Latest Posts

Economy Rotten-Like Apple Sales, Russia US Moving Towards Conflict, MSM Unfair to Trump

By Greg Hunter’s USAWatchdog.com (WNW 236 4.29.16)

By Greg Hunter’s USAWatchdog.com (WNW 236 4.29.16)

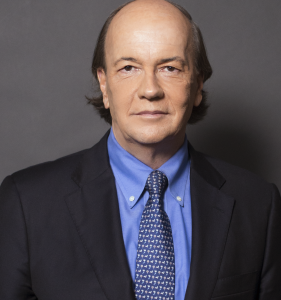

The economy is rotten just like Apple iPhone sales numbers. For the first time in 10 years, Apple reported its first quarterly sales drop for their popular iPhone. No, it’s not the end of the world, but it’s a sign there is trouble in the economy. Sure, Facebook beat its earnings projections, but they don’t make anything. Other bad news includes new home sales are down. Manufacturing numbers from the Dallas Fed are down. Consumer sentiment numbers from the University of Michigan are down. Spending is down. Retail sales are down. GDP in the first quarter came in at a paltry .5%. Economist John Williams says that number will be revised down and will probably turn negative. Williams says we are already in a recession or soon will be. Both Bo Polny and Greg Mannarino say the same thing: we are getting to a point where they can no longer hide the bad economy, and there really is no recovery after all.

Dollar Selling Panic Coming-John Williams

By Greg Hunter’s USAWatchdog.com

Economist John Williams has long predicted the $16 trillion in U.S. dollar assets held outside of America will be sold in a panic. The time draws near for that scenario to unfold, and Williams explains, “When people start selling the dollar, or dollar denominated assets, you will see the value of the plunge. We have had a remarkable rally in the dollar since mid-2014, and it is up over 30%. It is going to be going down by more than that, and we are going to be headed to new lows. We have the waffling of the Fed and the beginnings of the perception that the economy is in serious trouble, which generally would be negative for the dollar. We have started to see selling pressure on the dollar. It has been inching lower. It’s down year to year now. . . . The selling is going to intensify, not only with large central banks, but with corporations that will be beginning to dump their Treasury holdings. . . . Nobody wants to be the last one out the door when you have a panic like this. It’s not a panic yet, but the potential certainly is there.”

COMEX Default Is Coming Soon-Bill Holter

By Greg Hunter’s USAWatchdog.com (Special Release)

By Greg Hunter’s USAWatchdog.com (Special Release)

According to financial writer Bill Holter, we are getting to the end of the gold and silver price suppression game. Holter contends, “Because the inventories are so small, silver and gold registered categories (at COMEX) total about $1.2 billion. That’s nothing in today’s world. That’s less than one day’s interest the U.S. pays on its debt. I don’t see this going for a long time because inventories are so small. . . . This whole suppression game on gold and silver was brought about to protect the reserve currency, the dollar, because gold is a direct competitor with the dollar. If the silver market blows up, and I shouldn’t say if, it’s when the silver market blows up, that’s going to blow the gold market up, and that is basically going to expose the fact the West is a fraud, that the gold and silver markets were a fractional reserve Ponzi scheme. That’s going to blow confidence, and you are going to see derivatives blow up all over the world, and markets will be closed in a couple of days.”

Saudi Arabia US Friction, Economic Update, China Gold Fix and Fraud Ignored by MSM

By Greg Hunter’s USAWatchdog.com (WNW 235 4.22.16)

By Greg Hunter’s USAWatchdog.com (WNW 235 4.22.16)

The President was in Saudi Arabia in what the White House claims was a trip to “clear the air.” I really don’t know how you clear the air with the friction between the U.S. and the Kingdom. There is ISIS, which the Saudis are funding along with the U.S, but that’s changing because it appears the U.S. is increasing its attacks on ISIS. There is the bi-partisan Senate bill that will release the missing 28 pages of the 9/11 Commission Report that supposedly implicates Saudi Arabia. It will also allow the families if the 9/11 attack to sue Saudi Arabia if it was involved. The Saudis said they would dump a trillion dollars in U.S. assets if that becomes law. President Obama says he will veto. The House and Senate may have enough votes in this election year to override that veto as big time people in both parties are pushing this. The President is also basically telling Arab allies in the Middle East that they should learn how to share the region with Iran. So, I really do not know how they can “clear the air” with zero resolutions.

Biggest Financial Bubble in History Will Engulf World-Gregory Mannarino

G reg Hunter’s USAWatchdog.com

reg Hunter’s USAWatchdog.com

Financial analyst and stock trader Gregory Mannarino says pay no attention to the rising stock market because it is “fake.” Mannarino says, “The manipulation is absolutely epic. We have never seen anything like it. There is going to be a horrible price to pay for this. Why? Because it will correct to fair market value. There is no doubt in my mind that all of this will correct to fair value. All these distortions can only go so far, and we know this. We have seen this throughout history without exception. . . . We have the biggest bubble in the history of the world, and that is the debt bubble that has re-inflated this stock market bubble, it will burst. It will burst because every single financial bubble in history, without exception, has burst before it. This one is going to burst too, but this one is going to engulf the world. It’s going to be unlike anything we’ve seen in the history of the world, and there is no doubt that the middle class will no longer exist when this occurs. It’s going to be a massive transfer of wealth to these financial institutions that are going to go short all of this. It is legal theft on a magnitude and scale that is unimaginable.”

Tsunami of Dollars Coming Back to America Soon-Rob Kirby

By Greg Hunter’s USAWatchdog.com (Special Release)

By Greg Hunter’s USAWatchdog.com (Special Release)

Emergency Fed meetings at the White House, the launching of new gold trading market at the Shanghai Gold Exchange, revelations Deutsche Bank admitting it manipulated gold and silver prices, China starting its own global payment system. These may all seem unrelated, but according to macroeconomic researcher Rob Kirby, they are all connected. Kirby explains, “With China and their upstart CIPS, which is the China Interbank Payment System, China appears to be on the verge of merging their interbank payment system with SWIFT. My gut is telling me that this will very much marginalize America as the main processor of global payments. This, in my view, will embody very possibly a global reset in terms which currency is going to be the world’s reserve currency. I have a very sneaking suspicion that when China merges with the SWIFT system, I believe there is a very strong possibility that China will back their currency with gold. I do believe this is why China has aggressively been buying physical gold for the past 10 or 15 years. (more…)

Clinton Email Server Greatest Intel Disaster in History-Scott Uehlinger

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former frontline CIA Officer Scott Uehlinger says Hillary Clinton clearly broke the law with her private unprotected server. Uehlinger explains, “What the Clintons rely on is most Americans don’t really understand the security procedures. So, they can throw up a lot of smoke and mirrors that confuses people and makes them think that this was not so much of a problem. But people in the military and people in the intelligence community understand this better, and certainly it is even worse than it appears. . . . The fact that she set up a private server, in and of itself, means she is guilty of a felony right there. Obviously, by having a private server, she was conspiring to evade her signed sworn statements that she would uphold secrecy agreements. The fact that she simply established that (private server) regardless of what was on it, she intended to go around and circumvent the law. Now, we had more than 100 highly classified emails on the server, and the fact that this server is absolutely vulnerable to any Chinese, Russian or Iranian hacking, this is the greatest disaster or mishandling of classified information at the upper levels of the U.S. government in history. There is no question about it.”

All-Out Assault on All Life on Earth-Dane Wigington

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Dane Wigington, founder of the global climate engineering informational website, GeoengineeringWatch.org, says climate manipulation, commonly referred to as chemtrails, is the number one factor in destroying the planet and much of humanity. Wigington contends, “We have now enough data to prove that the greatest destructive factor, by far, on the ozone layer is geoengineering (chemtrails). It’s disrupting the hydrological cycle and disrupting the planet. We have governmental agencies that are set up to hide this fact from the population or to mask it. . . . We are seeing UVB levels that are a 1,000 % more than we are being told. . . . We have all the data being skewed to hide the severity of what is happening from the population for as long as possible. . . . We have friends behind the curtain that know this is going on and want it to stop. . . . I truly believe we have a growing number of allies behind the curtain that want this to stop as bad as we do. Let’s hope that is true and our allies grow because this is truly an all-out assault on all life on earth. How long can we hold our breath? Any breath we take is laden with these materials. We absolutely know it from lab testing. It’s not speculation or theory or conjecture. We see the human health statistics that are associated with this. The massive Alzheimer’s, dementia, autism and COPD. . . . Anyone who looks up, they can see how incredibly obvious this monstrosity is in our skies.”

Iran War Drums, Panama Papers Update, Economy Weak and Sick

By Greg Hunter’s USAWatchdog.com (WNW 234 4.8.16)

By Greg Hunter’s USAWatchdog.com (WNW 234 4.8.16)

Lots of news about Iran this week being overlooked because of the so-called Panama Papers. Iran has issued a warning to the U.S. not to interfere with its ballistic missile program. Iranian officials say any attempt to interfere with its weapons program would be crossing a “red line.” Iran also wants to improve the destructive power of its warheads which would also help in detonating a nuclear armed missile. Iran has recently test fired ballistic weapons and continues to develop them. An Iranian General was quoted this week on Iranian state run press, as saying “The reason we designed our missiles with a range of 2000 km is to be able to hit our enemy the Zionist regime from a safe distance.” The Obama Administration is now talking about putting sanctions on Iran because it continues to develop ballistic missiles. Might I remind you, the Iran deal to curtail its nuclear program was not signed by Iran. By the way, the U.S. Navy just intercepted a load of weapons going to the Iranian backed rebels in Yemen.

Biggest Collapse Ever-Get Gold Now-James Rickards

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial expert and best-selling author James Rickards says another economic collapse is coming. Rickards contends, “It’s very clear, and you can prove this scientifically. The next collapse will be bigger than anything in history or maybe since the Bronze Age or the fall of the Roman Empire. Why do I say that? . . . We have these things coming together. The system is larger. That means systemically it is exponentially more risky. The central banks don’t have any dry powder, and it is just a matter of time before the collapse comes. In 1987, the stock market fell 22% in one day, not in a week or a month, but one day. Today, that would be the equivalent of a 4,000 point drop. . . . In 1998, the Long Term Capital crisis shut almost every stock and bond exchange in the world. In 2000, the Dot Com; 2007, the mortgage crisis; and in 2008, you had Lehman and AIG (failures). In other words, these events are not rare, and they happen every three, four or five, six or eight years. It’s not like clockwork, but nobody should be surprised if it happened tomorrow. We’ve got the systemic scale. We’ve got exponential increase in risk. The central banks are out of dry powder, and it’s been eight years since the last one. It’s just a matter of time.”

Crash of Biblical Proportions Coming in 2016-Bo Polny

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Market cycle analyst Bo Polny says don’t bet on the U.S. dollar or the stock market to hold their value in 2016. Polny contends, “The dollar is going down with the stock market. It did in December of 2015. It did in August of 2015, and the dollar is falling right now again. As soon as the stock market gets started to the downside, the dollar is going to go with it again. So, the dollar is going to go down with the stock market with this next meltdown. What’s going to end up happening when they hit the cycle low is what they did the last low (2009) and had QE 3. Guess what, that’s going to mean (in the next crash) QE 4. Then, that will mean they will be printing money like crazy. Let’s say there is a 20% drop on the dollar, even 10%. Everybody goes to sell the bonds. If the 10-year is only giving 1.7% yield, if the dollar drops 10%, they are losing 8%. If the dollar drops 20%, they are losing 18%. So, all these countries will be losing on billions or trillions of dollars of bonds, and then you will get a fire sale on bonds. Everyone will be dumping the bonds because they will be trying to get rid of them as fast as possible. That is what’s going to happen when they announce QE 4.”

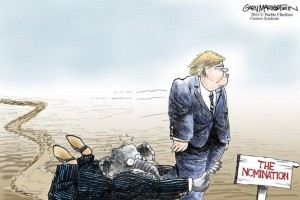

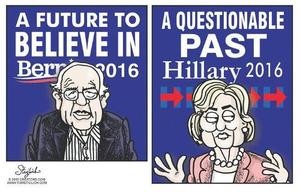

Clinton FBI Investigation Update, MSM Unfair to Trump, Syria Update

By Greg Hunter’s USAWatchdog.com (WNW 233 4.1.16)

By Greg Hunter’s USAWatchdog.com (WNW 233 4.1.16)

News broke this week that the FBI is getting ready to interview top aids to Democratic front-runner Hillary Clinton. It is also reported that Clinton herself may also be interview by the head of the FBI, James Comey. Comey is taking point on the Clinton investigation. This is not the first time Comey has been a part of an investigation into the Clintons. Early in his career, Comey was part of the Whitewater case. Time Magazine reports, “Comey and his fellow investigators concluded, (What the Clintons did) . . . ‘constituted a highly improper pattern of deliberate misconduct.” Comey is a former top federal prosecutor, and I think this case is far from closed.

Fraud Key Profit Center for Wall Street-William Black

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former top bank regulator Professor William Black says there is no hiding the cesspool that is Wall Street. Dr. Black says, “People on Wall Street agree that the system is rigged. You get them into a bar, they will say the same thing. When Bernie Sanders says the business plan of Wall Street is fraud, that’s simply an accurate, objective fact. That is their key profit center . . . and it’s not just here. The United States has been in a competition with the United Kingdom (UK) for decades now on this race to the bottom with the City of London and Wall Street. The UK Parliamentary Inquiry, which is run by the Tories, found as a fact that . . . all of the retail profits of the largest banks in the United Kingdom came from the deliberate or ‘mis-selling’ of products to customers. . . . They deliberately ripped off entrepreneurs. They deliberately ripped off their customers, and the Tories found it represented all of their retail profits. . . . You are talking in the range of $80 billion.”

Criminal Bankers Control US Government Push War-Paul Craig Roberts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Assistant Treasury Secretary in the Reagan Administration, Dr. Paul Craig Roberts, contends it is no accident why bankers do not get jail time for constantly committing fraud by stealing documents and committing fraudulent, criminal insider trading and market manipulations. Dr. Roberts explains, “Look at Edward Snowden and Julian Assange. They claim they stole documents, and we are determined to destroy them. One of them is hiding out in Russia, and one of them is hiding out in the Ecuadorian embassy in London. This again shows the immunity of the banks. They are not held accountable because they are in control. Who controls the Fed? Who controls the Treasury? Where do all the Treasury Secretaries come from? They come from the big New York banks. Look at the financial regulatory agencies that are supposed to be regulating the banks. They are filled with executives from the banks. The banks control the government. There isn’t a government, there’s the banks. . . . We have the entire economic policy in the United States concentrating on saving five banks. We had 10 million people who lost their homes, and nothing was done for them, but five banks are saved.”

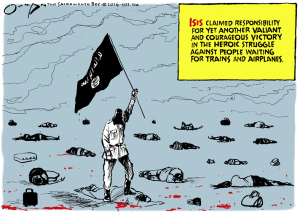

ISIS Terror in Belgium, Syria Peace Deal on Hold, US Fights ISIS in Iraq, Clinton Email Update

By Greg Hunter’s USAWatchdog.com (WNW 232 3.25.16)

By Greg Hunter’s USAWatchdog.com (WNW 232 3.25.16)

The top story is the carnage and terror in Belgium. ISIS is claiming responsibility. Even though there are suspects on the loose and anti-terror raids happening, there is still little known about how the size of an attack was pulled off. ISIS says more attacks are on the way. So, this is not the end, but the beginning of a long fight with radical Islam. Analysis out this past week by the Gatestone Institute, an international policy think tank, says people in Europe are not really grasping what kind of a fight they have on their hands. They say it comes down to “the ignorance, willful blindness and sheer incompetence” when it comes to Islam and “political Islam.”