a statistically meaningless one-month bounce.”

In his latest report, economist John Williams of Shadowstats.com said, “Like a ball bouncing down a hill, the regularly volatile housing starts series remained in downtrend despite a statistically meaningless one-month bounce.”

Look at this monthly housing start graph from Shadowstats.com. Does this look like a recovery?

I think the reporting in this story from USA Today is sloppy and inaccurate, at best, and outright spin doctoring a rotten housing market at worst. What do you think of the USA Today article?

Great write up Greg!! But I do have a question. I’ve been reading through your site and find your articles to be A++. All I can say is you are the man. Here is my question. How do you explain the increases in commercial real estate sales and developments that are happening in NYC when compared to the past few years? And I noticed in one of your posts, you mentioned an economic collapse with a time-frame that has already passed. When do you now think it will occur?

Steven,

From what I can tell scanning the Internet the commercial real estate (CRE) market is really in no great upswing. It appears to be bottom bouncing. Sure there is some good news but there is waaaay too much CRE out there. There is 21 square feet of retail space for every man woman and child in the country. with more and more on line sales we will need less and less CRE. Also the real unemployment number is 22% (according to shadowstats.com) How is there going to be a boom in CRE with that kind of unemployment. I don’t know when the collapse will happen but it will happen will happen and it is the dollar that will be crushed. We are seeing that now with increasing food and energy prices. The U.S. just went past the $14.3 trillion debt ceiling. Congress will raise it again by more than $1 trillion and that will further weigh down the buck. I said in my last post ” I’m betting the crisis starts by the end of this year – 2011.” How long after after the currency crisis to a financial collapse is anyone’s guess. If there is another 9/11 attack on the U.S or another Katrina all bets are off. Thank you for reading the site and for giving me your support.

Greg

Greg:

You and I both know why these rosy stories (headlines) are being painted, and not just in USA Today, but virtually everywhere in the MSM. When 90% of the people employed by the MSM are dyed in the wool Democrats and liberals, (that statistic/poll goes back the the Clinton Admin.) they are just simply helping their boy in the White House. This situation will get worse as 2012 nears and as conditions in this country deteriorate further, which they inevitably will.

Editors know full well that the majority of news readers just look at the headlines and “scan” the paper, especially at USA Today. You catch the paper on the fly, and take a quick look thru the sections.

The good news is that this tactic is becoming a loser. More and more people are turning away from MSM outlets and getting their information from the Internet, unfiltered by the liberal media. For those people that really want to know what is happening, the Internet provides the truth, via the blogosphere, social networking sites, and independent news outlets.

At some point you can no longer hide the devastation, ruin and economic decline that we are experiencing. We have reached that point.

Please keep posting your observations as you have done with the above article, eventually it will sink in and more a more sheeple will wake up from their government induced slumber.

PatriotRider,

You are correct sir. These stories are everywhere. I used the USA Today story as an example because it was so waaaaaaay off base. You are also correct about the editors, because nobody gets a story on any national mainstream media outlet without an editor approving it. Thank you for your comment and support.

Greg

Greg, more of the same from the MSM. I also have noticed many articles which feature a lead headline about recovery of one sector of the economy or another and then in the same article it contradicts itself.

Reporting like that must be intended to prejudice the casual “headline” reader into the articles’ false “grabline” and still have some credibity of real truth to it. Newspapers long ago learned that a great percentage of readers never read furher than the headline or maybe a paragraph under that if any. So, I believe this type of reporting is intentional, having their case and eating it too so to speak. They can try and help the elite with false reporting and continue to report some real facts claiming some credibilty in their craft. Frankly, its ming boggling; CNBC does it many times a day every day! I quick watching it because of that.

As to the Western Front and housing it is in the soup and not coming back. There are tens of thousands of people who are still in the homes and haven’t paid a payment in 2 to 3 years and the banks won’t finish the foreclosure and evict them – this keeps the price up as best they can. Then, when they feel they can withstand another home in the neighborhood on the market they finish the foreclosure and place it up for sale. This is a conspiracy of the banks and the illegal practice of price fixing. By the way, there is no way the average citizen can determine if his home is next or not, they live in limbo but they do live free which is helping kick the can of this pending third world toilet a little further down the road before it is flushed.

Art Barnes,

You and many other people are reporting the same thing. The headline contradicts the story all the time. This USA Today was especially bad. Thank you for your comment and all your support.

Greg

At this point I don’t know why anyone is listing to the mainstream news media anymore.

The Bill Moyers & William Black Investigative News Articles on PBS.com that came out in early 2009 called them cheerleaders & coverup artists for the major corporations & wallstreet along with the politicians & lawyers that service them.

John

Thank you John for the info and comment.

Greg

I don’t know why anyone would pay attention to Bill Moyers specifically or PBS in general.

Greg:

Thank you for reporting this. I’ve noticed that similar stories using the exact same statistics on housing often have bipolar headlines depending on who publishes the story. I cannot explain how different people can reach such opposite conclusions unless there is a deliberate attempt to mislead readers.

Eric

Eric,

I and many other readers on this site agree with your line of thinking! Thank you.

Greg

This guy did not do any research (as he stated) and is absolutely correct, the article make no sense. I am somebody that makes his living studying national real estate markets and in every market, micro-macro, listings are considerably lower than any of the sales. Active listings, mostly foreclosures, define the market and that means that as they compete for the few qualified buyers available, ALL the sellers are forced to keep discounting the properties. There is literally NO sign of a recovery. In fact, as down payment requirements increase and the availability of inventory increases, the discounts are becoming more steep (daily). Interest rates HAVE to continue to increase, and finally, the housing market is again MANY years away from any “recovery”. Most people do not realize that a robust real estate market is one of the few things that fuels the American Economy. Many jobs are tied to a strong real estate market, or at least a healthy market, and most of these people that benefit from real estate related jobs, do not have the job skills necessary to gravitate to other non-related real estate jobs. Not to mention, most of these “available” jobs are being exported to third world country’s.

Mobick,

Thank you for adding to this post with your professional analysis and first hand knowledge.

Greg

Good Spin on Bad Markets a True Understatement

An excellent viewpoint exposing underachievement calamity. Read this typical nonsense put out by 7 8 figure salary automatons…..

“Well Wall Street basically says it’s going to stay the course because you can’t argue with success. The market’s up 25 percent..”

The very high level analyst then recites the following inane blather “Of course there are big concerns by Bernanke over real estate and jobs. We could slide back. But he truly believes no surprises. He’ll telegraph any punches early. If he makes any changes, he’s going to make clucking noises first, and he’ll attach a time frame.” Posted by marketplacepublicradio.org

http://www.favstocks.com/u-s-1-axiom-%E2%80%9Cthere-is-no-argument-for-success%E2%80%9D-veil-pierced/1545880/

Thank you ak47.

Greg

Hi Greg,

I agree the mainstream media isn’t doing a good job of reporting on housing. One thing I’ve thought about more than once is what defines a “recovery”? I bet you we all have our own definitions. For me at least the housing marked has recovered when I can sell my condo for what I paid for it in 2008. Give the price has dropped about 35% I’m probably gonna wait a long time.

I don’t see how we can even begin to have a recovery until the bulk of all option ARMs have reset, the bulk of foreclosures are worked thru, and we see stable increases in employement year after year.

Shawn

Thank you Shawn.

Greg

greg,

i am confused. seems to me that we got into this real estate mess due to overinflation of real estate prices in the first place?

is this not just a much needed correction?

sure those who make money selling and investing in real estate are going to be hurting. i have little sympathy for them.

those who will benefit are those who need an affordable roof over their heads.

personally, it is my belief that real property needs a lot more deflation in order to mesh with personal income to bring us back to say the 60’s when house payment were about 20% of income rather than the 60-85% that they are today.

realty has become an excellent microcosmic model of how the investor class has sucked tremendous value out of the mainstream income without producing and damn thing.

it’s all about devaluing the worth of our wages, which is all about devaluing us.

G. Johnson,

You are right this is a much needed correction. It would be much deeper if the Fed was not artificially holding interest rates down to around 5%. Rates should be much higher right now and would be around 9% if the fed was not printing money to hold rates down. Real estate has a long hard road and prices have not stopped falling and won’t for at least more 2 years. Thank you for your comment.

Greg

“realty has become an excellent microcosmic model of how the investor class has sucked tremendous value out of the mainstream income without producing and damn thing.” The best line and quote I have read in a long while! In my mind real estate needs to drop another 50 percent to make up for the underemployment, inflation, and devaluation of the dollar the “late grate middle class” has been be sucked out of for the last 40 years. Your “invester class” are the ones who will throw the women and child off the life boat for a seat when this boat is sinking, they don’t know how to work and make honest money; I, for one, won’t shed a tear for them and should I see them on shore after the storm you can bet people like me will make sure they are exposed so that they can’t do it all again in the new economy which will take this corrupted ones place.

I don’t think this has anything to do with accurate reporting. The majority of people skim papers to later tout headlines as if they are in the know. The headlines read false because they were intended to mislead that majority. All of which believe in our jobless, moneyless and criminal recovery.

Right on target D. Coady!!

Greg

Yow, Yow. Black is white, bad is good, hunger is plenty, poverty is wealth, debt is riches, war is peace, slavery is freedom, your government loves you and has your best interest at heart, Obama is a legitimate president, Diane Sawyer does good investigative journalism, soldiers fight and die in foreign countries for the sake of freedom and democracy, the news media is not controlled by the illuminati, the economy is doing great, the bailout kept it from self-destructing, God loves homosexuals, fornicators,liars and adulterers, everybody is going to heaven, there is no such thing as hell, everyone deserves better than what they have, there are no bad people, just bad establishments, “no that’s not blood on the pavement, just red paint from the road crews so move along folks,” and everything will be alright, just do what you are told and you have nothing to fear from your government.

There now, did I miss any of the current lies of our day in that list?

Jay,

You did not miss a thing. Thank you for your comment. It is one of the best I have read for awhile.

Greg

Oh yes, I forgot to add to that list of lies. Your government is not in the illegal drug and terrorism business.

Greg, do you remember the old video game pong? This is how the MSM & our politicians seems to deal with the many problems this nation faces, they talk about one, then go to the next one,but never come to a real solution to any & the cycle continues where the ball keeps bouncing to one side to the other. How will we ever restore our nation to the Republic our Founders gave us? I want to list a set of web sites for folks to look,listen & learn from the basics of the foundation blocks that was built years ago to support what this foundation was set up for in the near future. Your article deals with housing so lets begin there.’The Fed is not here to solve your problem….The Fed is the problem’ by Bob Chapman has released the article at http://www.silverbearcafe.com/private/4.11/problem.html. Bob does not hold back any thing & if you compare what the MSM spins to the real truth that Bob provides,we see the gaps in the foundation’s building. Next lets stay on http://www.silverbearcafe.com‘s web site, the videos of the week goes into “How the Law was Lost” it’s a hour long but full of truth that most of the sheep never would believe it could/would happen here. The following videos ‘How to Take Our Country Back” are in parts by Kirk MacKenzie.Please save this web site,http://www.silentnomorepublications.com/Money/Home.html. Mr MacKenze has put up a very bold plan. After you get time to take in the facts he puts in detail, I want to see the response from the people. Where our politician’s have let us down we must look for those people that will step up & come forward as our Founders did to break the chains from the abusive government & banking cartels. What if Mr MacKenzie’s plan gets support? Will you be one of those willing to support the people who wants to really do what needs to be done like ‘Jefferson’ did. Wasting time on temporary fixes will never work like what has been happening in DC and all the way down to local towns,cities & States. We know Obama can speak & other than that he’s only thinking of being re-elected. Each political party does not seem to have anyone to beat Obama with the way republicans have split up over silly crap, that only helps Obama. We need a Andrew Jackson type to get behind & support.

PMs have been doing well, as Jim said we are far from a top!

Greg, please have a safe Easter week end with friends & family. Don’t forget about Japan, Texas & all those that have been hit buy the storms across the USA & all of our Military all over the world, they all need us to Pray for them!

Thank you M Smith for the links and comment.

Greg Happy Easter to you and yours as well!!!

Greg

I don’t see too many ways out of this, but here is another good quote:

“It is both a Silver Bullet into the corrupt banking institutions and a Silver Shield to protect your wealth from a mathematically inevitable dollar collapse.”

http://dont-tread-on.me/throwing-gasoline-on-to-the-silver-fire/

I told everyone in 1999 to get out of the stock market & get into metals, any metal at that time, before the Y2K scam ran out of steam for the technology bubble.

But since the 07/08 collapse, I have only recommended silver – the poor man’s gold.

John

Thank you John, Athlon and Joe!!

Greg

Thank you John.

Greg

Greg: Perhaps you misunderstand your faithful readers. We don’t read and/or believe the garbage media like USA Today etc. We wait for you to write and then come here to read it via a RSS feed or directly. And we read the links you have on your pages. That way, we get something closer to the unvarnished truth.

As always, keep up the great and important work. Good karma, my friend. Good karma.

Jason,

You are very kind. Thank you for your comment and support.

Greg

Amen Greg,

Here in southwest Florida we are being fed the same innane headlines, but the supporting data in the meat of the articles just doesn’t jibe with the ‘sunshiney’ bold face (lie) type at the articles head.

There is a glut (tens of thoudsands of sq ft) of empty commercial property here; many retail centers never occupied; still in ‘bare metal stud’ condition.

Median closed sales prices continue to decrease month over month and year to month; the numbers don’t lie.

There is no recovery of any meaningful degree in real estate in the good ole’ US of A. Some international investors, some deep pocketed locals, and the usual culprits perhaps; but without real jobs (not, McJobs) that pay real wages (not just qualify one for the tax break crumbs that our legislators throw us) there will be no real estate recovery.

Get used to bouncing along the bottom of economic existence…

Linen Ghost,

Thank you for the reporting from Florida. I used to live there, and sold my house in 2006. I miss the place!!!! I like this closing line of yours: “Get used to bouncing along the bottom of economic existence…” Thank you.

Greg

Greg-

Another great post. I think everyday Americans, are waking up to the lies and distortions of our MSM, and governments. That is why we, as Americans, need journalist, like you. And why more and more are turning to the internet for news.

I have followed John Williams Shadowstats.com for several years. John has been very accurate in what he has been warning about.

So, we hang on. Happy Easter to you and family.

Thank you LostinMissouri. Happy Eastrer to you and your family as well!!

Greg

The housing market was destroyed by securitization. It will never fully recover to what it was before the wall street banks ripped it to shreds and pushed it around the world in pursuit of obscene and unjustified profits.

Thank you J mac.

Short but very on target comment.

Greg

Of a truth many houses shall be desolate, even great and fair, without inhabitant. Is. 5:9

Greg,

The only puzzling part of your posting is your surprise at the

USA Today headline versus story discontinuity. I thought you

resolved some time ago that we are living in a Police State

and the main-stream media serve as the Propaganda Ministry.

Am I wrong about this?

You may wish to go back and re-read Dmitry Orlov’s book.

It was just published in a second edition with an expanded

section on Peak Oil/Energy. That will probably reference

“The Death of Suburbia” and all that implies for housing.

Looking at the Annual Rate of Monthly Housing Starts graph

https://usawatchdog.com/wp-content/uploads/2011/04/image006-300×210.gif

I cannot help but project a fractal continuation into the future.

Consider housing starts falling to half their present level in the

next year to 18 months. That will make the present plateau at

around 550K annual starts look like a landing between flights of

stairs downward. The graphs of this data in other countries may

already show that progression towards zero.

So, where are these houses being built? I would suggest the most

likely location is the Republica de Texas, one of a very few bright

spots amid the deepening gloom of Great Depression II, imo.

Thank you Denarius for the link and comment.

Greg

This story is a sad example of the type of “college educated” morons who lurk around the city desks of the few remaining daily newspapers in this country. Most of them can’t even string an intelligible sentence together, let alone come up with a thought that’s based in reason. What they ARE capable of doing is thumping their chests to see who can outdo the other in the most outlandish, politicaly correct muck that passes for an epistemolgy in their very odd world. It’s probably not “spin”, just the too common stupidity that these anti-Menckenites adore.

Thank you Dan, Robert and Reynolds.

Greg

Maybe USA Today’s bosses prefer the front page of their publication to have a positive appearance. Maybe bad news about the economy doesn’t sell newspapers, and yet it’s really something that needs to be reported, so it’s reported in the text.

You are right on the money! Talk about putting lipstick on a pig, this market is awful. The media has done their best to mislead the general public. I am a Realtor in central NC and it is survival of the fittest. Bank owned properties dominate the market and I don’t see any end in sight.

Greg,

My Wife is a Realtor and we’re seeing this first hand. It won’t be a recovery until the glut of homes now owned by the Banks, (which are causing the downward pressure on prices) are decreased from the market. For a Homeseller to compete in this kind of market is impossible. The Banks can frequently sell at below assessed values because they only need to recover the unpaid balances on their notes. It seems that these stories are only to paint a “rosey” picture and are, as you point out, completely false. Thanks and keep up the good work, its heartening to know someone is out there telling the truth.

BD

Thank you Bob for the front line reporting and first hand analysis of the real estate market!!

Greg

Spot on … The only thing you left out is why the media is doing this. Let’s face it. The media is a leftist, socialist machine. It is lopsided in it’s reporting when it comes to left vs. right issues. Right now, the economy is in the shape it is in because of socialistic ideals that go back to the Clinton era and continued on through the Bush years and now has come full force in this administration. The country is being driven into a 3rd world state by government and world banks. Smart people don’t listen to main stream media because they lie … plain and simple.

Thank you for adding your voice to the story Geo Patriot!!

Greg

Sadly, as I’m sure you know, your profession has been greatly impacted by the proliferation of the internet. Many writers nowadays are young, inexperienced, and it shows in their writing, grammar, and even spelling! To actually expect proper reasoning from some of these ‘writers’ is almost too much to ask.

In reference to housing, the bigger question I would like ANY politician to answer is…why do you want housing to be expensive??? Don’t we want the people to be able to comfortably afford a home and have extra money to spend to stimulate the economy. These politicians argue about the excesses of Fannie & Freddie, and the bad mortgages written by banks – they want all of that to go away and want a return to higher standards, but… they want the high prices on housing to remain. How many more people do they want to condemn to an eternity of onerous, excessive payments? Don’t they understand, the best thing for the future generations is for housing to return to a value that is commensurate with its true cost?

I need a house, but sorry. I will keep waiting until prices really return to their true value.

Antonio,

Thank you for your comment and point of view on this post!! You are going to be waiting to buy that house for awhile my friend, but it will be worth the wait!!

Greg

The MSM are hell bent on providing positive spin for most stories concerning finance and the economy. You are gracious in saying that the story is inacurate, but we all know that in the print media there are reporters, editors and edition chiefs who scrutinize each story and each page before the print button is pushed. That’s 3 sets of eyes or suposidly three functioning brains that are involved with each story. This is not coinsidence, but rather willful disregard for the truth. This is one of the reasons I no longer read print media.

Thank you Peter, PHC and Spirit of 76. All very good worthwhile comments for folks to digest!!!

Greg

Hi Greg,

First, thanks for all your good articles.

Next, on the USA Today fallacious headline, my observation is that we are living in an increasing Orwelian society, due to the fact that journalists are facing an increasingly impossible task: reporting facts that they cannot avoid reporting (the standard procedure is to ignore disturbing news) while making the negative (for “The Club”) news appear normal. And since a lot of people out there don’t go beyond the headlines (reading is a big effort…), it works!

What do I think of the USA Today article?

About what I think of everything in USA Today: pure State propaganda.

It is the USSA’s “Izvestia”. Dasvedanya, tovarich!

Greg, Easter Sunday at sunrise on the Wester Front: Have a Happy Easter. Let us take this day and be thankful we still can communicate with our people, the late great middle class, by this forum, for soon that might not be possible. Happy Easter, A. B.

Thank you Art.

Greg

Excellent article. People today are afraid of losing any downpayment they may have for a house now a days as the market continues to sink into oblivion. Plus young people need to be flexible and be able to quickly move to another state for a job if this becomes necessary. A home is now, too many, a millstone around their necks and I know a number of young professional who will just rent and save for their first house maybe when they are close to retirement. The mindset of the young sheeple is changing despite the happy talk ejected into the atmosphere by the main-media, the realtors, and the federal guvmint. There is no economic recovery. There was no economic recovery. If you believe the BS about the recession ending in 2009 then I have a bride I would like to sell to you. regards, tom

Tom Arch,

Thank you for the comment.

Greg

And another one for the collection!

http://www.marketwatch.com/story/us-new-home-sales-rise-111-in-march-2011-04-25

THINGS ARE GETTING BETTER, IVE HAD SEEN PLACES SELLING AT ONE SEVENTH THERE LAST SALE PRICES AND WAS TOLD BUYING WAS A NO BRAINER AND OF THE MANY I NISSED AS I DID NOT REALY WANT ANOTHER EATER UPON MY BACK, OR A TIME SINK, NOW I SEE THE PLACES SELLING AT ONE SEVENTH THE LAST SALE PRICE BUT THEY HAVE ONE LESS BEDROOM……..