Latest Posts

The Last Innings of a Very Bad Ball Game

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There is no way to characterize what is happening in the EU as positive. The Euro-zone is a gigantic mess, and it is on the verge of falling apart. There is no way the destruction of the European common currency (euro) will not cause huge problems here in the U.S. If you watch the financial news channels, you would think that problems for the Western fiat monetary system is a long way off. (more…)

Gold Will Win Money War

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It was recently reported that countries like China and India are going to buy Iranian oil with gold. Jim Sinclair of JSMineset.com said this week, “The implications of China paying for Iranian oil in gold is the most important event in the modern history of gold.” (more…)

Consequences of Iran-Israel War

The latest headline proves, once again, Iran and Israel are moving closer to war. The only question is when. A headline, today, from Debka.com said, “Tehran steps into US-Israel Iran row with threat of pre-emptive strike.” The story goes on to say, “Deputy Chief of Iran’s Armed Forces Gen. Mohammad Hejazi issued a new threat Tuesday, Feb. 21: “Our strategy now is that if we feel our enemies want to endanger Iran’s national interests… we will act without waiting for their actions.” debkafile’s military sources report that an Iranian preemptive attack on Israel has been in the air for some weeks. (more…)

The latest headline proves, once again, Iran and Israel are moving closer to war. The only question is when. A headline, today, from Debka.com said, “Tehran steps into US-Israel Iran row with threat of pre-emptive strike.” The story goes on to say, “Deputy Chief of Iran’s Armed Forces Gen. Mohammad Hejazi issued a new threat Tuesday, Feb. 21: “Our strategy now is that if we feel our enemies want to endanger Iran’s national interests… we will act without waiting for their actions.” debkafile’s military sources report that an Iranian preemptive attack on Israel has been in the air for some weeks. (more…)

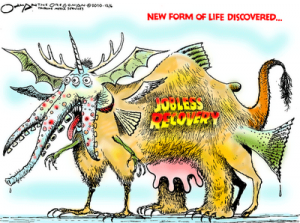

There is No Real Recovery in Economy

If the economy was doing so well, the Federal Reserve would not be announcing (last week) an extension of its zero interest rate policy until the end of 2014. If the economy was truly in a real recovery the Fed would be hiking interest rates instead of giving away money for virtually nothing. It is just not the U.S. that is doing badly, but the rest of the world is also tanking. Just look shipping traffic around the globe. (more…)

If the economy was doing so well, the Federal Reserve would not be announcing (last week) an extension of its zero interest rate policy until the end of 2014. If the economy was truly in a real recovery the Fed would be hiking interest rates instead of giving away money for virtually nothing. It is just not the U.S. that is doing badly, but the rest of the world is also tanking. Just look shipping traffic around the globe. (more…)

State of Denial in Coming War Catastrophe

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The world economy is in the tank, and the Federal Reserve’s decision to extend its zero interest rate policy to, at least, the end of 2014 proves it. What will happen if the fragile world economy also has to deal with a war with Iran? (more…)

Dollar Crisis Coming–Just a Matter of Time

I have long said the trouble in the U.S. economy will all eventually boil down to a currency crisis. Meaning, the dollar is going to lose a whole lot more buying power before this chapter in American history is over. This is not a matter of if but when, and we are not going to have to wait too much longer. People call the buck a “safe haven” investment, but the buck is hardly safe. Jim Willie from Goldenjackass.com agrees and has written a stellar post spelling out just how vulnerable the U.S. dollar really is. Please enjoy his work below, and check out his PhD credentials after the post.—Greg Hunter. (more…)

I have long said the trouble in the U.S. economy will all eventually boil down to a currency crisis. Meaning, the dollar is going to lose a whole lot more buying power before this chapter in American history is over. This is not a matter of if but when, and we are not going to have to wait too much longer. People call the buck a “safe haven” investment, but the buck is hardly safe. Jim Willie from Goldenjackass.com agrees and has written a stellar post spelling out just how vulnerable the U.S. dollar really is. Please enjoy his work below, and check out his PhD credentials after the post.—Greg Hunter. (more…)

Will China Stop Buying U.S. Debt?

A few weeks ago, the Telegraph UK did a story about the sharp drop in foreign holdings of U.S. Treasuries. One of the big buyers of American debt is, of course, China. There are those that think China is forced to buy our debt otherwise its economy will collapse. Until the Treasury releases what is called “TIC” data (Treasury International Capital) in November, we really will not know what is going on. (more…)

What’s Going On with Silver?

Even though silver and gold are both up around 25% for the year, silver has been lagging gold’s recent spike. Plenty of folks have been asking what’s going on. In the big picture, what is happening is fiat money is in the process of dying. Can governments save the fiat system with austerity? I don’t think so because there is simply too much debt in the world. What I do know is the rich are turning to physical assets for protection from calamity and inflation. Silver is used for storing wealth and industrial production. It is only a matter of time before silver catches up with gold, and most experts say it will go up in price on a percentage basis much more than gold. (more…)

Ramifications of a U.S. Debt Downgrade

The U.S. debt downgrade is really more than a tiny one notch cut in the credit worthiness of the U.S. One talking head on television said yesterday that there was never any question that the U.S. would repay its debt because the country can print money. The talking head is correct but does not take into consideration the future buying power of the repayment dollars. Printing money at the rate the Fed has been doing devalues the currency and, in effect, allows the government to default with dollars with reduced buying power. This is precisely why Bill Gross, head of the world’s biggest bond fund, PIMCO, said recently that people who invest in Treasuries will “get cooked.” (more…)

You Cannot Doubt the Gold Bull Market

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

Plunging Fuel Prices Will Not Last

Towards the end of June, the International Energy Agency (IEA) announced a plan to release 60 million barrels of oil to combat the high prices brought on by the Libyan crisis. That’s about 2 million barrels a day since June 23. It looks like prices have already hit bottom, and most think the cheap gasoline and diesel fuel will not last. I think this could be a dress rehearsal for this time next year, just before the 2012 elections–but what do I know? (more…)

Towards the end of June, the International Energy Agency (IEA) announced a plan to release 60 million barrels of oil to combat the high prices brought on by the Libyan crisis. That’s about 2 million barrels a day since June 23. It looks like prices have already hit bottom, and most think the cheap gasoline and diesel fuel will not last. I think this could be a dress rehearsal for this time next year, just before the 2012 elections–but what do I know? (more…)

What is Money?

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

I have consistently said since this site went on line that the only thing you can count on when it comes to the economy is inflation. Economist John Williams of Shadowstats.com says inflation is now running at 11.2%. To get that number, Williams computes the data the way Bureau of Labor Statistics did it in 1980 (or earlier.) No accounting gimmicks–just a true measurement of the cost of living, not the cost of existence. (more…)

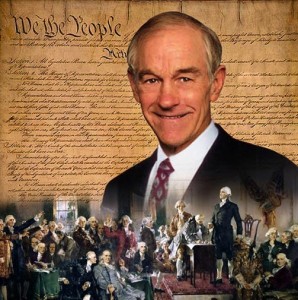

They Just Take Turns Ripping Us Off

Many people think that there is a big difference between Democrats and Republicans, but I think there’s not much difference at all. I have long said, the left and the right are really one body with two heads–they just take turns ripping us off. Both parties are not all bad. There are a few good eggs on both sides of the isle but only a few. Gerald Celente, founder of Trends Research, thinks much the same way as I do. Celente is famous for making many spot on predictions about the future based on trends of today. He is predicting that Congressman Ron Paul could win the Presidency in 2012. (more…)

Many people think that there is a big difference between Democrats and Republicans, but I think there’s not much difference at all. I have long said, the left and the right are really one body with two heads–they just take turns ripping us off. Both parties are not all bad. There are a few good eggs on both sides of the isle but only a few. Gerald Celente, founder of Trends Research, thinks much the same way as I do. Celente is famous for making many spot on predictions about the future based on trends of today. He is predicting that Congressman Ron Paul could win the Presidency in 2012. (more…)

When Honest Americans are Cast as Criminals

There are those who feel some of the leadership of America has sold us down a river of ruin. After all the bailouts, corruption and malfeasants that has brought a financial catastrophe to America, not a single financial elite has been indicted, let alone gone to jail. Crimes have surely been committed, but it appears the U.S. Justice Department has turned its back on prosecuting anyone. (more…)

There are those who feel some of the leadership of America has sold us down a river of ruin. After all the bailouts, corruption and malfeasants that has brought a financial catastrophe to America, not a single financial elite has been indicted, let alone gone to jail. Crimes have surely been committed, but it appears the U.S. Justice Department has turned its back on prosecuting anyone. (more…)

We Need Honest Money

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)