Latest Posts

Free Markets Have Been Completely Obliterated-Michael Pento

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Michael Pento says, “We live in a world now where free markets have been completely obliterated. You can’t find a free market left on the planet, and that goes for commodities, equity markets, currencies and particularly goes for the bond markets. The bond markets now do not represent any vestige of reality whatsoever. That should be apparent to anyone with a pulse or an IQ better than a retarded ameba.”

We Are in a Financial Meltdown-Nomi Prins

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Best-selling author and financial expert Nomi Prins says, “We are in a financial meltdown. I said 9 or 10 months ago, it hadn’t happened yet, but it should happen because of the instability of a system that is supported by central bank maneuvers and not really anything organic and leveraging and reaching for yields in places like oil and natural gas and other places on the virtue of cheap money. . . . It kind of boggles the mind. This QE is epic. It’s historic. It is larger and more insane that ever in history. It is pan-global. The reason that things have kind of stayed in place is because there was enough cheap money coming into the system and enough corporations getting it . . . that really kept the markets artificially buoyed by virtue of this cheap money coming in. (more…)

WNW-173 Swiss Franc & Euro Decouple, Russia Cuts Gas, Road to WWIII

By Greg Hunter’s USAWatchdog.com (1.16.15)

By Greg Hunter’s USAWatchdog.com (1.16.15)

My top story is Switzerland and the surprise move to remove its cap against the Euro. This cap kept the two currencies roughly the same value–but not anymore. The move was such a surprise that even IMF Chief Christine Lagarde admitted the move by Swiss National bank (SNB) caught her off guard. It also caught currency traders by surprise as the Swiss franc soared by as much as 30%. Gold also spiked on the news. (more…)

Major War Exploding Soon-Charles Nenner

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned analyst Charles Nenner says the biggest cycle he sees coming is the war cycle. Nenner says, “For the last couple of years, I have been saying, in the second decade of the new century, we will have a big war. Why, because there is a 100 year cycle. If you go back 100 years to the first world war in 1914 to 1918, that led to the second world war. That was actually one big war with peace in the middle. It you go back 100 years before that, you get Napoleon. . . . (more…)

European Bank Runs Could Come to America-Laurence Kotlikoff

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Boston University Economics Professor Laurence Kotlikoff says Greece is, once again, in financial trouble and that could set off another global financial calamity. Dr. Kotlikoff contends, “So, you have the same problem. You have a country that is fiscally unsustainable, and they haven’t really been able to get out from under that situation. . . . It sets up a situation where you could have runs on other banks like in Italy, Spain, Portugal, and that could spread to other banks in other countries, including France and Germany. (more…)

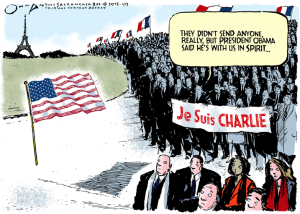

WNW 172-Islamic Terror Spreads West, Oil Price Plunge, Declining Economy

By Greg Hunter’s USAWatchdog.com (Weekly News Wrap-Up 1.9.15)

By Greg Hunter’s USAWatchdog.com (Weekly News Wrap-Up 1.9.15)

The Head of MI 5, British security, is sounding the alarm that Islamic terrorists from Syria are planning more attacks on the West. Andrew Parker says al-Qaeda fighters from Syria are planning mass casualty attacks against the West. He was not specific on the targets, but an attack on the United Kingdom was highly likely according to Parker. (more…)

Oil Derivatives Explosion Double 2008 Sub-Prime Crisis-David Morgan

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Precious metals expert David Morgan says the plunge in oil prices is not good news for big Wall Street banks. Morgan explains, “The amount of debt that is carried by the fracking industry at large is about double what the sub-prime was in the real estate fiasco in 2008. In summary, we’re looking at an explosion in potential that is greater than the sub-prime market of 2008 because, number one, oil and energy are the most important sectors out there. (more…)

Oil Derivatives Explode in Early 2015-Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Gold and derivatives expert Rob Kirby thinks crashing oil prices are going to lead to a 2008 style financial meltdown. This is not a maybe–a market explosion is going to happen in 2015. Kirby contends, “Oh yes, without a doubt, it will. It must because the income crude oil sales generate are used to pay the interest on the debt. (more…)

Happy New Year 2015!!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I can’t believe 2014 is done and gone. I said in 2014 that there would be some sort of dislocation and that would flow into 2015. I was not sure what it would be, but now, I think the crash in oil prices was that event. Oil prices were cut in half in a matter of months. Now, the oil derivatives and debt underpinning the energy sector are coming under pressure. (more…)

Dot-Com Style Crash Coming-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial analyst and newsletter writer Rick Ackerman is no stranger to contrarian calls. At the beginning of 2014, he said forget about rising interest rates because they were going down. They did. Now, Ackerman predicts rates will go lower and will stay low for a long time. Ackerman explains, “My perspective is that of a deflationist, and it’s been easy for me to see. Even though we have inflation in certain things . . . the much bigger picture is deflationary. It is that huge $1 quadrillion edifice the central banks are fighting to keep from imploding. (more…)

2015 Forecast-Manipulation, Depression and War-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Trends researcher Gerald Celente predicts one of his top trends in 2015 will be manipulation–of everything. Celente explains, “It’s the grand manipulation of the markets and the news, and it just keeps spreading. There is manipulation of the gold markets, and we know there is manipulation in the Forex market; we are not making this up. We are talking about $5.3 trillion a day. The markets are rigged. (more…)

Merry Christmas

Financial Fantasy Land Continues to Prevent Collapse-Bill Holter

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer Bill Holter says the record stock market does not reflect reality. Holter explains, “This will go on until it doesn’t. Very quietly, this past week, they postponed the “Volcker Rules” for the banking system. The reason they did that is they can’t allow the Volcker Rule to come into place. That would require increased capital ratios. It would bring mark to market back. We live in a financial fantasy land, and they need to continue the fantasy to prevent collapse.”

Central Banks Secretly Controlling all Futures Prices-Chris Powell

By Greg Hunter’s USAWatchdog.com (Early Sunday Release) Chris Powell, Secretary/Treasurer of the Gold Anti-Trust Action Committee (GATA), says recent bombshell evidence shows intense central bank “interventions” at the CME Group, which handles $1 quadrillion ($1,000 trillion) worth of business annually. Powell explains, “The greatest documentation that’s come out recently has been filings by the CME Group which operates the major futures exchange in the United States. They filed a letter with the U.S. Commodity Futures Trading Commission (CFTC) . . . showing that central banks are receiving special volume discounts for trading futures on all the major futures exchanges, not just financial futures contracts and metals futures contracts, but even agricultural futures contracts. (more…)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release) Chris Powell, Secretary/Treasurer of the Gold Anti-Trust Action Committee (GATA), says recent bombshell evidence shows intense central bank “interventions” at the CME Group, which handles $1 quadrillion ($1,000 trillion) worth of business annually. Powell explains, “The greatest documentation that’s come out recently has been filings by the CME Group which operates the major futures exchange in the United States. They filed a letter with the U.S. Commodity Futures Trading Commission (CFTC) . . . showing that central banks are receiving special volume discounts for trading futures on all the major futures exchanges, not just financial futures contracts and metals futures contracts, but even agricultural futures contracts. (more…)

WNW 171-Fed and Congress Signal Trouble, Putin Defends Russia, ISIS War

By Greg Hunter’s USAWatchdog.com (Friday 12.19.14)

By Greg Hunter’s USAWatchdog.com (Friday 12.19.14)

My top story is the economy, and I think the Fed and Congress just signaled that something is seriously wrong, and it’s going to get worse. First off, the Federal Reserve just came out and said that it was going to be “patient” when normalizing the monetary policy. I know Wall Street is jubilant and the stock market spiked on the news, but I think this is really ominous, and it is nothing to be celebrated. (more…)