Latest Posts

All Paper Will Burn-Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Macroeconomic analyst Rob Kirby has wealthy global connections. He says forget about the recent takedown in precious metals because his sources don’t think anything paper will survive the upcoming financial meltdown. Kirby explains, “The commentary that I get from people with much higher pay grades than me is that, in the end, the only thing that will stand is physical metal gold and silver. They say all paper will burn.” Kirby goes on to confirm that “stocks, bonds and pensions” will be toast.

MSM Committing Massive Fraud, Economic Red Alert, WWIII Update

By Greg Hunter’s USAWatchdog.com (WNW 258 10.14.16)

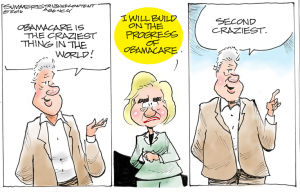

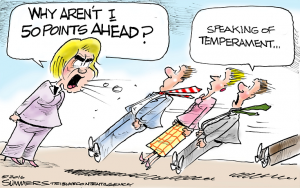

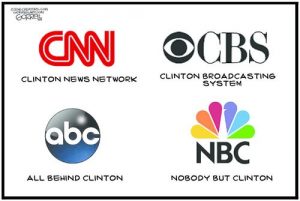

The Wiki Leaks slimy revelations about the DNC and the Clintons’ emails prove the mainstream media (MSM) is committing massive fraud on shareholders and the public. Organizations such as the New York Times, Washington Post, NBC, CNBC, Politico, The Boston Globe and many others hold themselves out as news organizations and fair arbiters of the truth, when they are really just one sided political hacks. I predict the public will reject the MSM in droves, and share prices will plunge. Look out for shareholder lawsuits in 2017.

Deutsche Bank Walking Dead-Bill Holter

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer Bill Holter says if you want to know how bad the global financial problems are in the world, start with Germany’s Deutsche Bank (DB). The problems keep mounting, and it’s been all downhill since June when the International Monetary Fund (IMF) deemed DB as the most systemically dangerous bank in the world. Holter warns, “Deutsche Bank is dead. It’s a walking dead institution. . . .Just the fact that there is a debate, whether or not there’s a problem, means they’re dead. Once you start talking about a financial institution and whether or not they are solvent or not, it doesn’t matter. The sharks are going to come into the water.”

Worst Crash of All Coming-Mike Maloney

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Gold and silver expert Mike Maloney has been producing an internet series called “The Hidden Secrets of Money.” His latest is episode seven in this ongoing series, and it gives a stark warning about “The USA’s Day of Reckoning.” Maloney explains, “Watch episode seven if you want to see the future. I was very accurate in predicting the crash of 2008 and the consequences of it. I believe the rest of my predictions that did not come true have not come true—yet. They are about to. Episode seven is the USA’s day of reckoning. . . . It’s going to be devastating for most people. . . . I believe there is going to be an enormous wealth transfer. It is up to every individual whether that wealth is transferred away from them or towards them. Sometimes the wealth transfer goes from 100 people to one or 1,000 people to one. This time, it’s going to be hundreds of thousands to one. There are going to be very few big winners and a whole lot of losers.”

US/Russia Very Close to War, Global Debt Out of Control says IMF and MSM Political Hacks

By Greg Hunter’s USAWatchdog.com (WNW 257 10.7.16)

By Greg Hunter’s USAWatchdog.com (WNW 257 10.7.16)

The U.S. and Russia are a lot closer to war in Syria than the mainstream media (MSM) would like you to think. One top U.S general said that war would be “extremely lethal and fast” and he said it was “almost guaranteed.” Russia threatened to “shoot down U.S. aircraft over Syria. Meanwhile, Secretary of State John Kerry has broken off all diplomatic relations with Russia in Syria.

Controlled Demolition Coming-Not a Crash-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned investment advisor Catherine Austin Fitts says there is $9.3 trillion missing from the Department of Defense in 2015 alone. Fitts explains, “This is a phenomenal number and a phenomenal amount of money. This is the cut and run. All this money has been disappearing from the federal government. . . . I’ve been demanding to know what banks and contractors are liable for the systems. We are talking about transactions that are in violation of the Constitution and the laws related to financial management. . . . As I have described many times, they’re using financial securities fraud, both mortgage securities and, I believe, government securities to basically shift all the assets out (of the country). I think you’ve got a game going on, and the Fed is accommodating all sorts of securities fraud. Then, the money is being pulled out in a variety of ways.”

October Surprise Coming-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Trends researcher Gerald Celente sees an “October surprise” coming for the economy, terror or war. Celente contends, “Even that sellout, Mario Draghi (Head of the European Central Bank-ECB) the former head of the Goldman Sachs European division, now playing the ECB President, came out and said the central banks can’t do anymore, and they are looking now for government stimulus. That’s going to be the new game. What I am saying is it’s collapsing. Look what happened in Japan a week and a half ago. Everybody was waiting for the bank of Japan to play another card, and they had none to play. So, look for October for things to go bad. (more…)

US and Russia Close to War, Global Economy on Brink of Collapse, NBC Biased for Clinton

By Greg Hunter’s USAWatchdog.com (WNW 256 9.30.16)

By Greg Hunter’s USAWatchdog.com (WNW 256 9.30.16)

The United States is reportedly suspending diplomacy with Russia, and it also says it’s preparing military options in Syria. The U.S. has asked Russia to stop its bombing campaign in Syria, and Russia will not agree to do so. State Department spokesman John Kirby says, “More Russian lives will be lost, and more Russian aircraft will be shot down.” This is a serious escalation between Washington and the Kremlin, and the only outcome to this is a wider war in Syria that could mean an eventual global war between America and Russia that would, no doubt, involve all allies as well.

Repeat of 2008 Financial Crisis Coming-Only Worse-Peter Schiff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In Monday night’s first Presidential debate, Donald Trump criticized the Federal Reserve’s handling of the economy and warned, “. . . if you raise interest rates even a little bit, that’s going to come crashing down. We are in a big, fat, ugly bubble.” Money manager Peter Schiff explains, “Trump says if we raise rates, a lot of bad things are going to happen. Then, he criticizes the Fed for keeping rates low. So, which is it? He’s trying to have his cake and eat it too. What Trump has to explain is low interest rates don’t help the economy. Low interest rates are one of the biggest headwinds to the economy because all they do is inflate asset bubbles and prevent legitimate economic growth. (more…)

Standing on House of Cards-Jonathan Cahn

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Rabbi Jonathan Cahn, a Messianic Jew, is out with a third best-seller in a row called “The Book of Mysteries.” In the “Harbinger,” he has said things like the attack on America on 9/11 was a warning. Now, Cahn is out with some new warnings. On the economy, Cahn says, “We are still on a house of cards, standing on a house of cards. There’s debt, and all the propping up, and actually, since the Shemitah of 2008, the world economy has never recovered. It’s been paralyzed. The growth has been paralyzed since 2008, and that’s with all the lowering of rates, which means we have no room for anything . . . . We are in the most dangerous months of the stock markets. . . . We are right now . . . in the period following the seventh Shemitah, which is the Jubilee period. It doesn’t have to happen, but it means the same dynamics (market crash) can happen as well into this period. (more…)

Teetering on Global War in Middle East, Obama Failed Black Community, Economic Update

By Greg Hunter’s USAWatchdog.com (WNW 255 9.23.16)

By Greg Hunter’s USAWatchdog.com (WNW 255 9.23.16)

The ceasefire is basically over in the Syrian War after less than a week. The U.S. reportedly bombed a known Syrian military position five days into the cease fire and killed at least 83 Syrian soldiers and wounded more than 100. The U.S. says it was just a “mistake,” but Russia says this “mistake” came with four U.S. warplanes and an attack that lasted 15 minutes. Now, trust between the U.S. and Russia is gone, and diplomacy is largely off the table. Is a wider Middle East war not too far behind? In a word, yes.

We Are Headed For War-Paul Craig Roberts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former Assistant Treasury Secretary (in the Reagan Administration) Dr. Paul Craig Roberts has a stark warning for the world. Dr. Roberts says, “We changed our nuclear doctrine. It used to be we used nuclear weapons only in retaliation. There was no first use, but the George W. Bush regime, the Neocons, changed our nuclear doctrine. It’s now a preemptive first strike. So, this tells both the Russians and Chinese they could get a preemptive first strike. Then, we tell the Russians we are putting missiles right on your border. You won’t have two minutes’ notice. They can’t accept that. It’s too much risk from a crazy country (U.S.) that won’t negotiate with them. . . . So, we’re headed for war. I think the only thing that would block it is if one or two of the European governments realize that they have nothing whatsoever to gain with a conflict with Russia. . . . The only thing they could do to prevent a nuclear war is to pull out of NATO.”

Stock & Bond Bubbles Much Worse Than 1929-David Stockman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Economic expert and best-selling author David Stockman offers a dire view of the deep financial trouble America faces in his new book titled “Trumped!” Stockman warns, “I think we are on the very edge, but what is different this time and makes it scarier . . . is I believe the central banks that ruled the roost have gone from one extreme to the next and done unfathomable things like negative interest rates on $13 trillion of bonds around the world, monetization of the debt, and bond purchases that are staggering such as $90 billion a month in Europe. . . . So, this time, as the phrase goes, they went all in. They have violated every principle of sound money and sustainable finance that mankind has ever learned about over many centuries. They have taken us to the edge, but they are out of dry powder. I think it’s pretty obvious that they can’t go any deeper with subzero interest rates, or negative interest rates. . . . If they tried this in the United States, I think there would be a huge political uprising. . . . They are out of dry powder and out of tools, and therefore, the financial markets of the world are more vulnerable, maybe even more so than in 1929. You are talking about a bond bubble like never before imagined or conceived, and the stock market is the same way as well as derivatives.”

Catastrophic Bond Market Collapse Approaches-Michael Pento

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Michael Pento wrote a book a few years ago warning of “The Coming Bond Market Collapse.” All the signs say this calamity is very close. Pento explains, “Global central bank balance sheets have risen from $6 trillion in 2007 to $21 trillion today. That’s the increase in the size of central bank balance sheets. . . . I can prove to you when this bubble breaks, it’s going to be disastrous. . . . Just that they (European Central Bank-ECB) didn’t hint at expanding QE and look at what it has rendered us. That’s proof positive that everything that has happened since the 2008 collapse, that it’s just been artificial and ephemeral in nature. Once central banks even hint at pulling back from their QE programs and ZIRP and NERP go away, bonds will crash, and when those sovereign bonds crash on a global basis, it’s going to take everything else down with it concurrently.”

Rising Rates: Financial Extinction Level Event Coming-Michael Krieger

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Wall Street analyst Michael Krieger says the key to predicting this market is to watch interest rates. Krieger explains, “Do I think that there is going to be a huge U.S. currency devaluation next month? No I don’t, but on the flip side, there is going to be some sort of financial calamity. What I am looking at personally is interest rates. I’m 38 years old. My entire life, basically, we’ve been in a downtrend on sovereign yields. So, it’s basically been this 40 year bond bull market. It’s a secular bull market my entire life. When that reverses and interest rates start to rise, and it’s probably not going to be because the Fed is raising rates, when rates naturally stop going down, and they start going up, that’s going to be a financial extinction level event. That’s going to be the most important event in all of our lives because it’s going to be the end of a 40 year bond bull. (more…)