Latest Posts

Greg Hunter’s 2016 Thanksgiving Message

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Greg Hunter gives a short wrap-up and his thoughts on why he is grateful on this Thanksgiving holiday. Enjoy:

Record Run into Gold and Silver Coming-David Morgan

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Precious metals expert David Morgan says trillions of dollars of negative interest rate paying bonds is a sign we are getting close to another financial calamity bigger than the last. Morgan explains, “Now, as everyone knows, we are even at negative interest rates, and people are buying into this. They are guaranteed to get less back. . . . This is the upside-down world we are living in. This is the scientific planet that is our reality. So, this is the reason you will see a run to the dollar before you see a run to gold. . . . We are in the final step before another 1% of the population takes action into the precious metals. When the run starts, it won’t be because 90% of the population wakes up and says I need precious metals to protect my financial wellbeing. (more…)

2017 Predictions for MSM, Markets and Gold-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Top trends researcher Gerald Celente started forecasting back in May 2016 that Trump would win. He was spot-on. What are the big trends and predictions in store for 2017? Mr. Celente gives us three of his top predictions coming up in this interview. We start with the mainstream media (MSM) that went all in for Hillary Clinton with actions associated with propaganda and not news. What’s going to happen to the MSM in 2017? (more…)

Weekly News Wrap-Up-Greg Hunter 11.18.16

By Greg Hunter’s USAWatchdog.com (WNW 261)

By Greg Hunter’s USAWatchdog.com (WNW 261)

The mainstream media (MSM) is in full panic mode as it realizes it is becoming irrelevant. Now there is a so-called list of “fake news” sites out and Breitbart.com and InfoWars.com are on the list. That is an outrageous claim considering President Elect Trump has called Alex Jones at InfoWars.com to thank him for the coverage. It is preposterous to think Trump would call a “fake news” site to thank them. Also, Steve Bannon, who used to run Breitbart, is being tapped by Trump to be his top advisor. (more…)

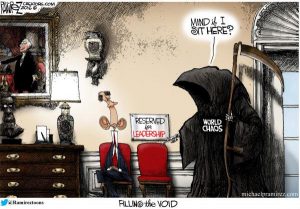

Globalists Will Crash Markets and Blame it on Trump-Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby explains the violent moves in the markets by saying, “We really do not have markets anymore. We have interventions, and we have massive fraud committed on a daily basis in what we call our capital markets. Our capital markets have become nothing more than a crime scene.”

Federal Reserve & Clintons Doomed-Clif High

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Internet data mining expert Clif High predicted that “Trump would win” the election and that Hillary Clinton would go “missing” after the election. Sure enough, Hillary was missing the night of her defeat. What does that mean? High thinks, “That there was a breakdown among a very delicate relationship among a lot of powerful parties that failed to deliver as promised. The plan didn’t work. So, now there is no real plan “B.” There never could be under the circumstances. We are in a situation where there can’t be a plan “B” for the Federal Reserve, for example. They (FED) have to go on a certain path, they’re doomed. That is true of the criminal organization we call CGI (Clinton Global Initiative). Any criminal gang, no matter where it is in the social order, progresses along a certain path, runs into opposition and dies. It always happens, and it always will.”

Trump Wins 2016 Presidential Election & Saves America

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

This is my take on the big Trump win that saves the country and the rule of law in America. We are going to get a market selloff, but at least we will only have to deal with economic problems created by the criminal crony class and not the additional full blown tyranny of a Clinton Administration. The financial markets will be in turmoil, and the fantasy economy is about to meet reality. Savor the Trump win, but be prepared for a lot of work and financial pain.

Final 2016 Presidential Election Update Before Voting Ends

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

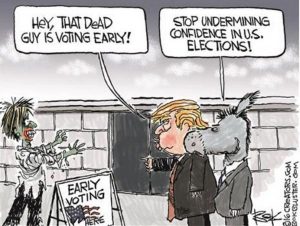

America faces the biggest election in the history of the country. The outcome will have huge implications for the rest of our lives. The desperation is so thick, with the Democrats and the Clinton campaign, you can’t cut it with a hacksaw. President Obama is telling illegal aliens to illegally vote. James Comey is doubling down on making the FBI look like buffoons by reclosing the investigation he reopened a week ago with, once again, no charges for Hillary Clinton. (more…)

Bill Holter and Jim Sinclair Get Ready-Crash After Election

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Recently, I was fortunate enough to be interviewed by Jim Sinclair and Bill Holter at JSMineset.com. They wanted to get my take on the state of journalism, or the propaganda mainstream media. They also wanted to get a read on what many of my guests have been saying over the past several months about what is coming for the economy.

WikiLeaks Documents Coming From US Intelligence Not Russia, MSM & Democrat Party Dying

By Greg Hunter’s USAWatchdog.com (WNW 260 11.4.16)

By Greg Hunter’s USAWatchdog.com (WNW 260 11.4.16)

There are numerous reports on the alternative media of documents being given to WikiLeaks to counter the corruption and lawlessness of the Obamas and Clintons. AG Loretta Lynch has been reportedly blocking an FBI investigation into the Clinton Foundation that many say is a “global charity fraud” and a “huge criminal conspiracy.” The leaked emails and documents show corruption between the Justice Department and Hillary Clinton. These documents and emails also show a grand cover-up of the true treason that has taken place in the highest offices of the U.S. government.

Money Riots Possible in Next Economic Crash-James Rickards

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Three time best-selling author James Rickards says the next economic crash will lock you out of your money. Rickards has a new book titled “The Road To Ruin.” Rickards paints a scary possible scenario for what is coming and contends, “The global elites have a secret plan for the next financial crisis.” Rickards goes on to explain, “They are going to lock down the system when the crisis hits. In 1998, everybody wanted their money back, and they printed the money. In 2008, everybody wanted their money back, and they printed the money. In 2018 or sooner, everyone is going to want their money back, but they are not going to print the money. They are going to tell you that can’t have it. They are going to lock down the system and close the banks. Money market funds are going to suspend redemptions. Stock exchanges are going to be closed, and they’ll say it’s ‘temporary.’ That’s what Nixon said when he closed the gold window in 1971. . . . They will do it to buy time until they can flood the market with SDR’s (Special Drawing Rights IMF currency).”

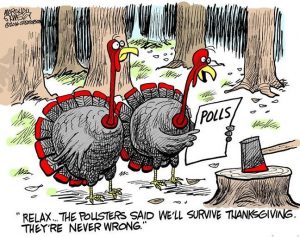

Trump Wins By Landslide-Polls 100% Manufactured-Clif High

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Internet data mining expert Clif High says the “naked data” on the Internet shows Trump winning the 2016 Presidential election by a “landslide.” High explains, “You can do a search on YouTube that brings back a list of primary speeches by both candidates. I am not talking about Fred Smith’s copy of a video he made of Trump. I am talking about a speech took officially of Trump, and they released it officially. If you take just those, you can see you’ve got Hillary Clinton on one side with 2,165 views, and Trump on the other side with 775,653 views. So, that is not anecdotal. This is a very crude level of statistical analysis, but it is nonetheless statistical analysis, and it is very pointed because it is extremely self-selecting. There is nobody watching you when you choose to watch something on YouTube. So, there is no peer pressure or external person polling you. . . . It’s what I call a very naked data set because there is no pressure on an emotional level on people.”

USA Actually Bankrupt Now-Laurence Kotlikoff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned Boston University Economics Professor Laurence Kotlikoff is running for President with a write-in campaign. He says we need an economic expert, not a politician, to fix our severe financial problems. Dr. Kotlikoff explains, “Our democracy is in trouble. We have 14% of the electorate who have chosen Hillary Clinton for us to vote for, and a different 14% have chosen Trump to vote for. The vast majority of the population realizes neither Clinton nor Trump are qualified. Just on the economic front, these folks have no idea how fiscally sick our country is. (more…)

Trump is Molotov Cocktail You Can Throw on Crooked System-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Investment advisor Catherine Austin Fitts is backing Donald Trump. Fitts explains, “Michael Moore said in an interview that Donald Trump is a Molotov cocktail you can throw on the system. Interestingly enough, if you look at the federal system, it has a negative return on investment to taxpayers. If you believe you can never fix that, then throwing a Molotov cocktail into the middle of that is the most intelligent thing you can do for productivity. It was when I wrote the theme for productivity for the second quarter wrap-up I realized . . . I may have profound disagreements with Trump’s style, but I can throw the Molotov cocktail (voting for Trump). . . . I was going to vote for Gary Johnson, but in the second debate when Trump said I will appoint a special prosecutor, I stood up and cheered. (more…)

MSM Lies for Hillary, Russia US Closer to War, Economic Update

By Greg Hunter’s USAWatchdog.com (WNW 259 10.21.16)

By Greg Hunter’s USAWatchdog.com (WNW 259 10.21.16)

The mainstream media (MSM) is totally lying to the public about everything from voter fraud to Wiki Leaks. There are many current examples of possible voter fraud such as the recent revelation by the Pew Center that 24 million U.S. voter registrations are “significantly inaccurate.” Pew Center also says there are 1.8 million dead people still on the voter rolls. The other part of the MSM lie is done by omission. The MSM is simply not covering major news stories that are negative to the Clinton campaign. I’ve said it before and I’ll say it again, this is pure fraud on shareholders and the public by so-called news organizations that are really functioning as Democrat propaganda shills.