Latest Posts

Weekly News Wrap-Up 1.17.14

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

President Obama told Democratic Senators at the White House this week he is going ahead with his agenda with or without Republicans in Congress. It looks like he will be ramping up the so-called executive order on policies such as immigration and income inequality. I don’t see how a Constitutional scholar doesn’t get the way the U.S. government works. Executive, Legislative and Judicial branches of government are essentially equal and provide checks and balances. I predict this policy will backfire.

Half of Every Mortgaged Home in America Still Completely Underwater-Fabian Calvo

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Forget what you are hearing about stiffer mortgage lending requirements. It’s not true. Real estate expert Fabian Calvo says, “If you can fog up a mirror or you have a pulse, they will give you a home loan. That’s what they have done with the car loans, and that’s what they are doing with housing loans.” T (more…)

U.S. Bled to Death by China and Harvested for its Organs-Dr. Jim Willie

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Financial newsletter writer, Dr. Jim Willie, has a bleak warning for America. Dr. Willie says, “I don’t think the United States is going to be killed as the host. I think it’s going to be bled to death and harvested for its organs, and done so by China.” (more…)

Weekly News Wrap-Up 1.10.14

Greg Hunter’s USAWatchdog.com

My top story is not New Jersey Governor Chris Christie and the “lane closure gate” on the George Washington bridge between New York and New Jersey. In a word, it is “stupid.” The amount of time the networks spent on this story is outrageous. They should spend this much time on things like the NSA spying and the IRS being used as a political weapon. This is why the mainstream media is fast becoming irrelevant and untrusted. (more…)

Dr. Paul Craig Roberts-U.S. Markets Rigged by its Own Authorities–It Blows the Mind

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Economist Dr. Paul Craig Roberts says, “We have a situation where all the markets are rigged. All the markets are manipulated.” As an example, Dr. Roberts points to the stock market. Dr. Roberts contends, “We have a stock market at all-time highs, and where is the economy? There’s not one. There’s no recovery.” (more…)

2014-Crisis in Dollar Will Trigger Inflation-John Williams

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Economist John Williams thinks 2014 will mark the beginning of hyperinflation. Williams contends, “You are going to see, early on, a crisis in the dollar that will start to trigger the inflation . . . as the inflation picks up, that’s going to savage the economy, which is already in a depression. It never recovered.” Forget what you have heard about the so-called recovery. Williams says, “The consumer is in trouble. There is nothing happening to turn the economy around.” The weak economy is bad news for the dollar. According to Williams, “Anything that would suggest deficit deterioration here, and a weak economy would do that, will have a devastating impact on the dollar.” (more…)

Weekly News Wrap-Up 1.3.14

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

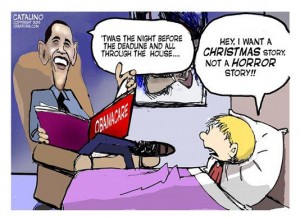

The top story is the official start of Obama Care. Look at the mainstream media headline: “Health Care sign-ups top 1 Million.” Here’s what they are not telling you. People who have turned negative on government-run health care are at record numbers. A CNN poll says 63% think the new law will make health care more expensive. (more…)

2014-Middle East Total Turmoil and Financial Crisis-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Gerald Celente is one of the world’s top trends researchers. His top trends in 2014 start with the Middle East. Iran, Syria, Egypt, Israel, Yemen and Turkey are just a few of the countries facing big problems. Celente exclaims, “You just keep going around the Middle East, it’s total turmoil.” (more…)

Weekly News Wrap-Up 12.27.13

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The top story for the last Wrap-Up of the year is the turmoil in the Middle East. The Iranian lawmakers are considering a bill that will allow the enrichment of uranium to 60%. If this passes and is approved, it will be, no doubt, a deal breaker for the recent accords agreed upon with the West in Geneva. Iran says its nuclear program is for the peaceful production of energy. The West is afraid of a nuclear armed Iran.

Colossal Fraud-There are No Free Markets-Rob Kirby

By Greg Hunter’s USAWatchdog.com (Early Release)

By Greg Hunter’s USAWatchdog.com (Early Release)

Financial analyst Rob Kirby says, “There is colossal fraud and price control going on. There are no free markets.” Kirby goes on to say, “What we’ve seen over the last six months is a ramp-up in interest rate swaps to the tune of $12 trillion . . . . What the build in these interest rate swaps is achieving, it’s stemming the rise in interest rates.” (more…)

What Happens When You Have to Admit the Gold’s Not There-Eric Sprott

By Greg Hunter’s USAWatchdog.com  (Early Sunday Release)

(Early Sunday Release)

Money manager Eric Sprott says the economy is going to tank in 2014. Sprott, who has $8 billion under management, contends, “We have created a situation, yet again, where we pulled demand forward and added debt to everyone’s balance sheet.” (more…)

Weekly News Wrap-Up 12.20.13

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Federal Reserve finally pulled the trigger on the so-called “taper”– or did it? I am talking about cutting back the Fed’s bond buying program by $10 billion a month. It is now $75 billion each and every month. Who is going to buy an extra $10 billion a month in debt? Are the banks going to take up the slack? (more…)

2014 Going to Be Better for Silver & Gold-David Morgan

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Precious metals expert David Morgan says, “I think 2014 is going to be better for both the metals.” Morgan is not “exceedingly bullish” on gold and silver, but he says, “If a black swan were to take place, all bets are off. This is where you could get limit-up days in gold and silver and never look back.” (more…)

Fed Wealth Creation Machine from Hell-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader/analyst Greg Mannarino says, “The Federal Reserve has re-inflated the bubble that burst in 2008. That bubble was inflated on purpose, and this bubble is being inflated on purpose as well.” Mannarino goes on to say that the Fed will “. . . burst these bubbles and allow big Wall Street banks to short it all.” Mannarino charges the Fed made a “wealth creation machine from hell. . . . (more…)

Weekly News Wrap-Up 12.13.13

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The latest budget deal that House and Senate leaders have come up with can be summed up by saying it really is more of the same. There are little spending cuts and little in tax increases. There is something in it for everyone to hate. The Tea Party did not get any meaningful spending cuts, and the liberal Democrats didn’t get much in the way of tax increases. Minority Leader Nancy Pelosi told Democrats, “Embrace the suck.” (more…)