Latest Posts

Global Debt Bubble a Gigantic Time Bomb – Peter Schiff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Peter Schiff says the Federal Reserve has already started a new money printing program that continues to expand the debt bubble and keep global markets propped up. This started abruptly last month in what is called the “repo market,” where the Fed provides liquidity for traders of short-term money or overnight funding. Schiff says, “When the Fed was doing QE3, they were buying $85 billion worth of debt per month. They (Fed) just did $176 billion in three weeks, and they say they are not doing QE. So, the Fed is monetizing more debt not doing QE than when they were doing QE, which means they are doing it and they are going to have to do more of it. The reason they are doing it is because the markets are finally trying to move interest rates higher because the Fed has been suppressing them. (more…)

Trump Impeachment Like KGB Operation – Kevin Shipp

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former CIA Officer and whistleblower Kevin Shipp says the so-called whistleblower the Democrats are using to try to impeach President Trump is part of another Deep State hoax. Shipp says, “This is not a whistleblower. Let’s just start with that. This is a leaker. This person did not have anything to blow the whistle on. Everything written in this document is written not by this leaker, but by attorneys, and it is hearsay. There is no evidence in it whatsoever. It is not a whistleblower complaint. He did not go through proper channels. He went directly to Congressman Adam Schiff, and people have got to understand this is another shadow government Deep State operation actually trying to remove the President. What they did was real sly. If they would have brought this leaker ahead, they would have taken him apart. The whistleblower, or leaker, would have been investigated. Everybody connected with him would have been investigated. . . . (more…)

Pelosi Impeachment Unconstitutional, MSM Propaganda, Dems Suppress Free Speech

By Greg Hunter’s USAWatchdog.com (WNW 404 10.4.19)

By Greg Hunter’s USAWatchdog.com (WNW 404 10.4.19)

Nancy Pelosi has changed the rules of impeachment to limit GOP involvement. This, according to legal experts, is unconstitutional. Funny that the rules were also changed for the CIA partisan so-called “whistleblower” to include hearsay just before the charges were made. Trump has released his phone call with the President of Ukraine that proves he did not hold up aid to Ukraine to get an investigation on Joe Biden. The whole false story is falling apart a little more every day, which is why the President is calling it another hoax just like the phony Russia collusion story.

Global Markets Tank When Dems Impeach Trump – Gerald Celente

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Top trends researcher Gerald Celente says if the Democrats impeach President Trump, the markets will tank and cause what he is forecasting to be the “Greatest Depression.” Celente explains, “What’s going to happen, as this impeachment process intensifies, go back to what happened when ‘Slick Willie’ Clinton got impeached, you saw the DOW go down almost 20% into correction territory. Now, it’s different than in 1998 because we still had growth going on. If this market goes down, it’s going to go down real hard because it’s already artificially being propped up with monetary methadone that morons and imbeciles call quantitative easing and negative and zero interest rate policy. So, now, when this thing goes down from the pressure of impeachment, there is nothing to hold it back up. . . . We have a global slowdown. We have pressure all over the world . . . . Economies have been artificially propped up, and the monetary methadone is wearing off. The addicted bull is ready to go under.”

Dollar Rejection is Why America Ramped Up Oil and Gas Production – Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Macroeconomic analyst Rob Kirby thinks the dollar shortage and liquidity crisis has something to do with the booming oil and natural gas industry. Kirby points out, “America is producing an awful lot of energy, but they are not making money doing it. What is it that would make them want to do that? That’s when I started thinking about the rest of the world or the rest of the story. The rest of the story goes something like this: Venezuela used to sell all of its oil in dollars. Russia used to sell all of its oil in dollars. Iran used to sell all of its oil in dollars. Iraq used to sell all of its oil in dollars, and up until very recently, Saudi Arabia used to sell all of its crude oil in dollars, but I believe they are now selling some of their oil in currency other than dollars. So, we have many millions of barrels of oil that were formerly transacted in dollars, and these barrels of oil are now being priced in other currencies. (more…)

Dems Made it Up Again, Impeachment Desperation, Economic Crash

By Greg Hunter’s USAWatchdog.com (WNW 403 9.27.19)

By Greg Hunter’s USAWatchdog.com (WNW 403 9.27.19)

It looks like the Democrat Party is fabricating another hoax to try, once again, to remove President Donald Trump from office, or at least hurt his chances for a second term. The Deep State and Democrats have teamed up with a “partisan” so-called whistleblower that has concocted a report with no real firsthand knowledge of a crime during a phone call to the new President of Ukraine. The DOJ said the President has committed no crime. On top of that, connections to Democrats abound that the whole thing is another hoax in an attempt to frame the President for something he did not do, which is to ask for an investigation into Joe Biden for alleged corruption in Ukraine. According to new information, it looks like the Ukrainians were already investigating what happened in 2016 in terms of election meddling and corruption, but it is the Democrats who are in the crosshairs.

Financial System Disappearing into Black Hole – Egon von Greyerz

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial and precious metals expert Egon von Greyerz (EvG) says the signs abound that we are nearing the end of this global fiat money experiment while central bankers are befuddled. EvG explains, “The central banks are panicking. They don’t know what to do anymore. They are just starting to print money and with the euro on a daily basis. . . . Europe is starting QE again with $20 billion a month, but that’s nothing compared to what is coming. . . . The panic that started with central banks in the summer in late July and August was, to me, the first step towards total chaos in the world that we will be seeing in the months and years to come. They (central bankers) see it clearly. They know the banking system is absolutely on the verge of collapse. They know Deutsche Bank (DB) and CommerzBank, too, are down 95%. (more…)

First Ever Triple Bubble in Stocks, Real Estate & Bonds – Nick Barisheff

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

We are living in an age of records in the financial world. The stock market is in its longest bull market in history and near all-time highs. The world has more debt than ever before while interest rates are near record lows, and some are negative in many countries for the first time ever. Nick Barisheff, CEO of Bullion Management Group (BMG), is seeing a dark ending for the era of financial records. Barisheff explains, “I have been in the business for 40 years, and this is the first time we have had a simultaneous triple bubble, a bubble in real estate, stocks and bonds all at the same time. In 1999, it was a stock bubble. In 2007, it was a real estate bubble. This time, we’ve got a triple simultaneous bubble. So, when we have the correction, it’s going to be massive. Value calculations on equities say it’s worse than 1999, and in some cases worse than 1929. The big problem is this triple bubble is sitting on a mountain of debt like never before.”

Iran Conflict or More Tariffs, Russia Hoaxsters Prosecuted, Fed Lost Control

By Greg Hunter’s USAWatchdog.com (WNW 401 9.20.19)

By Greg Hunter’s USAWatchdog.com (WNW 401 9.20.19)

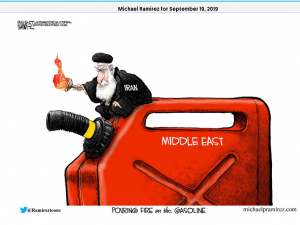

Is America going to have a conflict with Iran? It looks like it is not. Trump is going to increase the already stiff tariffs on that Persian Gulf nation. One sure sign that is true is former National Security Advisor John Bolton is reportedly upset the U.S. will not be bombing Iran over the drone attack on Saudi Arabia oil installations.

Economic & Civil Calamity Possible – Karl Denninger

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Analyst and entrepreneur Karl Denninger says the economy is good for some people but not so good for others. Denninger explains, “I think it is very good for people in the top couple of percent. I think it is moderately okay for people in the top 10%. It is terrible for people that are further down the line. The real problem is not that it is good or bad for any particular group, but it is the entire thing is running on borrowed funds. In other words, the days of you going and working and you saving your economic surplus, that’s gone. You don’t have an economic surplus. If you look at the statistics and they say the majority of Americans cannot come up with $400 for an emergency, please tell me how we can have a great economy if the majority of people cannot fix a transmission if it blew up in their car tomorrow.”

Obama Ordered FBI & CIA to Spy on Trump – Kevin Shipp (Pt #1)

By Greg Hunter’s USAWatchdog.com (Click here for Part #2)

By Greg Hunter’s USAWatchdog.com (Click here for Part #2)

Former Assistant FBI Director Andrew McCabe looks like he is going to be charged for his role in the Trump Russia hoax to try to remove a duly elected President from office. Former CIA Officer Kevin Shipp, who is an expert on counter-intelligence, says McCabe is going roll over on his co-conspirators and talk if the DOJ cuts him a deal. Shipp explains, “Yes, I do think he will talk, absolutely. It’s either that or be imprisoned with Billy Bob for the next 15 or 20 years. The motivation is great for him to talk. . . . This is one of their most outrageous things the Shadow Government and the Deep State has done. (more…)

Deep State Never Wants 9/11 Truth to be Revealed – Kevin Shipp (Pt #2)

By Greg Hunter’s USAWatchdog.com (Click Here for Pt #1)

By Greg Hunter’s USAWatchdog.com (Click Here for Pt #1)

There is a new engineering analysis and investigation done by the University of Alaska that says on 9/11/2001, building #7 was a controlled demolition and did not fall because fire melted the beams. This new report totally contradicts the official story and reveals a gigantic lie the public has been told for the past 18 years. The mainstream media (MSM) is largely ignoring this ground breaking report. Why? Former CIA Officer Kevin Shipp, who is an expert on counter-intelligence, says, “This is shocking . . . . As always, they call everyone who looks into this a conspiracy theorist. (more…)

Biden Survives Dem Debate, Indictments for FBI’s McCabe, Economic Update

By Greg Hunter’s USAWatchdog.com (WNW 400 9.13.19)

By Greg Hunter’s USAWatchdog.com (WNW 400 9.13.19)

If the Democrat candidates for president wanted frontrunner Joe Biden knocked out of the race, they did not get their wish. The headline is Biden may not have been stellar, but he held his own against the field. In my estimation, there was really no real standout during the debates. There was just more Marxist/communist/socialist ideas proposed with few details on how to pay for it all. Of course, gun control was a major topic, which is a hallmark of genocide and Marxism. In all, a pretty unappealing list of ideas from a very unappealing field.

Fed Still Working Against President Trump – John Williams

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Economist John Williams says the Fed is still not in President Trump’s corner when it comes to the economy. Williams contends, “The Fed was working against him (President Trump) on the economy, and they still are. Their primary concern is the banking system, and that certainly has to be supported, but when you have a weak economy, and this was fueled by the tightening of the Fed, I don’t think Trump is going to get blamed for that. It’s going to go against the Fed, and I don’t think it is going to hurt him that much in the upcoming election. (more…)

Biggest Inflation in the History of History Coming – Bill Holter

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Recently, one big name money manager after another is on record telling people to buy hard assets. Why? Financial writer and precious metals expert Bill Holter says they all know what is coming. Holter contends, “They understand that this is going to be the biggest monetary debasement in the history of history. They understand it’s hyperinflation that is on its way. They are late to the game, and they do manage billions and billions of dollars, and I don’t see how people talking about buying gold and buying silver are going to be able to get actual physical silver and physical gold in their hands or in their vaults.”