Latest Posts

China Could Reprice Gold to $100,000 per Ounce-Bill Holter

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer and gold expert Bill Holter contends China has enormous debt problems, but a very good plan B. Holter explains, “China used fiat debt to build real infrastructure, and when the system blows up, the fiat debt blows away and they are left with infrastructure. Do they have 20% bad loans? They very well could and probably do. If it is true that they are going to have a debt blow up, don’t forget China has been importing big tonnage of gold for years now. Over the last five years, they have imported 9,000 tons of gold. Their way out is the old way out. The old way out was to revalue gold higher. They could revalue gold and step up and say they will pay $50,000 or $100,000 per ounce for any and all ounces for sale. You can’t say there is not enough gold. What you can say is that it’s not priced correctly to support the system. If they have an implosion of debt which leaves their balance sheets impaired, the way to recapitalize the balance sheets is to revalue the price of gold higher. It creates capital, in other words.”

Bigger Financial Meltdown Starts Before End of Year-Doug Casey

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Best-selling author and economic expert Doug Casey says another financial meltdown worse than the last one is coming soon. Casey says, “I was saying in 2007 that we were going into a gigantic financial hurricane. It hit in 2008 and 2009. For the last few years, we have been in the eye of the storm of this gigantic hurricane. Now, as we speak, we are entering the trailing edge of this hurricane, and it’s going to be much worse and much longer lasting and much different than what we saw in 2008 and 2009, and that was ugly.”

Syria War Update, Economy Tanking, No Fed Rate Hike, MSM Dem Super-Pac

Greg Hunter’s USAWatchdog.com (WNW 214 10.30.15)

Greg Hunter’s USAWatchdog.com (WNW 214 10.30.15)

The U.S. Middle East policy is getting more confusing and more dangerous. They are talking peace while sending more troops to Iraq and Syria. Iran is now also invited to the peace table in Vienna to try and find a solution to the five year Syrian civil war. The Iranians and Russians are backing Bashar al-Assad, and the U.S. wants him gone. I don’t see how this will happen peacefully when it hasn’t been done with force and more than 250,000 dead in the crisis. Is John Kerry just going to talk Assad out of power now that Russia is clearly keeping him in power by force? He’s not leaving.

Going to be a Horrible Christmas-Peter Schiff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Peter Schiff says don’t fall for the lies the Fed is telling about the so-called “recovery.” Schiff explains, “Everybody is brainwashed. They believe the Fed propaganda. The Fed has been talking about how great the recovery is and that they are getting ready to raise interest rates. None of that is true. There is no recovery, thanks to the Fed. All there is is a gigantic bubble that has prevented a recovery from taking place. The only reason the Fed is pretending to raise rates is so they can pretend the economy is strong enough to withstand that. The Fed basically can’t do that. They are going to do more quantitative easing (QE). They are going to do QE4, and all that is going to do is weaken the economy further. The economy is in worse shape than prior to the financial crisis (of 2008) thanks to the Fed.”

Uncovered Government Docs Prove Chemtrails Real-Dane Wigington

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Lead researcher Dane Wigington for the global climate engineering informational website, GeoengineeringWatch.org, says newly discovered U.S. government documents prove global climate manipulation, commonly referred to as chemtrails, is real. Not only that, but the document, that originated in the U.S. Senate, also proves weather manipulation has been going on around the world for decades. The exponential damage it is doing continues today, and Wigington explains, “With the 750 page document, how much proof do people need? In this document, it describes the need for global cooperation between nations. There are some 50 or 60 countries named in the document involved with the programs, as well, even between nations that would otherwise have hostilities between them. . . . The document also names about 10 federal agencies, about 12 major universities, and it describes the need for complete immunity from liabilities created for all those involved in these programs. They have complete immunity for the damage they have done, basically. It is an extremely damning document. How big does the elephant in the room have to be? . . . There is no question these programs are real and ongoing.”

Putin War Warning, Syria Update, Benghazi Lie, Economy Not Good and Market Rally

By Greg Hunter’s USAWatchdog.com (WNW 213 10.23.15)

By Greg Hunter’s USAWatchdog.com (WNW 213 10.23.15)

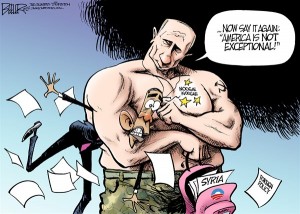

The biggest headline this week came from Sochi, Russia, and it plays right along the increasing war theme. Vladimir Putting is worried that the chances of a wider global war are increasing and not decreasing. At a global conference discussing war and peace prospects, Putin said, “We had the right to expect that work on development of US missile defense system would stop. But nothing like it happened, and it continues. This is a very dangerous scenario, harmful for all, including the United States itself. The deterrent of nuclear weapons has started to lose its value, and some have even got the illusion that a real victory of one of the sides can be achieved in a global conflict, without irreversible consequences for the winner itself – if there is a winner at all.”

Negative Rates for Next 10 Years-Buy Gold-Axel Merk

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Axel Merk says you simply must own physical gold in this risky environment. Merk explains, “Many people say why invest in a brick that doesn’t pay interest? When you look at cash paying negative interest rates on a real basis, after inflation, then a brick suddenly doesn’t look so bad anymore. . . . I would allege the Fed is all but promising to be behind the curve. Even if the Fed is trying to raise rates, emphasis on trying, they will be behind inflation. Yes, they will raise rates, but net inflation, real interest rates are going to continue to be negative. If I look out a decade from now, I don’t see how the U.S., Europe, Japan, or any other country can afford positive real interest rates.”

War Cycle Means Worldwide Trouble-Charles Nenner

Greg Hunter USAWatchdog.com ( Early Sunday Release)

Greg Hunter USAWatchdog.com ( Early Sunday Release)

Renowned financial and geopolitical analyst Charles Nenner says the war cycle that started in 2014 will take years to play out. Nenner explains, “When cycles in war and peace show we are going to have wars, then everywhere in the world you are going to have trouble. I have been saying that the major war is going to be China and Japan about the islands over there (in the South China Sea). The news today goes in that direction. So, for now, we don’t have major wars, but I think it’s not going to be stable in the world, and we are going to end up in a big war (on the scale of a world war). We predicted it would start in 2014, and it will grow slowly until 2021. Why do I think it will be China and Japan? Because the aerospace industry went through the roof, and so something was cooking over there. So, China is preparing something. It should slowly get worse during the next two years.”

Middle East & South China Sea Heating Up, Dem Debate, Economy Sinking

By Greg Hunter’s USAWatchdog.com (WNW 212 10.16.15)

By Greg Hunter’s USAWatchdog.com (WNW 212 10.16.15)

It looks like the war hot spots in the world are getting hotter. Russia continues to punish anything or anyone that is against Bashar al-Assad. Russia’s top goal is to keep the Assad regime in power, and they are doing it. Russia is flying bombing missions every day in Syria. They are reportedly very effective. The White House says what is happening in Syria is an act of desperation by Iran and Russia. Russia counters by saying that America did not have an “agenda” or strategy, and the U.S. is the weakling on Syria and stopping terrorists. The U.S. has given up on training the so-called moderate rebels in Syria. The U.S. spent millions of dollars and only trained less than a half dozen fighters. It did make a stab at supporting the anti-Assad forces which, as I have said in the past, are in large part al-Qaeda. It dropped 50 tons of ammunition to the “moderate” rebels. You know terror fighters are getting most, if not all, of that. Talk about desperate and, while we are at it, let’s add stupid, the U.S. continues to openly arm terror groups. What kind of foreign policy is this? Not a winning one, that’s for sure.

Financial Collapse to Wipe Away All the Lies-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial analyst Rick Ackerman says the mother of all market meltdowns is a sure thing. It is just a question of when, and when it starts, it will simply implode at a stunning pace. Ackerman explains, “We’re in a situation now where any day something can happen. I think that the black swan will be something like the stock market starting down for no apparent reason. That in itself would trigger the implosion, and I think the only thing that is propping up the markets now is the mentality of . . . how bad can things be if the stock market is trading within shooting distant of all-time highs? I think the stock market is the main buttress of this enormous hoax that has been going on with easing (QE or money printing).”

We’re in a New Recession-John Williams

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

At the beginning of 2015, economist John Williams predicted the U.S. economy would continue to slow down to stall speed, but it is much worse than that. Williams explains, “I’ll contend we’re in a new recession and recognized likely to be timed from December of 2014. . . . The downturn in 2007 wasn’t recognized until the end of 2008. I think by the end of this year, people will recognize the economy turned down in December of 2014. I’ll tell you why I say that. There are a couple of very solid leading indicators . . . of the broad economy. One is industrial production. Industrial production contracted in both the 1st and 2nd quarter of this year. Those are the official numbers out of the Federal Reserve. Estimations for industrial production are for continued contraction. Industrial production used to be the GDP measure. . . . Retail sales contracted in the first quarter, adjusted for inflation. Year over year growth have dropped to levels you only see in a recession. It’s the same thing again with industrial production.”

Syria War Escalates, Economic Data Getting Worse, Hillary Email Scandal Update

By Greg Hunter’s USAWatchdog.com

Weekly News Wrap-Up (WNW 211 10.09.15)

The Russians are putting on a clinic on how to destroy terrorists. They are pulling off a well-planned takedown of just about anyone who stands in the way of the Assad regime. To the Russians, there are no so-called moderate rebels—just terrorists and non-terrorists. Only in the land of the “Wizard of Oz” are there good witches and bad witches. In the real world, witches are witches, and Russia sees things much the same way. They are spending big money and deploying many assets to destroy them. The latest show of force was launched from the Caspian Sea. Russian ships fired 26 cruise missiles into terror targets such as training camps and supply dumps. You can bet the missiles cost around $1 million each and have high explosive payloads that are measured by the ton. These are very big bombs, and they traveled across 900 miles and two countries to hit their targets in Eastern Syria. NATO is stunned, and President Obama looks weak and indecisive in the Middle East. This is bad news for America’s leadership role in the Middle East and bad news for the U.S. dollar.

We Are Entering the Time of Financial Collapse Point-V the Guerrilla Economist

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“V, the Guerrilla Economist” says we have reached the point of no return in the global financial system. “V” explains, “We are entering a time which I call the collapse point. At the collapse point, there is going to be massive systemic shock. Why? Because you have one paradigm and one system being done away with, which is the dollar. It is going to be replaced by a new system. During that transition period, you cannot expect to trade anything because what do you trade it in? That’s why the Chinese are gearing up their own gold price fix. Once that collapse point happens and the world reels from the systemic shock, the Chinese gold price fix and the BRICS system will be there to fill in that vacuum. That is what’s being set up right now.”

Fed Plan is Print Money Until System Blows-Bix Weir

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer and analyst Bix Weir is not surprised by the Federal Reserve’s policies because it is all part of the long term plan. Weir explains, “The goal, since we went off the gold standard in 1971, has been to run the financial system as long and as hard as possible, sucking up all the benefits of fiat money, and there are very few attempts to slow this mess down. The idea is to put as much money as you can . . . until you have printed so much money the system implodes. This was a Nobel Prize winning paper in the 1960’s called “On the Road to the Golden Age.” It basically says if you have this freedom and flexibility with the monetary system, run it as hard as you can until people stop accepting the unbacked fiat money, then crash the system and go back to something safe and sound after it all blows up. . . . What they need is a big enough bubble so when it crashes, it take out all the derivatives, the malfeasance of the banks, the good guys and the bad guys and all the things going on behind the scenes. They need the bubble so big, and that’s what they are doing right now is blowing the bubble so big everybody feels the effect of a crash.”

Middle East Chaos &War, Clinton Email Woes, Planned Parenthood Update

By Greg Hunter’s USAWatchdog.com (WNW 210 10.02.15)

By Greg Hunter’s USAWatchdog.com (WNW 210 10.02.15)

The Middle East is spiraling into chaos and war at an alarming rate. It went from a war of words between President Obama and President Putin at the UN on Monday to the Russians bombing targets in Syria just a few days later. The Russians say they are fighting terrorism, and the U.S. says Russia is propping up the Syrian government, and it is bombing the CIA backed so-called moderate rebels. Russia has sent the world’s biggest nuclear armed submarine to the coast of Syria. It reportedly holds some 200 nuclear warheads, and its missiles have more than a 6,000 mile range. It looks like the Russians are in it for the long haul and are drafting 150,000 into the Russian military. Ash Carter, U.S. Defense Secretary, says the Russian plan is “doomed to fail.” I have been saying for years the Russians were not going to allow Assad to be removed from power. It has a strategic port on the Syrian coast in Tartus, and it has spent billions of dollars retrofitting it for nuclear armed ships and subs. Obama looks like a buffoon and failure on the foreign policy stage. Putin looks like he is taking over, and there is not much President Obama is going to do about it.