Latest Posts

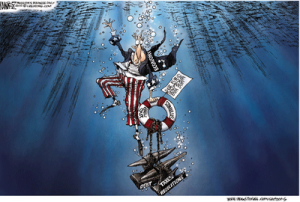

Most U.S. Cities and States Float in a Sea of Red Ink

Nearly every state in the Union and nearly every large city are facing ballooning budgets and shrinking tax revenue (confiscation). Some, such as Illinois and California, are boarding on insolvency and need to fill budget holes that are tens of billions of dollars. Tax receipts everywhere are plummeting because of the high unemployment rate that, in reality, is above 22%. On top of that, foreclosures hit another record nationwide in 2010 and are expected to set yet another one this year.

Nearly every state in the Union and nearly every large city are facing ballooning budgets and shrinking tax revenue (confiscation). Some, such as Illinois and California, are boarding on insolvency and need to fill budget holes that are tens of billions of dollars. Tax receipts everywhere are plummeting because of the high unemployment rate that, in reality, is above 22%. On top of that, foreclosures hit another record nationwide in 2010 and are expected to set yet another one this year.

Inflation Is Here

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

For months now, the Federal Reserve has been worried about inflation being too low. So low, that the Fed claims it is unhealthy to the U.S. economy. When it announced its second wave of money printing (QE2) in early November 2010, the Fed said, “Longer-term inflation expectations have remained stable, but measures of underlying inflation have trended lower in recent quarters. . . . (more…)

Bad Real Estate News Ignored to Spin Bright Future

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was shocked to see this headline from an Associated Press story yesterday, “Economists project home sales, construction to rise sharply in 2011 from extreme lows of 2010.” I was dumbfounded by the title of the article and even more taken back when I read the story which said, “The forecast delivered at the International Builders’ Show in Orlando sees U.S. economic growth sharply lifting home sales and residential construction over the next two years, but from near-historic lows posted last year. “ (more…)

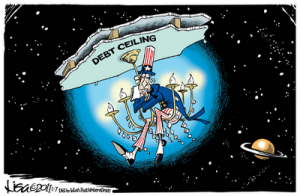

Will Raising the Debt Ceiling Bail Out the Banks, Again?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just after the first of the year, the Chairman of the U.S. Council of Economic Advisers, Austan Goolsbee, emphatically pushed for Congress to raise the debt ceiling. Goolsbee said on the ABC Sunday talk show, “This Week,” if it was not raised, the “impact on the economy would be catastrophic . . . “If we get to the point where we damage the full faith and credit of the United States, that would be the first default in history caused purely by insanity.” (more…)

Vitriol is a Veiled Attack on Free Speech

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com 2011 Prediction Follow-up

The 2011 Predictions post garnered more than 100 comments and several hundred predictions. I want to thank everyone for taking the time to make a prediction or comment. Your involvement is what makes this site come alive. I put together a few of your predictions below. I thought they were, for the most part, deductive and rational. Here are a few of the highlights from USAWatchdog.com readers: (more…)

The 2011 Predictions post garnered more than 100 comments and several hundred predictions. I want to thank everyone for taking the time to make a prediction or comment. Your involvement is what makes this site come alive. I put together a few of your predictions below. I thought they were, for the most part, deductive and rational. Here are a few of the highlights from USAWatchdog.com readers: (more…)

B of A Settlement, Another Taxpayer Rip-off

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In case you have not heard, Fannie and Freddie (also known as Government-Sponsored Enterprises or GSE’s) settled a big lawsuit with Bank of America Monday. The case was settled for cents on the dollar, even though the GSE’s had had a strong case to force B of A to buy back billions in sour mortgage-backed securities (MBS.) (more…)

Your New Year Predictions and Comments

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This post is going to be a little different because I want you all to be an even bigger part of the site than normal. I want you to give me your predictions for 2011. It can be as simple as what you think the price of gold, silver and oil will be, or as complicated as what country or countries might go to war. (more…)

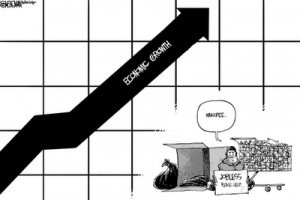

Fed Can’t Prop Up Stock Market Forever

Greg Hunter’s USAWatchdog.com (updated)

Greg Hunter’s USAWatchdog.com (updated)

From the very beginning of QE2, it was no secret the Federal Reserve wanted the stock market to rise. The Fed got its wish. Many people see the stock market increase of nearly 20% in a few short months as a sign things are turning around. The turnaround is really a mirage of the printing press. (more…)

Real Estate Spin Continues by Mainstream Media

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The mainstream media was at it again last week–putting a positive spin on the awful real estate market. The USA Today headline on top of the “Money” section last Thursday read “Optimism for home sales adds up.” The story said, “The trend is starting to move in the right direction,” says Diane Swonk, chief economist at financial services firm Mesirow Financial. (more…)

Spreading Some Christmas Cheer

By Greg Hunter’s USAWatchdog.com (corrected) Anybody who reads this site knows I can get pretty heavy handed when it comes to reporting and analyzing the news. Sometimes I freak myself out, but the facts are the facts–things are bad. In the spirit of Christmas, I am going to take this opportunity to share with you a couple of pretty funny YouTube videos. If we are all going to get through this, we need to take time for a little levity. (more…)

By Greg Hunter’s USAWatchdog.com (corrected) Anybody who reads this site knows I can get pretty heavy handed when it comes to reporting and analyzing the news. Sometimes I freak myself out, but the facts are the facts–things are bad. In the spirit of Christmas, I am going to take this opportunity to share with you a couple of pretty funny YouTube videos. If we are all going to get through this, we need to take time for a little levity. (more…)

CBS 60 Minutes Finally Gets One Right

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

I have been pretty hard on “CBS 60 Minutes” for doing fluff interviews with Fed Chief Ben Bernanke and not asking the hard questions that would be obvious to a freshman journalism student. In all fairness, I have to admit last Sunday’s story called “The Day of Reckoning” was an eye opening, hard hitting piece. (more…)

Headlines Confirming Troubled Times Are Here

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Some people see the Internet as an electronic world of wires and computers run at speeds measured in nanoseconds. I tend to see the Internet as an electronic extension of human biology. Sample enough of the Internet in the right places and you can get a snapshot of what people are generally feeling. One of my own readers, Alyce, commented recently, “It’s easy for people to become lulled into a false sense of security. (more…)

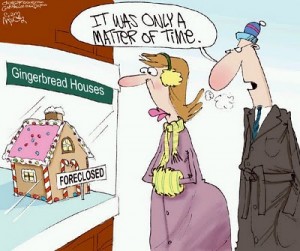

You Should Rent Instead of Own a Home

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? (more…)

One of the headlines in yesterday’s USA Today read, “Foreclosures take biggest dive in years in November.” That would make you think things are getting better in the rent vs. buy arena. When you read the story, you realize things are just taking a breather and about ready to get worse. Why does the mainstream media feel it has to spin stories to make the economy look better than reality? I think this is a blatantly dishonest headline. Why do I say that? (more…)

Everything is Under Control?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There are some big messages being put out by the government that appear to be for the sole purpose of reassuring the public that everything is under control. Bernanke appeared on “60 Minutes” 10 days ago to tell the public that he is “100 percent” sure inflation is not going to be an issue, and that it’s a “myth” the Fed is “printing money.” I am not going to touch on the veracity of his statements. (more…)