Latest Posts

The Year America Dissolved

Guest writer for Greg Hunter’s USAWatchdog.com

It was 2017. Clans were governing America.

The first clans organized around local police forces. The conservatives’ war on crime during the late 20th century and the Bush/Obama war on terror during the first decade of the 21st century had resulted in the police becoming militarized and unaccountable. (more…)

What is it?

Guest writer for Greg Hunter’s USAWatchdog.com

The New York Times ran a story of curious import this morning: “Mel Gibson Loses Support Abroad.” Well, gosh, that’s disappointing. And just when we needed him, too. Concern over this pressing matter probably reflects the general mood of the nation these dog days of summer – and these soggy days, indeed, are like living in a dog’s mouth – so no wonder the USA has lost its mind, as evidenced by the fact that so many people who ought to know better, in the immortal words of Jim Cramer, don’t know anything. (more…)

Banking Disaster Largely Ignored By Mainstream Media

Last week, bank failures quietly passed the 100 milestone for the year. I say “quietly” because the bank failure story has gone largely unreported or, at least, under-reported by the mainstream media. Just to give you an idea of how fast the bank insolvency problem is accelerating, last year, at this time, 64 banks had been taken over by the Federal Deposit Insurance Corporation. So far, this year, 103 banks have already been taken over by the FDIC. (more…)

Government Dodges Dire Gulf Claims

Last week, guest writer James Howard Kunstler wrote a compelling and controversial article on this site called, “What If He’s Right.” It was about shocking comments made by veteran oil analyst Matthew Simmons in an interview about some extreme dangers BP’s Gulf gusher pose. Kunstler did a great job with the article, but the comments were so alarming I felt further work was needed to verify Simmons’ claims. (more…)

Irrational Exuberance to Unusually Uncertain

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The decade of the 1990’s is America’s modern day equivalent of the Roaring 20’s. Back then, we were making great strides in productivity. We had near full employment, the government had a surplus of cash and the stock market was making many people rich. The future looked so bright in December of 1996 that Fed Chief Alan Greenspan warned investors not to get carried away with the good times. (more…)

What If He’s Right?

By James Howard Kunstler

By James Howard Kunstler

Guest Writer for Greg Hunter’s USAWatchdog.com

More on the Dollar

By Greg Hunter’s USAWatchdog.com I wanted to do a little more on the coming plight of the U.S. dollar. I received this comment from a reader named Billhopen who wrote, “Inflation??? you go to lengths quoting Karl Denninger (Market Ticker) who will tell you its is massive default, delevering, etc that will lead to DEFLATION….Your thesis is lacking on how we get an inflated currency from or situation, and certainly you can’t quote Karl to support that theory.” (more…)

By Greg Hunter’s USAWatchdog.com I wanted to do a little more on the coming plight of the U.S. dollar. I received this comment from a reader named Billhopen who wrote, “Inflation??? you go to lengths quoting Karl Denninger (Market Ticker) who will tell you its is massive default, delevering, etc that will lead to DEFLATION….Your thesis is lacking on how we get an inflated currency from or situation, and certainly you can’t quote Karl to support that theory.” (more…)

Inflation Nation

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I have been saying for months the path the country will ultimately take will be the inflation path. Yes, I know we have had some deflationary signs in the past. The financial meltdown of 2008 would have been a deflationary event if the government had not stepped in with cash. (more…)

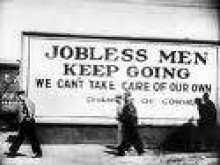

Media Spin Will Not Stop the Coming Downturn

There is hardly a day goes by I don’t hear some spin about the economy and how the so-called “recovery” is progressing. Last week’s job numbers is a classic example. It seems the jobless claims fell to an eight week low. (more…)

A Nasty Email Says I Don’t “Get It”

I got this rather nasty email from a reader who identified himself with only an email address. So, I am going to identify this person with the first part of the address, which is Jdavidm24. Here is what he had to say about my most recent post called, “Two Stories that Should Scare the Heck Out of You.” (more…)

Two Stories that Should Scare the Heck Out of You

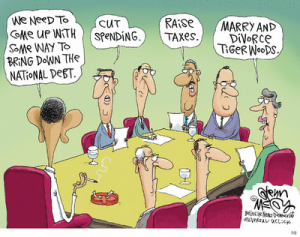

I was sitting here trying to find a way to wrap up the week and then, like a bolt of lightning, an idea hit me. Gold expert Jim Sinclair sent me this story: “Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY’10.” The story said, “The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009.” (more…)

“Myths” Paul Krugman Does Not Want To Talk About

I have been telling you for months there is going to be a double dip in the economy. Nobel Prize Winning economist Paul Krugman also thinks the economy is so bad we need to keep on stimulating the economy. In a New York Times Op-Ed piece last week, Krugman said, “. . . somehow it has become conventional wisdom that now is the time to slash spending, despite the fact that the world’s major economies remain deeply depressed.” (more…)

Greg Hunter On The Edge With Max Keiser

By Greg Hunter’sUSAWatchdog.com

By Greg Hunter’sUSAWatchdog.com

I was interviewed by Max Keiser in Europe last week. For the 4th of July holiday on Monday the 5th, I am posting part three of a three part interview. (more…)

Another Sign on the Road to a Devalued Dollar

The President gave a speech on immigration reform yesterday. One of the most outrageous things the President said, “The southern border is more secure today than at any time in the past 20 years.” Please, Mr. President, Phoenix is the kidnapping capitol of America, second only in the world to Mexico City. Meanwhile, as the President tried to score political points, questions about the viability of the U.S. dollar as the world reserve currency are increasing on the world stage. (more…)

Stealth Austerity Already Hitting the U.S.

Last week, at the G20 meeting in Toronto, there was much discussion about money printing for bailouts and cutbacks for austerity. These were the two main options talked about to deal with the economic malaise facing the globe. The U.S. is firmly in the money printing camp. Europe, on the other hand, is officially taking the cutback and austerity path. (more…)