Latest Posts

Look Out Above for Gold and Silver Prices

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gold hit another all-time high yesterday, closing well over $1,450 per ounce. Silver’s closing price of more than $39 per ounce is the highest it has been in 31 years. Why the big jump in gold and silver prices? The answer is pretty scary because there are many reasons precious metals are heading higher. Let’s start with the most obvious —inflation. (more…)

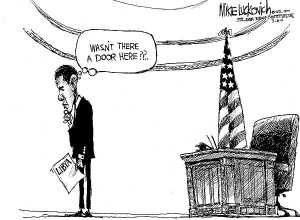

The Non-War Illusion

By Greg Hunter’s USAWatchdog.com

The President and his supporters are going to great lengths to make it appear the military operation in Libya is not a war. Deputy national security adviser Ben Rhodes called the NATO bombing in Libya “kinetic military action,” but not war. (more…)

Overwhelmed

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

As I look over the news and try to find the one story that I need to comment on, I am overwhelmed. I see the nuclear meltdown story in Japan and wonder how it will all turn out. It is nowhere near under control. We still do not know the full extent of the damage, but there are traces of radiation showing up in things like milk here in the U.S. (more…)

The Libyan Folly

Today is the day the United States turned over the Libyan no-fly-zone mission to NATO. This idea sounds absurd to me because the U.S is the backbone of the North Atlantic Treaty Organization.

Former U.N. Ambassador John Bolton said, this week, handing over command and control from the U.S. to NATO was “like handing over from the right hand to the left hand.” (more…)

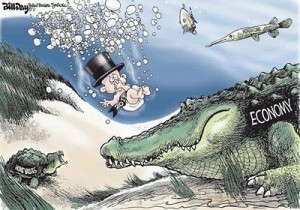

We are Way Over the Edge Right Now

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Last Friday, I wrote a piece called “Could America be Pushed over the Economic Edge?” It was about how Libya, Japan or even covert economic warfare (from America’s enemies) could push the U.S. into another financial meltdown. I received a one sentence email from my friend Jim Sinclair that said, “We are way over the edge right now.” His message gave me a sinking feeling. (more…)

Could America be Pushed over the Economic Edge?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It’s official. The U.S. transferred command of the Libyan no-fly-zone to NATO yesterday, but don’t think that ends U.S. involvement. Crienglish.com is reporting Secretary of State Hillary Clinton will be heading to London next week to discuss and coordinate military strategy. (more…)

Fed Stress Test a Farce

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Last Friday, the Federal Reserve announced it completed its so-called Fed stress test on 19 of the country’s largest banks. Improved financial health allows some banks to “increase or restart dividend payments, buy back shares, or repay government capital.” The news was met by some mainstream media outlets with jubilation, even though the Fed did not disclose which banks did well and which banks did not. (more…)

Libyan Sinkhole

By Greg Hunter’s USAWatchdog.com

The U.S. signed on for another war this past weekend with Libya. The action came after a much hyped U.N. Security Council resolution last week that allowed coalition nations “. . . to take all necessary measures to protect civilians under threat of attack in the country. . .” The main component of the resolution is to enforce “a no-fly zone” so Libya’s leader, Muammar Gaddafi, cannot use air strikes against his own people. This seems to be a noble action backed by the U.N. and the Arab League. (more…)

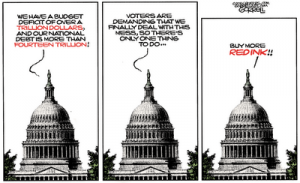

We Need Honest Money

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)

Currency Meltdown Coming

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

The situation in Japan is getting worse, not better. There are shortages in food, fuel and warm dry shelter. To make matters exponentially worse, nuclear power plants there continue to burn out of control and emit high levels of radiation. Japan is a stark reminder of how fast a modern technologically advanced society can be brought to its knees by an unforeseen calamity. (more…)

The Economic Aftershock of Japan

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

The news from Japan is grim. At least 10,000 people are reported dead from the killer quake that rocked the island nation last week. Likely, the death toll will go much higher in the coming days. There have been at least 3,400 buildings destroyed by the flood of a 3 story tsunami, the 8.9 earth quake or by fire. Oil refineries were damaged and shut down. Roads and bridges were destroyed by the quake and the rail system was wiped out in some areas. (more…)

Has Gold and Silver Topped Out?—No Way

The world looked like a scary place yesterday for gold and silver investors. There was a lot of talk about a global economic slowdown. The price of oil dropped, and gold and silver sold off. In the grand scheme of things, the correction was quite small.

The world looked like a scary place yesterday for gold and silver investors. There was a lot of talk about a global economic slowdown. The price of oil dropped, and gold and silver sold off. In the grand scheme of things, the correction was quite small.

If there is a slowdown, and there may be, do you think the U.S. Fed is going to stand by and watch the economy crash? No way! Expect the Fed printing press to go into high gear and shift from QE2 right into QE3. The Fed will, once again, come to the rescue and save the day as it kills the dollar. (more…)

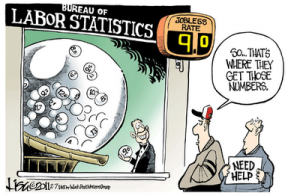

Flying Blind

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Last Friday, the Bureau of Labor Statistics (BLS) reported the economy created 192,000 new jobs and the unemployment rate fell to 8.9%. The good news was reported almost everywhere as a turning point in the U.S. economy. For example, CNBC said, “U.S. employers hired more workers in February than in any month since May last year and the unemployment rate fell (more…)

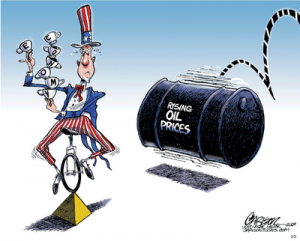

Spiking Oil, Plunging Economy

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This weekend, violence continued to erupt in the Middle East. In Libya, the Gaddafi government launched counter attacks against the rebels. Many fear there is a full blown civil war brewing in that oil rich country.

Yemeni loyalists also staged counterattacks against anti-government protesters in hopes of dispersing them. They used sticks and stones, but still, 25 people were reported injured. (more…)

Trouble for MERS Keeps Mounting

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

In Guilford County, North Carolina, the Register of Deeds, Jeff Thigpen, is questioning if his county was cheated out of more than a million dollars real estate fees because banks did not file proper chain of ownership documents with his office.

Instead, the banks used a Virginia based company called MERS. It bypassed the local Register of Deeds office, not just in Guilford but all counties across the U.S. (more…)