Latest Posts

Barr Battle, 1% Rates Cut & Poynter Institute is Pointless

By Greg Hunter’s USAWatchdog.com (WNW 382 5.3.19)

By Greg Hunter’s USAWatchdog.com (WNW 382 5.3.19)

Attorney General William Barr refused to show up for a House of Representatives request for him to testify on Trump collusion that has now proven to be a hoax by the Mueller report. There are calls by Democrats to impeach Barr. Speaker of the House Nancy Pelosi has even accused Barr of lying in other House appearances. The DOJ says Pelosi’s charge is “reckless, irresponsible and false.” Why is this happening? I say it is all to discredit AG Barr. This way, when arrests happen for the Trump Russia hoax, the Dems can claim the Trump Administration is attacking them for their politics and not their crimes. It’s not going to work, and this looks like a desperate act.

Iran Nuke Deal — Bribes, Treason and Fraud – Dave Janda

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Dave Janda, host of the popular radio show called “Operation Freedom,” says the Iran nuclear deal (also known as the JCPOA) is an unsigned scam with huge implications of “treason and fraud.” Janda says, besides the public not being told it was never signed by Iran, they were also lied to about the enormous amounts of cash brought to Iran on pallets. It’s way more than the $1 billion or so the Obama Administration admitted to giving the number one state sponsor of terror. Janda, who has high ranking sources in Intel, politics and law enforcement, explains, “Everybody got a piece of this. My contacts say when this happens, the cash gets lighter. (Meaning, everybody gets a cut of the money.) I spoke to my contacts about the cash part of this and, according to my contacts behind the curtain about this stuff, they say it’s more than the $1.5 billion that folks have been speaking about, significantly more. (more…)

Global Gold Supplies Getting Tighter – Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Forensic macroeconomic analyst Rob Kirby says big money knows “gold supplies are tight” and getting tighter by the day. Kirby, who also arranges gold sales by the ton on a global scale, explains, “There are reports of people trying to buy institutional amounts of physical gold bullion in the Asian market, and there is none available even if they are paying a premium. I’m not talking about availability at the coin shop where you would buy two American Gold Eagles or a Gold Panda. I am talking about institutions wanting to buy serious amounts of physical gold bullion in bar form.”

Reset Rule of Law – Dr. Dave Janda

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Dr. Dave Janda is a radio host and a patriot who is a Washington outsider with insider contacts. Janda says a new Inspector General’s report will be the beginning of the reset of the rule of law. Janda explains, “Comey, Lynch and Clinton are now in the crosshairs, and I believe that’s accurate. Many people believe that the Inspector General’s report was not going to happen and was not going to be turned in. 1.2 million pages were delivered to Congress. . . . The reason why this report is important is, I believe, it will reset the rule of law in this country. (more…)

Alabama Will Vote for Moore, Trump Asia Trip, Plan on Inflation

By Greg Hunter’s USAWatchdog.com (WNW 310 11.17.17)

By Greg Hunter’s USAWatchdog.com (WNW 310 11.17.17)

The saga of Roy Moore continues with twists and turns and dirty tricks by the Deep State. It’s been revealed that a so-called robocall campaign to try and find dirt on Senate candidate Roy Moore happened after he won the GOP primary. Now, the only piece of evidence in multiple accusations that Roy Moore committed sexual misconduct has been called into question. Moore and his attorney are charging a yearbook inscription from the 1970’s, that proves contact with one of the alleged victims, is a forgery and a fraud. Moore denies any and all wrongdoing and is going to sue two women with the most damaging claims.

Dark Dollars Propping Up Failing System – Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Forensic macroeconomic analyst Rob Kirby says few people have any idea how many “dark dollars” are out there. Kirby explains, “When you start talking about how many dollars there are in the world, nobody really knows. I would suggest to you the real quantity of dollars in the world is much greater than anyone imagines. A lot of these dollars are ‘dark,’ and they are held in the bowels of institutions like the Exchange Stabilization Fund (ESF). So, the world may be cruising along thinking the total number of dollars in the world is ‘X,’ but the true amount in the world, if you count the dark ones, might be three or four times ‘X’. This really means the money supply is much bigger than anyone understands or believes.” Kirby contends that the so-called “dark dollars” are being used to prop up the Treasury bond market. The ESF simply buys the debt and essentially hides it.

Conspiracy to Remove Trump at All Costs – Paul Craig Roberts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

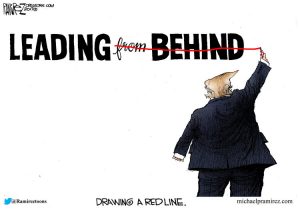

Dr. Paul Craig Roberts agrees that Democrats, RINO Republicans, military complex and the Deep State want Donald Trump removed from the White House at any and all costs. Dr. Roberts explains, “That’s correct and, again, it’s several different interests. The Democrats want him out because they want to be vindicated that he stole the election from them through some form of collusion with the Russians. The military security complex want him out because they see him as a threat to their budget. Trump normalizing relations with Russia—they don’t want that. They need an enemy. The talk of pulling out of Syria also annoyed them. They don’t want to give up these wars that keep people worried and willing to support the military. . . . (more…)

Still No Proof of Trump/Russia Collusion, Economic Update, MSM Is Fake News

By Greg Hunter’s USAWatchdog.com (WNW 285 5.26.17)

By Greg Hunter’s USAWatchdog.com (WNW 285 5.26.17)

Former CIA Director John Brennan testified on Capitol Hill this week and told Congress that he was “concerned” and “aware of information and intelligence that revealed contacts and interactions between Russian officials and . . . the Trump campaign.” The big headline buried in the mainstream media (MSM) reporting was Brennan admitting in the same hearing, “I don’t know whether or not such collusion . . . existed. I don’t know.” That means there is still zero evidence that anyone in the Trump campaign colluded with the Russians. The “Witch Hunt” continues.

Fake Russia/Sessions Story, Obama Plotting Against Trump, Fed Rate Hike

By Greg Hunter’s USAWatchdog.com (WNW 274 3.3.17)

By Greg Hunter’s USAWatchdog.com (WNW 274 3.3.17)

New Attorney General Jeff Sessions is under fire in the ongoing fake story about Russian involvement in the 2016 election. It centers on his old job as a senior member of the Armed Services Committee in the U.S. Senate. Sessions was asked if he had contact with Russian officials about the election. Sessions said, “No.” Sessions did talk to the Russian Ambassador as part of his duties in the Senate. Now, Sessions has recused himself in the ongoing Russian hacking investigation where no evidence has come forth about the Russian government having an effect on the outcome of the 2016 election.

Clinton Charity is Massive Global Swamp-Charles Ortel

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Wall Street financial analyst Charles Ortel has applied the same research skills he does to see if a company has sound solvent accounting to the Clinton charity machine. Ortel has called the Clintons the “Bonnie and Clyde” of charity fraud. What does Ortel say now that the Clintons are shutting down there so-called global charity? Ortel contends, “The Clinton Global Initiative (CGI) was a fraud from the very beginning. It started in September of 2005 as an interesting idea that you would convene around the time of the U.N. General Assembly in New York. You would convene world leaders, former government officials, investors, corporate officers and members of the media in closed sessions where you would talk about high sounding topics, and noble people would stand up on stage and say how much good they were going to do under the guise of charity. (more…)

Why Are World Leaders Visiting Antarctica?-Steve Quayle

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

In the last few months, the world’s political and religious leaders have been making trips to the continent at the bottom of the world—Antarctica. Author of “Empire Beneath the Ice” (second edition December 2016). Steve Quayle says people should take notice. Quayle explains, “What really is going on down there? Here is the billion dollar question, and probably the trillion dollar question: Why are the world’s religious leaders and the world’s most powerful leaders going to Antarctica? I don’t think the Russian Patriarch Kirill is going down there to meet penguins, with no disrespect meant. Someone or something has summoned the world’s leaders.”

2017 Predictions for MSM, Markets and Gold-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Top trends researcher Gerald Celente started forecasting back in May 2016 that Trump would win. He was spot-on. What are the big trends and predictions in store for 2017? Mr. Celente gives us three of his top predictions coming up in this interview. We start with the mainstream media (MSM) that went all in for Hillary Clinton with actions associated with propaganda and not news. What’s going to happen to the MSM in 2017? (more…)

Globalists Will Crash Markets and Blame it on Trump-Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby explains the violent moves in the markets by saying, “We really do not have markets anymore. We have interventions, and we have massive fraud committed on a daily basis in what we call our capital markets. Our capital markets have become nothing more than a crime scene.”

Global Elite Making Preparations for Post-Dollar World-Rob Kirby

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby says his rich clients around the planet are bracing for an inevitable economic calamity. Kirby explains, “The people I know, that I would say are at the higher level of the food chain in the global world of finance, are hunkered down and making very serious preparations. What I see on a macro level is people acting like squirrels preparing for winter. They are burying nuts and gathering as much physical precious metals as they can. They are making preparations for a post-dollar world in terms of world reserve currency.”

Economic Collapse Happening Now-Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Macroeconomic analyst Rob Kirby’s predictions of a downward spiraling economy are coming true. Kirby contends, “I think the last time we spoke, it was in early December. I suggested that a window was opening where we were very likely to see some systemic breakdowns in our financial universe to likely start occurring. Low and behold, it looks like we are seeing the beginnings of exactly what we were speaking of. The reason why we are beginning to see these things start to unfold now is that everything we’ve been told by our financial elites . . . has basically been a lie or a false flag or fraudulent.”